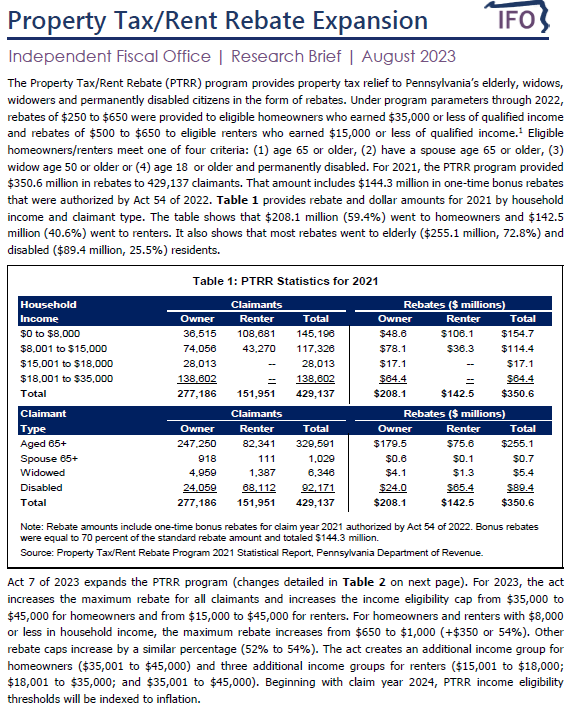

This research brief uses data from the Pennsylvania Department of Revenue, the American Community Survey and Social Security Administration to estimate the impact of the recently enacted expansion of the PTRR program. It provides detail on impact by income level, claimant type and county.

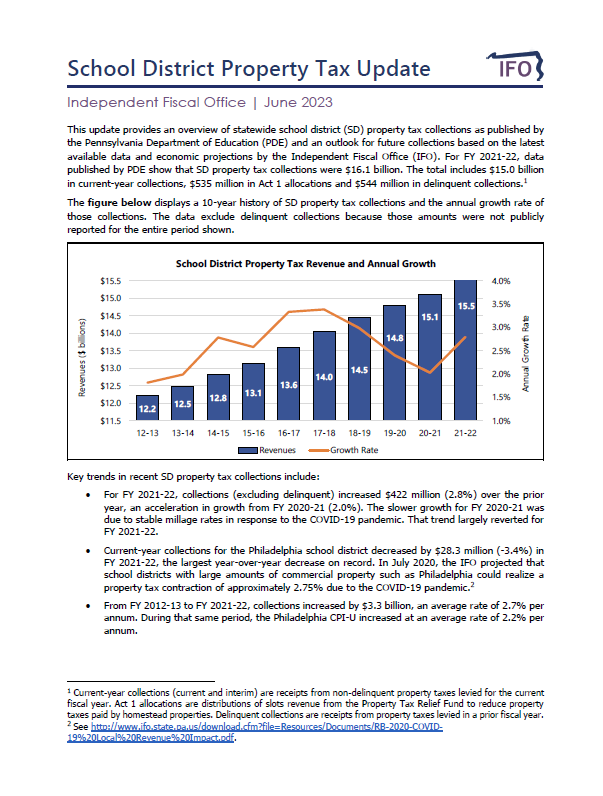

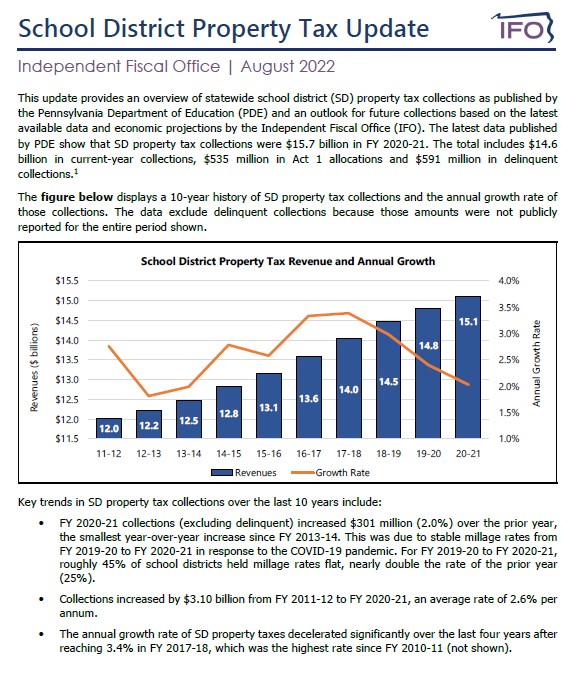

The IFO released an updated school district property tax forecast. The report (1) projects revenues through FY 2027-28, (2) estimates revenues collected from senior homeowners, (3) ranks counties based on per capita revenues and (4) provides detail on the projected Act 1 index.

In response to a legislative request, the IFO transmitted a letter that analyzes a proposal to provide property tax rebates for senior homeowners in certain income ranges.

This research brief uses (1) income data from the Bureau of Economic Analysis and the Internal Revenue Service and (2) property tax data from the Pennsylvania Department of Education and Department of Community and Economic Development to estimate county-level property tax burdens across the state for 2020.

The IFO released an updated school district property tax forecast. The report (1) projects revenues through FY 2026-27, (2) estimates revenues collected from senior homeowners, (3) ranks counties based on per capita revenues and (4) provides detail on the projected Act 1 index.

In response to a legislative request, the IFO transmitted a letter that provides additional information to a previous analysis for potential property tax replacement revenues proposed under House Bill 13.

Tags: legislative, property, request, tax

In response to a legislative request, the IFO transmitted a letter that provides updated estimates for potential revenue sources that could replace school district property taxes if eliminated.

Tags: legislative, property, request, tax

In response to a legislative request, the IFO transmitted a letter that estimates the potential reduction in property taxes due to Act 25 of 2011.

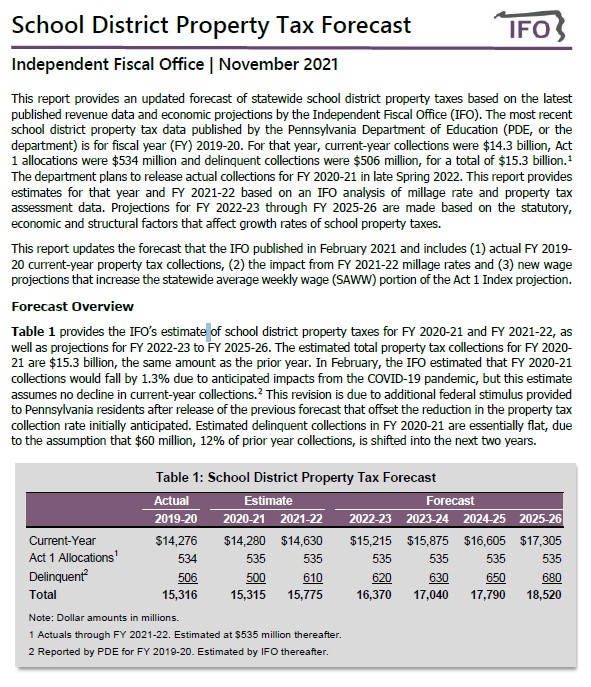

This report contains the IFO's updated forecast of school district property tax collections from FY 2020-21 to FY 2025-26. This report updates the forecast that the IFO published in February 2021 and includes (1) actual FY 2019-20 current-year property tax collections, (2) the impact from FY 2021-22 millage rates and (3) new wage projections that increase the statewide average weekly wage (SAWW) portion of the Act 1 Index projection.

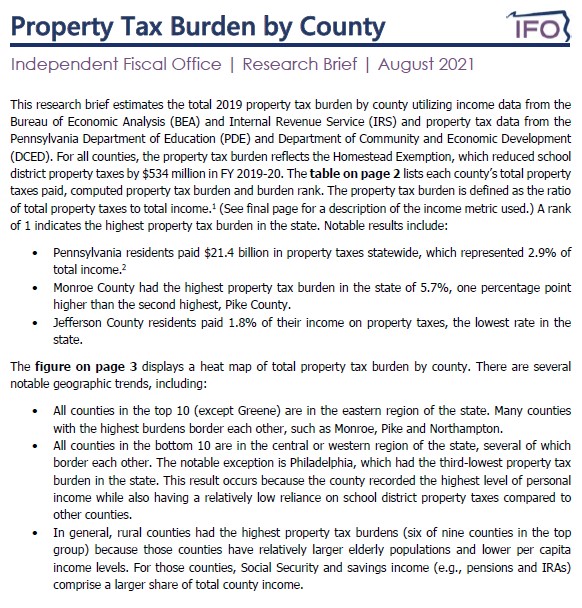

This research brief uses (1) income data from the Bureau of Economic Analysis and the Internal Revenue Service and (2) property tax data from the Pennsylvania Department of Education and Department of Community and Economic Development to estimate and rank county-level property tax burdens across the state for 2019.

Note: This research brief was originally posted on 8/17/2021. It has been updated to include a map that displays school district property tax burdens by county.