As required by statute, the IFO submitted an economic impact report for the Eastern Sectional Synchronized Skating Championship in Dauphin County (January 2025) to the General Assembly. The analysis finds that economic activity related to the event generated $2.6 million in statewide spending and $102,000 in select state and local taxes.

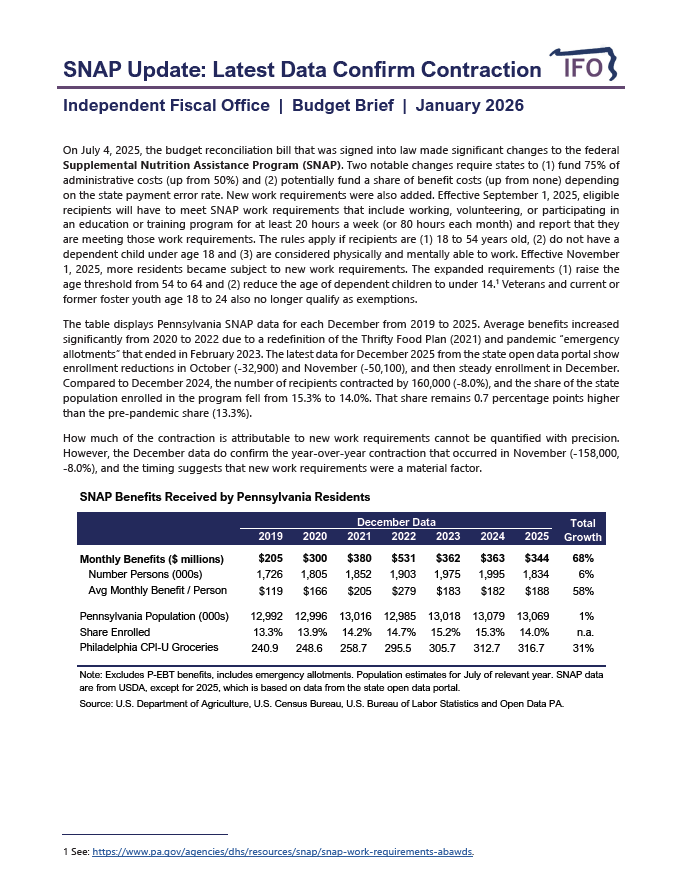

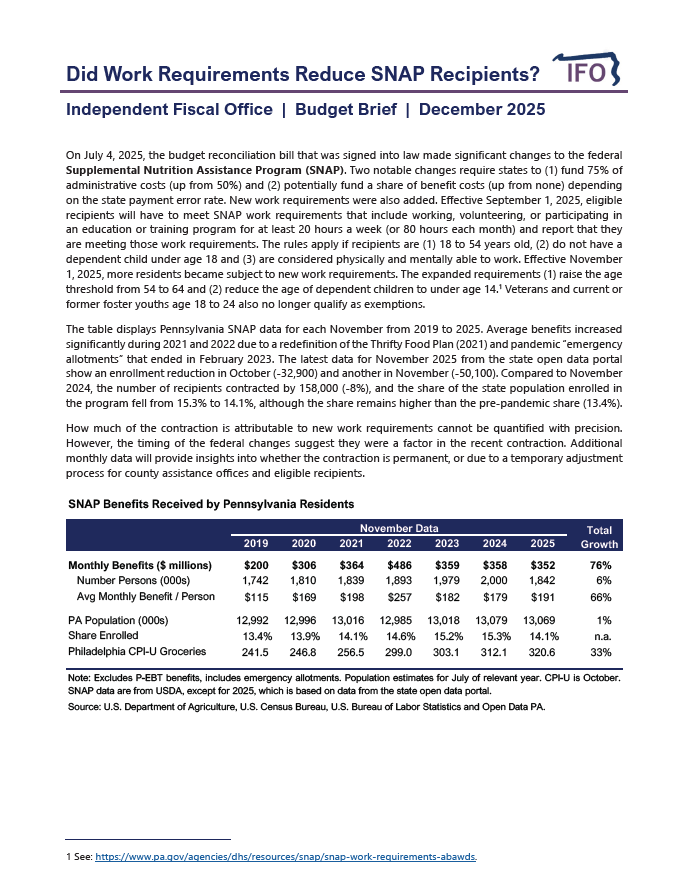

The IFO published a budget brief that uses the latest SNAP benefits data for December 2025. For the second consecutive month, the data show that the number of enrollees declined by 160,000 (-8%) from the prior year as new work requirements took effect.

The IFO will present its mid-year revenue update for the Commonwealth on January 28th at 1:30 PM. The update will include a discussion of recent economic trends, an updated financial statement for FY 2025-26 and an advance look at General Fund revenues for FY 2026-27.

The IFO released a new research brief that uses data from the Pennsylvania Department of Education and Philadelphia Office of Property Assessment to compare median homestead school property taxes by county.

The Commonwealth collected $4.97 billion in General Fund revenues for December, an increase of $1.20 billion (+31.7%) compared to December 2024.

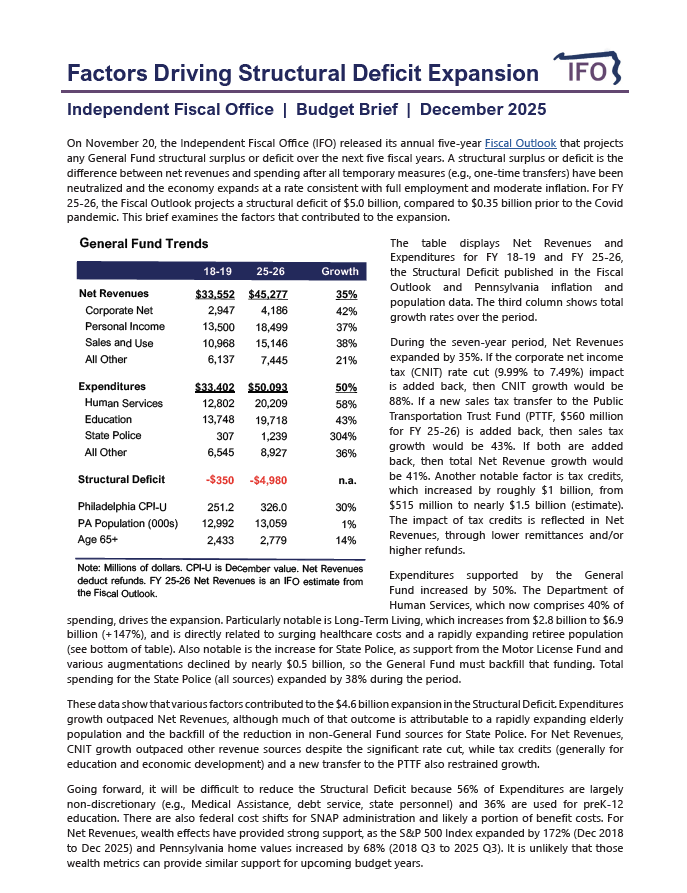

Director Knittel submitted content for publication in the CPA Now blog posted on December 22, 2025. The blog discusses the $5 billion structural deficit for FY 25-26 and provides background on income and sales tax that might be used to address it.

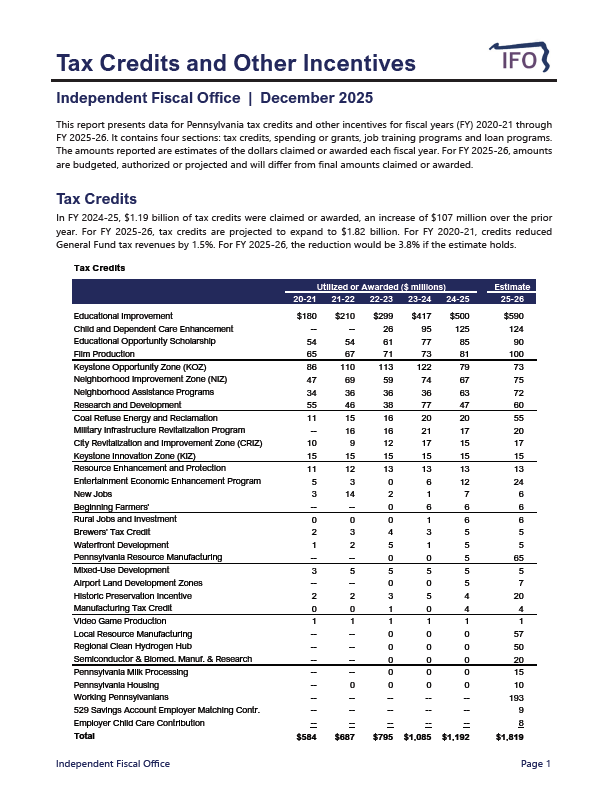

This report presents data on Pennsylvania tax credits and economic development incentives for fiscal years (FY) 2020-21 through FY 2025-26. The tables provide annual detail on tax credit utilization or awards, state spending or grants, job training programs and state loan programs. Fiscal year 2025-26 amounts are budgeted, authorized or projected and will differ from final amounts claimed or awarded. The report also highlights recent changes to incentive program spending or utilization.

The IFO published a new budget brief that uses the latest SNAP benefits data for November 2025. The data show that the number of enrollees declined by 158,000 (-8%) from the prior year as new work requirements take effect.

This research brief examines recent trends for Pennsylvania gasoline consumption and PennDOT's highway and bridge construction project materials index. The data show a significant divergence, creating funding issues for future projects.

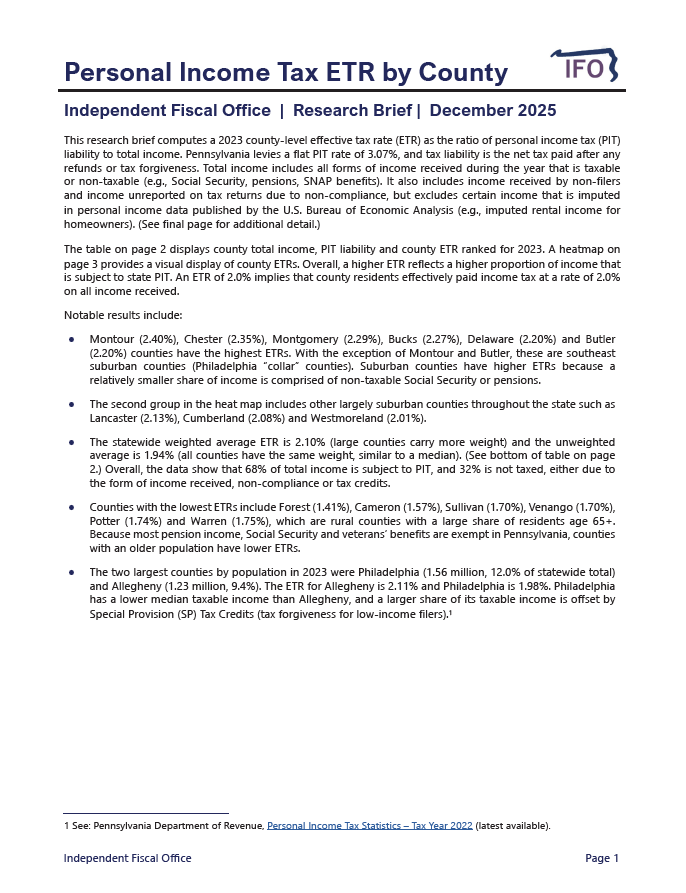

This research brief computes 2023 county-level effective tax rates (ETRs) as the ratio of personal income tax liability to total income. Total income includes both taxable and non-taxable income (e.g., Social Security, pensions, SNAP benefits). Counties surrounding Philadelphia (Chester, Montgomery, Bucks and Delaware) had some of the highest ETRs, while rural counties (Forest, Cameron, Sullivan and Venango) had the lowest ETRs.

This report uses recent data published by the Department of Environmental Protection to project CY 2025 Impact Fee collections (remitted April 2026). Collections are estimated to be $240 million, an increase of $75 million from the prior year.

As a follow up to its annual Fiscal Outlook, the IFO released a one page summary that examines factors that contributed to the rapid expansion of the General Fund structural deficit.

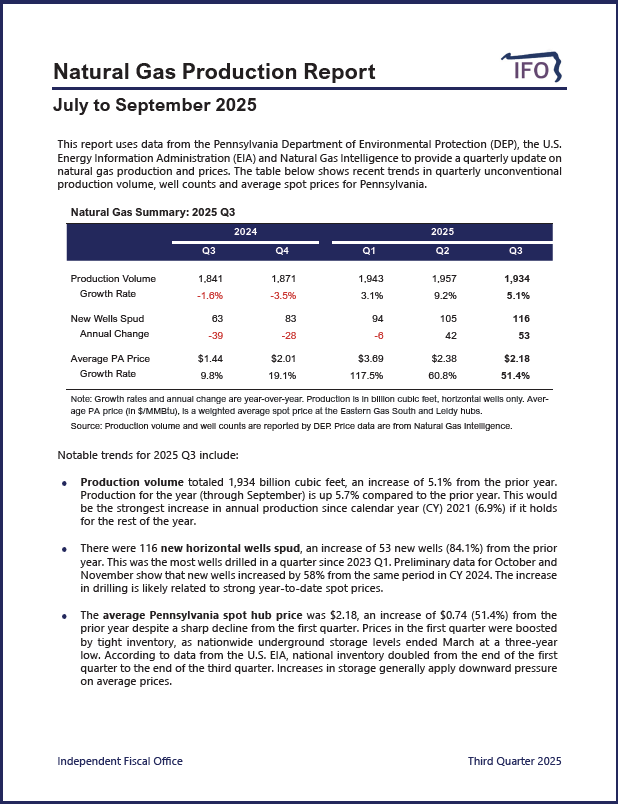

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

The IFO released an updated forecast of the Act 1 Index, which limits school district property tax rate increases. The report projects the index through FY 2030-31 and provides an overview of recent usage of the index by school districts.

The Commonwealth collected $3.02 billion in General Fund revenues for November, an increase of $90 million compared to November 2024.

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the State Employee Retirement System’s (SERS) recent stress test report. Based on SERS baseline projections, the IFO projects that over the next 20 years, Commonwealth agencies will use $22.0 billion in General Fund revenues (1.7%) for employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of baseline assumptions.

This report uses data from the U.S. Census Bureau, the U.S. Bureau of Economic Analysis (BEA), the National Center for Education Statistics and the U.S. Department of Transportation to facilitate a comparison of state and local government expenditures by major spending category across the 50 states. The report (1) examines Pennsylvania expenditures by category (e.g., education) over time, (2) compares Pennsylvania expenditures to other states and the U.S. average and (3) ranks the distribution of major spending categories by state.

This economic brief tracks the latest claims for unemployment compensation (UC) for all Pennsylvania covered workers and federal workers only.

This report provides revised monthly General Fund revenue estimates for FY 2025-26 based on projections contained in the Official Revenue Estimate published by the IFO on June 20, 2025 (includes adjustments released with the original monthly estimates in August 2025) adjusted to reflect the impact of statutory changes that were enacted in conjunction with the state budget in November 2025.

The Independent Fiscal Office released a one-page summary of highlights of its annual Fiscal Outlook for the General Fund. See the full report for additional detail not included in the one-page summary.

The Independent Fiscal Office (IFO) released its five-year Fiscal Outlook. Click the hyperlink above to view the report and presentation.

Due to recent developments with the state budget, the IFO will postpone its long-term fiscal outlook for FY 2025-26 to FY 2030-31 to November 20 at 1:30 pm. The report will include an assessment of the General Fund surplus and Rainy Day Fund under current law and policies.

See the announcement for a link to register for the presentation. Those already registered do not need to re-register.

The IFO published a letter in response to a request from Representative Grove for an analysis of HB 860 from the 2015-2016 Legislative Session. The analysis estimates what would have been the 2016-2025 impact from a 0.63 percentage point increase in the personal income tax rate and a 1.0 percentage point increase in the sales and use tax rate. The new revenues would have been used to lower millage rates (personal income tax) and increase homestead/farmstead exclusions (sales and use tax).

The IFO released a report that outlines options for sales-use tax (SUT) base expansion. The report includes (1) an overview of the tax and recent collection trends, (2) a comparison to other states, (3) estimates for expansion of the SUT base to 15 additional goods and services, (4) a discussion of tax incidence across six income groups and (5) the impact of the current tax on the 67 counties. The report fulfills the office’s statutory obligation under Section 604-B (a)(5) of the Administrative Code of 1929.

This economic brief tracks the latest claims for unemployment compensation (UC) for all covered workers and federal workers only. The IFO is tracking these claims in preparation for its November five-year outlook report.

Section 604-B (a)(2) of the Administrative Code of 1929 specifies that the Independent Fiscal Office (IFO) shall “provide an assessment of the state’s current fiscal condition and a projection of what the fiscal condition will be during the next five years. The assessment shall take into account the state of the economy, demographics, revenues and expenditures.” This report fulfills the demographics obligation of this statute.

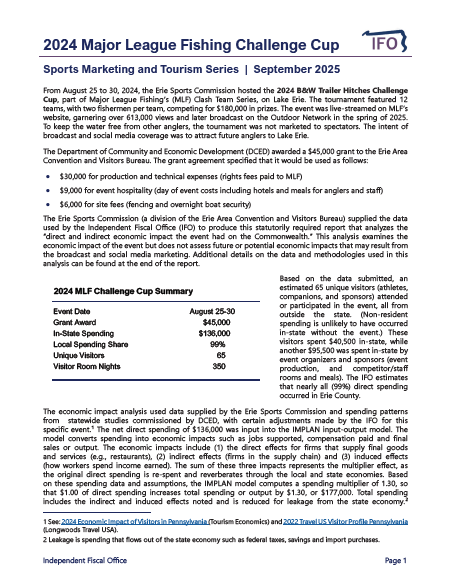

As required by statute, the IFO submitted an economic impact report for the Major League Fishing Challenge Cup in Erie County (August 2024) to the General Assembly. The analysis finds that economic activity related to the event generated $177,000 in statewide spending and $21,000 in select state and local taxes.

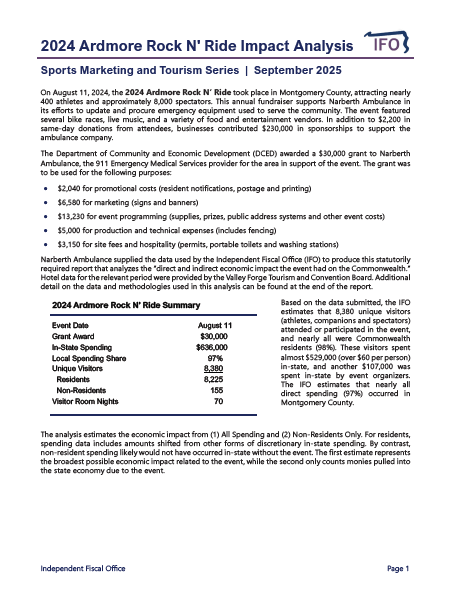

The IFO published an economic impact report for the Ardmore Rock N’ Ride in Montgomery County (August 2024). The analysis finds that economic activity related to the event generated $891,000 in statewide spending, supported 5 full-time equivalent jobs and $29,000 in select state and local taxes.

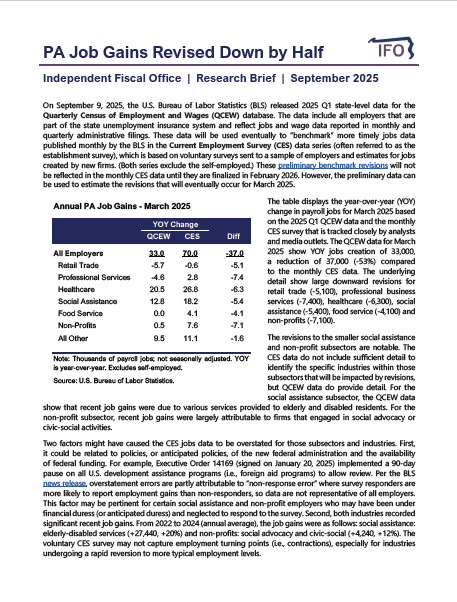

This research brief examines how the significant downward revision to employment made by the U.S. Bureau of Labor Statistics on September 9 impacts Pennsylvania. It includes specific commentary for the social assistance and non-profit subsectors.

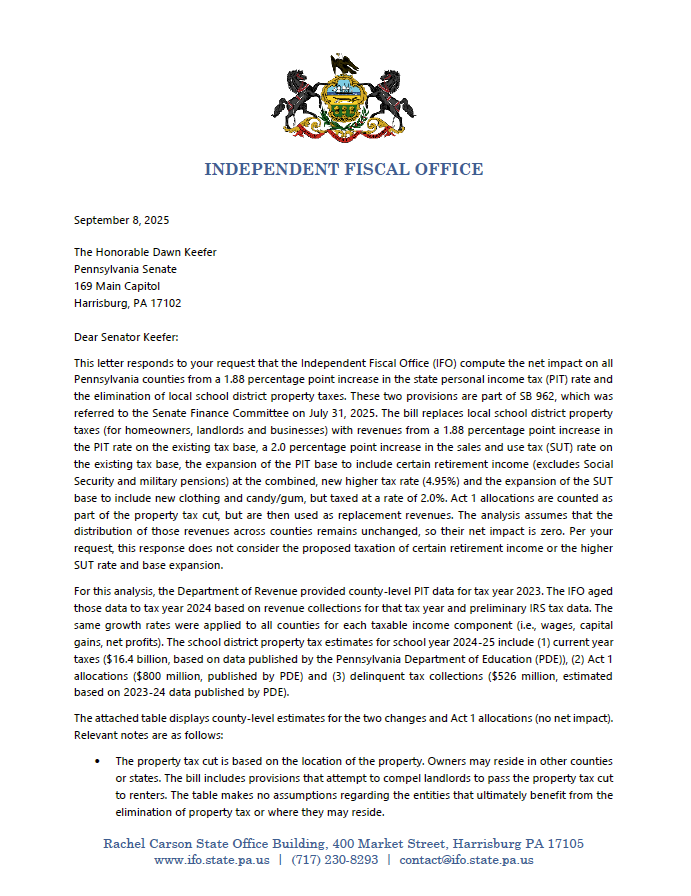

The IFO published a letter in response to a request from Senator Keefer for a partial analysis of SB 962. The analysis estimates the net impact for all counties from the elimination of school district property tax partially replaced by a 1.88 percentage point increase in the personal income tax rate.

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

The IFO released a budget brief that provides a General Fund update at the midpoint between the start of the fiscal year and release of its five-year outlook in November.

This research brief discusses recent increases in electricity prices for Pennsylvania residential consumers. The price to compare for residential customers at three large utilities increased by 13% to 16% for June through November compared to the prior six months. Relevant factors include (1) growth in natural gas prices, (2) higher capacity costs for the PJM grid and (3) compliance costs related to the Alternative Energy Portfolio Standards.

This report provides revenue distributions based on the FY 2025-26 projections contained in the Official Revenue Estimate published by the IFO on June 20, 2025 and the impact of statutory changes enacted with federal H.R. 1.

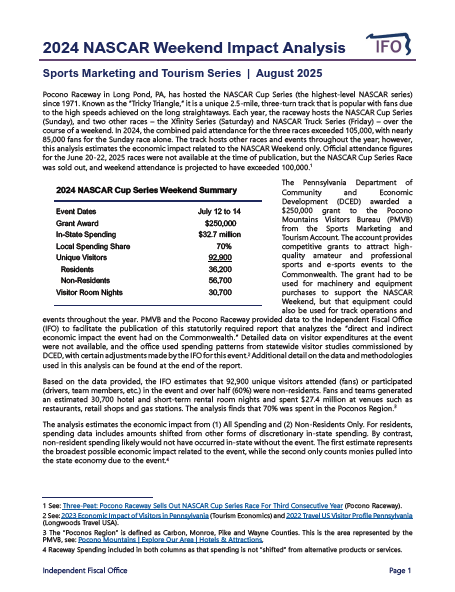

The IFO published an economic impact report for the NASCAR Cup Series Weekend in the Poconos Region (July 2024). The event attracted nearly 93,000 fans and related economic activity supported 290 full-time equivalent jobs and $2.4 million in select state and local taxes.

This report examines the historical performance of IFO revenue estimates. For FY 2024-25, actual collections exceeded IFO projections by 1.4%, or $640 million.

Director Knittel made a presentation to the Transportation Advisory Committee on a proposed Retail Delivery Fee modeled after the Colorado fee. Rates of 25, 50, 75 and 100 cents per taxable delivery were considered.

This research brief estimates the impact of the new federal deduction for filers age 65 or older ($6,000 for single, $12,000 for joint). For tax year 2025, the IFO projects the provision will reduce federal income tax by $1.1 billion for PA seniors.

The IFO released a budget brief highlighting General Fund and Rainy Day Fund interest earnings, which peaked at a combined $1 billion in FY 2023-24 and FY 2024-25, but are declining rapidly.

The IFO published an economic impact report for the Ironman 70.3 Pennsylvania Happy Valley Triathlon in Centre County (June 2024). The analysis finds that economic activity related to the event generated over $3.1 million in statewide spending, supported 16 full-time equivalent jobs, and $178,000 in select state and local taxes.

The IFO released a budget brief that discusses two new expensing provisions included in the federal reconciliation bill passed on July 4. The provisions could reduce revenues (and increase the projected deficit) by $500 to $900 million for FY 2025-26.

The IFO released an updated budget brief that examines the budget implications of recent SNAP changes and the number of beneficiaries that will be impacted by new work requirements for able-bodied adults age 55 to 64.

The IFO released a budget brief that discusses the potential impact of proposed federal policy changes on General Fund deficit projections.

The Independent Fiscal Office (IFO) released its official revenue estimate for FY 2025-26. Updated estimates for FY 2024-25 are included.

This update examines 2024 impact fee collections and provides an outlook for 2025. Collections totaled $164.6 million for 2024, a decrease of $15.0 million from 2023.

This budget brief highlights Pennsylvania Medicaid (MA) enrollment and funding trends from FY 18-19 through the administration’s proposal for FY 25-26. It also provides projections of the impact for certain MA provisions included in the federal reconciliation bill passed by the U.S. House of Representatives.

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

As part of the draft reconciliation bill, the US House proposed to increase the state share of costs for the Supplemental Nutrition Assistance Program (SNAP). This research brief describes the proposed changes and the potential impact on the state budget.

The IFO released an updated school district property tax forecast. The report projects revenues and the Act 1 index through FY 2026-27 and provides an overview of recent trends in school district funding.

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the Public School Employees Retirement System’s (PSERS) recent stress test report. Based on PSERS’ baseline projections, the IFO projects that from FY 2025-26 to FY 2053-54, the Commonwealth will use $50.8 billion in General Fund revenues (2.3%) for the state’s share of public school employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of assumptions.

The IFO released its initial revenue estimate for FY 2025-26. Click the hyperlink above to view the report and presentation.

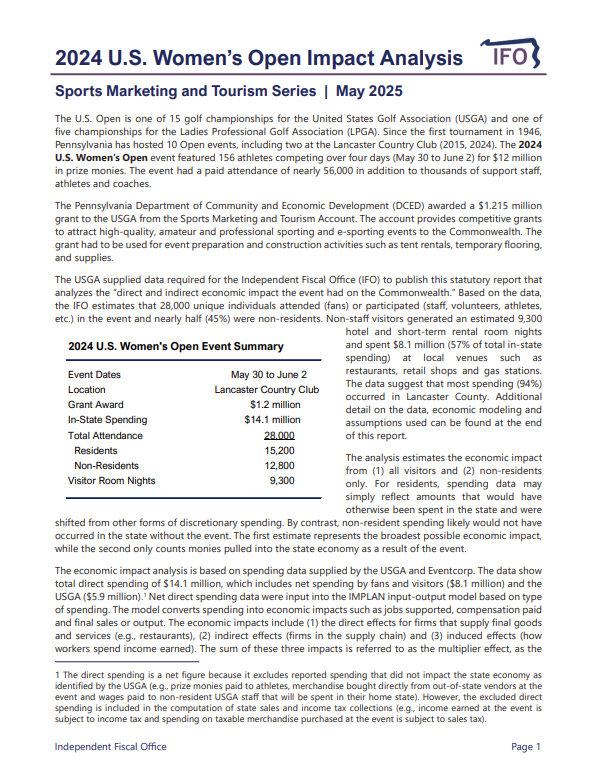

The IFO published an economic impact report for the 2024 U.S. Women’s Open which took place May 30 to June 2, 2024 at the Lancaster Country Club. The analysis finds that economic activity related to the event supported 147 full-time equivalent jobs and generated $14.1 million in in-state spending, nearly $570,000 in state sales and use tax and $560,000 in personal income tax revenue.

This economic brief tracks the latest claims for unemployment compensation (UC) for all covered workers and federal workers only. The IFO is tracking these claims in preparation for its May 20 initial revenue estimate.