APRIL 2018

May 02, 2018 | Revenue & Economic Update

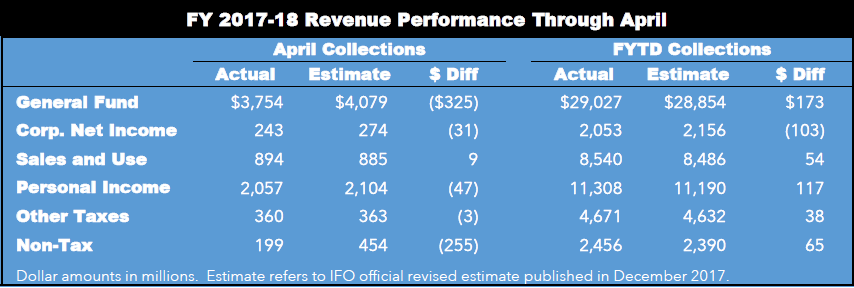

In December, the Independent Fiscal Office (IFO) released an update of the fiscal year (FY) 2017-18 official revenue estimate (originally published in June 2017) and corresponding revised monthly projections.1 Through April, total General Fund revenues are $173 million, or 0.6 percent, above the IFO’s updated official estimate.

For the month of April, General Fund collections were $325 million (-8.0 percent) below estimate. Overall sales and use tax revenues exceeded estimate by $9 million. Collections from motor vehicle ($6 million) and non-motor vehicle ($3 million) sales were slightly over estimate.

Corporate net income tax (CNIT) payments were below estimate by $31 million (-11.2 percent) in April. The shortfall was entirely attributable to final payments, which were below estimate by $43 million (-18.7 percent). It is unclear how much of this shortfall is a temporary timing issue related to a change in due dates for final payments beginning in 2017. For the fiscal year, CNIT revenues are $103 million below estimate, driven by final payments, which are $119 million below estimate for the year.

Personal income tax (PIT) April collections were $47 million below estimate. Monthly withholding ($6 million) and quarterly ($19 million) payment gains partially offset annual payments, which were $73 million below estimate. The weak April annual payment is due to the acceleration of payments into December and January (quarterly payments for tax year 2017) as taxpayers attempted to maximize the benefits of federal tax law changes. For the fiscal year-to-date, PIT collections are $117 million above estimate. An overage in quarterly ($152 million) and withholding ($46 million) payments for the fiscal year are partially offset by a shortfall in annual payments (-$80 million).

Non-tax revenues were $255 million below estimate in April, mainly due to timing issues. The official estimate assumed (1) special fund transfers ($150 million) and (2) liquor store profits ($85 million) would be received in April. However, those transfers were received earlier in the year, and the revenues are incorporated into fiscal year-to-date receipts. Escheat collections were $27 million below estimate for the month, accounting for the remainder of the shortfall. Fiscal year-to-date escheats collections are down $97 million.