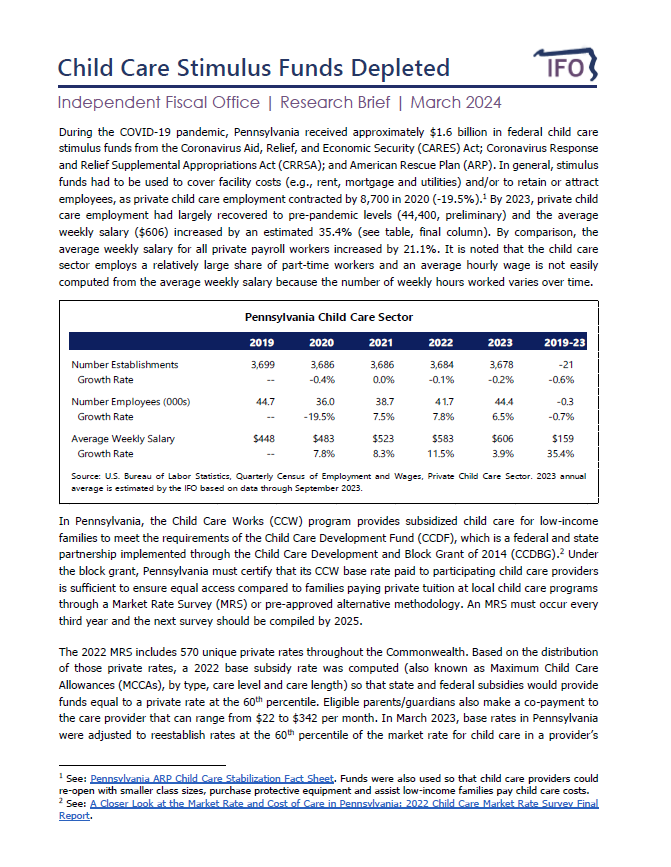

This research brief highlights the depletion of federal child care stimulus funds and the impact on that sector. During the COVID-19 pandemic, Pennsylvania received approximately $1.6 billion in federal child care stimulus funds from the Coronavirus Aid, Relief, and Economic Security (CARES) Act; Coronavirus Response and Relief Supplemental Appropriations Act (CRRSA); and American Rescue Plan (ARP).

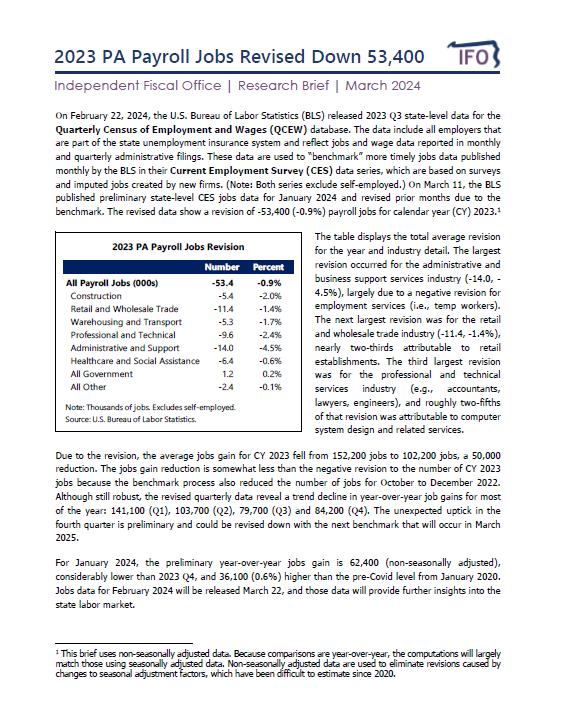

This research brief provides detail on the latest benchmark revision made by the U.S. Bureau of Labor Statistics to Pennsylvania payroll jobs.

The Independent Fiscal Office (IFO) responded to requests for additional information raised at the office’s budget hearing before the Senate Appropriations Committee. The requests relate to an adjusted financial statement, public assistance savings resulting from a higher minimum wage, impact of the Ohio rate structure on Pennsylvania tax liability, net migration for Pennsylvania, regional student loan debt comparison and U3 and U6 unemployment rates.

Director Knittel made a presentation to the House Finance Subcommittee on Tax Modernization and Reform.

Based on a request from Chair Rabb, the presentation was updated to add an additional slide that displays the income distribution for self-employment and S corporation/partnership income.