IFO Releases

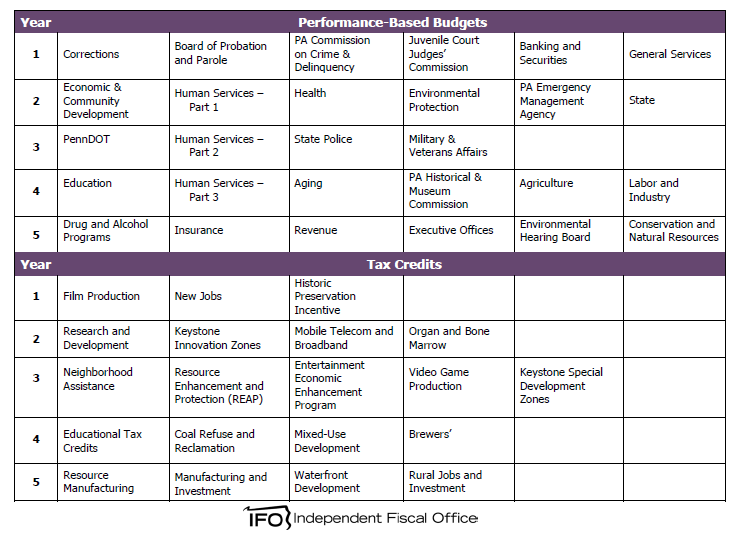

Performance-Based Budget and Tax Credit Review Schedule

January 30, 2018 | Performance Budgeting

The IFO has posted the schedule for upcoming performance-based budgets and tax credit reviews.

Mid-Year Update FY 2017-18

January 29, 2018 | Revenue Estimates

The Independent Fiscal Office (IFO) has released a mid-year update of its revenue estimate for fiscal year (FY) 2017-18. The revised estimate is $34.780 billion, which is $35 million higher than the IFO’s November 2017 estimate. As part of the mid-year update, the IFO also provides an advance look at revenue projections for the next fiscal year. For FY 2018-19, revenues are projected to be $33.914 billion, a decrease of -2.5 percent over the current year. The presentation also addresses the impact of recent federal tax law changes on the Pennsylvania budget. The changes affect estimates for corporate net income, personal income and sales tax revenues in FY 2017-18 and FY 2018-19. The office will update the estimate in its next round of revenue projections to be released in early May.

Aging and the Pennsylvania Economy

January 25, 2018 | Economics and Other

Director Matthew Knittel gave a presentation to the Task Force on Private Sector Retirement Security on the implications of aging for the Pennsylvania economy.

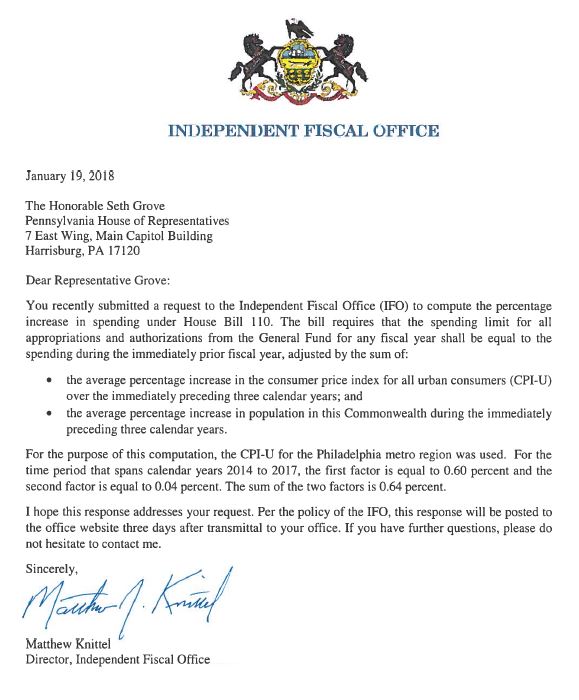

Increased Spending Allowed under House Bill 110

January 23, 2018 | Economics and Other

The IFO responds to a request regarding the percentage increase in spending allowed under House Bill 110.

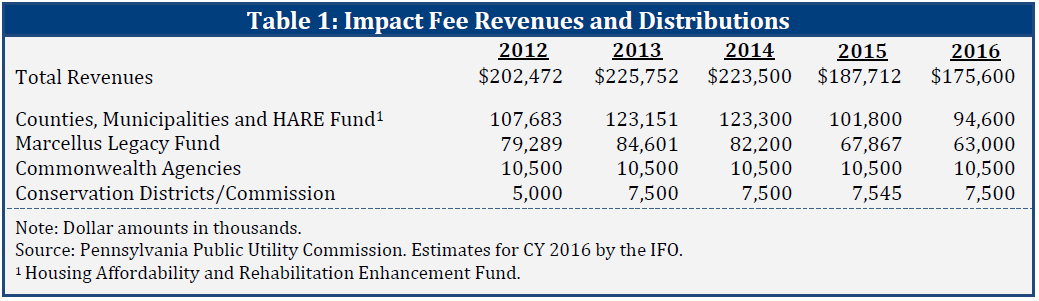

2017 Impact Fee Estimate - January 2018

January 19, 2018 | Energy

This research brief uses recent data published by the Department of Environmental Protection to project CY 2017 Impact Fee collections in Pennsylvania. Revised for technical factor on 2/22/2018.

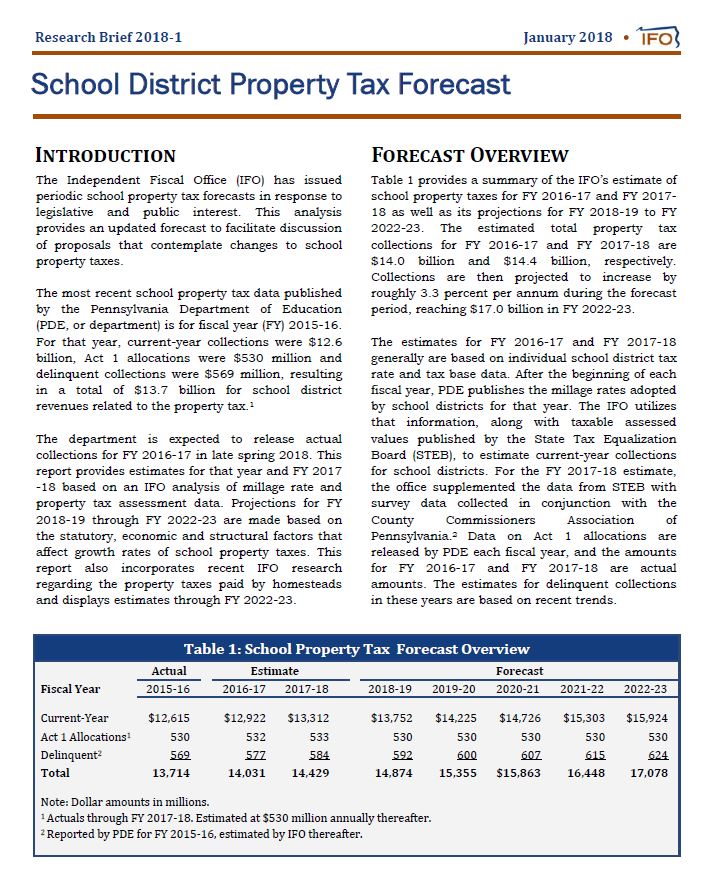

School District Property Tax Forecast

January 18, 2018 | Property Tax

This research brief contains the IFO's forecasted school district property tax collections from FY 2016-17 through FY 2022-23. The brief also contains estimates of school district property tax collections that can be attributed to homestead property.

Total school property tax collections for FY 2016-17 ($14.0 billion) and FY 2017-18 ($14.4 billion) are estimated using millage rates published by the Pennsylvania Department of Education and property tax assessment data. For FY 2018-19 through FY 2022-23, collections are projected based on the statutory, economic and structural factors that affect growth rates of property taxes. During that period, total school property tax collections are projected to grow by an average annual rate of 3.3 percent, reaching $17.0 billion by FY 2022-23.

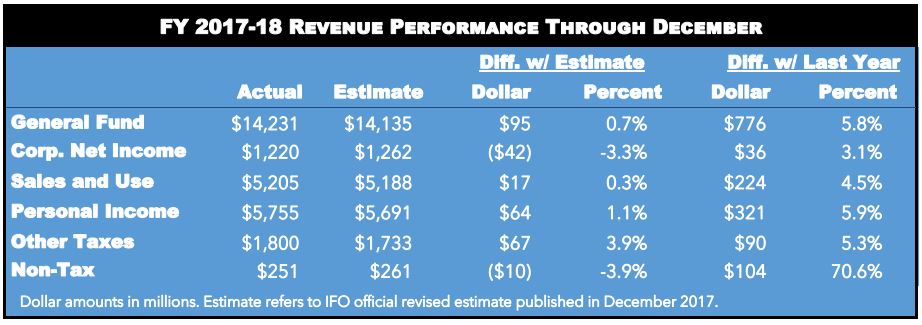

December 2017

January 02, 2018 | Revenue & Economic Update

The Commonwealth collected $2.8 billion in General Fund revenues for December, an increase of $198.1 million (7.6%) compared to December 2016. Fiscal year-to-date revenues were $14.2 billion, an increase of $775.8 million (5.8%) from the prior year.