August 2016

September 01, 2016 | Revenue & Economic Update

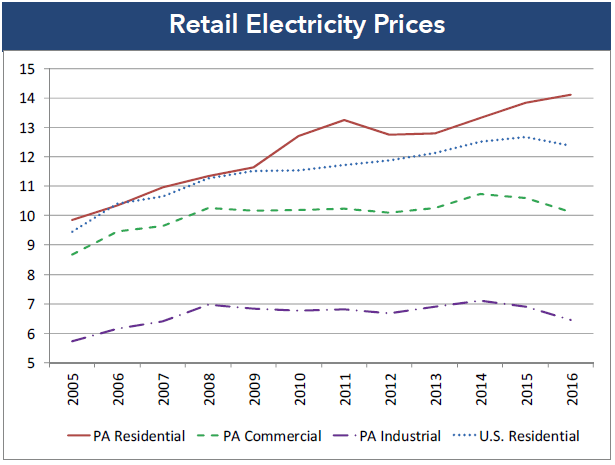

The U.S. Energy Information Administration (EIA) releases an Electricity Monthly Update, which provides historical revenues, retail sales (demand) and average retail prices of electricity on national, regional and state levels. For Pennsylvania, these data show that from 2005 to 2015, demand for electricity displayed nearly flat growth (-0.1% per annum), while average prices grew moderately (2.6%). The flat demand combined with moderate price growth caused total revenues from electricity sales to grow at a rate of 2.4% per annum.

Sales from the first half of 2016 reveal a downturn in the PA electricity market. Total retail sales of electricity declined by 5.7% compared to the same period in 2015, as demand contracted in every sector. The unseasonably warm winter was a potential factor affecting demand in 2016. The residential sector was especially affected by this phenomenon, as EIA data reveal that roughly one-fifth of PA households use electricity as their primary source of heat.

Decreased demand has likely applied downward pressure on recent prices. Average retail prices in the first six months of 2016 were 1.1% lower than in the first half of 2015, driven by declines in the commercial (-3.2%) and industrial (-5.5%) sectors. By contrast, average residential prices continue to grow in PA, and were 4.2% higher in the first half of 2016 than the same period in 2015.

Declining prices of natural gas and coal, which generated 43.7% of PA electricity in the first half of 2016, may be a factor in recent electricity price trends. The lower prices may be realized more quickly in the commercial and industrial sectors since they are more sensitive to price changes and likely to seek low-cost suppliers who benefit from falling commodity prices.

Recent data from the Pennsylvania Public Utility Commission show that from 2013 to 2015, the number of commercial and industrial customers who actively shopped for electricity suppliers remained constant, while the number of residential customers who shopped declined. More recently, residential customers have started to return to competitive suppliers, but that trend has yet to induce lower residential prices.

The EIA projects average U.S. residential prices to decline slightly through the rest of 2016, and then rise by 3.0% in 2017. Given the divergent price trends for the first half of 2016, it is unclear whether residential prices in PA will follow the same trend as the national average.