This letter provides a statutorily required report analyzing the implementation of the shared-risk pension provisions introduced by Act 120 of 2010.

The Commonwealth collected $1.81 billion in General Fund revenues for November, an increase of $75.0 million (4.3%) compared to November 2014.

Fiscal year-to-date revenues were $10.7 billion, an increase of $86.6 million (0.8%) from the prior year.

This research brief presents an analysis of the potential impact of the proposal to 1) raise the Pennsylvania state minimum wage from $7.25 to $10.10 and 2) automatically adjust future minimum wage levels to offset inflation.

The Commonwealth collected $2.13 billion in General Fund revenues for October, a decrease of $109.9 million (-4.9%) compared to October 2014.

Fiscal year-to-date revenues were $8.87 billion, an increase of $11.6 million (0.1%) from the prior year.

The Commonwealth collected $2.73 billion in General Fund revenues for September, an increase of $156.2 million (6.1%) compared to

September 2014.

Fiscal year-to-date revenues were $6.74 billion, an increase of $121.5 million (1.8%) from the prior year.

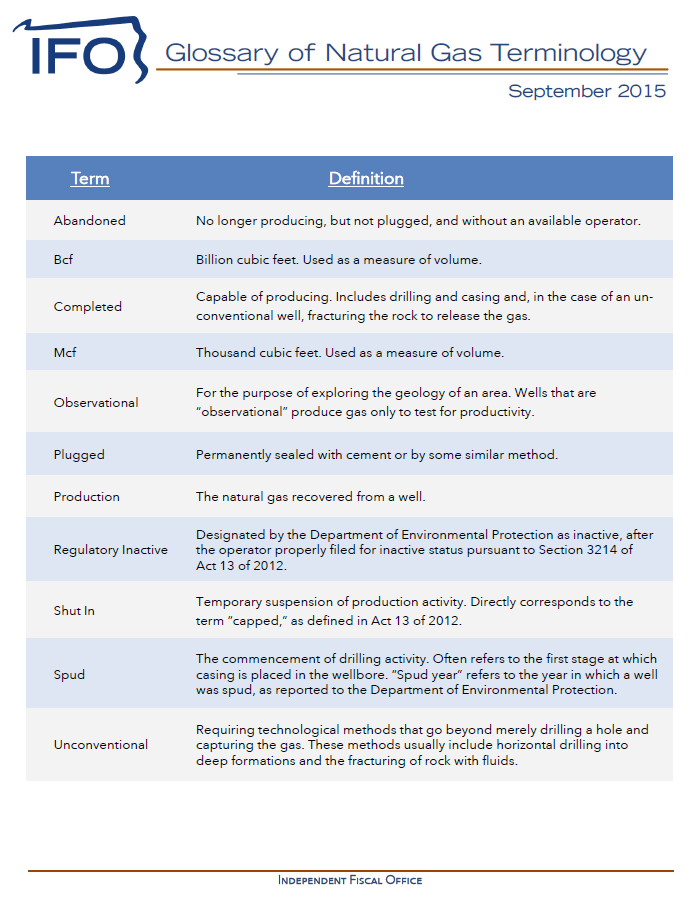

Glossary of technical terms to supplement the Natural Gas Production Report for the first half of 2015.

This report for the first half of 2015 uses data collected by the PA Department of Environmental Protection to develop statewide and county-level tabulations of production volume and well counts.

The Commonwealth collected $1.87 billion in General Fund revenues for August, an increase of $76.4 million (4.3%) compared to August 2014.

Fiscal year-to-date revenues were $4.0 billion, a decrease of -$34.8 million (-0.9%) from the prior year.

The Commonwealth collected $2.14 billion in General Fund revenues for July, a decrease of $111.1 million (-4.9%) compared to July 2014.

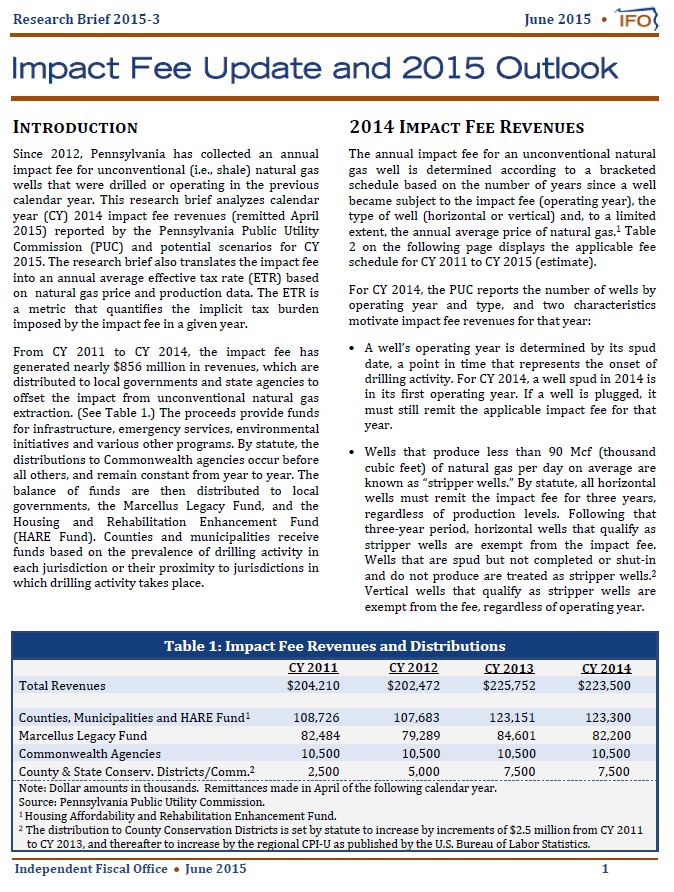

This research brief analyzes calendar year (CY) 2014 impact fee revenues (remitted April 2015) reported by the Pennsylvania Public Utility Commission (PUC) and potential scenarios for CY 2015. The research brief also translates the impact fee into an annual average effective tax rate (ETR) based on natural gas price and production data. The ETR is a metric that quantifies the implicit tax burden imposed by the impact fee in a given year.