IFO Releases

Analysis of Revenue Proposals in the 2019-20 Executive Budget

March 22, 2019 | Revenue Estimates

This report provides estimates for the revenue proposals contained in the 2019-20 Executive Budget released February 2019. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under 71 Pa.C.S. § 4104. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

IFO News Stand - March Edition

March 19, 2019 | Economics and Other

The March edition of our monthly newsletter - The IFO News Stand. The new release highlights links to recent articles and reports that provide insight into state or national economic, demographic, budget and tax revenue trends.

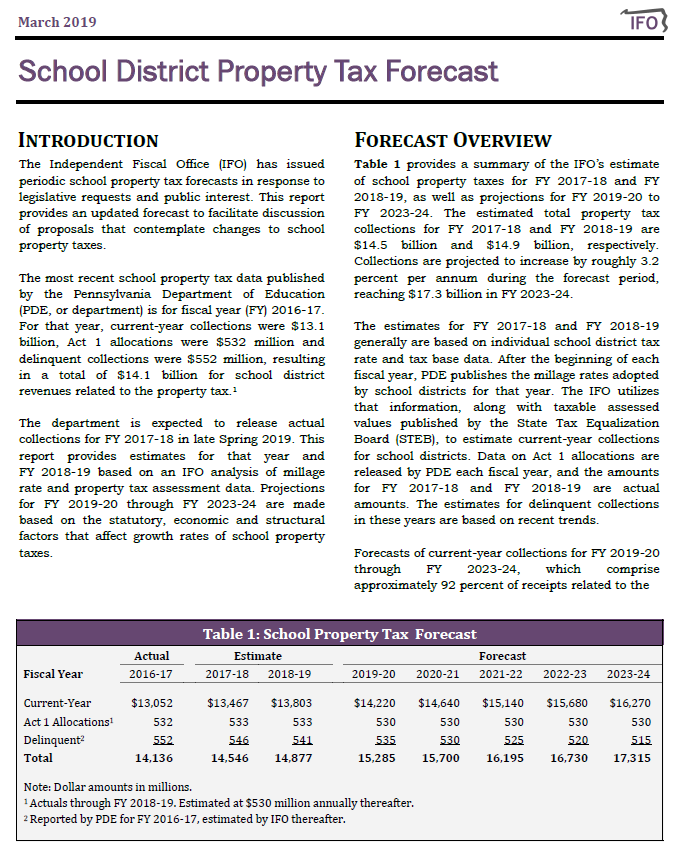

SCHOOL DISTRICT PROPERTY TAX FORECAST

March 18, 2019 | Property Tax

This report contains the IFO's forecasted school district property tax collections from FY 2017-18 through FY 2023-24. The report also contains projections of the Act 1 index and estimates of school district property taxes that can be attributed to homesteads.

Total school property tax collections for FY 2017-18 ($14.5 billion) and FY 2018-19 ($14.9 billion) are estimated using millage rates published by the Pennsylvania Department of Education and property tax assessment data. For FY 2019-20 through FY 2023-24, collections are projected based on the statutory, economic and structural factors that affect growth rates of property taxes. During that period, total school property tax collections are projected to grow by an average annual rate of 3.2 percent, reaching $17.3 billion by FY 2023-24.

Special Fund Receipts and Disbursements and Ambulatory Surgical Center Assessment

March 13, 2019 | Economics and Other

The Independent Fiscal Office (IFO) responded to questions raised at the office's budget hearing before the Senate Appropriations Committee. A committee member asked for an update to a February 12, 2018 report on the receipts and disbursements of certain special funds and information on how Pennsylvania compares to other states with regard to the use of special funds. Another committee member asked about the proposed ambulatory surgical center assessment for the Department of Human Services (DHS).

Homestead Exclusion and PIT

March 13, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that computes the level of personal income tax (PIT) increase needed to fully fund a 100% homestead exclusion for school district property taxes.

Income and Property Tax Burden for Retirees

March 06, 2019 | Economics and Other

In response to a legislative request, the IFO transmitted a letter that modifies or supplements certain computations from the IFO report entitled State and Local Taxes: A Comparison Across States (December 2018). The letter also compares Pennsylvania’s relative debt burden to other states.

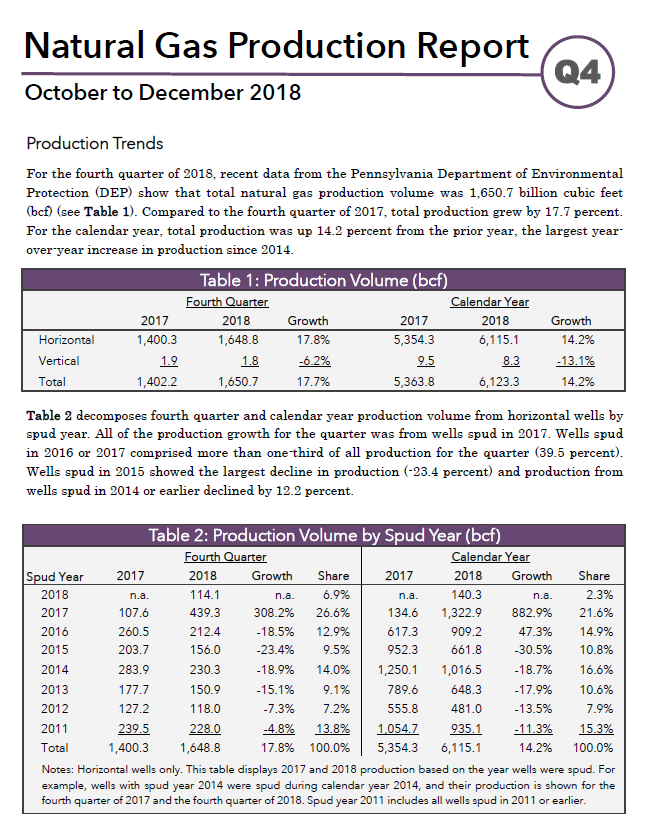

NATURAL GAS PRODUCTION REPORT, 2018 Q4

March 05, 2019 | Energy

This report for the fourth quarter of 2018 uses data collected by the PA Department of Environmental Protection to develop statewide and county-level tabulations of production volume and well counts.

Economic & Budget Outlook Presentation

March 01, 2019 | Economics and Other

Deputy Director Brenda Warburton gave a presentation at a session of the Pennsylvania Education Policy Fellowship Program regarding the Commonwealth's economic and budget outlook. The presentation summarized the office's five year economic and budget outlook (November 2018) as well as more recent updates to the office's revenue estimates for FY 2018-19 and FY 2019-20 (January 2019). The presentation also addressed the office's most recent estimate for school property tax collections.

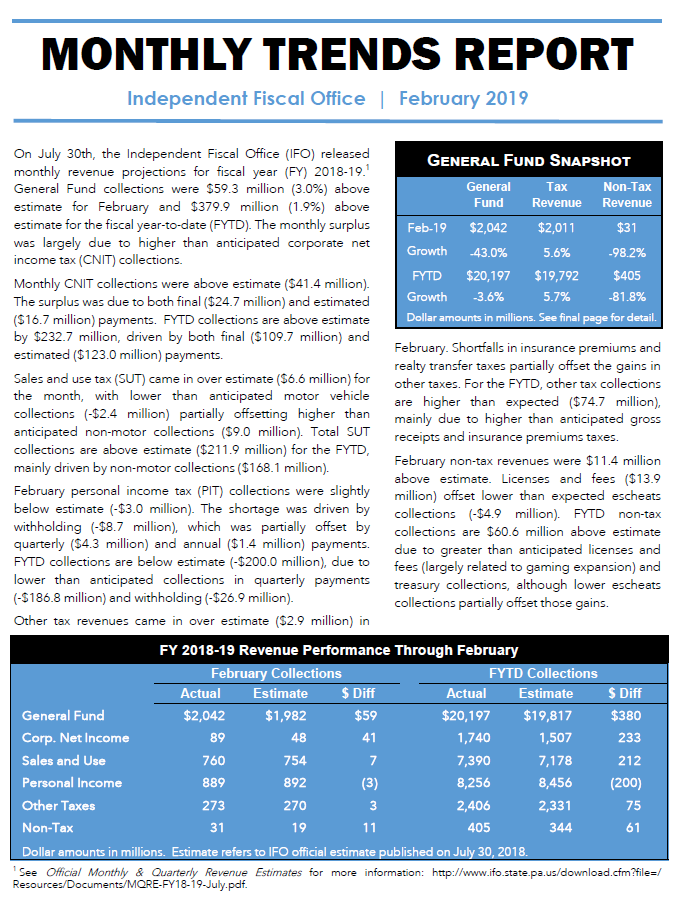

February 2019

March 01, 2019 | Revenue & Economic Update

The Commonwealth collected $2.04 billion in General Fund revenues for February, a decrease of $1.54 billion (-43.0%) compared to February 2018. Fiscal year-to-date revenues are $20.20 billion, a decrease of $0.75 billion (-3.6%) from the prior year.