This research brief estimates the impact of the new federal deduction for filers age 65 or older ($6,000 for single, $12,000 for joint). For tax year 2025, the IFO projects the provision will reduce federal income tax by $1.1 billion for PA seniors.

The IFO released a budget brief highlighting General Fund and Rainy Day Fund interest earnings, which peaked at a combined $1 billion in FY 2023-24 and FY 2024-25, but are declining rapidly.

The IFO published an economic impact report for the Ironman 70.3 Pennsylvania Happy Valley Triathlon in Centre County (June 2024). The analysis finds that economic activity related to the event generated over $3.1 million in statewide spending, supported 16 full-time equivalent jobs, and $178,000 in select state and local taxes.

The IFO released a budget brief that discusses two new expensing provisions included in the federal reconciliation bill passed on July 4. The provisions could reduce revenues (and increase the projected deficit) by $500 to $900 million for FY 2025-26.

The IFO released an updated budget brief that examines the budget implications of recent SNAP changes and the number of beneficiaries that will be impacted by new work requirements for able-bodied adults age 55 to 64.

This budget brief highlights Pennsylvania Medicaid (MA) enrollment and funding trends from FY 18-19 through the administration’s proposal for FY 25-26. It also provides projections of the impact for certain MA provisions included in the federal reconciliation bill passed by the U.S. House of Representatives.

As part of the draft reconciliation bill, the US House proposed to increase the state share of costs for the Supplemental Nutrition Assistance Program (SNAP). This research brief describes the proposed changes and the potential impact on the state budget.

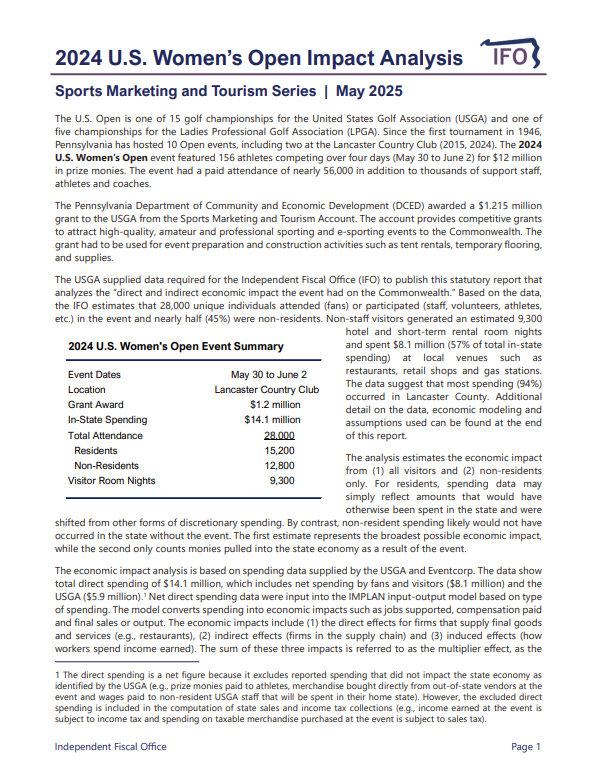

The IFO published an economic impact report for the 2024 U.S. Women’s Open which took place May 30 to June 2, 2024 at the Lancaster Country Club. The analysis finds that economic activity related to the event supported 147 full-time equivalent jobs and generated $14.1 million in in-state spending, nearly $570,000 in state sales and use tax and $560,000 in personal income tax revenue.

This economic brief tracks the latest claims for unemployment compensation (UC) for all covered workers and federal workers only. The IFO is tracking these claims in preparation for its May 20 initial revenue estimate.

In response to a legislative request, the IFO transmitted a brief that provides revenue estimates for a statewide retail delivery fee.