IFO Releases

Property Tax Rent Rebate Program

September 17, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that supplements a previous request to analyze a proposed expansion of the Property Tax Rent Rebate Program.

Property Tax Rent Rebate Program

September 12, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that analyzes a proposed expansion of the Property Tax Rent Rebate Program.

Note: This analysis was originally posted on May 15, 2019. The analysis was reposted on September 12, 2019 to reflect technical adjustments made by the IFO based on research cited in the footnotes of the updated analysis.

Property Tax Rebate for Older Homeowners

September 12, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that provides additional information to a previous analysis of a proposed property tax rebate for older homeowners based on various levels of household income.

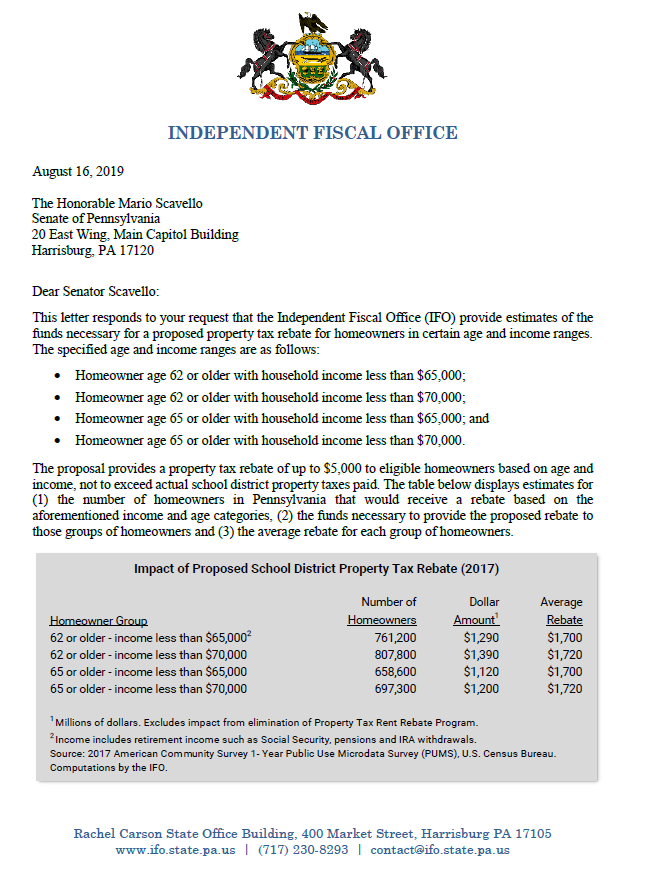

Property Tax Rebate for Older Homeowners

August 22, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that analyzes a proposed property tax rebate for older homeowners based on various levels of household income.

Property Tax Replacement Estimates

May 23, 2019 | Property Tax

In response to a legislative request, the IFO has posted a letter that provides revenue estimates for various proposed changes to the state tax code that affect personal income, sales and property taxes.

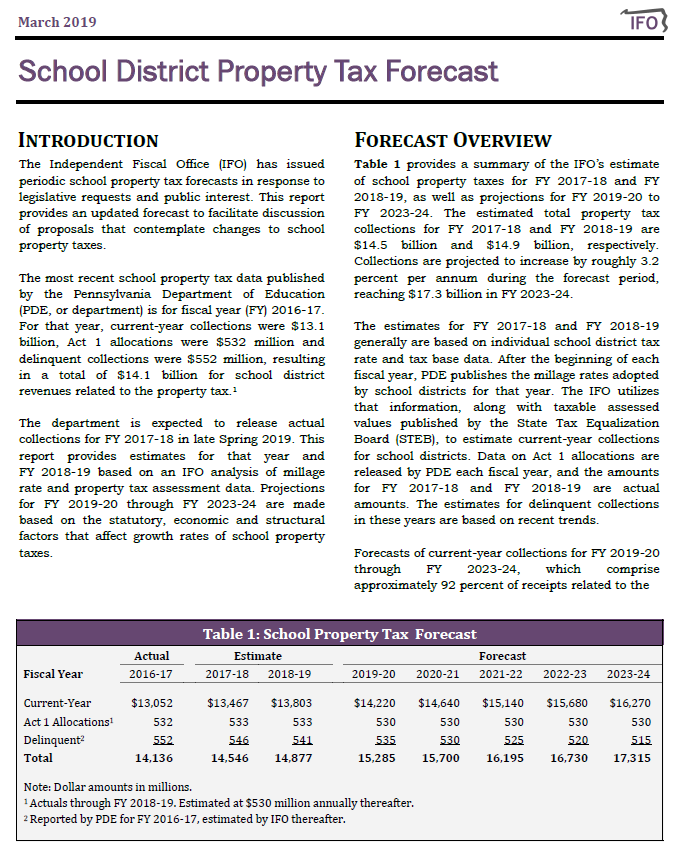

SCHOOL DISTRICT PROPERTY TAX FORECAST

March 18, 2019 | Property Tax

This report contains the IFO's forecasted school district property tax collections from FY 2017-18 through FY 2023-24. The report also contains projections of the Act 1 index and estimates of school district property taxes that can be attributed to homesteads.

Total school property tax collections for FY 2017-18 ($14.5 billion) and FY 2018-19 ($14.9 billion) are estimated using millage rates published by the Pennsylvania Department of Education and property tax assessment data. For FY 2019-20 through FY 2023-24, collections are projected based on the statutory, economic and structural factors that affect growth rates of property taxes. During that period, total school property tax collections are projected to grow by an average annual rate of 3.2 percent, reaching $17.3 billion by FY 2023-24.

Homestead Exclusion and PIT

March 13, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that computes the level of personal income tax (PIT) increase needed to fully fund a 100% homestead exclusion for school district property taxes.

PROPERTY TAX ELIMINATION PROJECTION

February 27, 2019 | Property Tax

In response to a legislative request, the IFO has updated projections regarding school district property tax elimination. The document projects the school property tax revenues that would be subject to replacement under potential legislation that would eliminate school property taxes.

Property Tax Update - August 2018

August 17, 2018 | Property Tax

In response to a legislative request, the IFO updated select tables and graphs related to school district property tax that were originally released in January and December of 2017.

Budget And Economic Update with Property Tax Discussion

June 05, 2018 | Property Tax

Director Matthew Knittel gave a budget and economic update to the Pennsylvania Association of School Business Officials (PASBO). Revenue Analyst Jesse Bushman also discussed an updated school district property tax forecast and recent proposed legislation.