May 2016

June 01, 2016 | Revenue & Economic Update

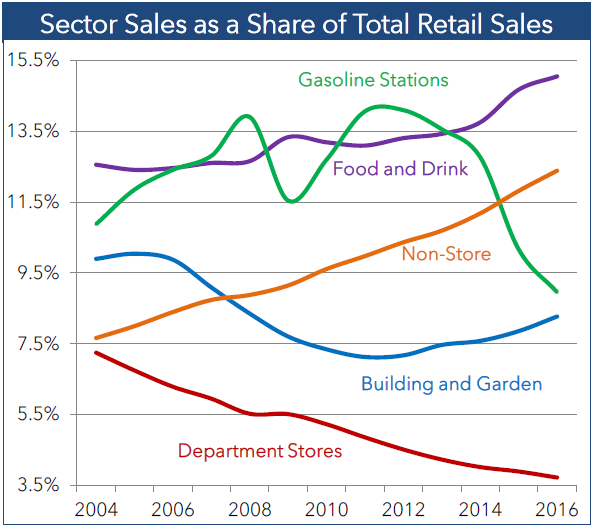

The U.S. Census Bureau publishes monthly data on retail sales by sector (excludes services), which is used as an indicator for U.S. consumer spending trends. The chart below displays annual sales for certain sectors as a share of total retail sales. The data reveal some interesting trends.

Food services and drinking places (e.g., restaurants and bars) is now one of the largest sectors of retail sales, as the share of total sales increased from 12.6% in 2004 to 15.0% in 2016 (January through April). Most of the gains in this sector have been realized in the past two years; from 2013 to 2015, sales grew at a rate of 7.1% per annum. Data through April 2016 show a continuation of this trend, with annual growth of 6.1%.

By contrast, sales at gasoline stations have become a less significant component of consumer spending. In 2012, gasoline station sales comprised 14.1% of total sales, whereas in 2016, these sales comprised 9.0% of the total. This contraction is generally attributable to the rapid decline in U.S. gasoline prices, which averaged $3.62 per gallon in 2012 versus $1.94 per gallon for January to April 2016.

For 2016, building and garden sales comprised 8.3% of total sales. This sector is well below its pre-recession share of roughly 10%. However, sales have picked up recently, due to the improving housing market, and have been particularly strong through April 2016 (9.2% annual growth). One of the larger retailers in this sector, Home Depot Inc., reported that customers spent $60 per trip this year, which is the highest level since the first quarter of 2006.

Sales at department stores have declined due to strong growth in the non-store sector (e.g., online stores such as Amazon.com Inc. and catalog retailers), as consumers shifted from brick-and-mortar stores to online retailers. In 2004, the share of department stores (7.2%) and non-store sales (7.7%) were roughly equal. For 2016, the share of non-store sales comprised 12.4% of the total, compared to 3.7% for department stores.

Overall, the retail sales data suggest that consumers are more likely to shop online, spend money on dining out and invest in their homes rather than shop at traditional stores. The decline in gasoline prices may have further bolstered spending in some of these sectors. While some of these trends are long-term (i.e., the switch to online shopping), it is unclear if others will reverse (i.e., less dining out if gasoline prices increase).