November 2016

December 01, 2016 | Revenue & Economic Update

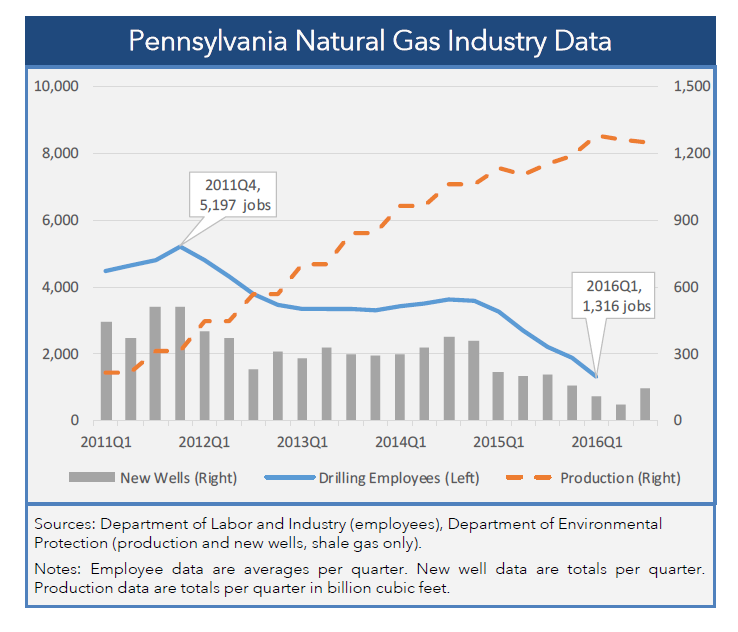

Employment in the natural gas industry has been declining in Pennsylvania in recent years. Data from the Quarterly Census of Employment and Wages show a significant reduction in natural gas drilling jobs through the first quarter of 2016. Conversely, data from the Pennsylvania Department of Environmental Protection reveal a significant increase in the production of natural gas during the same period.

The chart on page 1 of the document shows these trends from the first quarter of 2011 to the third quarter of 2016. The solid blue line represents the number of workers engaged in drilling oil or gas wells. This series peaked in the fourth quarter of 2011 and has since declined by 3,881 jobs (74.7%) through the first quarter of 2016, the last data point for which this series is available. Meanwhile, production of natural gas has more than tripled through the first quarter of 2016, as shown by the orange dotted line. Data through the third quarter remain at the same high level.

Drilling jobs are not necessary to support production from a well. A new well can produce at a high level for at least two years with minimal labor. Once operators have built up an inventory of wells, they can manage production levels by increasing or decreasing output from existing wells. Quarterly counts of newly-drilled wells (grey columns) suggest the utilization of well inventory to increase production. Moreover, improvements in technology have increased the potential output of newer wells, which allows operators to enhance production with less new drilling.

After the first few years of a well’s life, production declines dramatically. A typical shale gas well in Pennsylvania might yield 40% of its output in the first two years. This implies that more new wells will be needed to maintain production at current levels, and demand for drilling employees should increase. However, as shown in the IFO’s Natural Gas Production Report for the third quarter of 2016, operators still possess a substantial inventory of wells that have been drilled but remain dormant. Industry analysts predict that, due to the potential of this untapped inventory, the drilling of new wells will not meaningfully increase until at least the middle of 2017, or possibly 2018. Although the recent uptick in drilling in the third quarter of 2016 (grey columns) suggests that the employment contraction may have abated, more employment data are necessary to confirm that outcome.