June 2016

July 01, 2016 | Revenue & Economic Update

In recent months, U.S. economic uncertainty has increased due to weak job growth, tepid business investment and pressure on corporate profits. Those economic indicators can be used to assess the probability of a recession (i.e., a decline in real GDP in two consecutive quarters) within the next year. A recent Wall Street Journal survey of economists placed that probability at 21%, an increase of 11 percentage points from the prior year.

Recent international trends also affect the potential for recession. These include: (1) the deceleration of growth in China and other emerging markets, (2) the U.K.’s vote to exit the European Union and (3) appreciation of the U.S. dollar, which restrains exports. In June, the World Bank and International Monetary Fund reduced their 2016 outlooks for global and U.S. economic growth.

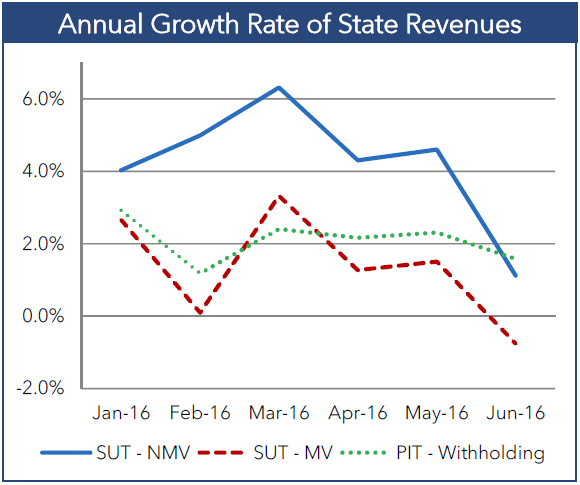

Despite these trends, Pennsylvania’s economy remains relatively healthy; however, the release of state economic data typically lags national sources. One timely indicator of the state economy is employment growth, which remains solid. Based on data from the first five months of the year, the state is on pace to add 54,500 jobs in 2016, which is comparable to last year’s average gain of 48,600. During the same five months, sales and use tax (SUT) revenues increased 4.6%, an indication that consumers remain confident in the economy and are willing to spend instead of save.

However, very recent revenue data from June suggest possible weakness in Pennsylvania. June sales and use tax revenues declined (-1.1%) year-overyear, while personal income tax (PIT) collections exhibited unexpected weakness for withholding (0.9%) and estimated payments (-11.4%). Positive signs from June include gains in corporate tax payments (8.6%) and realty transfer tax remittances (22.6%).

Although certain national indicators show an increased risk of recession, the latest state indicators do not yet provide strong evidence of that outcome. This pattern is consistent with Pennsylvania’s slower growth economy that exhibits more moderate swings compared to the U.S. Additional data are necessary to evaluate the implications of recent economic trends. The release later this month of June employment growth and second quarter GDP will provide key insights to the U.S. economic outlook.