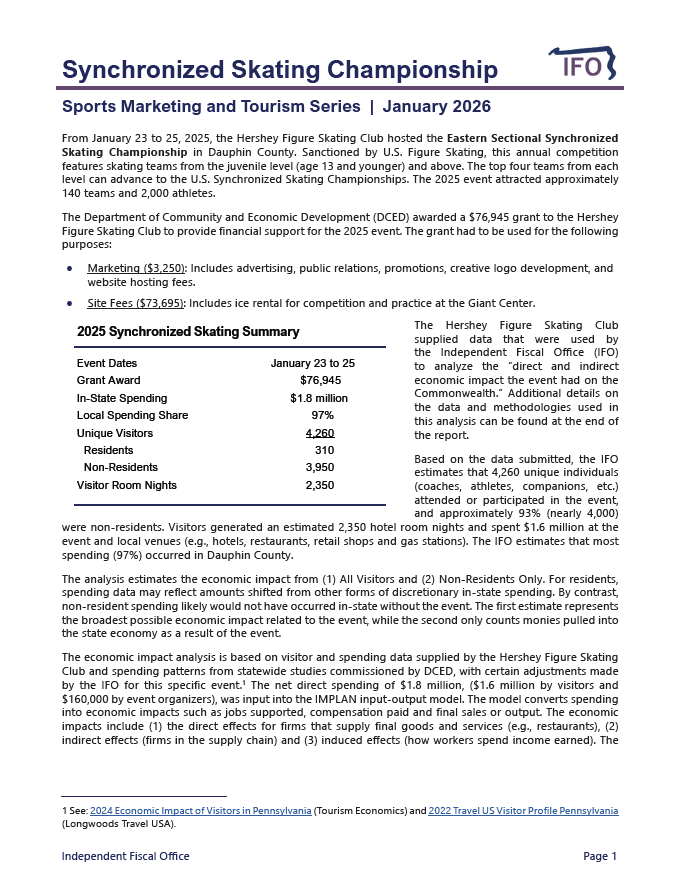

As required by statute, the IFO submitted an economic impact report for the Eastern Sectional Synchronized Skating Championship in Dauphin County (January 2025) to the General Assembly. The analysis finds that economic activity related to the event generated $2.6 million in statewide spending and $102,000 in select state and local taxes.

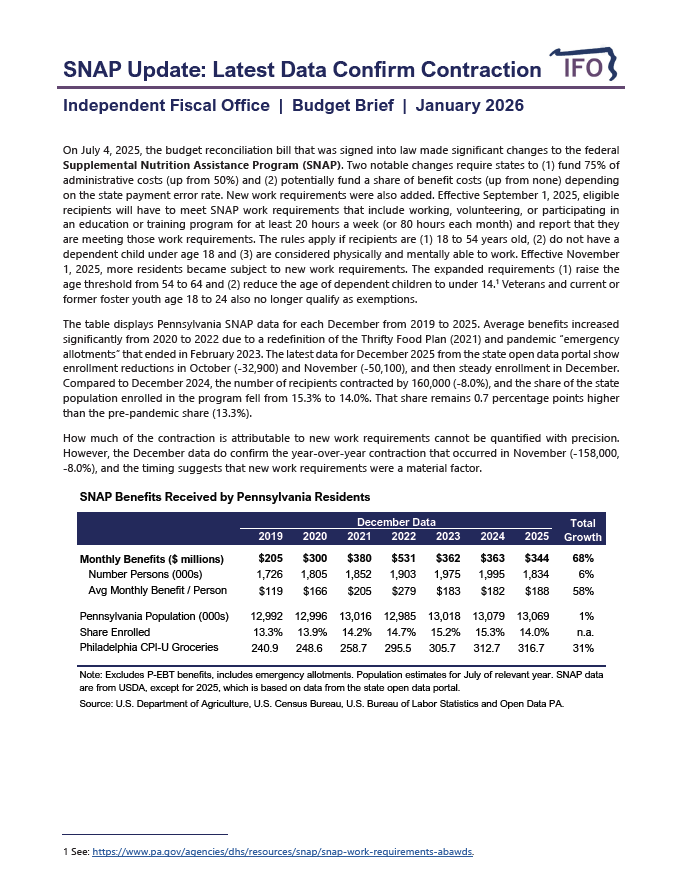

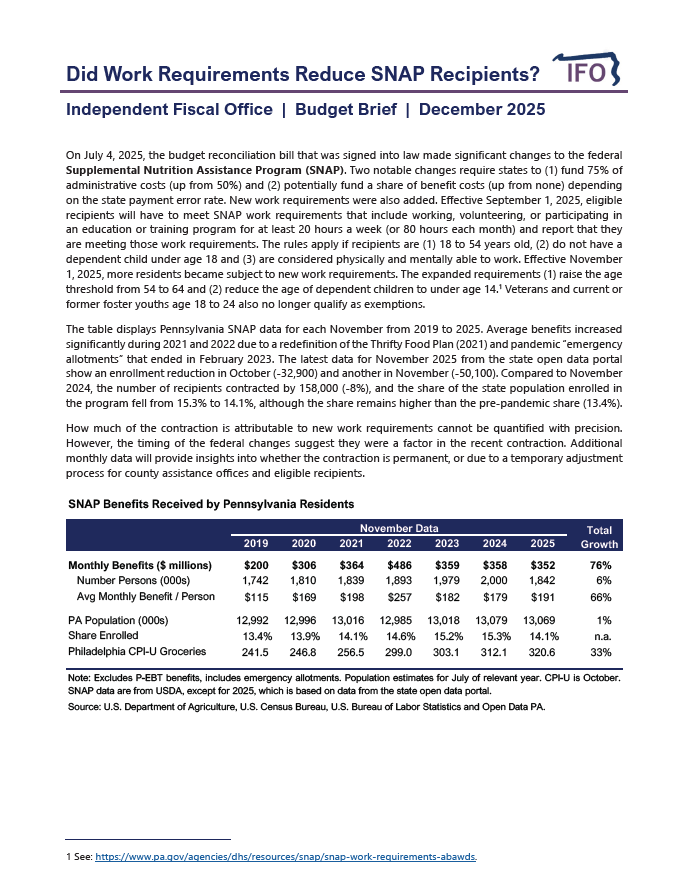

The IFO published a budget brief that uses the latest SNAP benefits data for December 2025. For the second consecutive month, the data show that the number of enrollees declined by 160,000 (-8%) from the prior year as new work requirements took effect.

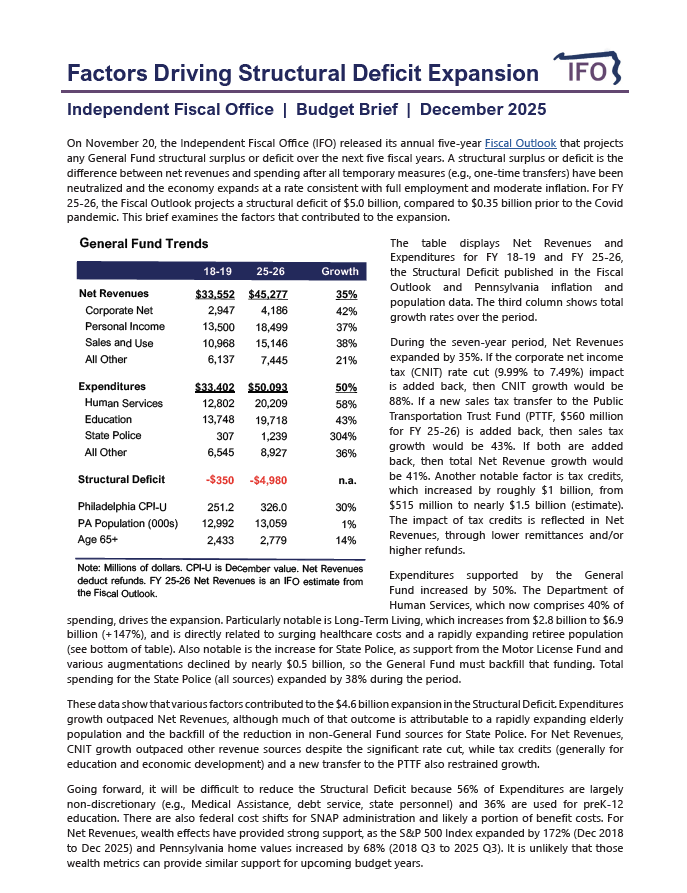

Director Knittel submitted content for publication in the CPA Now blog posted on December 22, 2025. The blog discusses the $5 billion structural deficit for FY 25-26 and provides background on income and sales tax that might be used to address it.

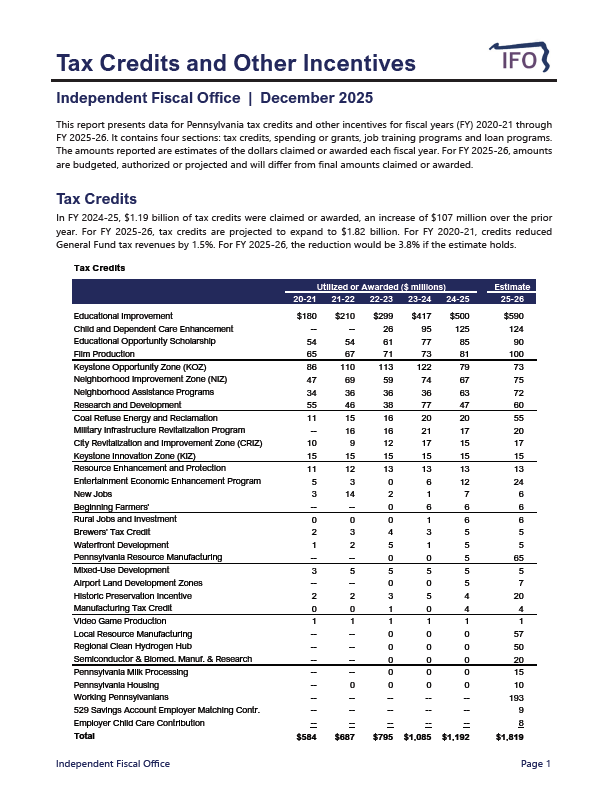

This report presents data on Pennsylvania tax credits and economic development incentives for fiscal years (FY) 2020-21 through FY 2025-26. The tables provide annual detail on tax credit utilization or awards, state spending or grants, job training programs and state loan programs. Fiscal year 2025-26 amounts are budgeted, authorized or projected and will differ from final amounts claimed or awarded. The report also highlights recent changes to incentive program spending or utilization.

The IFO published a new budget brief that uses the latest SNAP benefits data for November 2025. The data show that the number of enrollees declined by 158,000 (-8%) from the prior year as new work requirements take effect.

This research brief examines recent trends for Pennsylvania gasoline consumption and PennDOT's highway and bridge construction project materials index. The data show a significant divergence, creating funding issues for future projects.

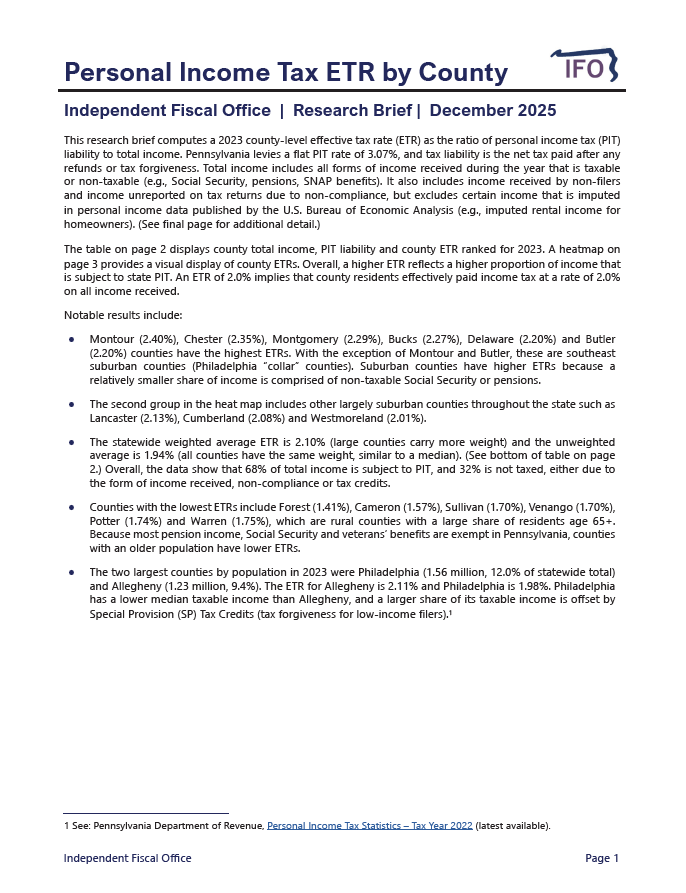

This research brief computes 2023 county-level effective tax rates (ETRs) as the ratio of personal income tax liability to total income. Total income includes both taxable and non-taxable income (e.g., Social Security, pensions, SNAP benefits). Counties surrounding Philadelphia (Chester, Montgomery, Bucks and Delaware) had some of the highest ETRs, while rural counties (Forest, Cameron, Sullivan and Venango) had the lowest ETRs.

As a follow up to its annual Fiscal Outlook, the IFO released a one page summary that examines factors that contributed to the rapid expansion of the General Fund structural deficit.

This report uses data from the U.S. Census Bureau, the U.S. Bureau of Economic Analysis (BEA), the National Center for Education Statistics and the U.S. Department of Transportation to facilitate a comparison of state and local government expenditures by major spending category across the 50 states. The report (1) examines Pennsylvania expenditures by category (e.g., education) over time, (2) compares Pennsylvania expenditures to other states and the U.S. average and (3) ranks the distribution of major spending categories by state.

This economic brief tracks the latest claims for unemployment compensation (UC) for all Pennsylvania covered workers and federal workers only.