November 2017

December 01, 2017 | Revenue & Economic Update

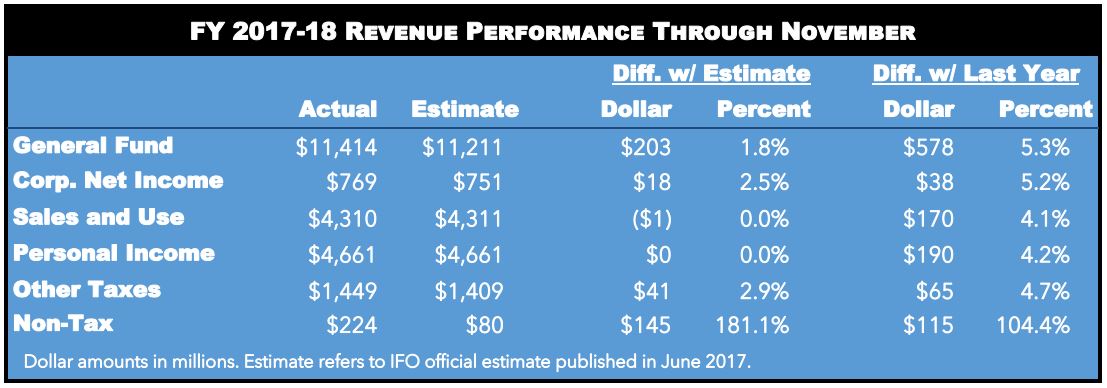

In August, the Independent Fiscal Office (IFO) released monthly projections for the fiscal year (FY) 2017-18 revenue estimate published in June 2017.1 Through the first five months of FY 2017-18, total General Fund revenues were $203.1 million (1.8 percent) above the IFO’s official estimate. Tax revenues were $58.5 million (0.5 percent) above estimate and non-tax revenues were $144.5 million (181.1 percent) above estimate.

The outperformance of General Fund revenues compared to the IFO’s official estimate is due to earlier-than-anticipated revenues from (1) a state stores fund transfer ($100.0 million), (2) a slots license fee ($50.0 million) and (3) a transfer from a delinquent collections holding account ($26.8 million). These amounts were anticipated to be remitted to the General Fund later in the fiscal year and therefore do not represent permanent revenue gains. Excluding such temporary gains, total General Fund revenues were $26.3 million (0.2 percent) above the IFO’s official estimate through November. Tax revenues were $31.7 million (0.3 percent) above estimate and non-tax revenues were $5.5 million (-6.8 percent) below estimate.

Adjusted for temporary gains, collections from the three largest tax revenue sources, personal income tax (PIT), sales and use tax (SUT) and corporate net income tax (CNIT), were roughly at estimate through November. PIT revenues were $7.1 million (-0.2 percent) below estimate, driven by quarterly payments that were $32.6 million (-6.3 percent) below estimate. SUT revenues were $8.6 million (-0.2 percent) below estimate, while CNIT revenues were $8.9 million (1.2 percent) above estimate.

Fourth-quarter estimated payments for PIT (non-withholding) and CNIT liabilities are remitted each December and January. These payments represent significant contributions to the General Fund, but can fluctuate from year to year. The potential outperformance or underperformance of the General Fund revenue estimate for the remainder of FY 2017-18 should become more clear once those payments have been remitted.

In December, the IFO will release updated monthly projections for FY 2017-18 that reflect the impact of recently enacted legislation.2 The legislation was enacted as part of the FY 2017-18 state budget.