June 2018

July 02, 2018 | Revenue & Economic Update

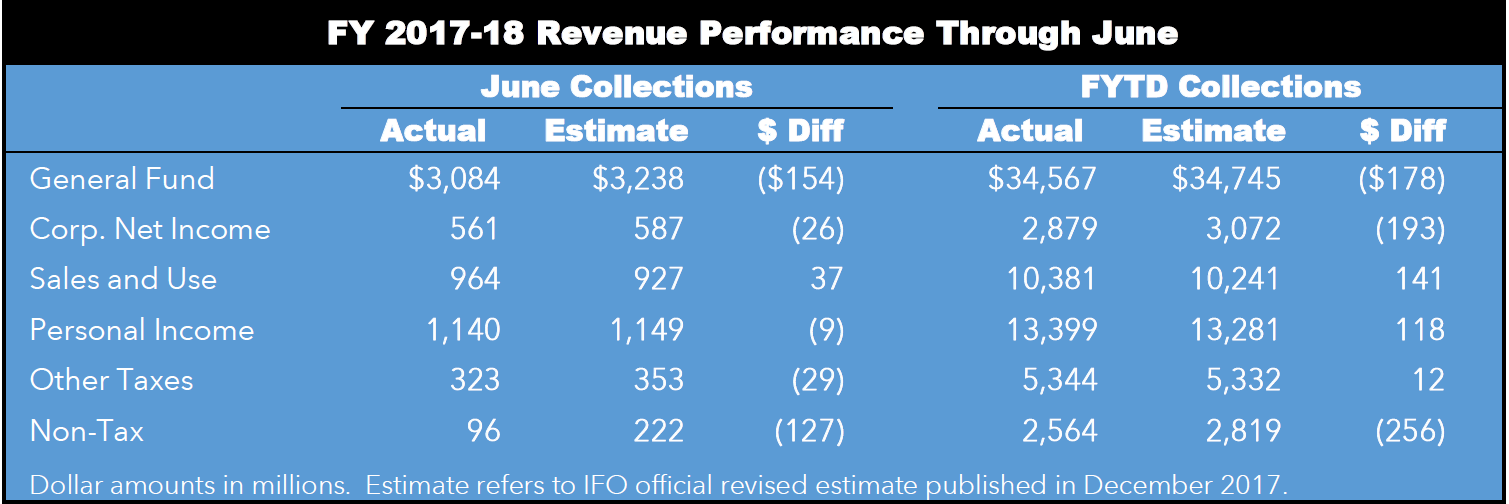

In December, the Independent Fiscal Office (IFO) released an update of the fiscal year (FY) 2017-18 official revenue estimate (originally published in June 2017) and corresponding revised monthly projections.1 For June, General Fund collections were $154 million (-4.7 percent) below estimate due to the lack of a funds transfer ($200 million) from the Pennsylvania Professional Liability Joint Underwriting Association (JUA). The transfer was included in the updated official estimate per Act 44, but was blocked as a result of a federal court ruling. Revenue collections for the year were $178 million (-0.5 percent) short of the IFO’s official revenue estimate. Excluding the JUA transfer, collections for the year were generally consistent with the IFO official estimate.

June corporate net income tax (CNIT) payments were $26 million (-4.4 percent) below estimate. Final payments came in above estimate (8.3 percent), while estimated payment fell below (-7.5 percent). Fiscal year CNIT payments fell $193 million short of estimate mainly due to final payments, which were $176 million below estimate for the year.

Sales and use tax (SUT) collections exceeded estimate by $37 million in June. Non-motor collections drove the surplus (5.2 percent), while motor vehicle revenues were below estimate (-3.8 percent). Fiscal year SUT collections followed the same pattern, with non-motor exceeding estimate by $152 million and motor vehicle falling short by $11 million.

June personal income tax (PIT) collections were below estimate by $9 million, due to slightly weaker than anticipated withholding and quarterly payments. Fiscal year PIT collections exceeded estimate (0.9 percent), driven by an overage for quarterly payments (7.8 percent).

Non-tax revenues for June were $127 million below estimate. The lack of the JUA transfer was partially offset by a $24.8 million table games certificate fee and $65 million in special fund transfers. Escheats collections were also weak, falling $22 million below estimate. For the fiscal year, non-tax collections were $256 million below estimate, driven by shortfalls in other miscellaneous revenue (largely transfers, -$178 million) and escheats (-$150 million). Licenses and fees revenues exceeded estimate by $61 million, due to the table games fee and higher than expected revenues from the mini-casino auctions.