IFO Releases

SCHOOL DISTRICT PROPERTY TAX FORECAST

March 18, 2019 | Property Tax

This report contains the IFO's forecasted school district property tax collections from FY 2017-18 through FY 2023-24. The report also contains projections of the Act 1 index and estimates of school district property taxes that can be attributed to homesteads.

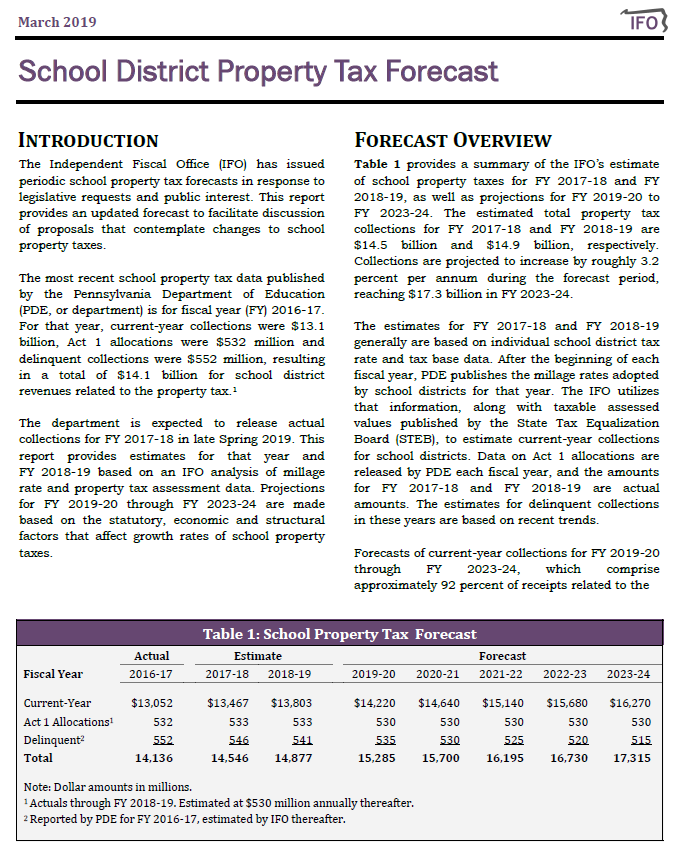

Total school property tax collections for FY 2017-18 ($14.5 billion) and FY 2018-19 ($14.9 billion) are estimated using millage rates published by the Pennsylvania Department of Education and property tax assessment data. For FY 2019-20 through FY 2023-24, collections are projected based on the statutory, economic and structural factors that affect growth rates of property taxes. During that period, total school property tax collections are projected to grow by an average annual rate of 3.2 percent, reaching $17.3 billion by FY 2023-24.

Homestead Exclusion and PIT

March 13, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that computes the level of personal income tax (PIT) increase needed to fully fund a 100% homestead exclusion for school district property taxes.