IFO Releases

Mid-Year Update FY2016-17

January 25, 2017 | Revenue Estimates

The Independent Fiscal Office (IFO) has released a mid-year update of its revenue estimate for fiscal year (FY) 2016-17. The revised estimate is $32.060 billion, which is $250 million lower than the IFO’s November 2016 estimate and $450 million lower than the estimate published by the IFO at the beginning of the fiscal year. As part of the mid-year update, the IFO also provides an advance look at revenue projections for the next fiscal year. For FY 2017-18, revenues are projected to be $32.637 billion, an increase of 1.8 percent over the current year. The office will update the estimate in its next round of revenue projections to be released in early May.

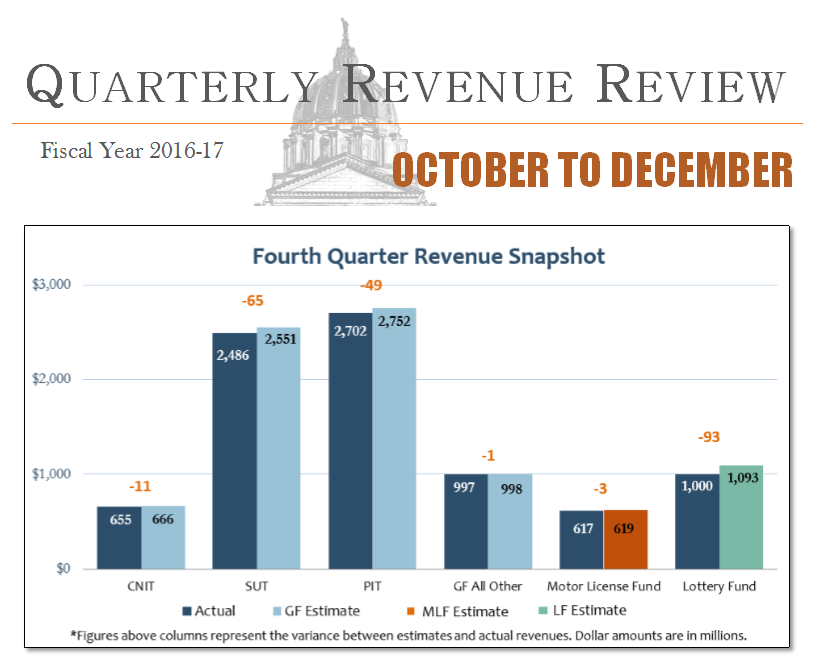

Quarterly Revenue Review 2016 Q4

January 24, 2017 | Revenue Estimates

The IFO produces this report to facilitate comparison of its quarterly revenue estimates with actual revenue collections. The report also provides context for the variances between estimates and actual collections.

School District Property Tax Elimination

January 19, 2017 | Property Tax

Director Matt Knittel and Deputy Director Mark Ryan made a presentation to the Pennsylvania School Boards Association (PSBA) regarding the current proposal and forecasts for school district property taxes in Pennsylvania.

*Updated February 13, 2017

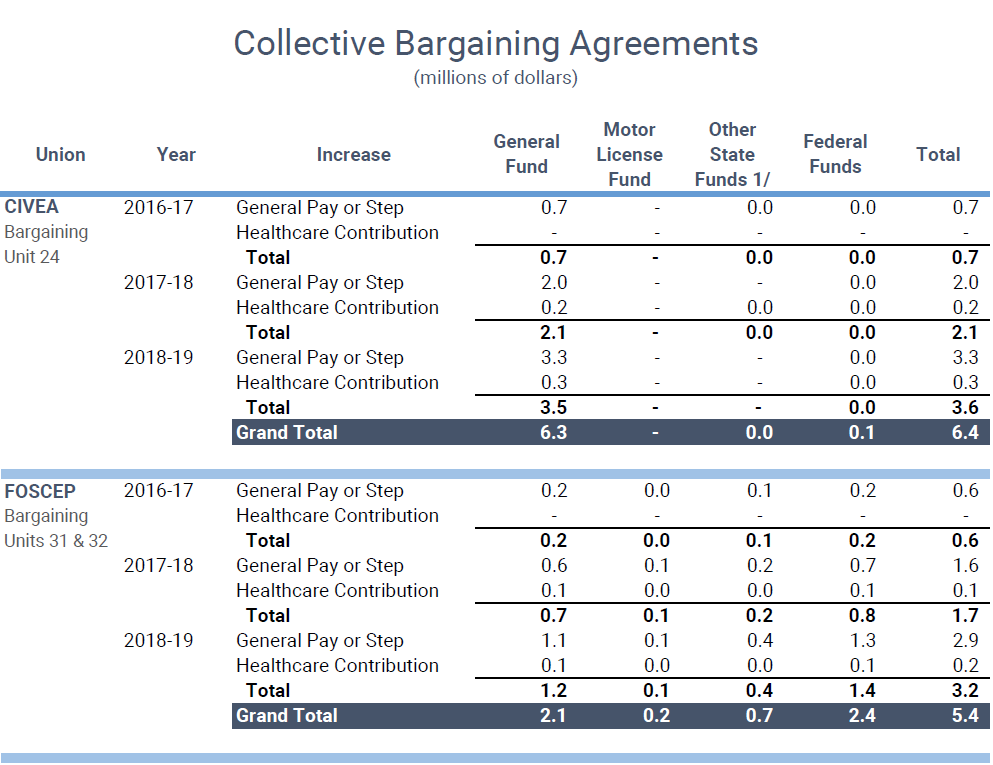

Analysis of Recent Collective Bargaining Agreements

January 12, 2017 | Wage Contracts

Pursuant to section 604-B(a)(8) of the Administrative Code of 1929, the Independent Fiscal Office has prepared a cost analysis of the collective bargaining agreements between the Commonwealth of Pennsylvania and the following six unions:

-

Correctional Institution Vocational Education Association (CIVEA)

-

Federation of State Cultural and Educational Professionals (FOSCEP)

-

Office and Professional Employees International Union (OPEIU), Healthcare Pennsylvania

-

PA State Education Association (PSEA), Non-Tenured Teachers

-

Service Employees International Union (SEIU), Healthcare Pennsylvania

-

United Food and Commercial Workers (UFCW)

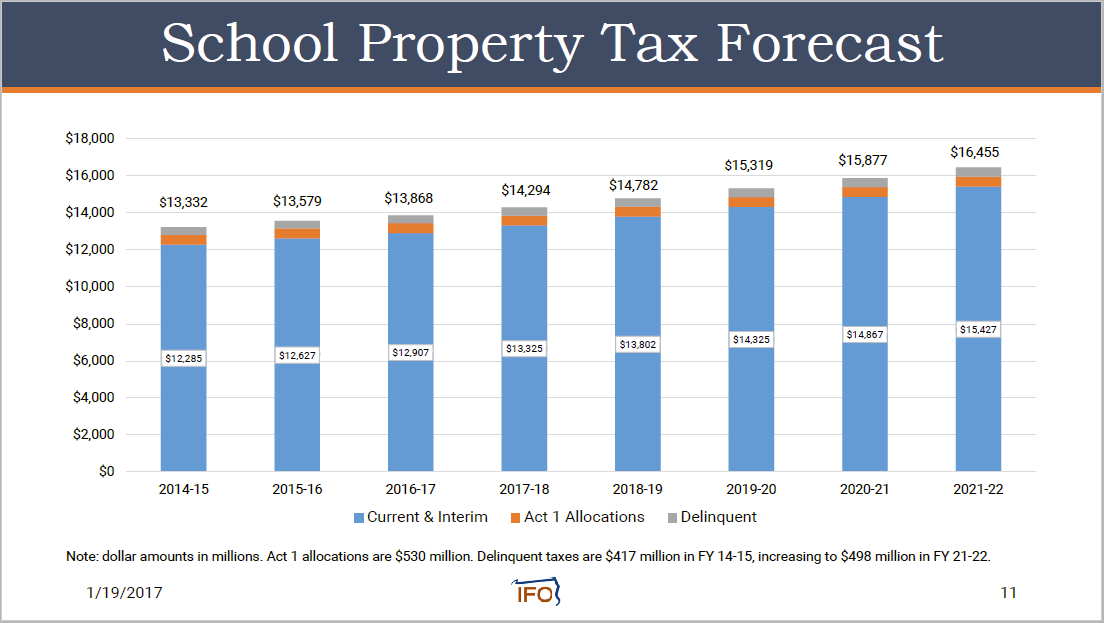

Updated School District Property Tax Forecast

January 09, 2017 | Property Tax

Letter updating the IFO's forecast of school district property tax collections for FY 2015-16 through FY 2021-22. The letter also includes projections of school district debt service payments and earned income tax collections for FY 2015-16 through FY 2021-22.

Total school property tax collections for FY 2015-16 ($13.6 billion) and FY 2016-17 ($13.9 billion) are estimated using millage rates published by the Pennsylvania Department of Education. For FY 2017-18 through FY 2021-22, collections are projected based on a forecast of the Act 1 index and exceptions. During that period, total school property tax collections are projected to grow by an average annual rate of 3.5 percent, reaching $16.5 billion by FY 2021-22.

Prior reports / references: (1) 2013 IFO analysis of HB / SB 76 and (2) 2014 update of the school property tax forecast.

December 2016

January 03, 2017 | Revenue & Economic Update

The Commonwealth collected $2.62 billion in General Fund revenues for December, a decrease of $106.6 million (-3.9%) compared to December 2015. Fiscal year-to-date revenues were $13.45 billion, an increase of $54.2 million (0.4%) from the prior year.

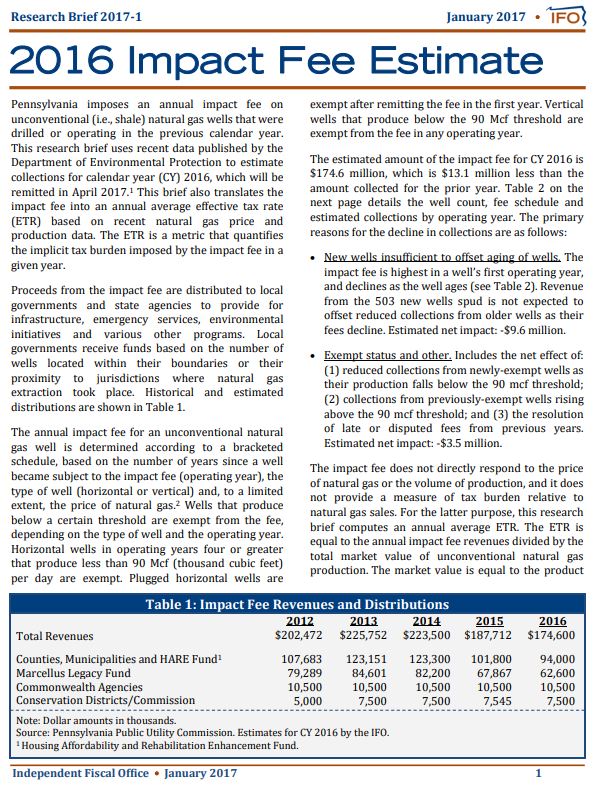

2016 Impact Fee Estimate - January 2017

January 02, 2017 | Energy

This research brief uses recent data published by the Department of Environmental Protection to project CY 2016 Impact Fee collections in Pennsylvania.