This economic brief tracks the latest claims for unemployment compensation (UC) for all covered workers and federal workers only. The IFO is tracking these claims in preparation for its November five-year outlook report.

Section 604-B (a)(2) of the Administrative Code of 1929 specifies that the Independent Fiscal Office (IFO) shall “provide an assessment of the state’s current fiscal condition and a projection of what the fiscal condition will be during the next five years. The assessment shall take into account the state of the economy, demographics, revenues and expenditures.” This report fulfills the demographics obligation of this statute.

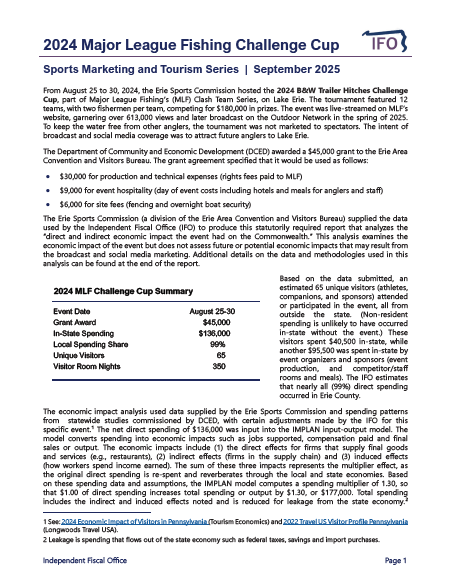

As required by statute, the IFO submitted an economic impact report for the Major League Fishing Challenge Cup in Erie County (August 2024) to the General Assembly. The analysis finds that economic activity related to the event generated $177,000 in statewide spending and $21,000 in select state and local taxes.

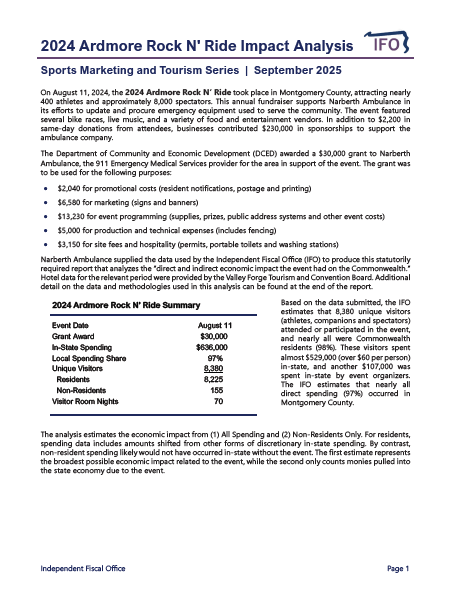

The IFO published an economic impact report for the Ardmore Rock N’ Ride in Montgomery County (August 2024). The analysis finds that economic activity related to the event generated $891,000 in statewide spending, supported 5 full-time equivalent jobs and $29,000 in select state and local taxes.

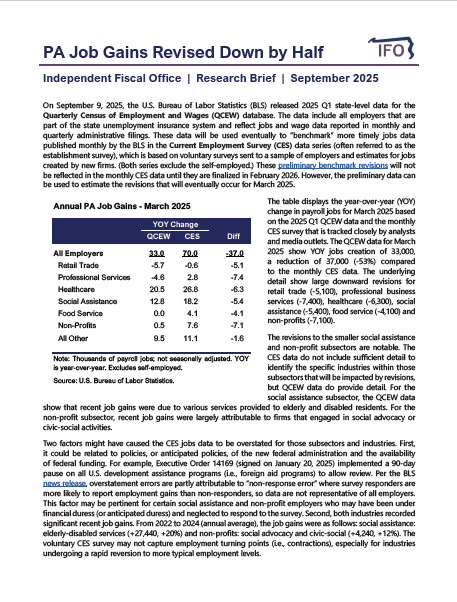

This research brief examines how the significant downward revision to employment made by the U.S. Bureau of Labor Statistics on September 9 impacts Pennsylvania. It includes specific commentary for the social assistance and non-profit subsectors.

The IFO published a letter in response to a request from Senator Keefer for a partial analysis of SB 962. The analysis estimates the net impact for all counties from the elimination of school district property tax partially replaced by a 1.88 percentage point increase in the personal income tax rate.

The IFO published an economic impact report for the NASCAR Cup Series Weekend in the Poconos Region (July 2024). The event attracted nearly 93,000 fans and related economic activity supported 290 full-time equivalent jobs and $2.4 million in select state and local taxes.

Director Knittel made a presentation to the Transportation Advisory Committee on a proposed Retail Delivery Fee modeled after the Colorado fee. Rates of 25, 50, 75 and 100 cents per taxable delivery were considered.

This research brief estimates the impact of the new federal deduction for filers age 65 or older ($6,000 for single, $12,000 for joint). For tax year 2025, the IFO projects the provision will reduce federal income tax by $1.1 billion for PA seniors.

The IFO released a budget brief highlighting General Fund and Rainy Day Fund interest earnings, which peaked at a combined $1 billion in FY 2023-24 and FY 2024-25, but are declining rapidly.