The IFO released a new research brief that uses data from the Pennsylvania Department of Education and Philadelphia Office of Property Assessment to compare median homestead school property taxes by county.

The IFO released an updated forecast of the Act 1 Index, which limits school district property tax rate increases. The report projects the index through FY 2030-31 and provides an overview of recent usage of the index by school districts.

The IFO released an updated school district property tax forecast. The report projects revenues and the Act 1 index through FY 2026-27 and provides an overview of recent trends in school district funding.

The IFO released a research brief that reviews county-level millage rate changes for CY 2025 and the prior decade.

This brief was updated on March 20, 2025 to correct an issue related to counties characterized as reassessed.

Fiscal Analyst Jesse Bushman presented an update on the Pennsylvania economy and a new projection of the Act 1 Index to the Pennsylvania Association of School Business Officials.

This research brief uses data from the Pennsylvania Department of Education and Pennsylvania Gaming Control Board to examine the recent increase in Act 1 property tax relief due to gaming expansion.

This research brief uses (1) income data from the Bureau of Economic Analysis and the Internal Revenue Service and (2) property tax data from the Pennsylvania Department of Education and Department of Community and Economic Development to estimate county-level property tax burdens on homeowners and renters across the state for 2022.

The brief was updated on September 6, 2024 to address a technical correction.

The IFO released an updated school district property tax forecast. The report projects revenues and the Act 1 index through FY 2025-26 and provides an overview of recent trends in school district funding.

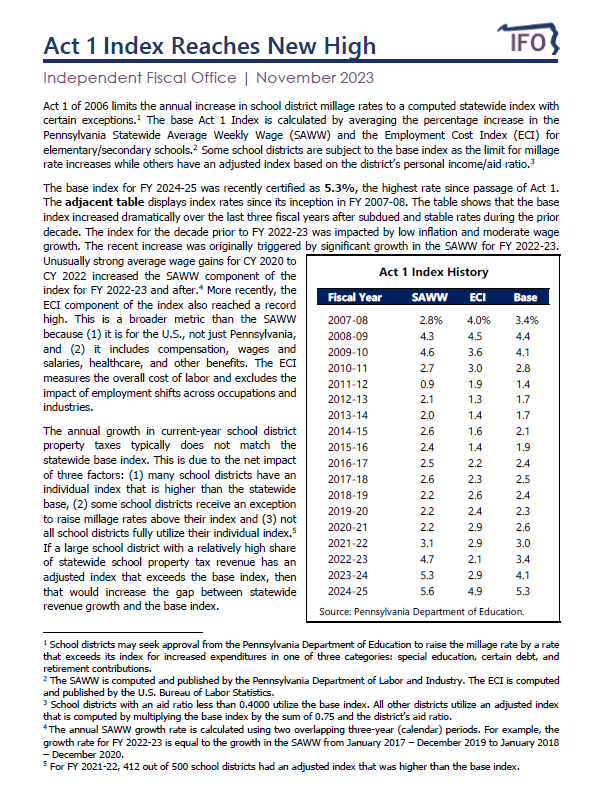

The Act 1 index limits the annual increase in school district millage rates. For FY 24-25, PDE recently certified an all-time high value (5.3%). This report examines the factors that drive that outcome and provides projections through FY 28-29.

This research brief uses (1) income data from the Bureau of Economic Analysis and the Internal Revenue Service and (2) property tax data from the Pennsylvania Department of Education and Department of Community and Economic Development to estimate county-level property tax burdens across the state for 2021.