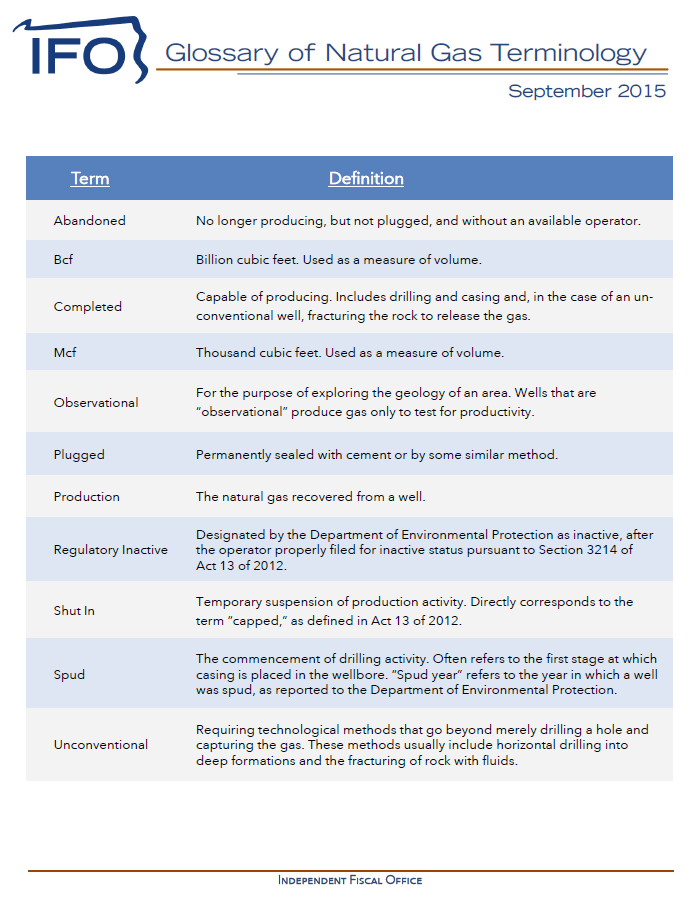

Glossary of technical terms to supplement the Natural Gas Production Report for the first half of 2015.

This report for the first half of 2015 uses data collected by the PA Department of Environmental Protection to develop statewide and county-level tabulations of production volume and well counts.

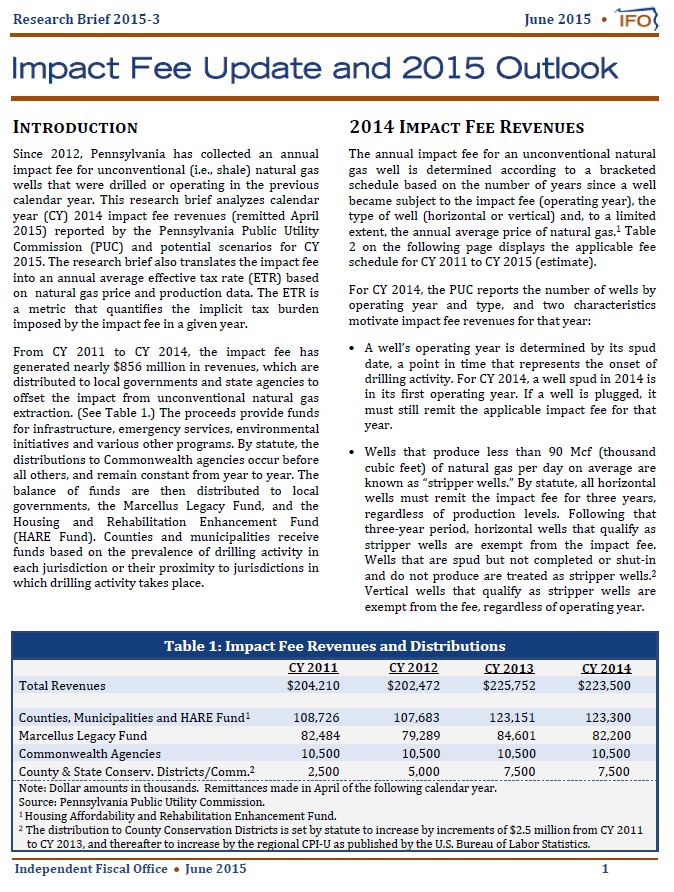

This research brief analyzes calendar year (CY) 2014 impact fee revenues (remitted April 2015) reported by the Pennsylvania Public Utility Commission (PUC) and potential scenarios for CY 2015. The research brief also translates the impact fee into an annual average effective tax rate (ETR) based on natural gas price and production data. The ETR is a metric that quantifies the implicit tax burden imposed by the impact fee in a given year.

Testimony by Director Matthew Knittel regarding a proposed severance tax . The information was presented at a public hearing conducted by the Senate Environmental Resources and Energy and Finance Committees (June 2015).

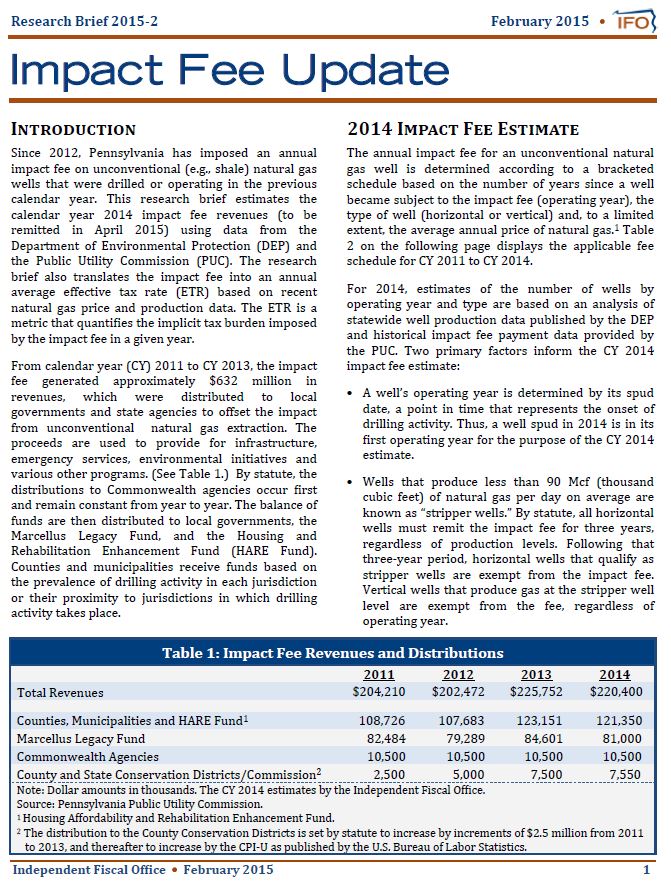

This research brief estimates the calendar year 2014 impact fee revenues (to be remitted in April 2015) using data from the Department of Environmental Protection (DEP) and the Public Utility Commission (PUC). The research brief also translates the impact fee into an annual average effective tax rate (ETR) based on recent natural gas price and production data. The ETR is a metric that quantifies the implicit tax burden imposed by the impact fee in a given year.

This report compares Pennsylvania's unique natural gas tax structure to other states. The report also considers other taxes that may be levied on natural gas producers such as real and personal property, corporate and personal income, sales and use and miscellaneous fees. Due to the complexity of the analysis, readers are encouraged to thoroughly review the methodology and assumptions contained in Section 1 of this report.

- Full report

- Analysis-in-Brief (2 pages)

- Background on effective tax rates (2 pages, updated 4/4/2014 for the 2013 reporting year impact fee collections)