This report uses data from the U.S. Census Bureau, the U.S. Bureau of Economic Analysis, CCH AnswerConnect and the Tax Foundation to facilitate a comparison of state and local tax systems across the 50 states. The report examines (1) the level of per capita state and local taxes across states (unadjusted and adjusted for price differentials) and (2) the distribution of state and local taxes across revenue sources (e.g., income, sales and property).

Tags: comparison, state, tax

The IFO responded to questions raised at the House Budget Roundtable on January 31, 2024.

Director Knittel made a brief presentation at the NFIB Economic Forum.

Tags: presentation

Director Knittel made a presentation of the mid-year update to the House Budget Roundtable.

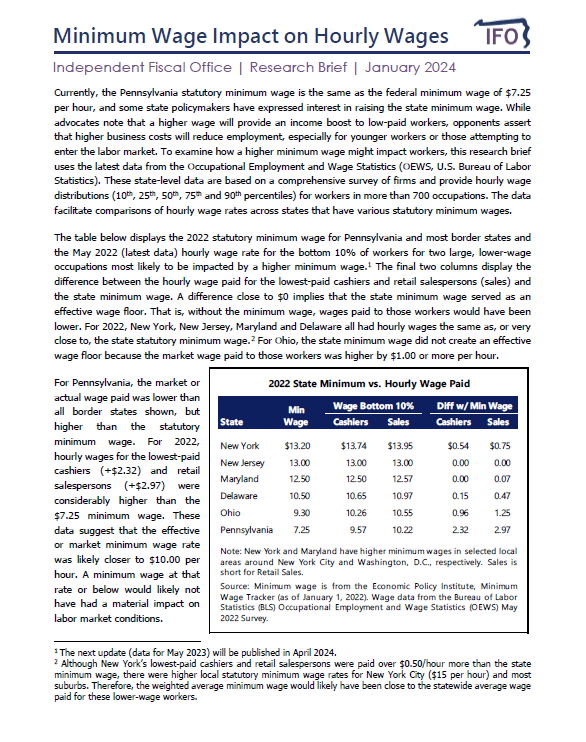

This research brief examines how a higher statutory minimum wage could impact lower-wage workers and provides employment and hourly wage estimates for certain lower-wage occupations to illustrate that Pennsylvania effective labor market minimum wage is likely in the range of $10.50 to $11.00 per hour.

This report presents data on Pennsylvania tax credits and economic development incentives for fiscal years (FY) 2018-19 through FY 2023-24. The tables provide annual detail on tax credit utilization or awards, state spending or grants, job training programs and state loan programs. Fiscal year 2023-24 amounts are budgeted, authorized or projected and may differ from final amounts expended or awarded for the year. The report also highlights recent changes to incentive program spending or utilization.

This research brief uses the latest data from the US Dept of Agriculture to examine post-pandemic SNAP trends. Since November 2019, policy and definition changes have increased the number of recipients by 16% and the average monthly benefit by 52%.