In response to a legislative request, the IFO updated select tables and graphs related to school district property tax that were originally released in January and December of 2017.

Director Matthew Knittel gave a budget and economic update to the Pennsylvania Association of School Business Officials (PASBO). Revenue Analyst Jesse Bushman also discussed an updated school district property tax forecast and recent proposed legislation.

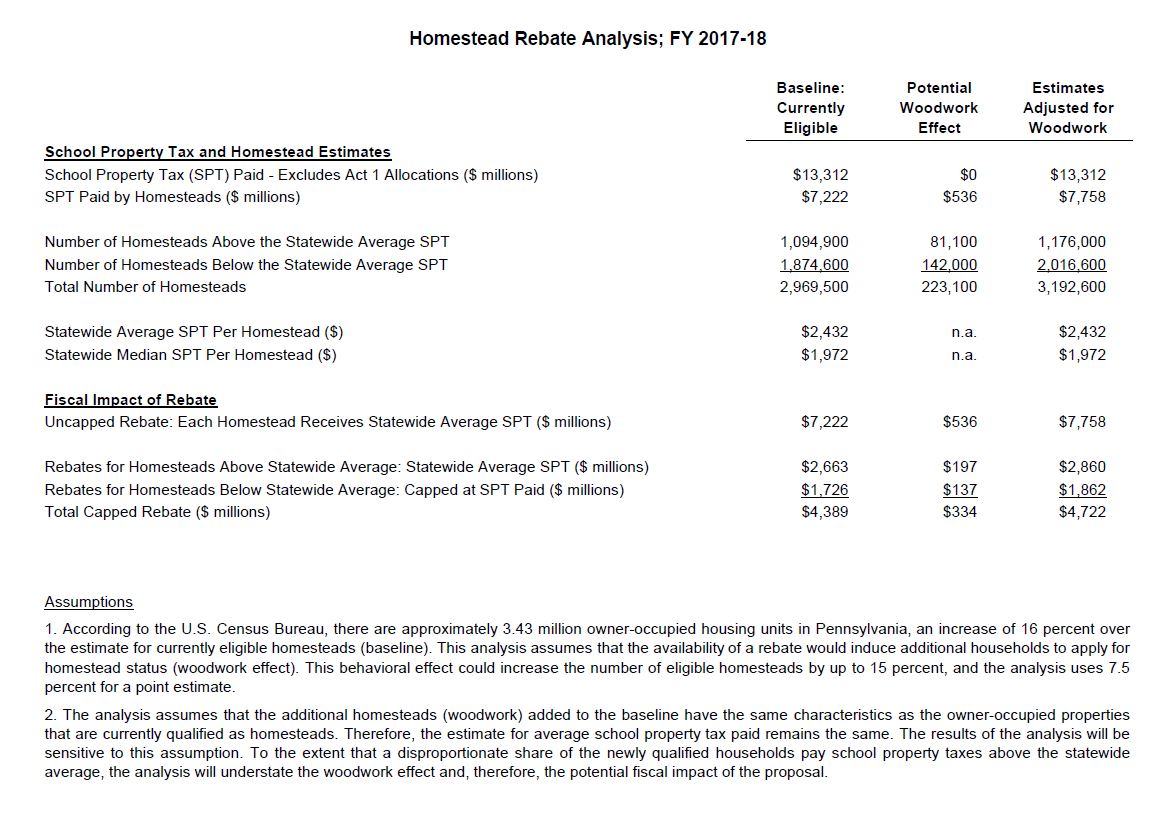

In response to a legislative request, the IFO estimated the fiscal impact of a school property tax rebate for all homesteads. The rebate would be equal to the statewide average school property tax paid by homesteads. The response includes both baseline estimates for currently eligible homesteads and estimates for a behavioral effect based on the filing of additional homestead applications in response to the availability of rebates.

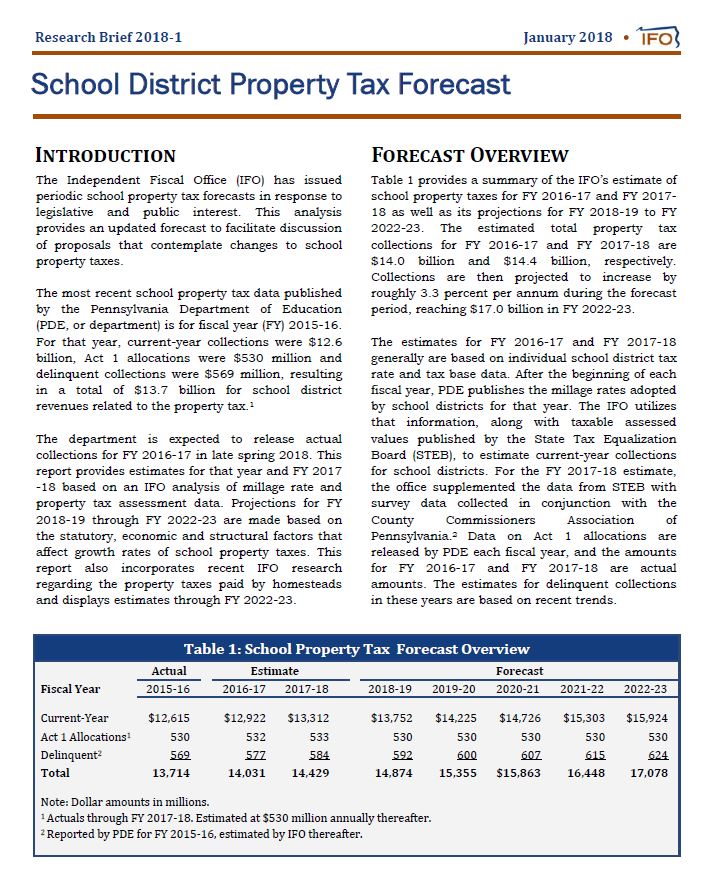

This research brief contains the IFO's forecasted school district property tax collections from FY 2016-17 through FY 2022-23. The brief also contains estimates of school district property tax collections that can be attributed to homestead property.

Total school property tax collections for FY 2016-17 ($14.0 billion) and FY 2017-18 ($14.4 billion) are estimated using millage rates published by the Pennsylvania Department of Education and property tax assessment data. For FY 2018-19 through FY 2022-23, collections are projected based on the statutory, economic and structural factors that affect growth rates of property taxes. During that period, total school property tax collections are projected to grow by an average annual rate of 3.3 percent, reaching $17.0 billion by FY 2022-23.