Impact Fee Update - February 2016

February 29, 2016 | Energy

In June 2015, the Independent Fiscal Office (IFO) issued Research Brief 2015-3, which reported unconventional gas well impact fee collections for calendar year (CY) 2014 along with three potential scenarios for CY 2015 collections (to be remitted in April 2016). This research brief uses recent data published by the Department of Environmental Protection to project CY 2015 collections. The research brief also translates the impact fee into an annual average effective tax rate (ETR) based on recent natural gas price and production data. The ETR is a metric that quantifies the implicit tax burden imposed by the impact fee in a given year.

The annual impact fee for an unconventional natural gas well is determined according to a bracketed schedule, based on the number of years since a well became subject to the impact fee (operating year), the type of well (horizontal or vertical) and, to a limited extent, the average annual price of natural gas. Wells that produce less than 90 Mcf (thousand cubic feet) per day on average are known as “stripper wells.” Horizontal wells in operating years four or greater qualify for exemption from the impact fee if their production does not exceed the stripper well threshold. Vertical wells that produce below the threshold also are exempt from the fee, as well as all plugged wells after remitting the fee in the first year.

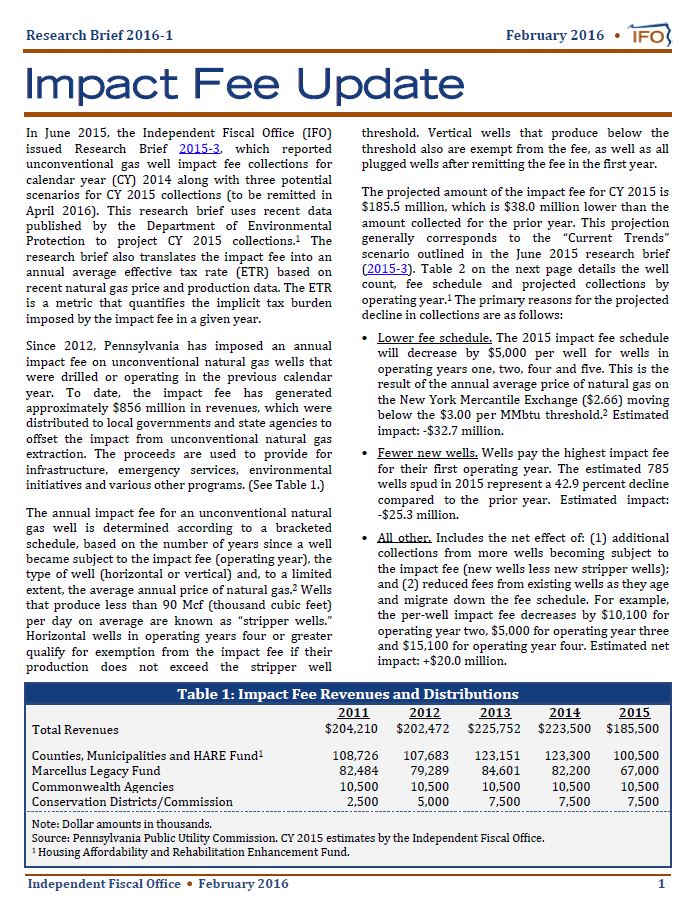

The projected amount of the impact fee for CY 2015 is $185.5 million, which is $38.0 million lower than the amount collected for the prior year. This projection generally corresponds to the “Current Trends” scenario outlined in the June 2015 research brief (2015-3).

For 2015, the ETR is estimated to be 5.5 percent, an increase of 3.4 percentage points from 2014. The annual ETR for 2011 to 2014 declined in each successive year. The main cause of that trend was the dramatic increase in production over the time period. The 2015 increase is predominantly motivated by the sharp decline of natural gas prices (54.2 percent prior to the deduction of post-production costs).