Featured Releases

General Fund Surplus Likely Depleted Next Year

Economics and Other

July 18, 2024

This research brief uses the recently passed state budget for FY 24-25 to update deficit estimates for the current and subsequent fiscal year.

Corporate Rate Reduction and Higher NOL Cap

Economics and Other

July 17, 2024

This research brief examines two recent provisions that reduce corporate net income tax liability: a lower tax rate and a higher net operating loss (NOL) deduction threshold. The provisions significantly reduce corporate tax liability and will be phased-in through tax year 2031.

Stadium Economic Impact Report: Philadelphia Phillies

Economics and Other

July 10, 2024

The IFO performed an analysis that measured the 2023 economic footprint attributable to the Philadelphia Phillies’ Major League Baseball (MLB) operations at Citizens Bank Park. The analysis finds that economic activity related to team operations and fan spending generated $970 million in statewide spending, supported 5,400 full-time equivalent jobs, and $45 million in state taxes.

Stadium Economic Impact Report: Pittsburgh Pirates

Economics and Other

July 10, 2024

The IFO performed an analysis that measured the 2023 economic footprint attributable to the Pittsburgh Pirates’ Major League Baseball (MLB) operations at PNC Park. The analysis finds that economic activity related to team operations and fan spending generated $546 million in statewide spending, supported 3,000 full-time equivalent jobs, and $22 million in state taxes.

Revenue Estimate Performance

Revenue Estimates

July 09, 2024

This report examines the performance of IFO revenue estimates for the past twelve budget cycles. For FY 2023-24, actual collections exceeded IFO projections by 0.6%, or $273 million.

Southern Migration Continued During COVID

Economics and Other

July 01, 2024

From 2021 to 2022, IRS data indicate that net domestic migration for Pennsylvania was -21,711 (-0.17% of state population) which ranked 35th across all states.

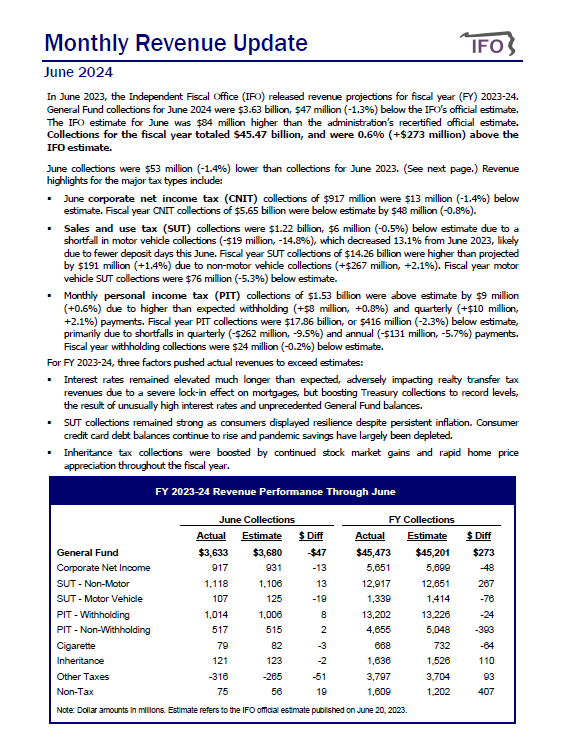

June 2024 Revenue Update

Revenue & Economic Update

July 01, 2024

The Commonwealth collected $45.47 billion in General Fund revenues for FY 2023-24, which was within 0.6% ($273 million) of the IFO official revenue estimate.

Sources of Pennsylvania Income

Economics and Other

June 27, 2024

This research brief is the first in a series that describes a new distribution model that will be used to examine the progressivity/regressivity of state-local taxes.

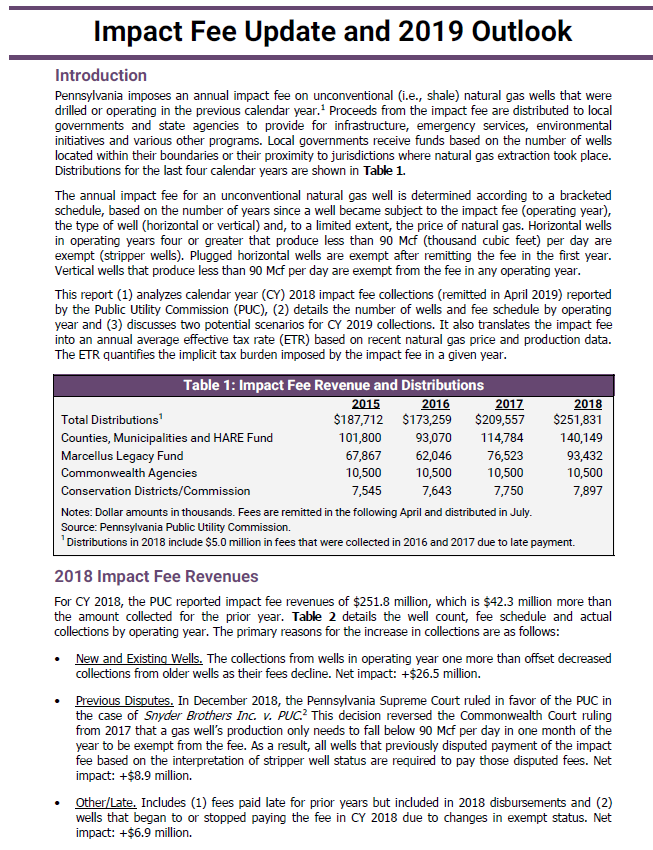

Impact Fee Revenue Update and Outlook 2024

Energy

June 26, 2024

This update examines 2023 impact fee collections and provides an outlook for 2024. The Commonwealth collected $179.6 million in impact fees for 2023, a $99.2 million decrease from 2022.

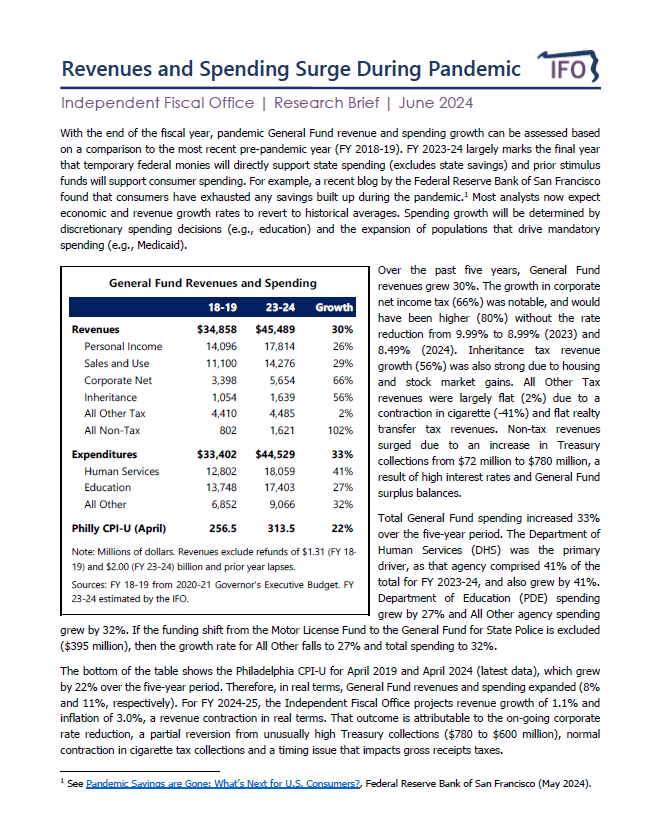

Revenues and Spending Surge During Pandemic

Economics and Other

June 25, 2024

This research brief looks at the drivers of revenue and spending growth during the pandemic.

Official Revenue Estimate FY 2024-25

Revenue Estimates

June 20, 2024

The Independent Fiscal Office (IFO) released its official revenue estimate for FY 2024-25. Updated estimates for FY 2023-24 are included.

School District Property Tax Forecast

Property Tax

June 19, 2024

The IFO released an updated school district property tax forecast. The report projects revenues and the Act 1 index through FY 2025-26 and provides an overview of recent trends in school district funding.

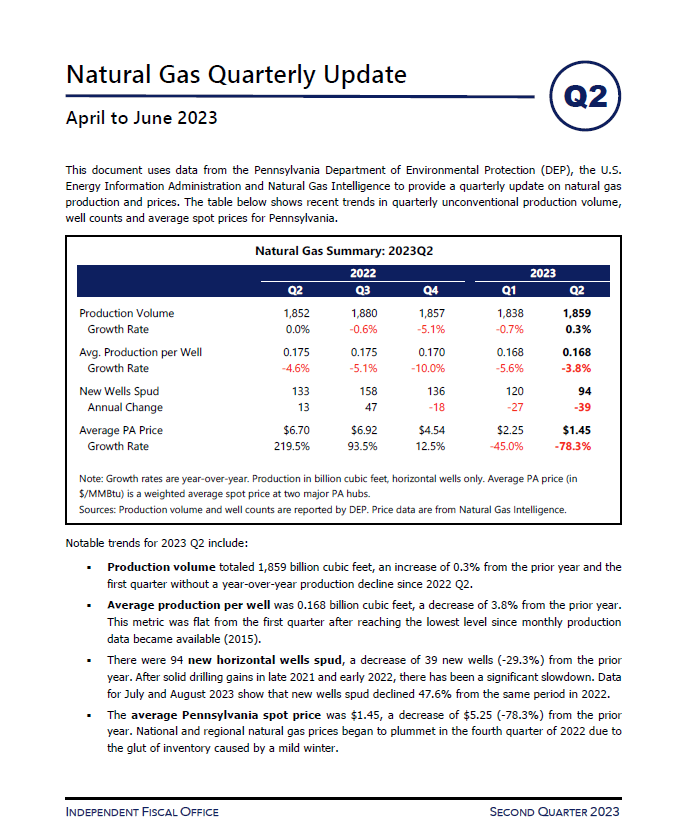

Natural Gas Quarterly Update, 2024 Q1

Energy

June 03, 2024

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

May 2024 Revenue Update

Revenue & Economic Update

June 03, 2024

The Commonwealth collected $3.36 billion in General Fund revenues for May, an increase of $64 million (+2.0%) compared to May 2023.

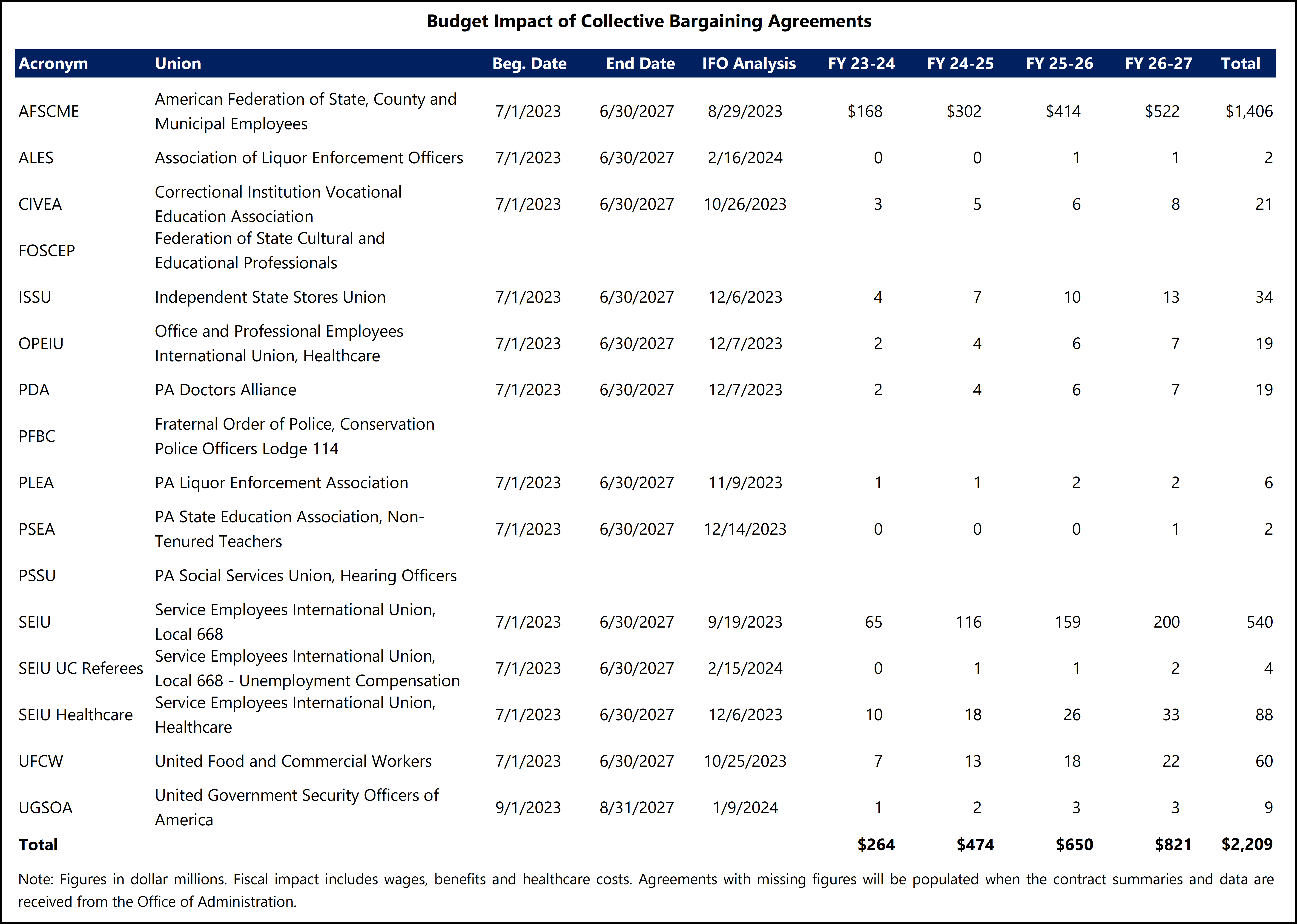

2024 Wage Contracts Summary Table

Wage Contracts

May 21, 2024

This table provides an up-to-date summary of the recent wage contracts analyzed by the IFO. Additional estimates will be provided after the relevant contract detail has been transmitted to the IFO by the Office of Administration.

FOSCEP Wage Contract Analysis

Wage Contracts

May 21, 2024

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Federation of State Cultural and Educational Professionals (FOSCEP).

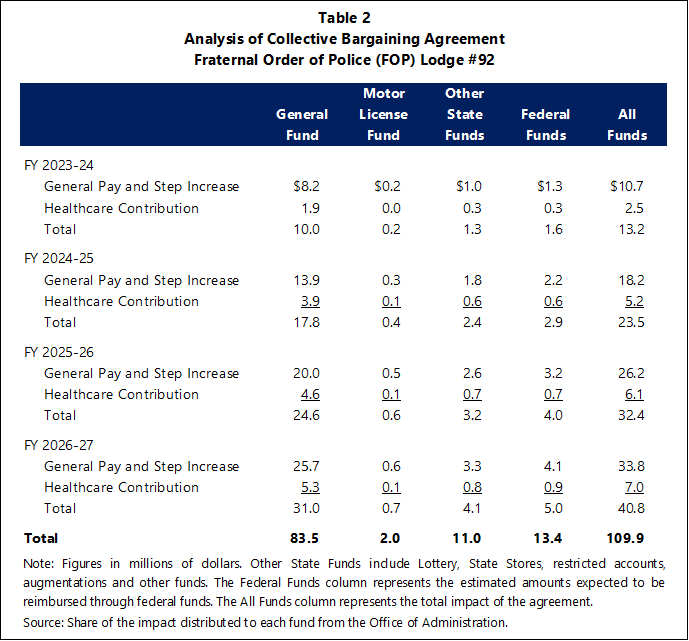

FOP, Lodge #92 Wage Contract Analysis

Wage Contracts

May 21, 2024

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Fraternal Order of Police (FOP), Lodge #92.

Initial Revenue Estimate FY 2024-25

Revenue Estimates

May 20, 2024

The IFO released its initial revenue estimate for FY 2024-25. Click the hyperlink above to view the report and presentation.

Initial Revenue Estimate Announcement

Revenue Estimates

May 13, 2024

The IFO will release its Initial Revenue Estimate on Monday, May 20th at 1:30 PM. The report will contain revisions to the FY 2023-24 estimate and an initial estimate for FY 2024-25. See the announcement for a link to register for the presentation.

Treasury Windfalls Boost Revenues - Update

Economics and Other

May 02, 2024

Treasury collections have generated a short-term revenue windfall. This research brief updates a prior analysis and provides preliminary Treasury revenue estimates for FY 2024-25.

Affordable Connectivity Program Ends

Economics and Other

May 01, 2024

Due to the depletion of approved funds, the federal Affordable Connectivity Program (ACP) is no longer accepting new enrollments and the last fully-funded program month was April 2024. In 2023, Pennsylvania households received $241 million in ACP funds, an average monthly benefit of $33 per household.

April 2024 Revenue Update

Revenue & Economic Update

May 01, 2024

The Commonwealth collected $5.69 billion in General Fund revenues for April, an increase of $30 million (+0.5%) compared to April 2023.

The IFO transmitted a brief revenue update to the chairs of the Senate and House Appropriations Committees.

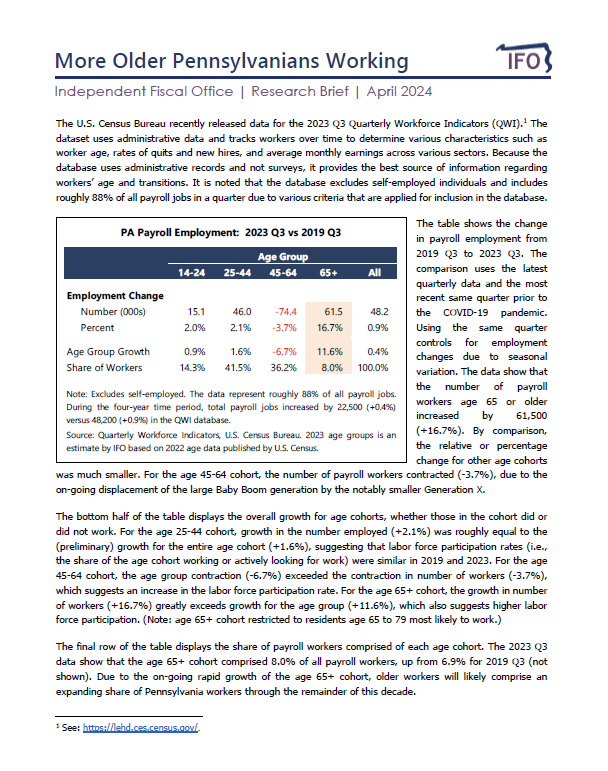

More Older Pennsylvanians Working

Economics and Other

April 17, 2024

This research brief uses the latest data from the U.S. Census Bureau Quarterly Workforce Indicators to track the age composition of Pennsylvania payroll workers. Compared to data prior to COVID-19, there has been a large absolute (number) and relative (growth) increase in older workers.

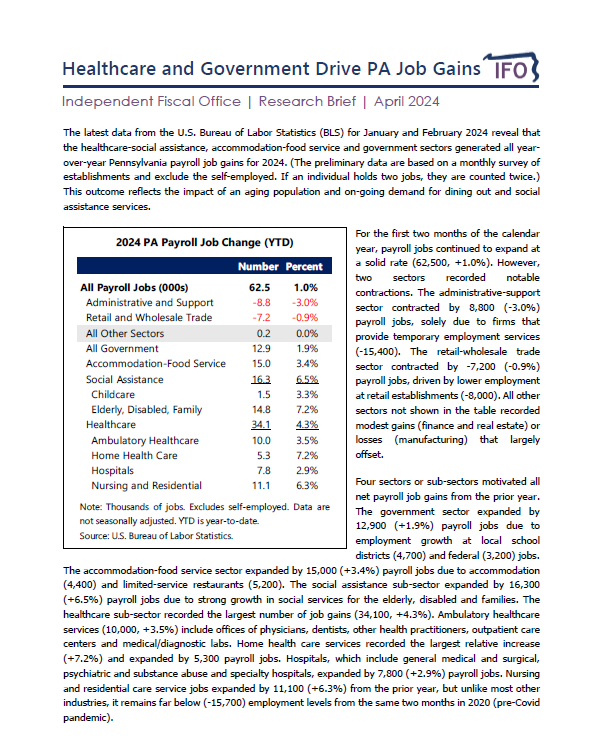

Healthcare and Government Drive PA Job Gains

Economics and Other

April 10, 2024

The latest jobs data from the U.S. Bureau of Labor Statistics show that all Pennsylvania job gains for 2024 occurred in the government, healthcare or accommodation-food service sectors. The data reflect the aging demographics of the state and on-going demand for dining out and social assistance services.

Economic and Budget Update Presentation

Economics and Other

April 05, 2024

The IFO presented on the Commonwealth's economic and budget outlook at a session of the Pennsylvania Education Policy and Leadership Center.

Sports, Marketing & Tourism Series: 2023 Ironman PA Happy Valley Triathlon

Economics and Other

April 04, 2024

The IFO published an economic impact report for the Ironman 70.3 Pennsylvania Happy Valley Triathlon in Centre County (July 2023). The analysis finds that economic activity related to the event generated over $4.7 million in statewide spending, supported 30 full-time equivalent jobs, and $238,000 in select state and local taxes.

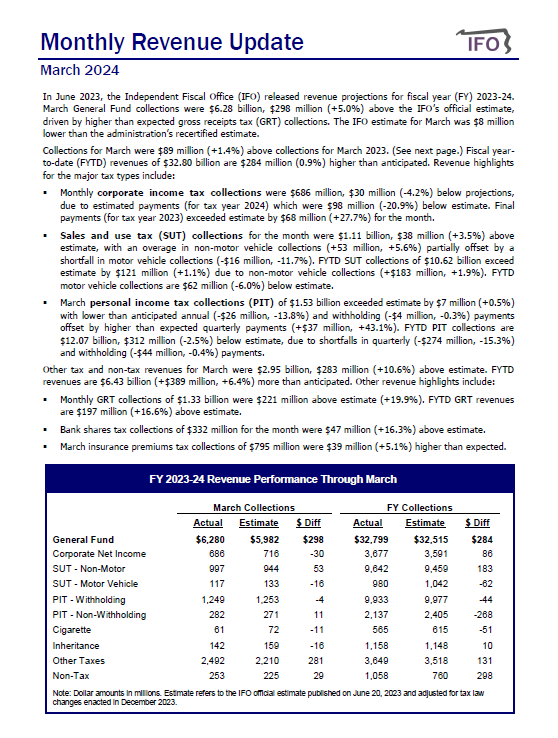

March 2024 Revenue Update

Revenue & Economic Update

April 01, 2024

The Commonwealth collected $6.28 billion in General Fund revenues for March, an increase $89 million (+1.4%) compared to March 2023.

The IFO transmitted a brief revenue update to the chairs of the Senate and House Appropriations Committees.

Analysis of Revenue Proposals

Revenue Estimates

March 28, 2024

This report provides estimates for the revenue proposals contained in the 2024-25 Governor's Executive Budget released February 2024. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under Section 604-B (a)(4) of the Administrative Code of 1929. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

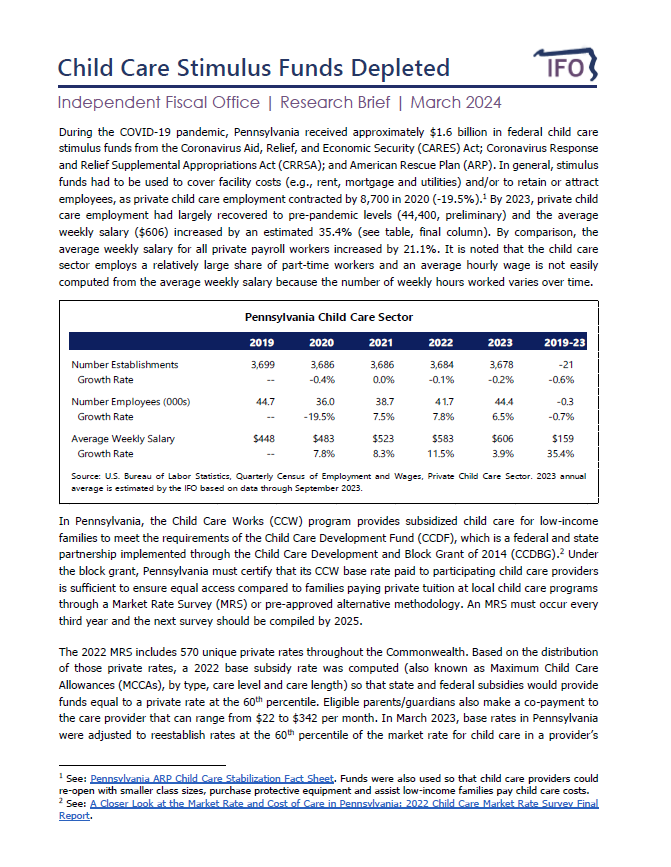

Child Care Stimulus Funds Depleted

Economics and Other

March 21, 2024

This research brief highlights the depletion of federal child care stimulus funds and the impact on that sector. During the COVID-19 pandemic, Pennsylvania received approximately $1.6 billion in federal child care stimulus funds from the Coronavirus Aid, Relief, and Economic Security (CARES) Act; Coronavirus Response and Relief Supplemental Appropriations Act (CRRSA); and American Rescue Plan (ARP).

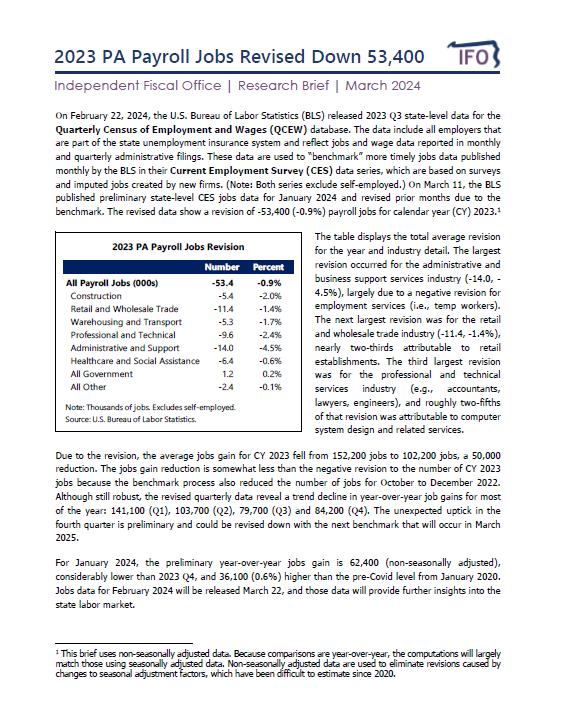

2023 PA Payroll Jobs Revised Down 53,400

Economics and Other

March 13, 2024

This research brief provides detail on the latest benchmark revision made by the U.S. Bureau of Labor Statistics to Pennsylvania payroll jobs.

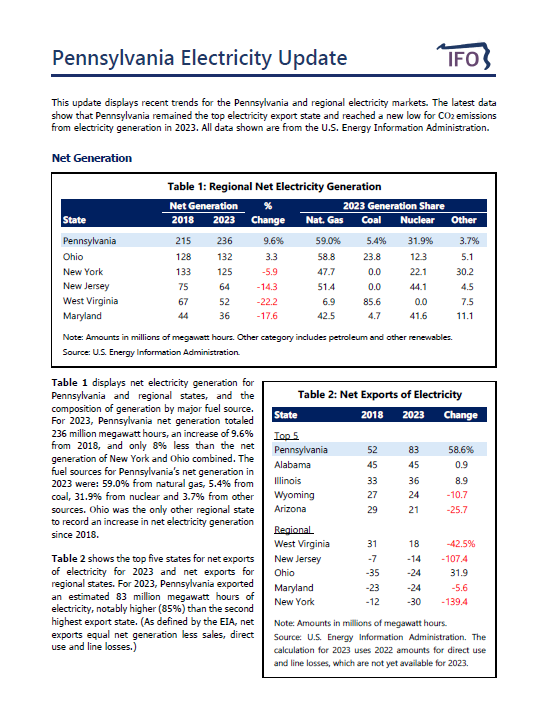

Pennsylvania Electricity Update

Energy

March 07, 2024

This report utilizes data from the U.S. Energy Information Administration to display recent trends for the Pennsylvania and regional electricity markets. The report examines recent trends in net generation, net exports, CO2 emissions and prices.

Senate Budget Hearing Request

Economics and Other

March 06, 2024

The Independent Fiscal Office (IFO) responded to requests for additional information raised at the office’s budget hearing before the Senate Appropriations Committee. The requests relate to an adjusted financial statement, public assistance savings resulting from a higher minimum wage, impact of the Ohio rate structure on Pennsylvania tax liability, net migration for Pennsylvania, regional student loan debt comparison and U3 and U6 unemployment rates.

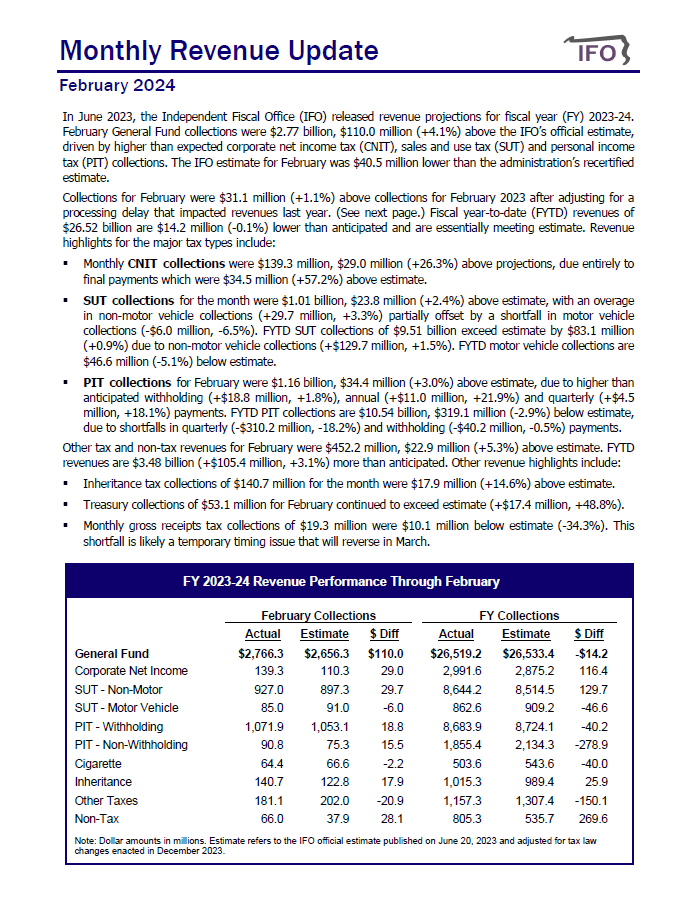

February 2024 Revenue Update

Revenue & Economic Update

March 01, 2024

The Commonwealth collected $2.77 billion in General Fund revenues for February, an increase of $31.1 million (1.1%) compared to February 2023 (adjusted).

Tax Modernization and Reform Presentation

Economics and Other

March 01, 2024

Director Knittel made a presentation to the House Finance Subcommittee on Tax Modernization and Reform.

Based on a request from Chair Rabb, the presentation was updated to add an additional slide that displays the income distribution for self-employment and S corporation/partnership income.

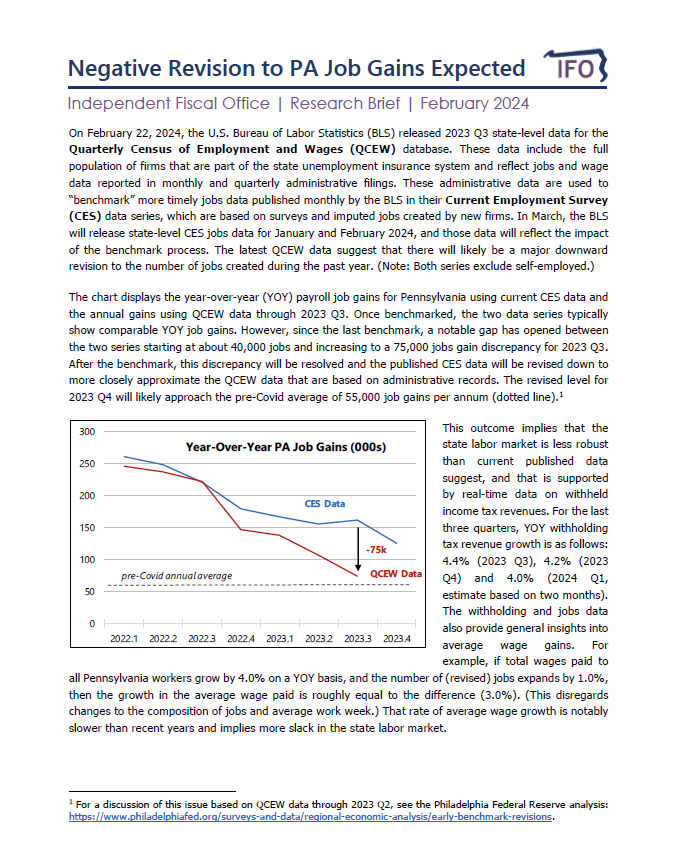

Negative Revision to PA Job Gains Expected

Economics and Other

February 29, 2024

This research brief examines the implications of a recent QCEW data release for state payroll jobs data.

Summary and Analysis of Annual PSERS Stress Test Report

Pension Analysis

February 28, 2024

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the Public School Employees Retirement System’s (PSERS) recent stress test report. Based on PSERS’ baseline projections, the IFO projects that from FY 2024-25 to FY 2051-52, the Commonwealth will use $53.0 billion in General Fund revenues (2.7%) for the state’s share of public school employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of assumptions.

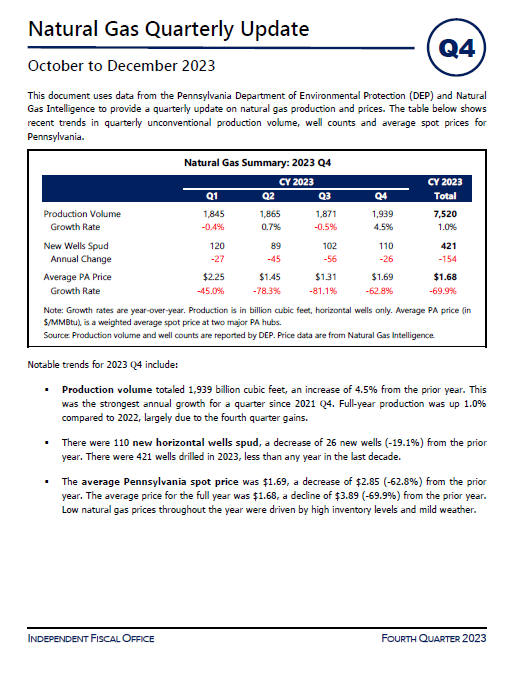

Natural Gas Quarterly Update, 2023 Q4

Energy

February 26, 2024

This document uses data from the Pennsylvania Department of Environmental Protection and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

Economic Update

Economics and Other

February 22, 2024

Director Knittel provided an economic update at the Economic Forecast and Business Leadership Summit.

2024 Budget Hearing Materials

Economics and Other

February 20, 2024

The Independent Fiscal Office submitted materials to the Senate Appropriations Committee ahead of its budget hearing. The packet includes data on the state budget, revenue proposals, economy, revenues, demographics and other miscellaneous topics.

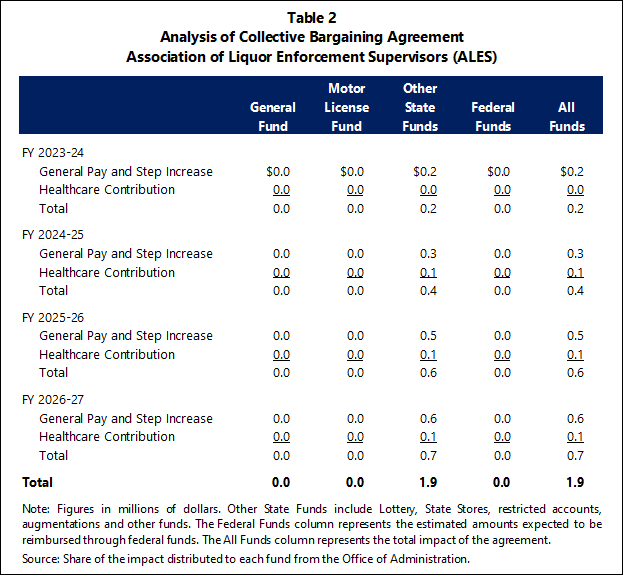

ALES Wage Contract Analysis

Wage Contracts

February 16, 2024

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Association of Liquor Enforcement Supervisors (ALES).

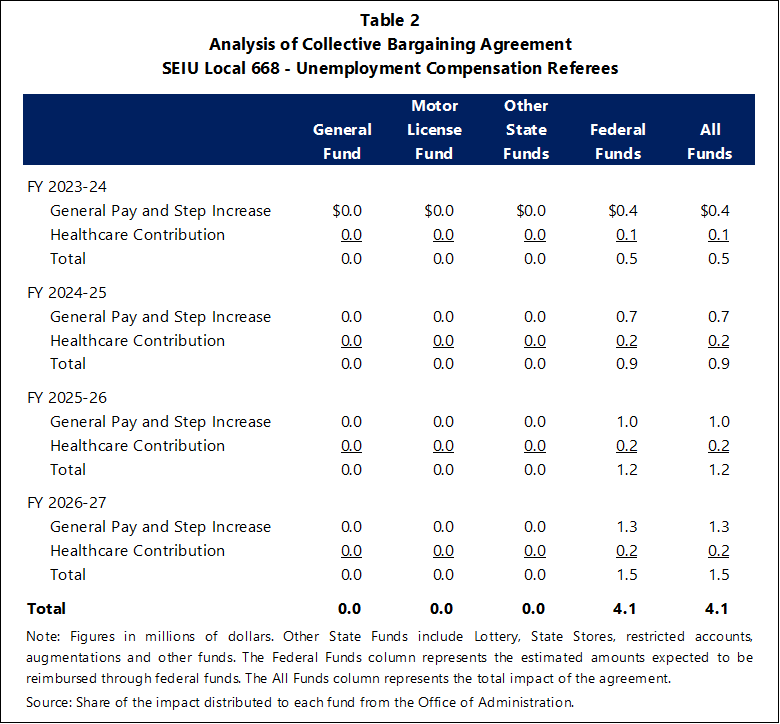

SEIU Local 668 - UC Referees Wage Contract Analysis

Wage Contracts

February 15, 2024

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Service Employees International Union (SEIU) Local 668 Unemployment Compensation (UC) Referees.

State and Local Tax Revenues: A 50 State Comparison

Economics and Other

February 14, 2024

This report uses data from the U.S. Census Bureau, the U.S. Bureau of Economic Analysis, CCH AnswerConnect and the Tax Foundation to facilitate a comparison of state and local tax systems across the 50 states. The report examines (1) the level of per capita state and local taxes across states (unadjusted and adjusted for price differentials) and (2) the distribution of state and local taxes across revenue sources (e.g., income, sales and property).

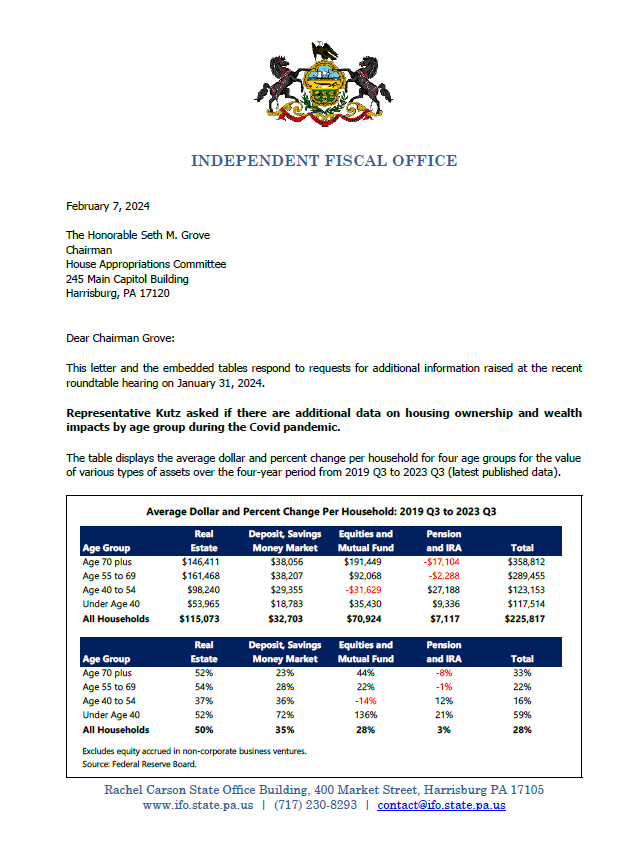

Budget Roundtable Request

Economics and Other

February 09, 2024

The IFO responded to questions raised at the House Budget Roundtable on January 31, 2024.

Economic Forum

Economics and Other

February 05, 2024

Director Knittel made a brief presentation at the NFIB Economic Forum.

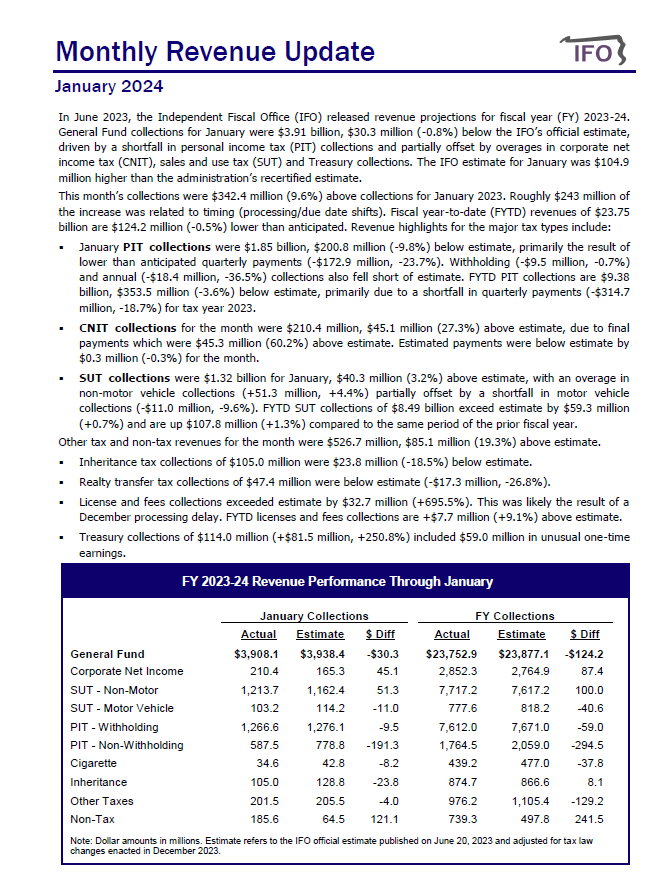

January 2024 Revenue Update

Revenue & Economic Update

February 01, 2024

The Commonwealth collected $3.91 billion in General Fund revenues for January, an increase of $342.4 million (9.6%) compared to January 2023.

Mid-Year Update FY 2023-24

Revenue Estimates

January 30, 2024

The Independent Fiscal Office (IFO) released a mid-year update of its revenue estimate for fiscal year (FY) 2023-24 and provided an advance look at revenue projections for the next fiscal year. The IFO will update the estimate in its next round of revenue projections released in late May.

Revised Monthly Revenue Estimates

Revenue Estimates

January 29, 2024

This report provides revised monthly General Fund revenue estimates for FY 2023-24 based on projections contained in the Official Revenue Estimate published by the IFO on June 20, 2023 (includes adjustments released with the original monthly estimates in August 2023) adjusted to reflect the impact of statutory changes that were enacted in conjunction with the remainder of the state budget in December 2023.

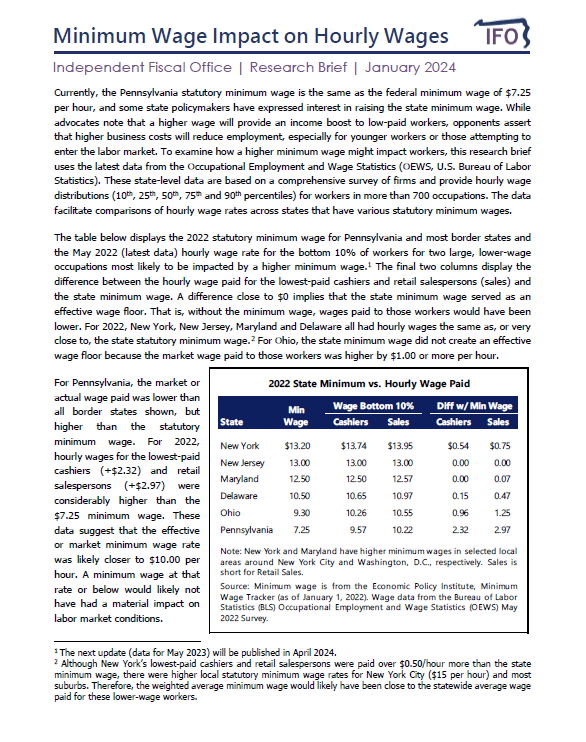

Minimum Wage Impact on Hourly Wages

Economics and Other

January 24, 2024

This research brief examines how a higher statutory minimum wage could impact lower-wage workers and provides employment and hourly wage estimates for certain lower-wage occupations to illustrate that Pennsylvania effective labor market minimum wage is likely in the range of $10.50 to $11.00 per hour.

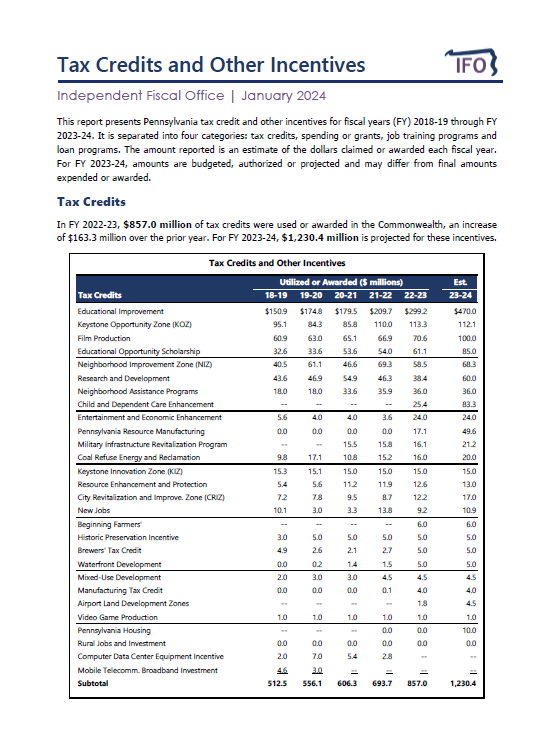

Tax Credits and Economic Development Incentives

Economics and Other

January 09, 2024

This report presents data on Pennsylvania tax credits and economic development incentives for fiscal years (FY) 2018-19 through FY 2023-24. The tables provide annual detail on tax credit utilization or awards, state spending or grants, job training programs and state loan programs. Fiscal year 2023-24 amounts are budgeted, authorized or projected and may differ from final amounts expended or awarded for the year. The report also highlights recent changes to incentive program spending or utilization.

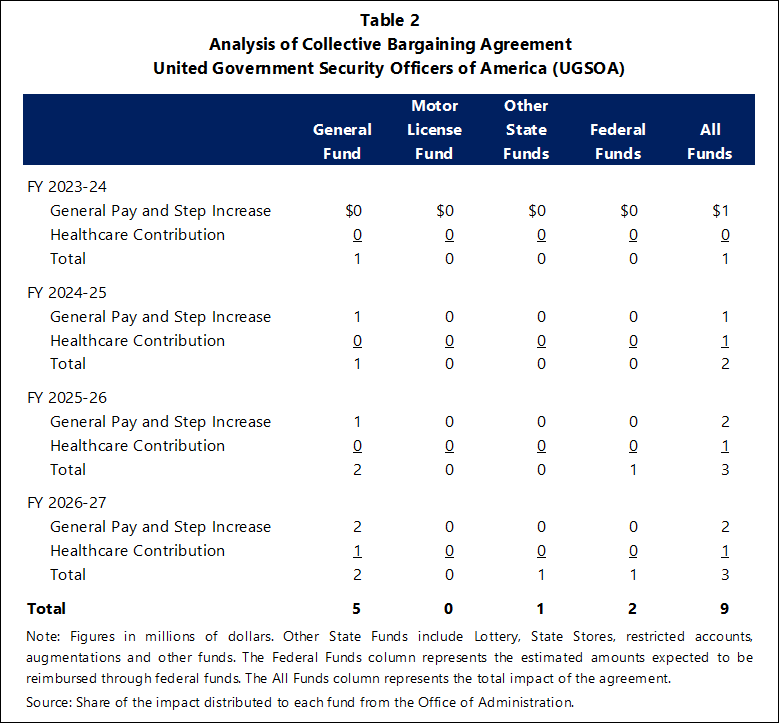

UGSOA Wage Contract Analysis

Wage Contracts

January 09, 2024

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the United Government Security Officers of America (UGSOA).

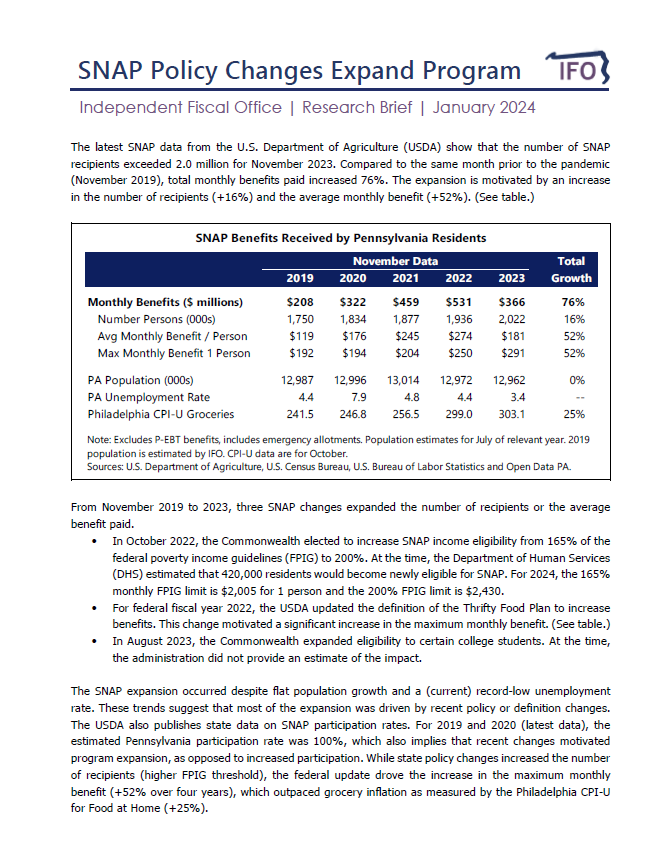

SNAP Policy Changes Expand Program

Economics and Other

January 03, 2024

This research brief uses the latest data from the US Dept of Agriculture to examine post-pandemic SNAP trends. Since November 2019, policy and definition changes have increased the number of recipients by 16% and the average monthly benefit by 52%.

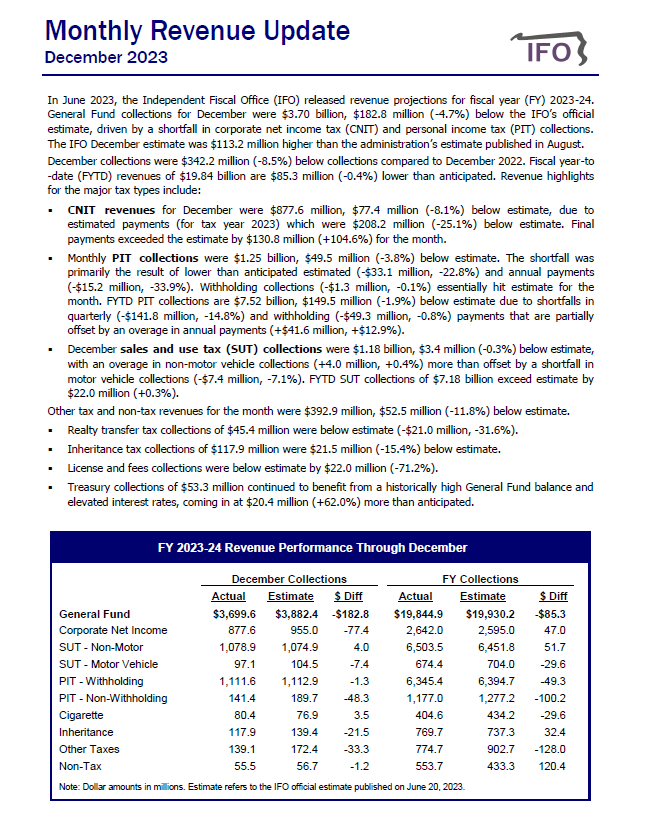

December 2023 Revenue Update

Revenue & Economic Update

January 02, 2024

The Commonwealth collected $3.70 billion in General Fund revenues for December, a decrease of $342.2 million (-8.5%) compared to December 2022.

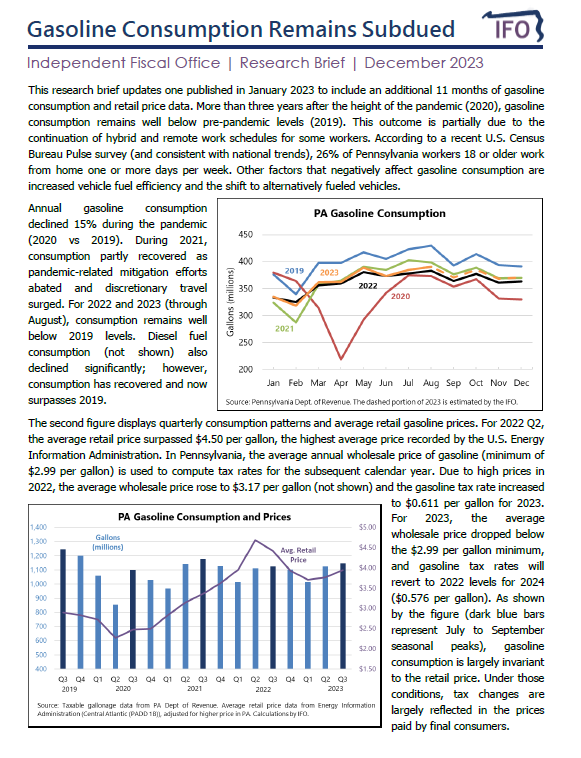

Gasoline Consumption Remains Subdued

Economics and Other

December 19, 2023

The IFO updated a gasoline consumption research brief published in January 2023 with additional consumption and retail pump price data. Gasoline consumption remains well below pre-pandemic levels partially due to the continuation of hybrid and remote work schedules for some workers.

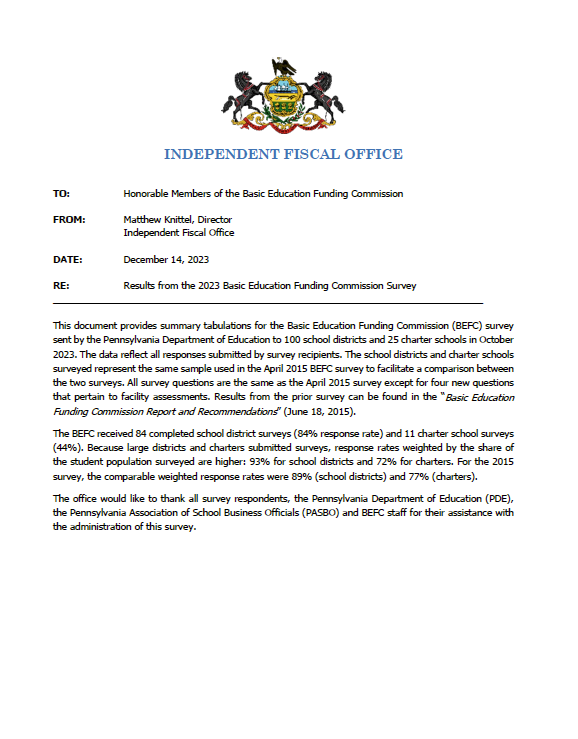

Testimony on the 2023 Basic Education Funding Commission Survey

Economics and Other

December 15, 2023

Director Matthew Knittel provided testimony to the Basic Education Funding Commission on the results from the 2023 Basic Education Funding Commission Survey.

The IFO response to questions raised at the BEFC hearing can be found here.

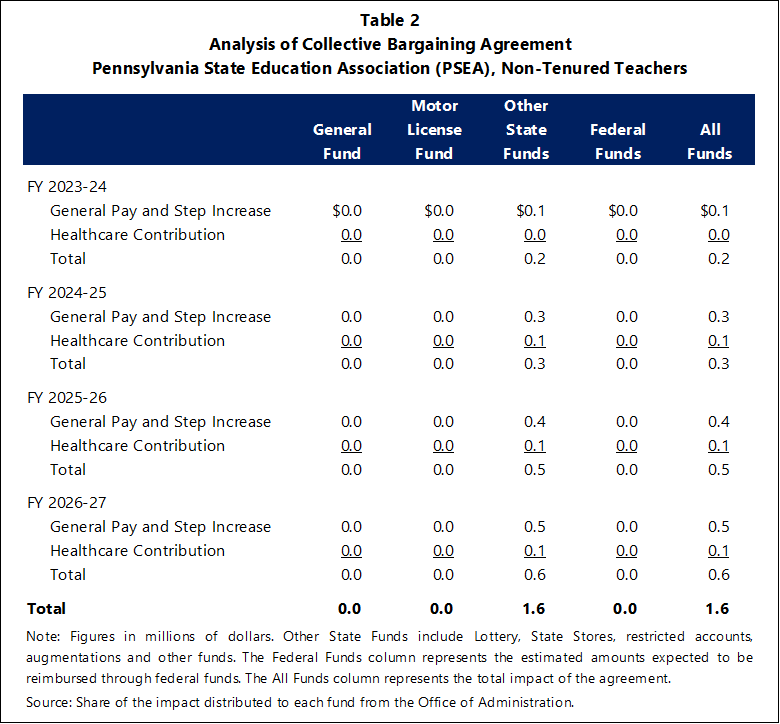

PSEA Wage Contract Analysis

Wage Contracts

December 14, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Pennsylvania State Education Association (PSEA), Non-Tenured Teachers Unit.

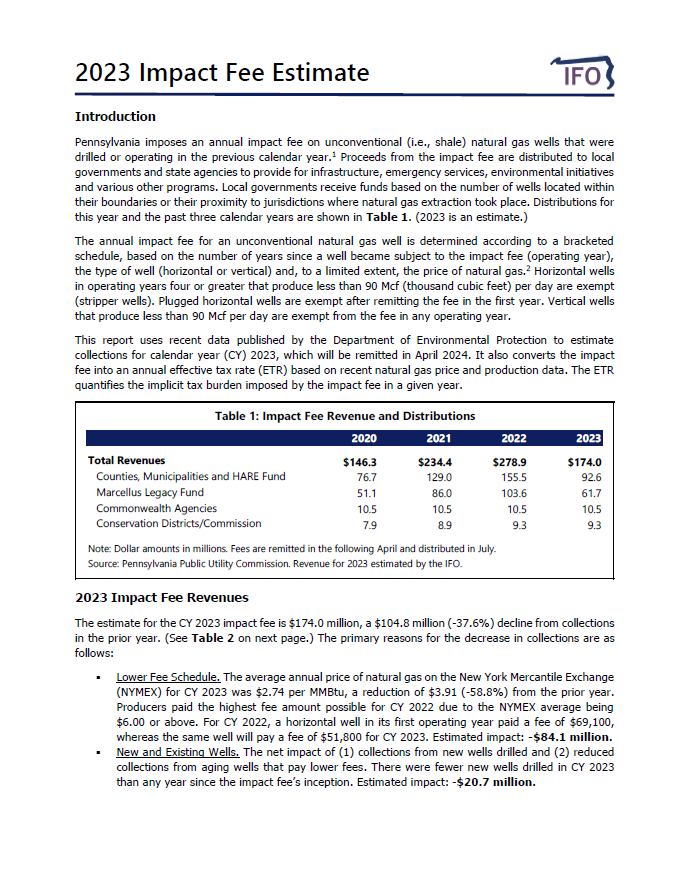

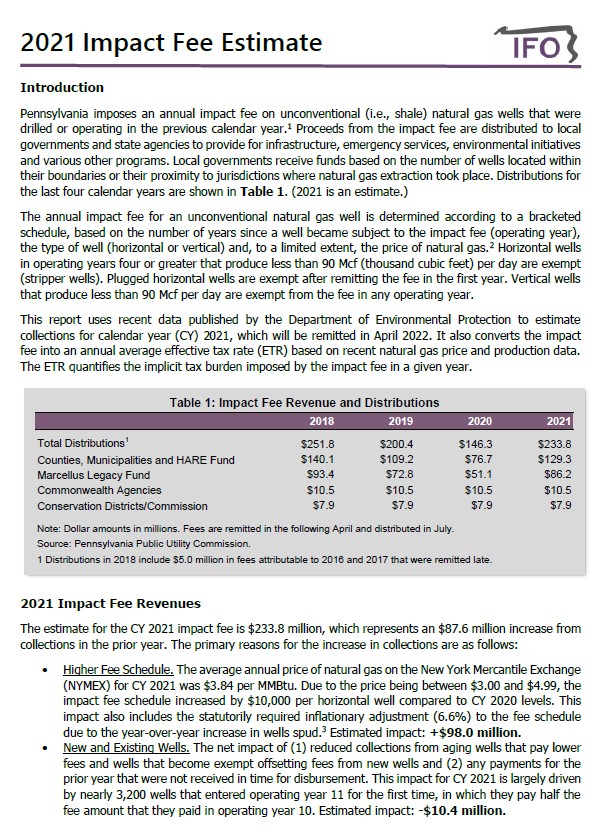

2023 Impact Fee Estimate

Energy

December 13, 2023

This report uses recent data published by the Department of Environmental Protection to project CY 2023 Impact Fee collections (remitted April 2024). Collections are estimated to be $174.0 million, a decrease of $104.8 million from the prior year.

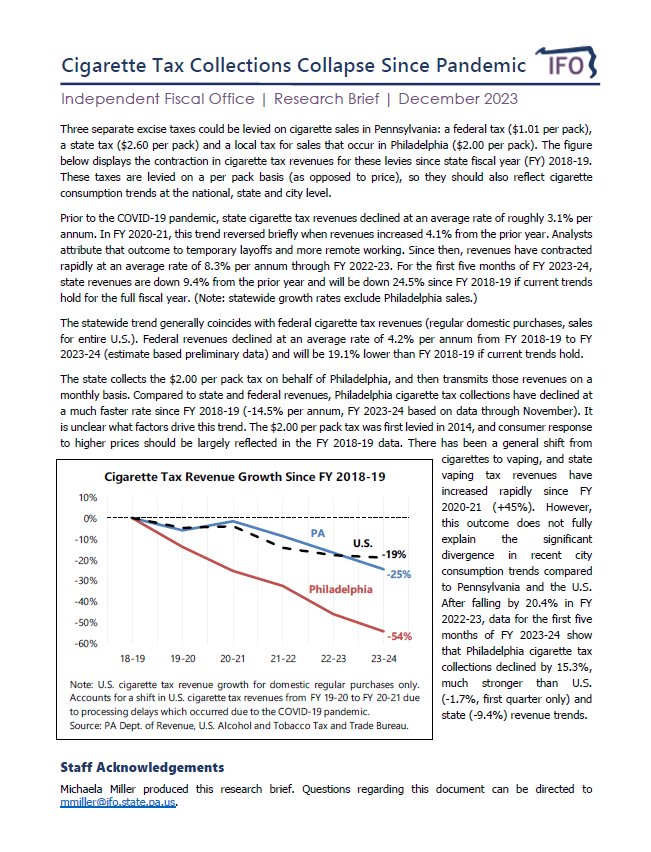

Cigarette Tax Collections Collapse Since Pandemic

Economics and Other

December 11, 2023

This research brief highlights the dramatic decline in federal, state and Philadelphia cigarette tax collections since FY 2018-19.

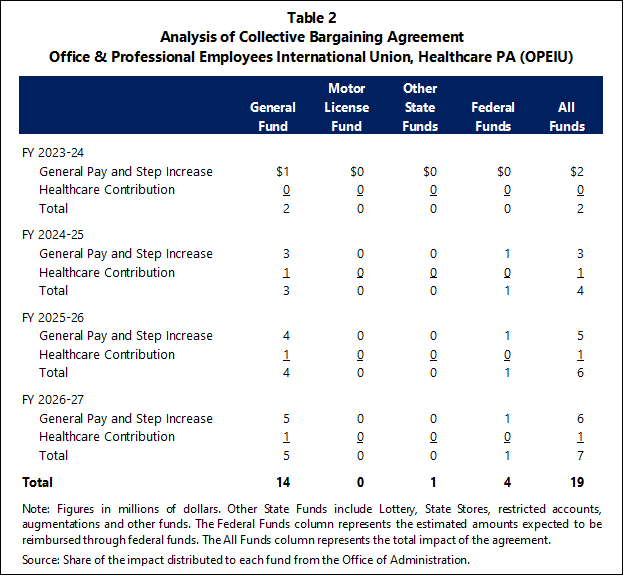

OPEIU Wage Contract Analysis

Wage Contracts

December 07, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Office and Professional Employees International Union, Healthcare Pennsylvania (OPEIU).

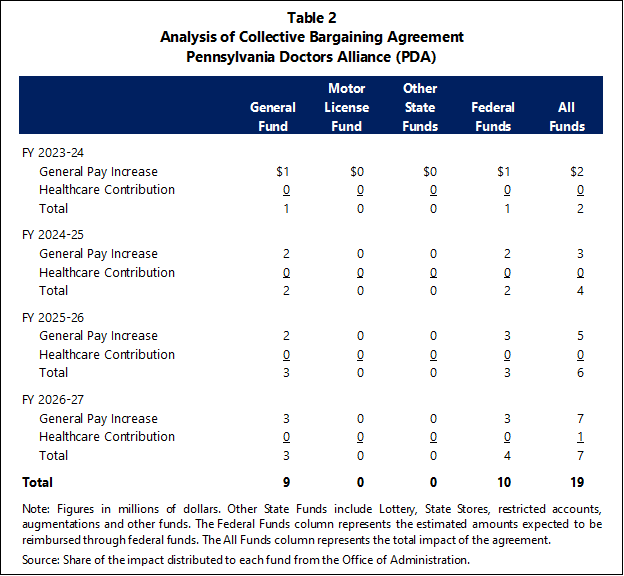

PDA Wage Contract Analysis

Wage Contracts

December 07, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Pennsylvania Doctors Alliance (PDA).

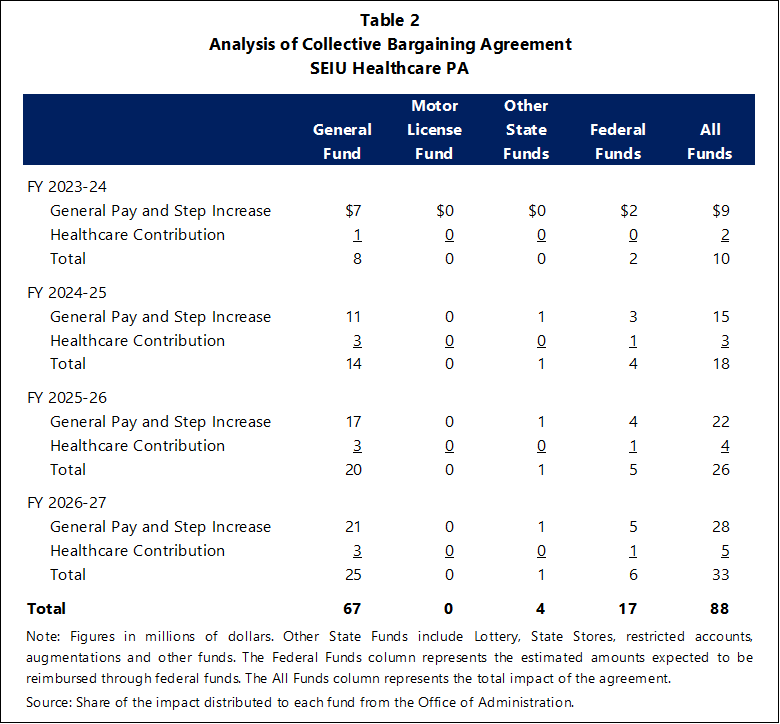

SEIU Healthcare Wage Contract Analysis

Wage Contracts

December 06, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Service Employees' International Union (SEIU) Healthcare Pennsylvania.

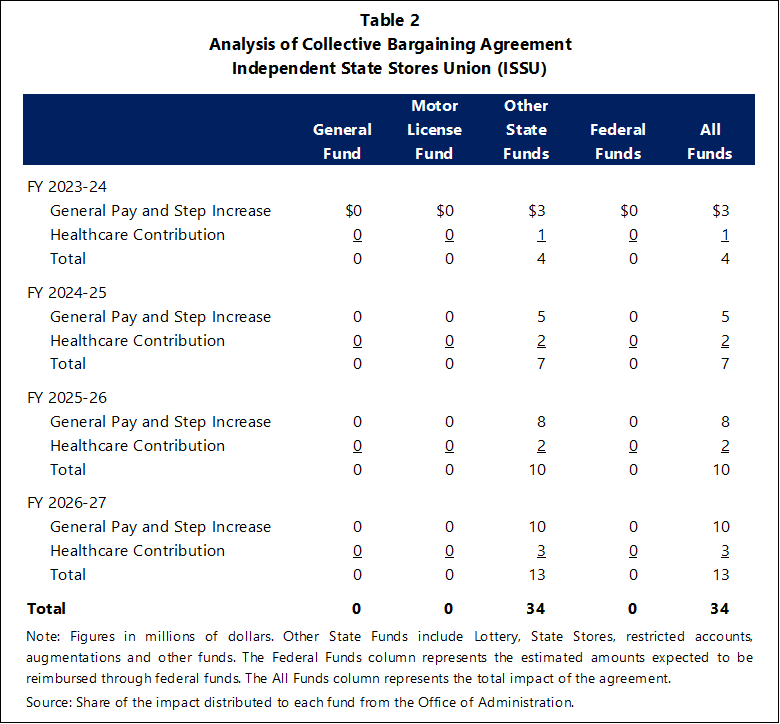

ISSU Wage Contract Analysis

Wage Contracts

December 06, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Independent State Stores Union (ISSU).

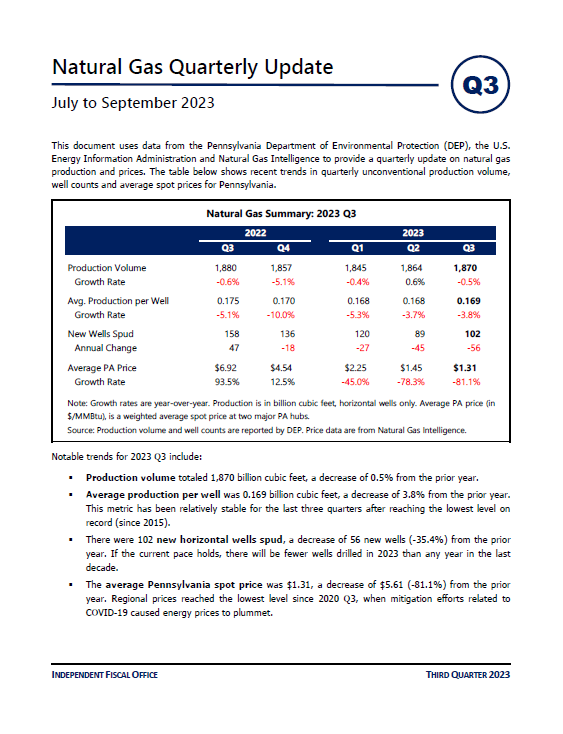

Natural Gas Quarterly Update, 2023Q3

Energy

December 04, 2023

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

Summary and Analysis of Annual SERS Stress Test Report

Pension Analysis

December 01, 2023

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the State Employee Retirement System’s (SERS) recent stress test report. Based on SERS baseline projections, the IFO projects that over the next 20 years, Commonwealth agencies will use $24.9 billion in General Fund revenues (2.0%) for employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of baseline assumptions and the issuance of an 8.3% cost-of-living adjustment (equal to a 13th monthly annuity each year).

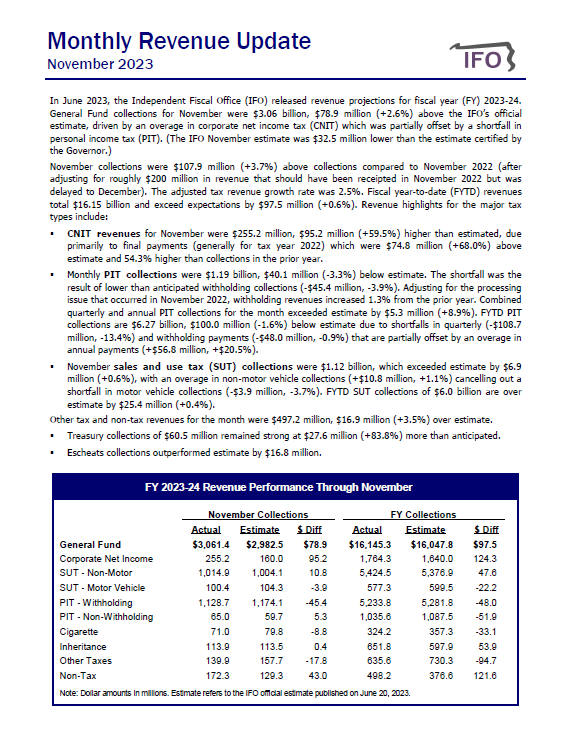

November 2023 Revenue Update

Revenue & Economic Update

December 01, 2023

The Commonwealth collected $3.06 billion in General Fund revenues for November, an increase of $107.9 million (3.7%) compared to November 2022 (adjusted).

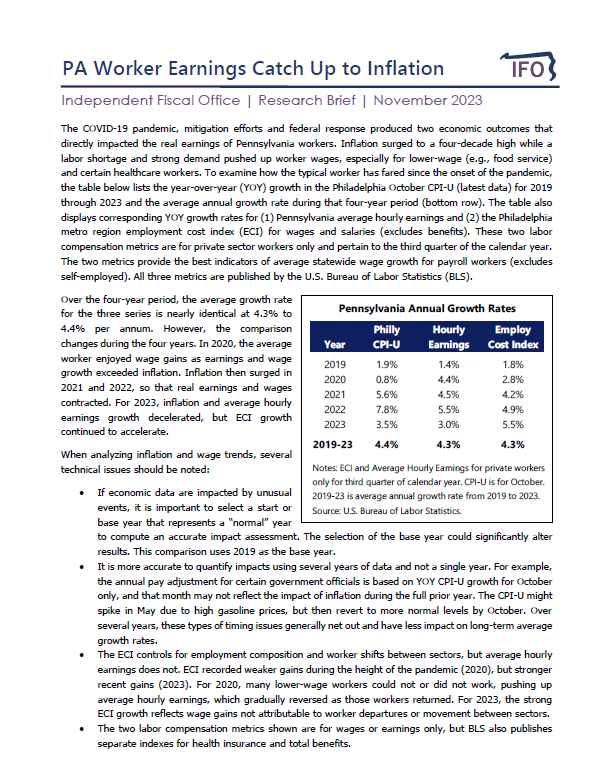

PA Worker Earnings Catch Up to Inflation

Economics and Other

November 30, 2023

The COVID-19 pandemic caused an inflation surge and wage pressures due to worker shortages and strong demand. This research brief uses the latest published data to examine how those outcomes affected real wages and earnings for the average or typical Pennsylvania private sector worker.

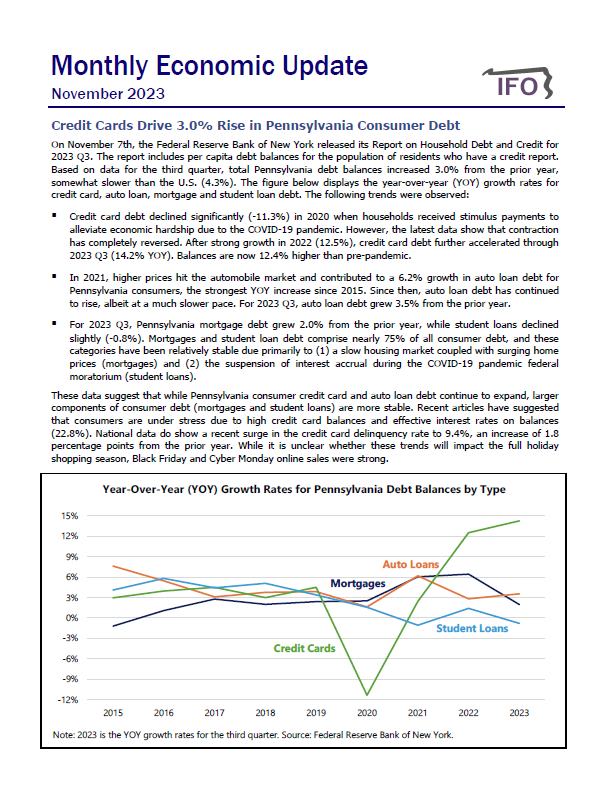

November 2023 Monthly Economic Update

Revenue & Economic Update

November 29, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

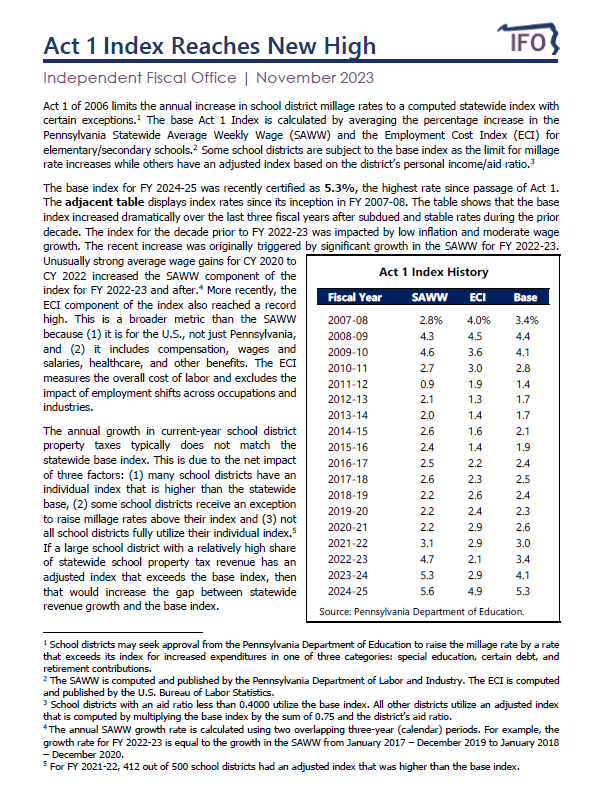

Act 1 Index Reaches New High

Property Tax

November 28, 2023

The Act 1 index limits the annual increase in school district millage rates. For FY 24-25, PDE recently certified an all-time high value (5.3%). This report examines the factors that drive that outcome and provides projections through FY 28-29.

Five-Year Economic and Budget Outlook

Revenue Estimates

November 15, 2023

The Independent Fiscal Office (IFO) released its five-year Economic and Budget Outlook. Click the hyperlink above to view the report and presentations.

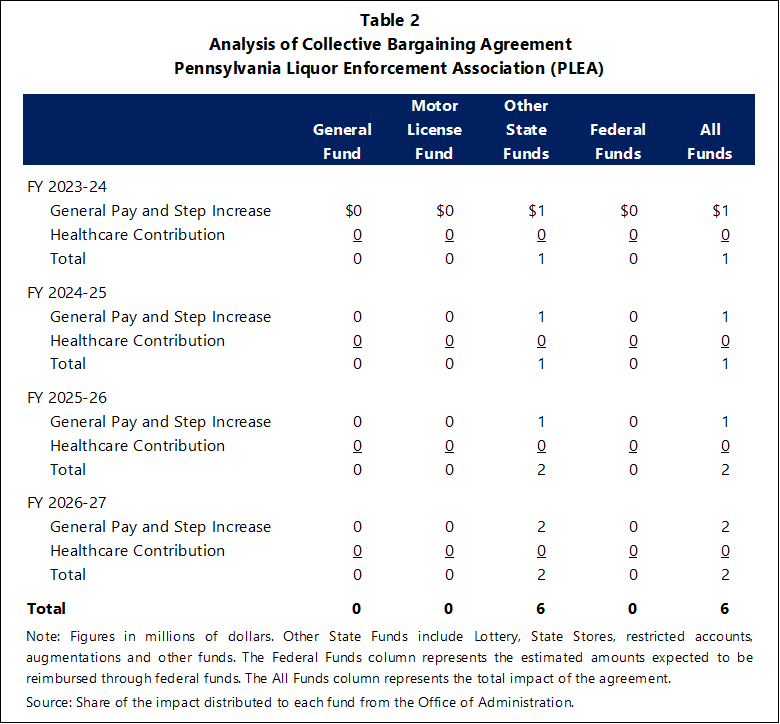

PLEA Wage Contract Analysis

Wage Contracts

November 09, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Pennsylvania Liquor Enforcement Association (PLEA).

Economic and Budget Outlook

Revenue Estimates

November 08, 2023

The IFO will release its long-term budget outlook for FY 2023-24 to FY 2028-29 on November 15 at 1:30 pm. Long-term issues that impact the outlook include the expiration of federal relief programs, a rapidly expanding 75+ age cohort and the depletion of surplus balances that currently generate significant interest income. See the announcement for a link to register for the presentation.

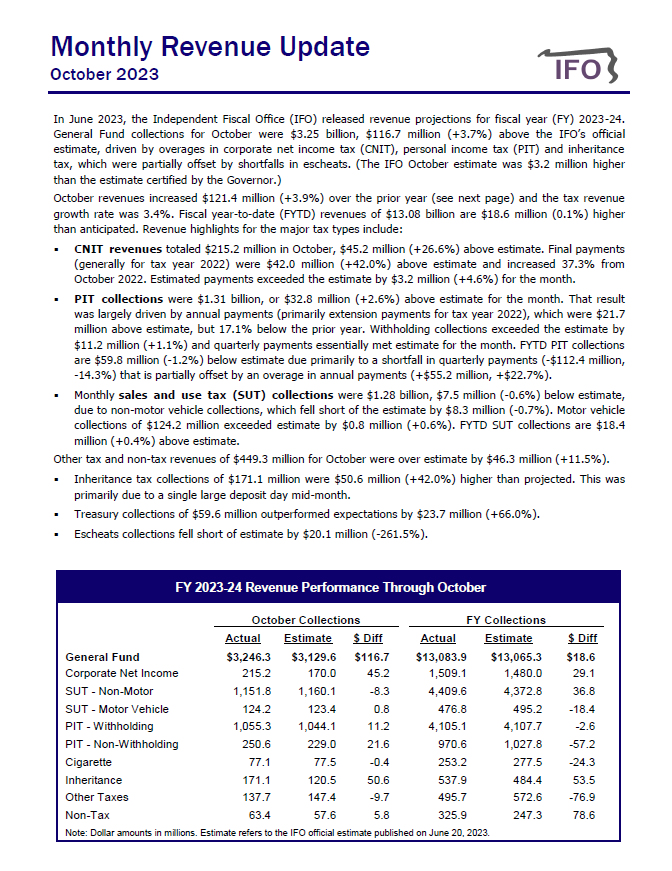

October 2023 Revenue Update

Revenue & Economic Update

November 01, 2023

The Commonwealth collected $3.25 billion in General Fund revenues for October, an increase of $121.4 million (3.9%) compared to October 2022.

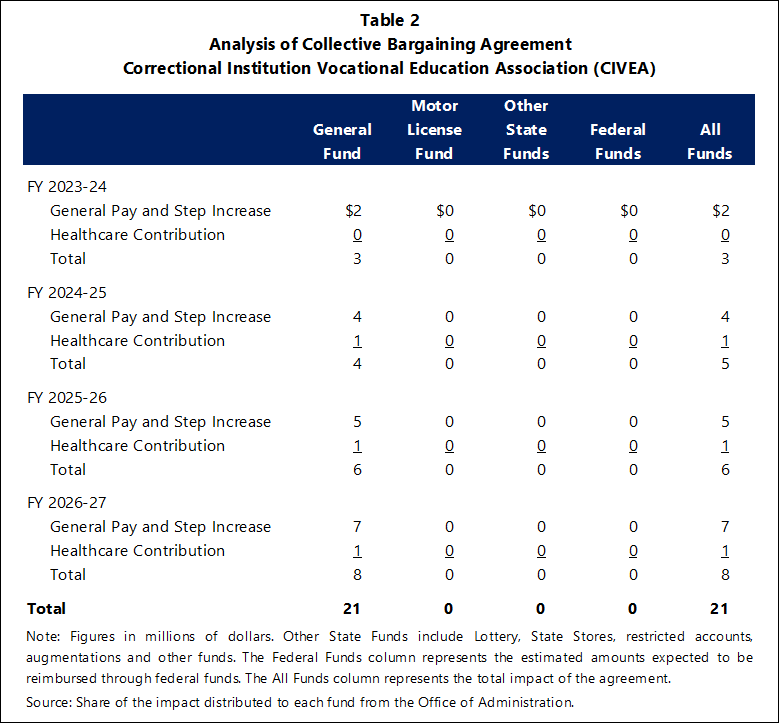

CIVEA Wage Contract Analysis

Wage Contracts

October 26, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Correctional Institution Vocational Education Association (CIVEA).

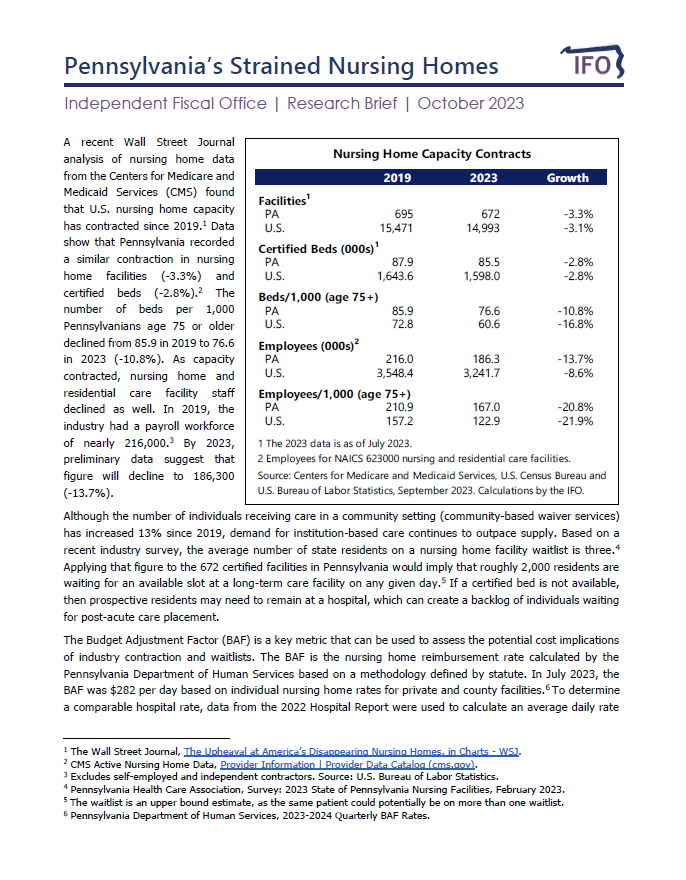

Pennsylvania's Strained Nursing Homes

Economics and Other

October 25, 2023

The IFO posted a new research brief that discusses placement waitlists and potential cost implications from the contraction in nursing home capacity since 2019.

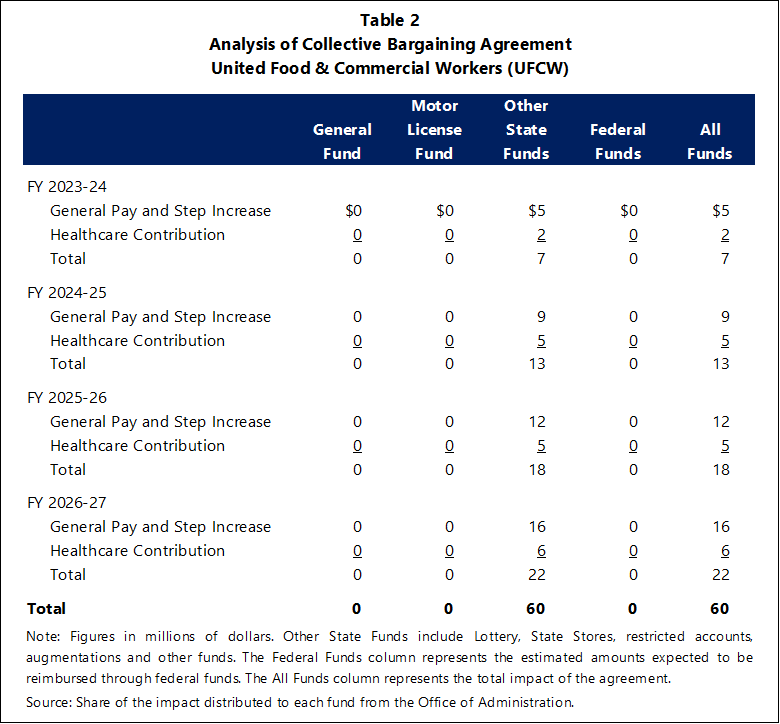

UFWC Wage Contract Analysis

Wage Contracts

October 25, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the United Food and Commercial Workers (UFCW).

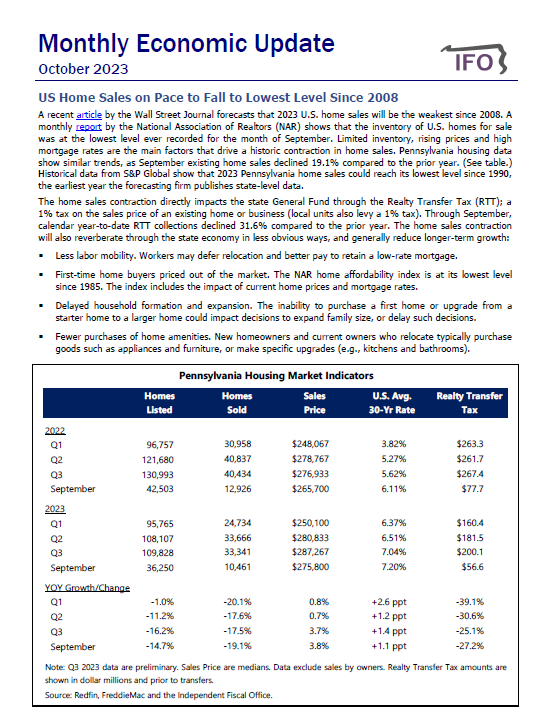

October 2023 Monthly Economic Update

Revenue & Economic Update

October 23, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

2023 Demographic Outlook

Economics and Other

October 19, 2023

Section 604-B (a)(2) of the Administrative Code of 1929 specifies that the Independent Fiscal Office (IFO) shall “provide an assessment of the state’s current fiscal condition and a projection of what the fiscal condition will be during the next five years. The assessment shall take into account the state of the economy, demographics, revenues and expenditures.” This report fulfills the demographics obligation of this statute. The IFO will release the Economic and Budget Outlook for Fiscal Years 2023-24 to 2028-29 in November 2023.

Summary of Tax Credit Reviews

Tax Credit Review

October 10, 2023

New IFO report highlights findings from the 20 tax credit reviews published during the first five-year evaluation cycle (2019 to 2023).

Economic and Revenue Impact of Student Loan Moratorium

Economics and Other

October 03, 2023

Director Knittel gave a presentation at the FTA Revenue Estimation and Tax Research Conference on the economic and revenue impact of the student loan moratorium.

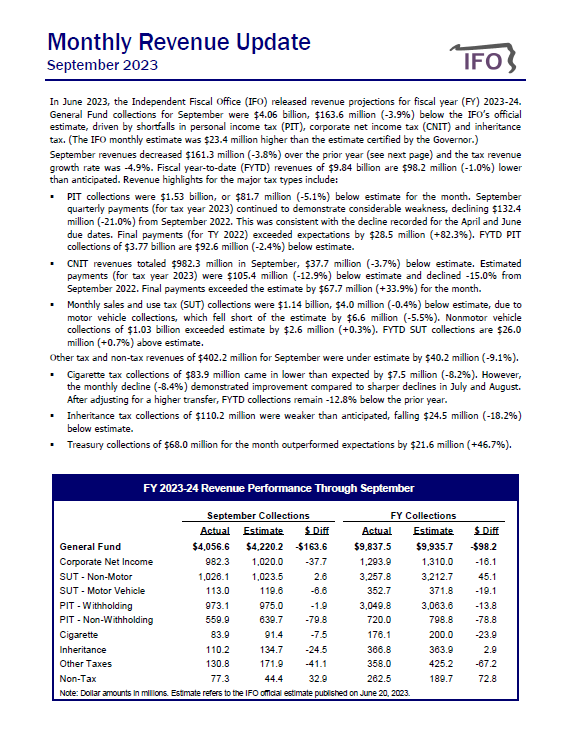

September 2023 Revenue Update

Revenue & Economic Update

October 02, 2023

The Commonwealth collected $4.06 billion in General Fund revenues for September, a decrease of $161.3 million (-3.8%) compared to September 2022.

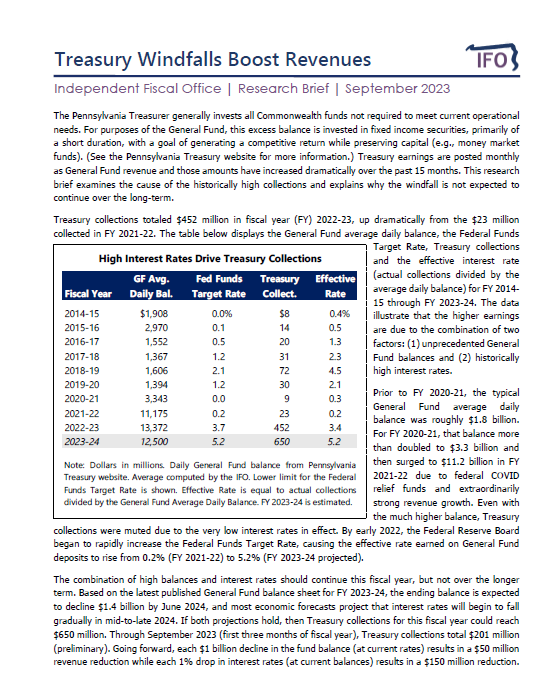

Treasury Windfalls Boost Revenues

Economics and Other

September 25, 2023

Treasury collections are up dramatically from prior years. This research brief examines the cause of the windfalls and explains why they aren’t expected to continue over the long-term.

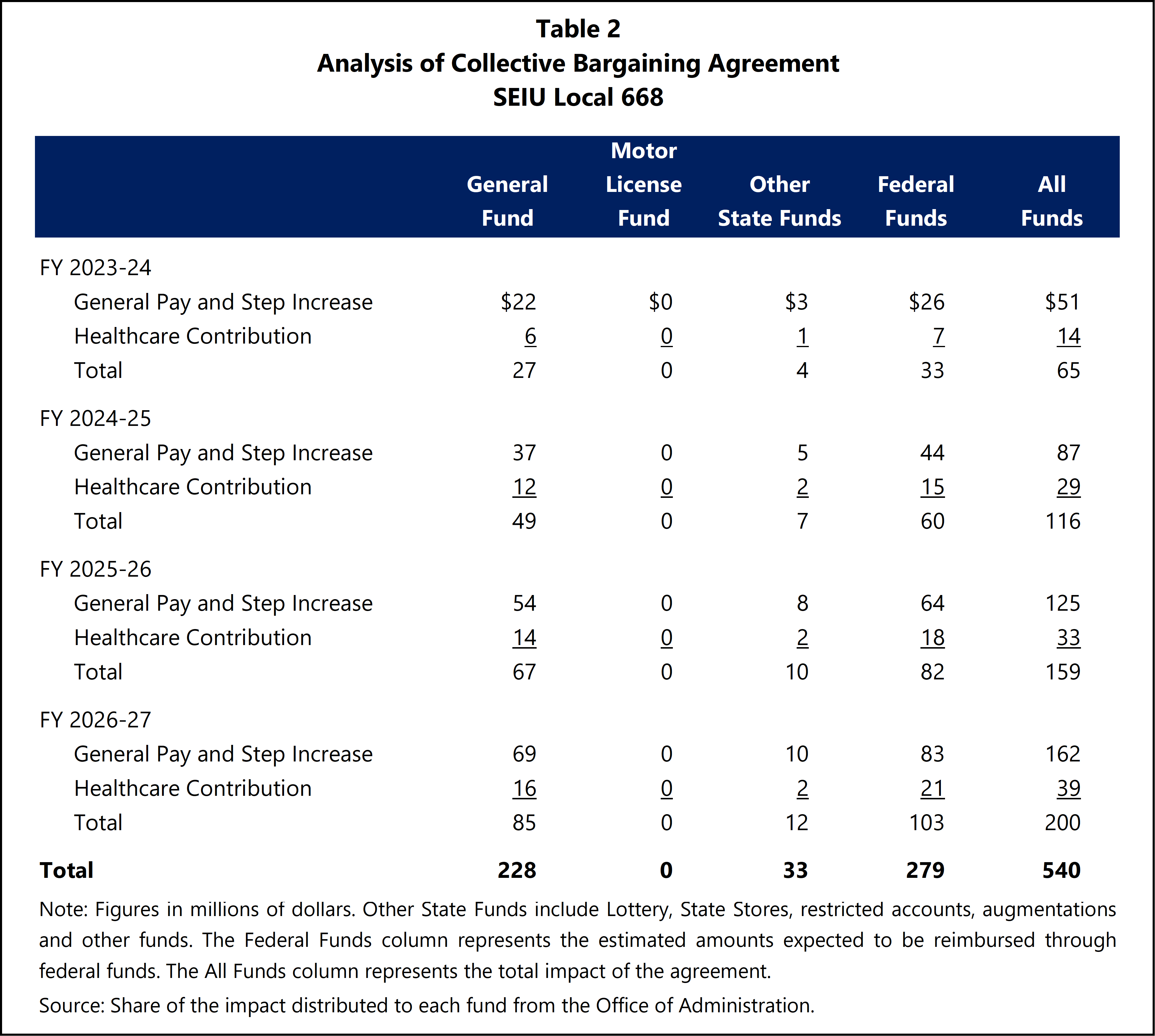

SEIU Local 668 Wage Contract Analysis

Wage Contracts

September 19, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the Service Employees' International Union (SEIU) Local 668.

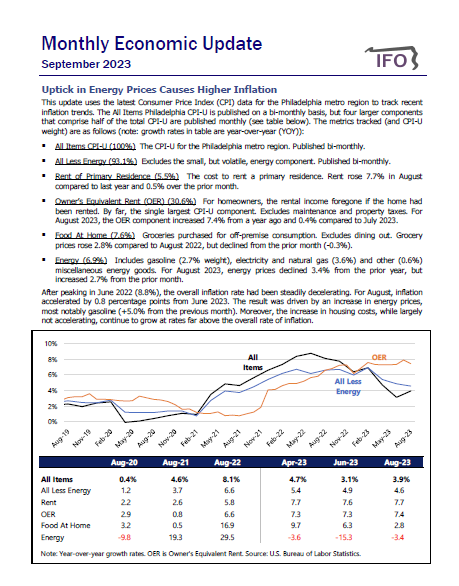

September 2023 Monthly Economic Update

Revenue & Economic Update

September 14, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

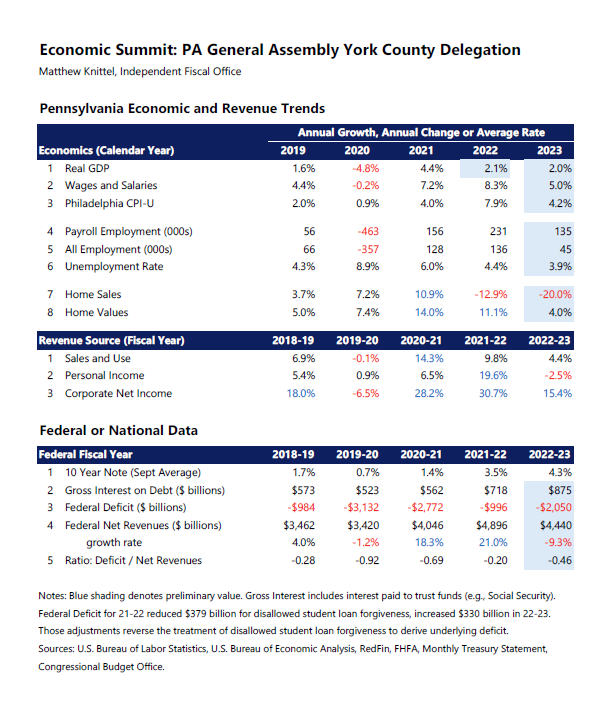

Economic Update

Economics and Other

September 14, 2023

Director Knittel made a brief presentation to an economic summit hosted by the York County Delegation of the General Assembly.

House Bill 1379 Presentation

Pension Analysis

September 07, 2023

Fiscal Analyst Mathieu Taylor made a presentation to the House Local Government Committee regarding House Bill 1379, P.N. 1539. The bill would provide cost-of-living adjustments for certain retired municipal police officers and firefighters.

Natural Gas Quarterly Update, 2023Q2

Energy

September 07, 2023

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

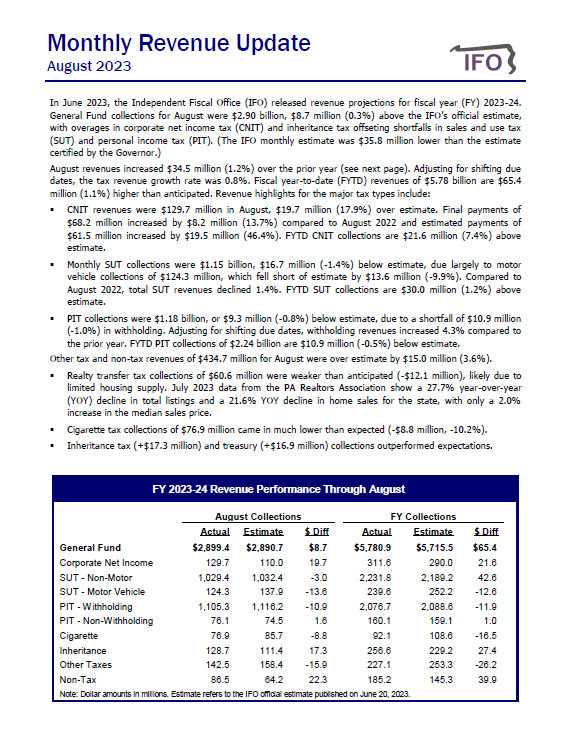

August 2023 Revenue Update

Revenue & Economic Update

September 01, 2023

The Commonwealth collected $2.90 billion in General Fund revenues for August, an increase of $34.5 million (1.2%) compared to August 2022.

Monthly and Quarterly Revenue Estimates

Revenue Estimates

August 30, 2023

This report provides revenue distributions based on the FY 2023-24 projections contained in the Official Revenue Estimate published by the IFO on June 20, 2023.

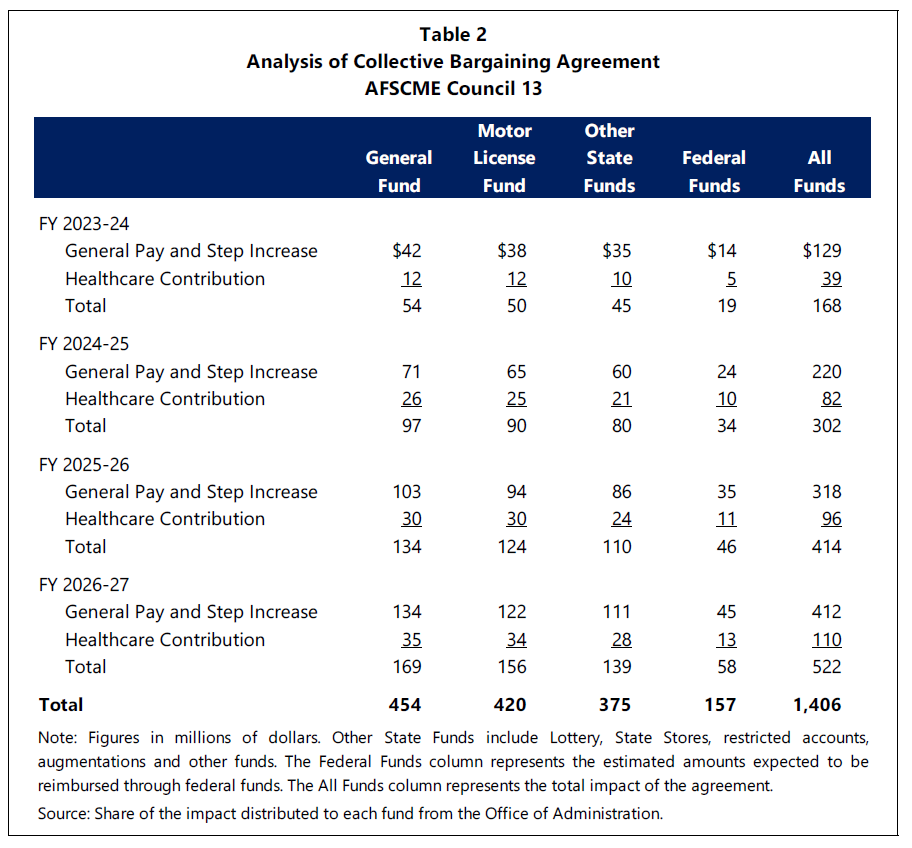

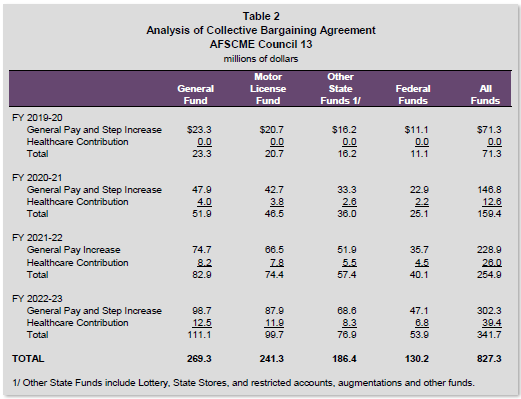

AFSCME Wage Contract Analysis

Wage Contracts

August 29, 2023

This letter provides a fiscal impact analysis of the collective bargaining agreement between the Commonwealth of Pennsylvania and the American Federation of State, County and Municipal Employees (AFSCME) Council 13.

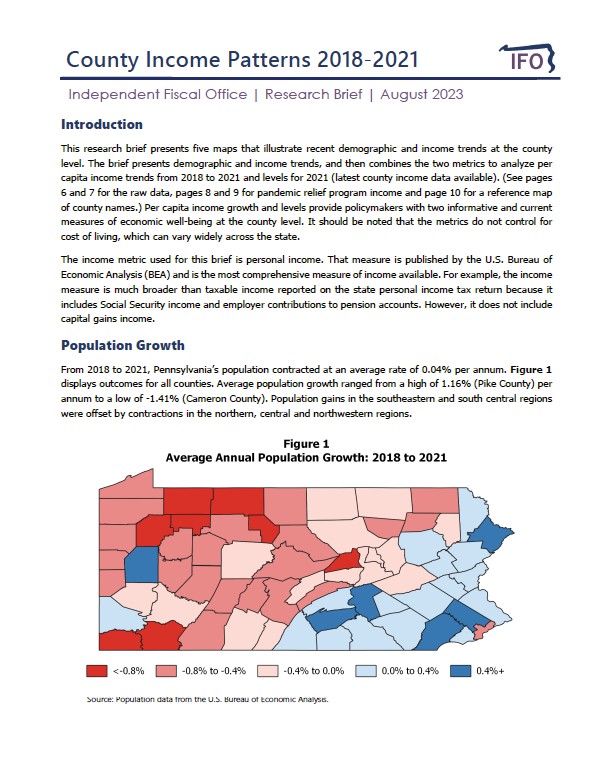

County Income Patterns 2018-2021

Economics and Other

August 24, 2023

This research brief uses the latest published data to generate maps and county rankings of recent demographic and income trends. The release highlights population change, personal income growth and per capita amounts for all counties in the Commonwealth.

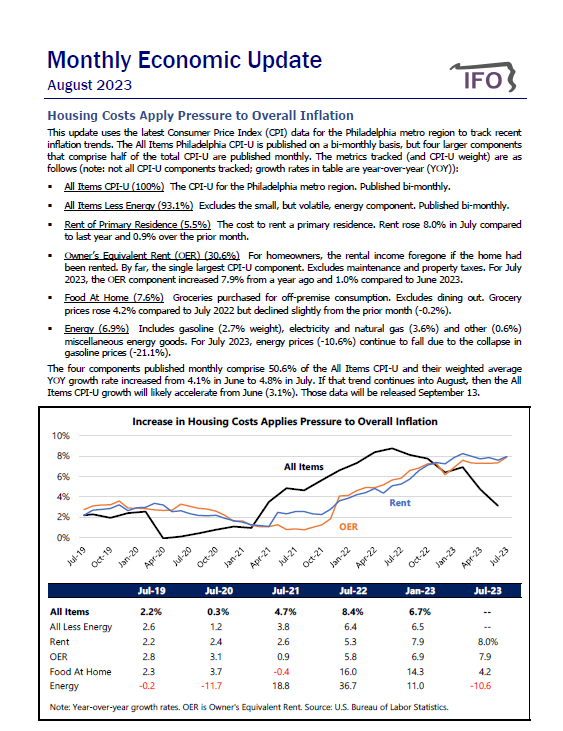

August 2023 Monthly Economic Update

Revenue & Economic Update

August 23, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

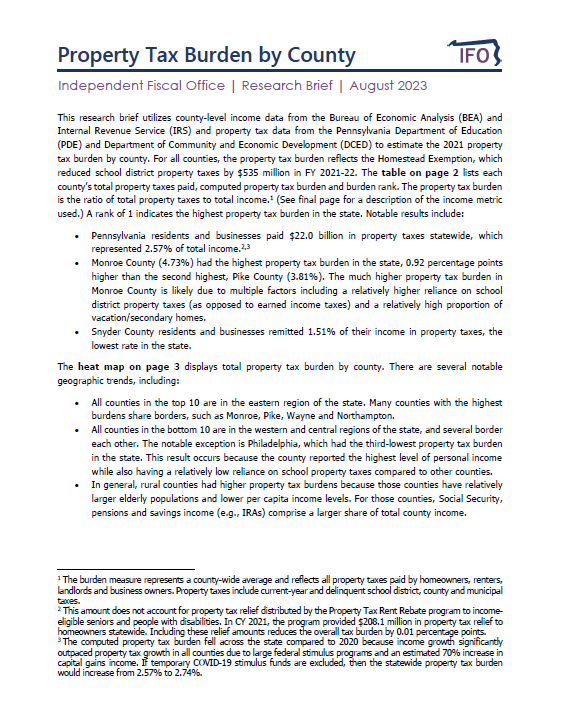

Property Tax Burden By County

Property Tax

August 22, 2023

This research brief uses (1) income data from the Bureau of Economic Analysis and the Internal Revenue Service and (2) property tax data from the Pennsylvania Department of Education and Department of Community and Economic Development to estimate county-level property tax burdens across the state for 2021.

Budget Impact of 2023 Wage Contracts

Wage Contracts

August 14, 2023

This research brief provides a preliminary estimate of the budget impact if the terms of the newly ratified AFSCME collective bargaining agreement (CBA) apply to all CBAs reviewed by the IFO, as well as management and non-represented workers.

Revenue Estimate Performance

Revenue Estimates

August 10, 2023

This report examines the performance of IFO revenue estimates for the past eleven budget cycles.

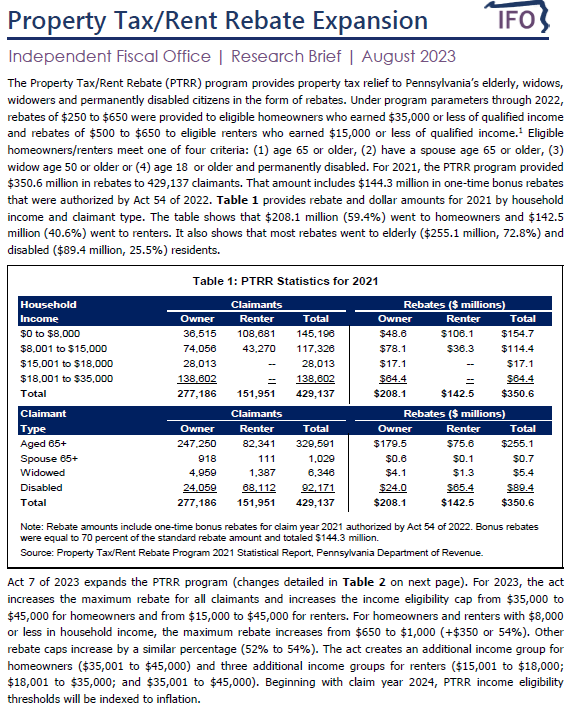

Property Tax/Rent Rebate Expansion

Property Tax

August 09, 2023

This research brief uses data from the Pennsylvania Department of Revenue, the American Community Survey and Social Security Administration to estimate the impact of the recently enacted expansion of the PTRR program. It provides detail on impact by income level, claimant type and county.

July 2023 Revenue Update

Revenue & Economic Update

August 01, 2023

The Commonwealth collected $2.88 billion in General Fund revenues for July, an increase of $185.3 million compared to July 2022.

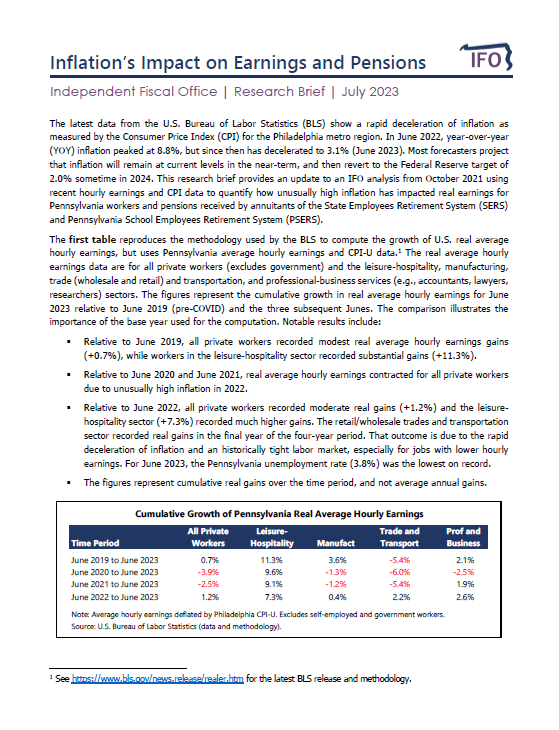

Inflation's Impact on Earnings and Pensions

Economics and Other

July 31, 2023

This research brief uses recent data from the U.S. Bureau of Labor Statistics to compute the impact of unusually high inflation on real average hourly earnings of Pennsylvania workers and a typical SERS-PSERS annuitant.

Corporate Net Income Tax TY 2019

Economics and Other

July 25, 2023

This research brief provides tabulations of corporate net income tax (CNIT) return data from tax year 2019 based on tax liability, apportionment factor and NAICS code.

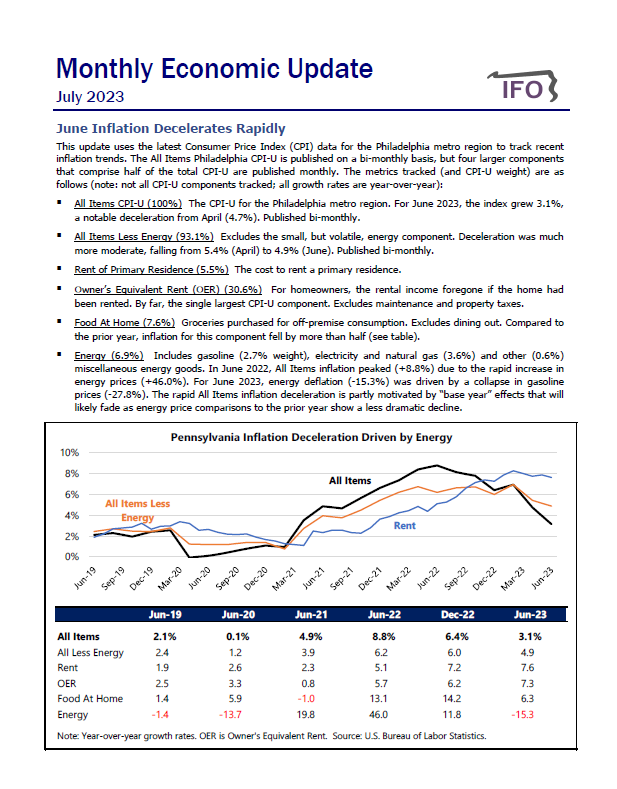

July 2023 Monthly Economic Update

Revenue & Economic Update

July 12, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

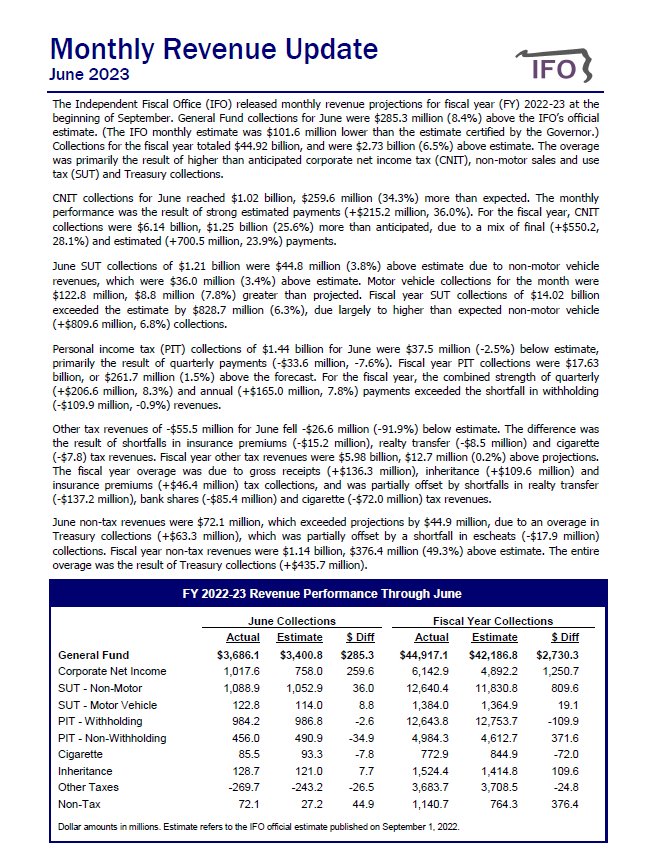

June 2023 Revenue Update

Revenue & Economic Update

July 03, 2023

The Commonwealth collected $44.92 billion in General Fund revenues for fiscal year 2022-23, a decrease of $3.22 billion (-6.7%) compared to the prior fiscal year. The decline is due to a one-time transfer of $3.84 billion in FY 2021-22 and a new SUT transfer.

Presentation on Combined Reporting

Economics and Other

June 29, 2023

Director Matt Knittel made a brief presentation to the House Finance Committee on combined reporting.

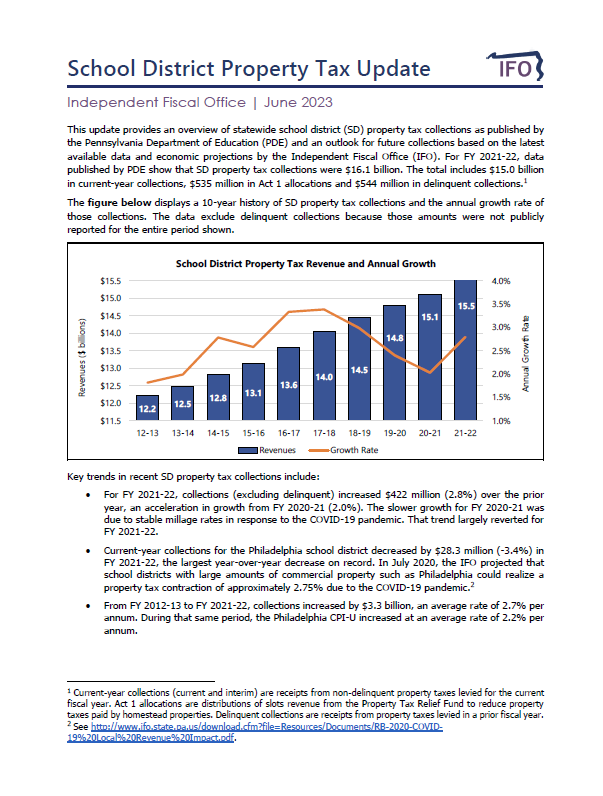

School District Property Tax Update

Property Tax

June 28, 2023

The IFO released an updated school district property tax forecast. The report (1) projects revenues through FY 2027-28, (2) estimates revenues collected from senior homeowners, (3) ranks counties based on per capita revenues and (4) provides detail on the projected Act 1 index.

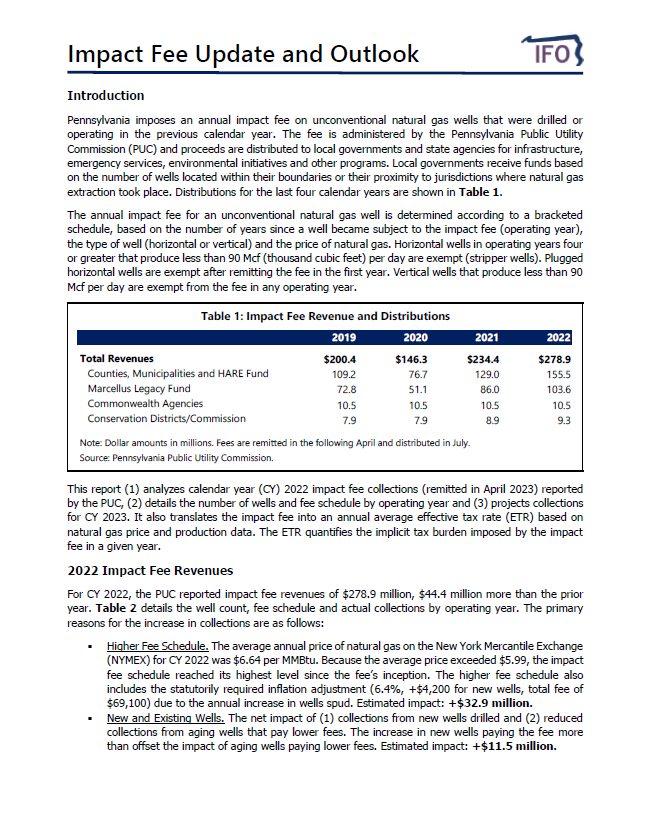

Impact Fee Update and Outlook 2023

Energy

June 26, 2023

This update examines 2022 impact fee collections and provides an outlook for 2023. The Commonwealth collected $278.9 million in impact fees for 2022, a $44.4 million increase from 2021.

June 2023 Monthly Economic Update

Revenue & Economic Update

June 26, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

Official Revenue Estimate FY 2023-24

Revenue Estimates

June 20, 2023

The Independent Fiscal Office (IFO) released its official revenue estimate for FY 2023-24. Updated estimates for FY 2022-23 are included.

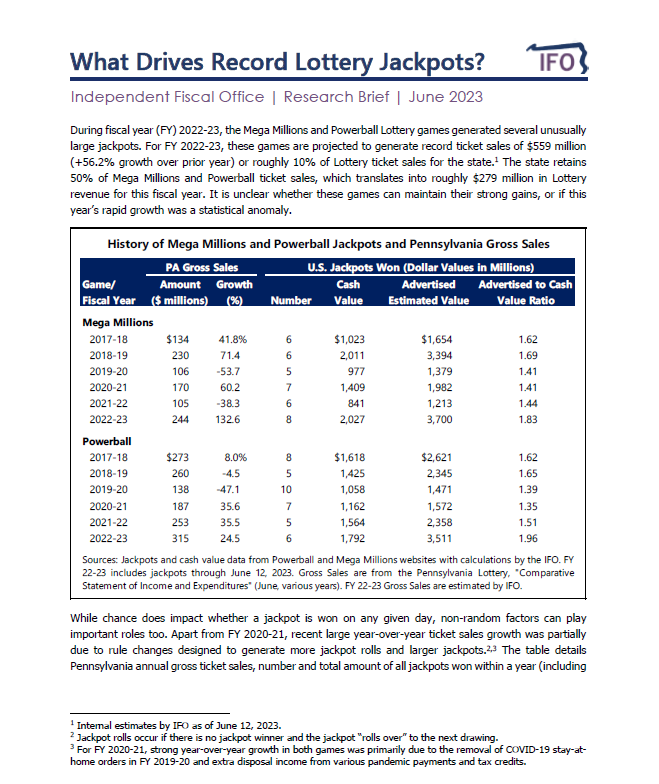

What Drives Record Lottery Jackpots?

Economics and Other

June 13, 2023

The IFO posted a new research brief that discusses the factors that motivate recent record Lottery jackpots for Mega Millions and Powerball and how large jackpots from those two games impact funds for programs the Lottery Fund supports.

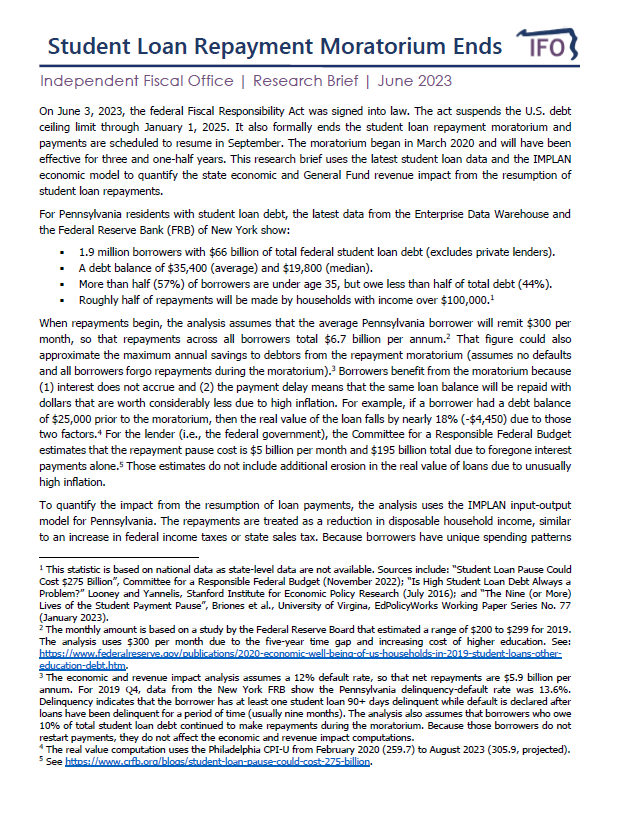

Student Loan Repayment Moratorium Ends

Economics and Other

June 12, 2023

As part of its annual revenue estimate, the IFO modeled the economic and revenue impact from the scheduled end of the student loan moratorium in September 2023. An IMPLAN economic simulation finds that annual state nominal GDP will decline by $3.4 billion while sales tax revenues decline by $125 million and personal income tax by $40 million.

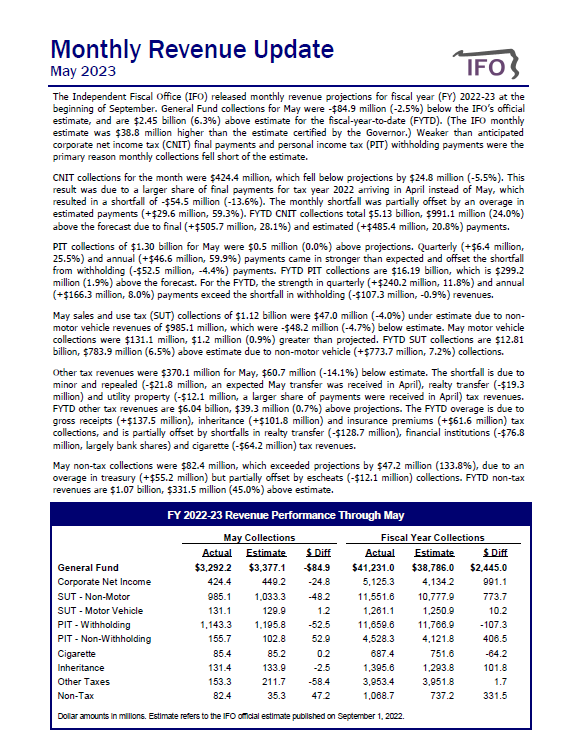

May 2023 Revenue Update

Revenue & Economic Update

June 01, 2023

The Commonwealth collected $3.29 billion in General Fund Revenues for May, an increase of $61.1 million (1.9%) compared to May 2022.

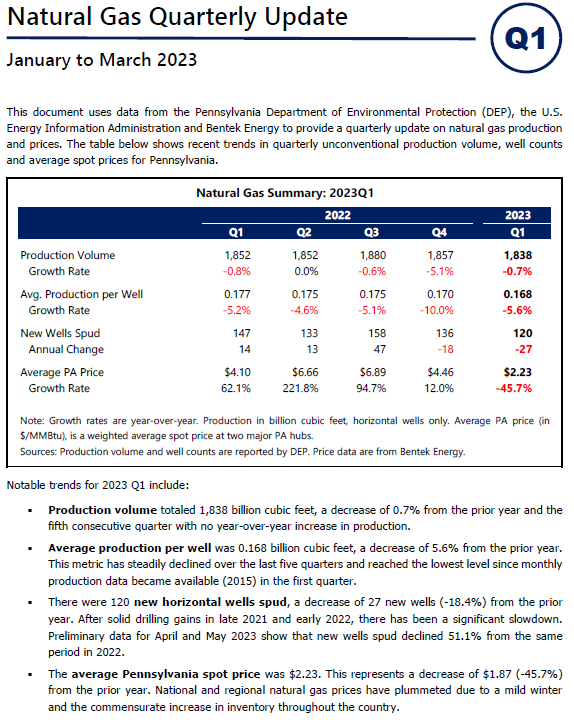

Natural Gas Quarterly Update, 2023Q1

Energy

May 31, 2023

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Bentek Energy to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

Initial Revenue Estimate FY 2023-24

Revenue Estimates

May 24, 2023

The IFO released its initial revenue estimate for FY 2023-24. Click the hyperlink above to view the report and presentation.

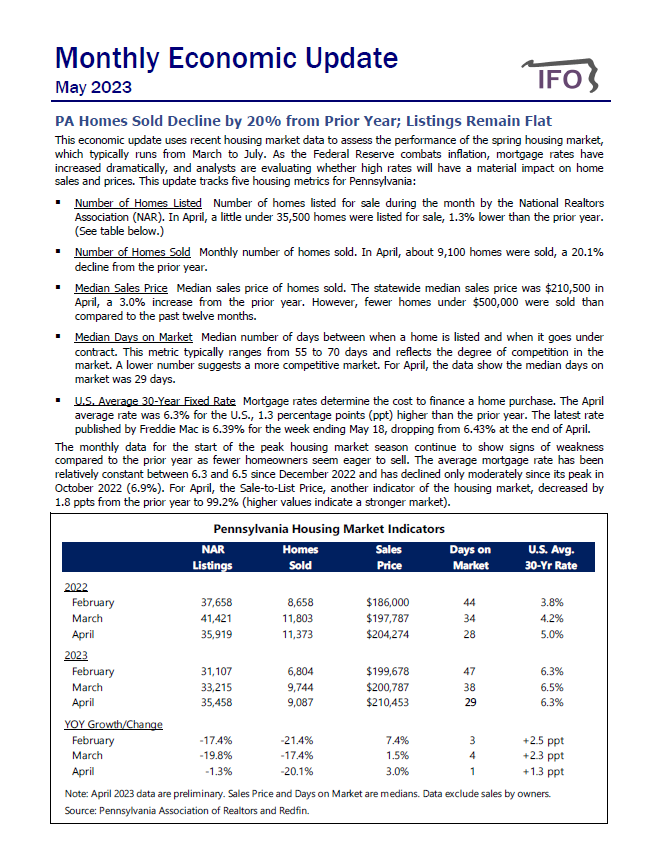

May 2023 Monthly Economic Update

Revenue & Economic Update

May 23, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

Initial Revenue Estimate Announcement

Revenue Estimates

May 17, 2023

The IFO will release its Initial Revenue Estimate on Wednesday, May 24th at 1:30 PM. The report will contain revisions to the FY 2022-23 estimate and an initial estimate for FY 2023-24. See the announcement for a link to register for the presentation.

PA Taxpayers Continue to Migrate South

Economics and Other

May 03, 2023

The IFO posted a research brief that uses recent IRS tax data to track migration between states for 2020 and 2021. The IRS data indicate Pennsylvania net domestic migration was -14,376 (-0.11% of state population), which ranked 34th across all states. Large net inflows came from border states and net outflows went to southern states, most notably Florida. The adjusted gross income averaged $46,600 for the inflow group and $52,300 for outflows, with a total net flow of nearly -$2.0 billion.

Analysis of Revenue Proposals

Revenue Estimates

May 03, 2023

This report provides estimates for the revenue proposals contained in the 2023-24 Executive Budget released March 2023. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under Section 604-B (a)(4) of the Administrative Code of 1929. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

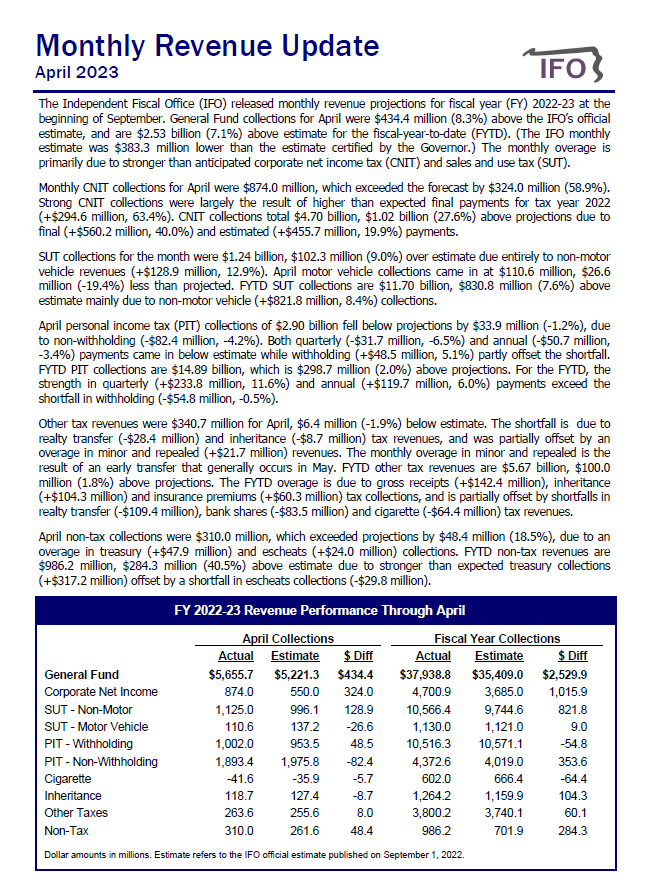

April 2023 Revenue Update

Revenue & Economic Update

May 01, 2023

The Commonwealth collected $5.66 billion in General Fund revenues for April, a decrease of $863.0 million (-13.2%) compared to April 2022.

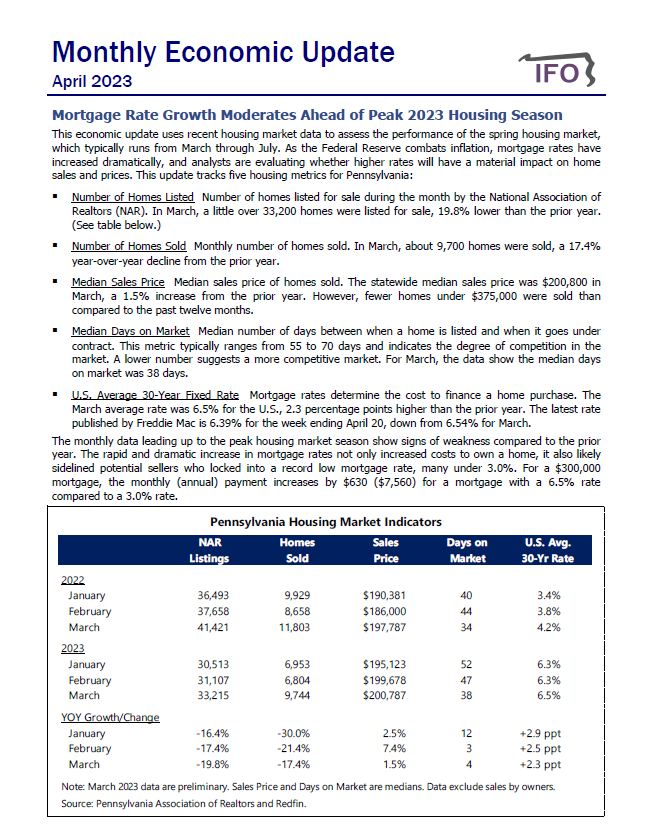

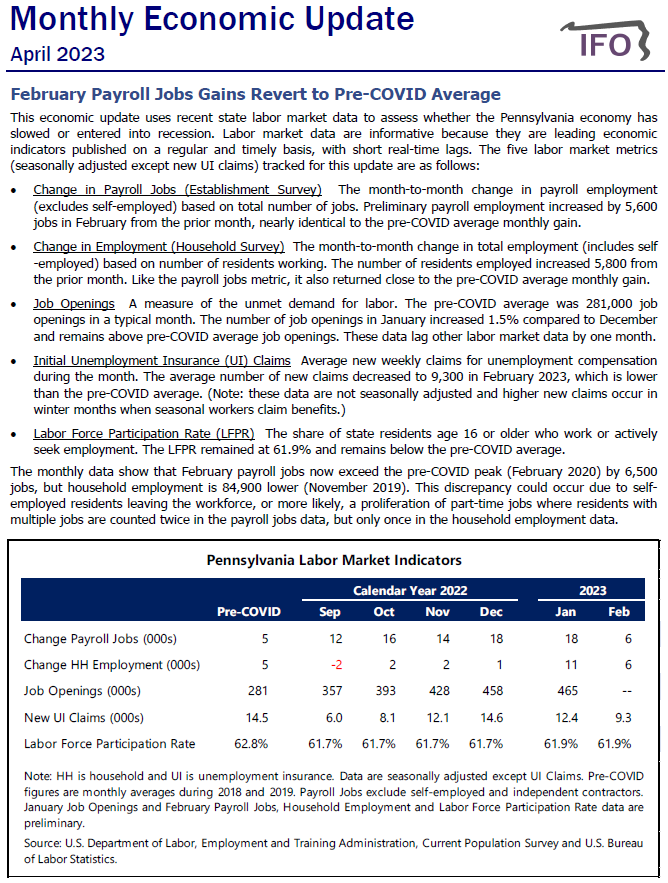

APRIL 2023 MONTHLY ECONOMIC UPDATE

Revenue & Economic Update

April 25, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

Economic and Budget Update

Economics and Other

April 19, 2023

The IFO presented an Economic and Budget Update to the PA Motor Truck Association.

Property Tax Rebates for Senior Homeowners

Property Tax

April 13, 2023

In response to a legislative request, the IFO transmitted a letter that analyzes a proposal to provide property tax rebates for senior homeowners in certain income ranges.

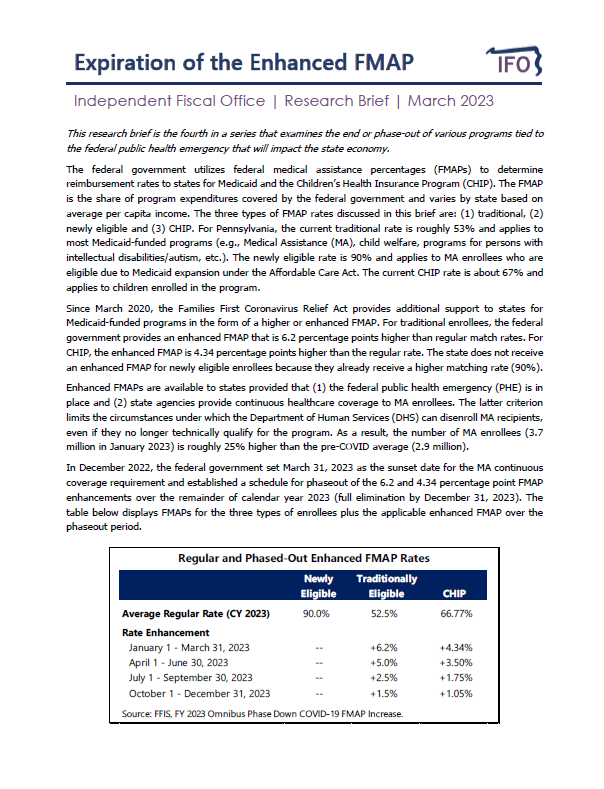

Expiration of the Enhanced FMAP

Economics and Other

April 06, 2023

The IFO posted a fourth research brief that examines the end or phase-out of various programs tied to the federal public health emergency that will impact the state economy. The brief examines the fiscal impact on the Commonwealth that will result from the phaseout of the enhanced Federal Medical Assistance Percentage (FMAP) and disenrollments due to the elimination of the continuous coverage requirement. The analysis finds a $1.70 billion net increase in state costs for FY 2023-24 and $2.13 billion the year after.

The report was originally posted on March 17, 2023 and was updated on April 6, 2023 for technical changes to the FMAP enhancement for newly eligible enrollees. The updated report also includes revised estimates from DHS for FY 23-24 expenditures covered by the enhanced FMAP phaseout.

Senate Budget Hearing Request

Economics and Other

April 05, 2023

The Independent Fiscal Office (IFO) responded to questions raised at the office’s budget hearing before the Senate Appropriations Committee. The questions relate to net migration for Pennsylvania, U3 and U6 unemployment rates, tax burden and labor force participation rates for Pennsylvania and border states, Pennsylvania’s declining workforce and the Pennsylvania Child and Dependent Care Enhancement Tax Credit.

APRIL 2023 MONTHLY ECONOMIC UPDATE

Revenue & Economic Update

April 04, 2023

The Monthly Economic Update provides data and insight on current trends that impact the state economy.

March 2023 Revenue Update

Revenue & Economic Update

April 03, 2023

The Commonwealth collected $6.19 billion in General Fund revenues for March, an increase of $633.3 million (11.4%) compared to March 2022.

State Rainy Day and General Fund Balances

Economics and Other

March 24, 2023

The IFO posted a new research brief that uses published data from The Pew Charitable Trusts to rank states based on the ratio of (1) Rainy Day Fund balances and (2) Total Balances (Rainy Day plus General Fund) to General Fund expenditures for enacted FY 2022-23 budgets.

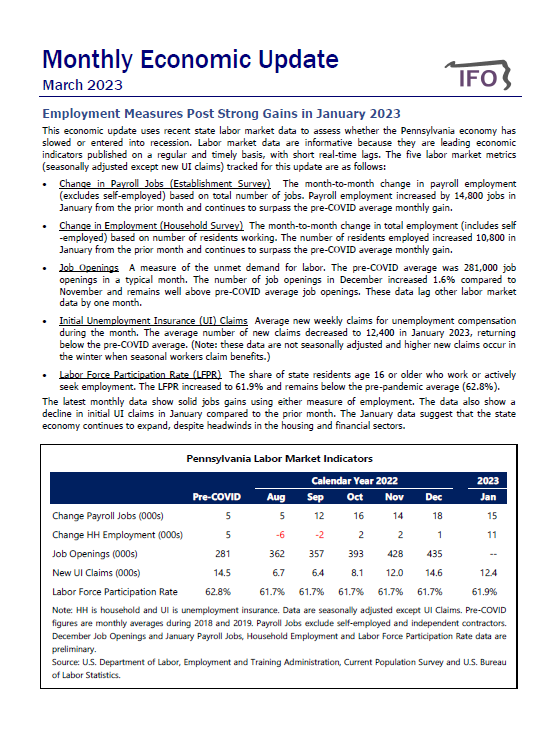

March 2023 Monthly Economic Update

Revenue & Economic Update

March 21, 2023

The March edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

Budget Hearing Materials 2023

Economics and Other

March 16, 2023

The Independent Fiscal Office submitted materials to the Senate Appropriations Committee ahead of its budget hearing. The packet includes data on the state economy, revenues, demographics and other miscellaneous topics.

Economic and Act 1 Index Update

Economics and Other

March 16, 2023

Director Knittel gave an Economic and Act 1 Index update at the Pennsylvania Association of School Business Officials (PASBO) Annual Conference.

Economic Update

Economics and Other

March 13, 2023

Director Knittel provided an economic update to the PA Chamber of Business and Industry.

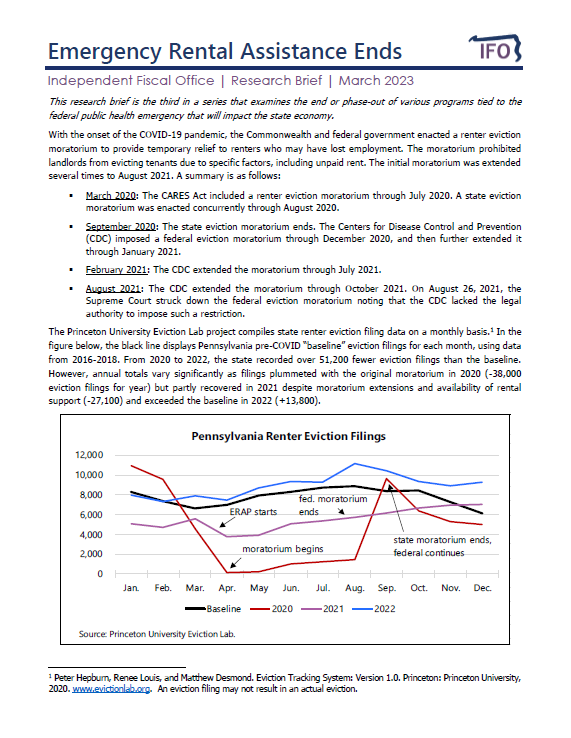

Emergency Rental Assistance Ends

Economics and Other

March 06, 2023

The IFO posted a third research brief that examines the end or phase-out of various programs tied to the federal public health emergency that will impact the state economy. The brief examines trends in eviction filings since the onset of the pandemic and the use of $1.6 billion in funds received for the Emergency Rental Assistance Program throughout the state.

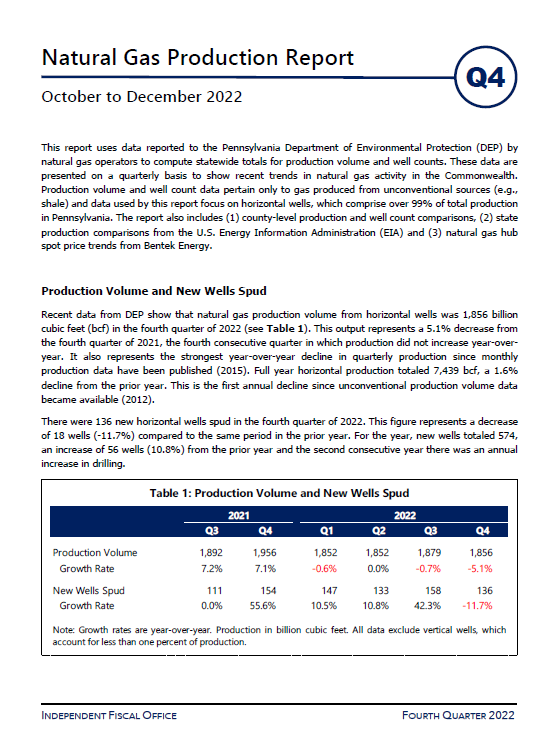

Natural Gas Production Report, 2022Q4

Energy

March 02, 2023

This report for the fourth quarter of 2022 uses data collected by the PA Department of Environmental Protection to develop statewide and county-level tabulations of production volume and well counts.

Summary and Analysis of Annual PSERS Stress Test Report

Pension Analysis

March 01, 2023

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the Public School Employees Retirement System’s (PSERS) recent stress test report. Based on PSERS baseline projections, the IFO projects that from FY 2023-24 to FY 2050-51, the Commonwealth will use $46.5 billion in General Fund revenues (2.3%) for the state’s share of public school employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of baseline assumptions.

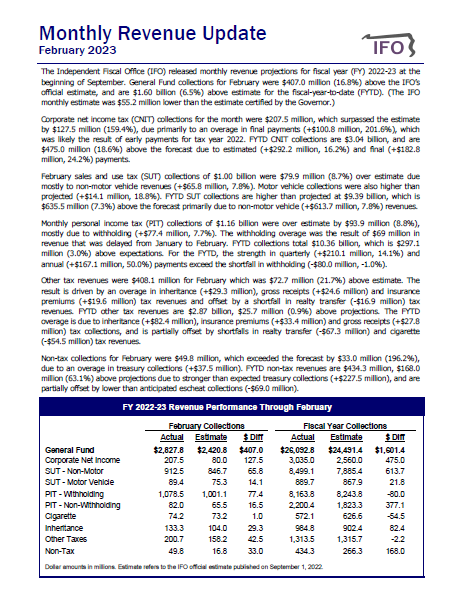

February 2023 Revenue Update

Revenue & Economic Update

March 01, 2023

The Commonwealth collected $2.83 billion in General Fund revenues for February, an increase of $393.5 million (16.2%) compared to February 2022.

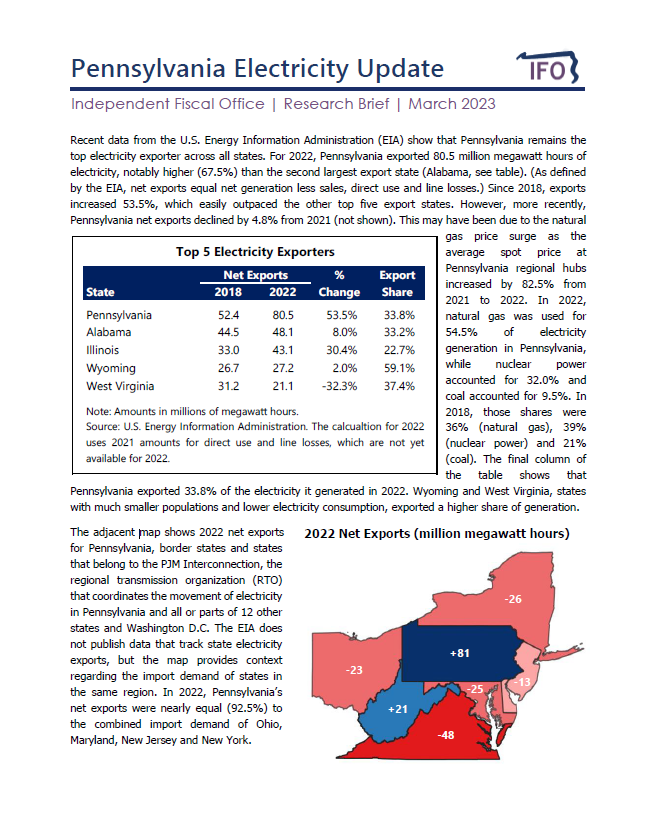

Pennsylvania Electricity Update

Energy

March 01, 2023

The IFO posted a research brief that provides an overview of the Pennsylvania electricity market. For 2022, PA remains the top exporter of electricity across all states. The next largest state (AL) exported 40% less electricity.

Impact of Proposed Changes to the NOL Cap

Economics and Other

February 24, 2023

The IFO published a letter in response to a request from Senator Pennycuick. The letter contains projections for the impact of proposed changes to the amount of taxable income that C corporations may offset through net operating loss deductions.

Post-Pandemic Child Care Cliff

Economics and Other

February 23, 2023

The IFO posted a second research brief that examines the end or phase-out of various programs tied to the federal public health emergency that will impact the state economy. The brief examines the impact that nearly $820 million in federal support had on the child care industry and its employees, and the funding cliff the industry will encounter in the near future.

State and Local Tax Revenues: A 50 State Comparison

Economics and Other

February 21, 2023

This report uses data from the U.S. Census Bureau, the Internal Revenue Service (IRS), the U.S. Bureau of Economic Analysis and the Federation of Tax Administrators to facilitate a comparison of state and local tax systems across the 50 states. The report examines (1) the relative level of state and local taxes across states, (2) the distribution of state and local taxes across revenue sources (e.g., income, sales and property) and (3) state debt levels.

Economic and Budget Outlook Hearing Request

Economics and Other

February 10, 2023

The IFO published a letter in response to requests for additional information raised at a recent economic and budget outlook hearing on January 24, 2023.

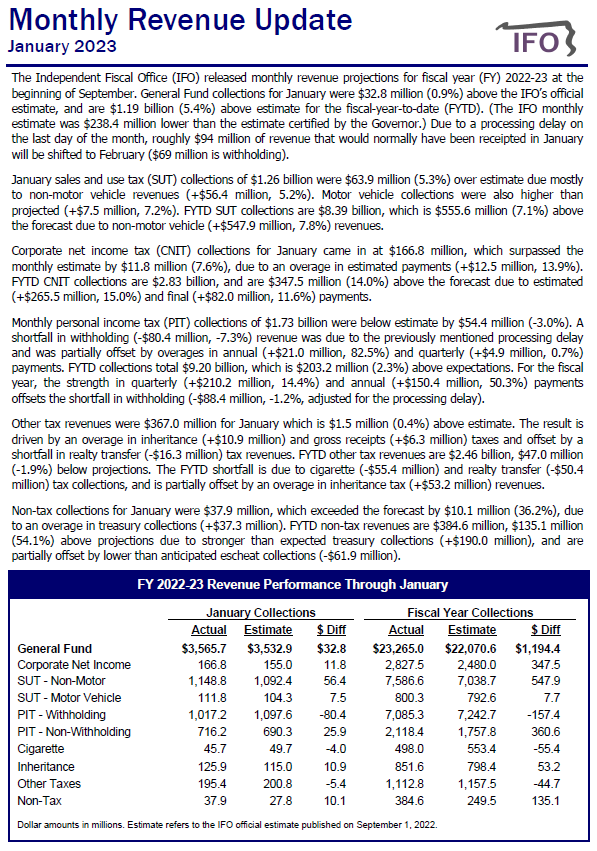

January 2023 Revenue Update

Revenue & Economic Update

February 01, 2023

The Commonwealth collected $3.57 billion in General Fund revenues for January, a decrease of $23.7 million (-0.7%) compared to January 2022. Due to a processing delay on the last day of the month, roughly $94 million of revenue that would normally have been receipted in January will be shifted to February.

Mid-Year Update FY 2022-23

Revenue Estimates

January 31, 2023

The Independent Fiscal Office (IFO) released a mid-year update of its revenue estimate for fiscal year (FY) 2022-23 and provided an advance look at revenue projections for the next fiscal year. The IFO will update the estimate in its next round of revenue projections released in late May.

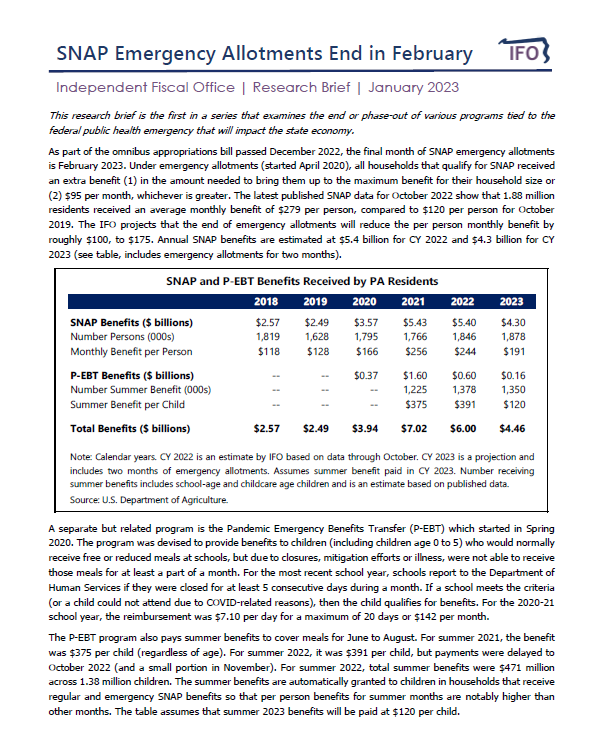

SNAP Emergency Allotments End in February

Economics and Other

January 27, 2023

The IFO posted a research brief that is the first in a series that examines the end or phase-out of various programs tied to the federal public health emergency that will impact the state economy. The brief quantifies the impact from the end of SNAP emergency allotments in February 2023.

This research brief was reposted on February 2, 2023 to change the 2023 summer benefit to $120 per child.

Analysis of Proposed Changes to State Motor Fuel Taxes

Economics and Other

January 26, 2023

The IFO published a letter in response to a request from Chairman Grove for a static and dynamic analysis of proposed changes to state motor fuel taxes. The proposal would reduce those taxes and replace lost revenues with motor vehicle sales and use taxes.

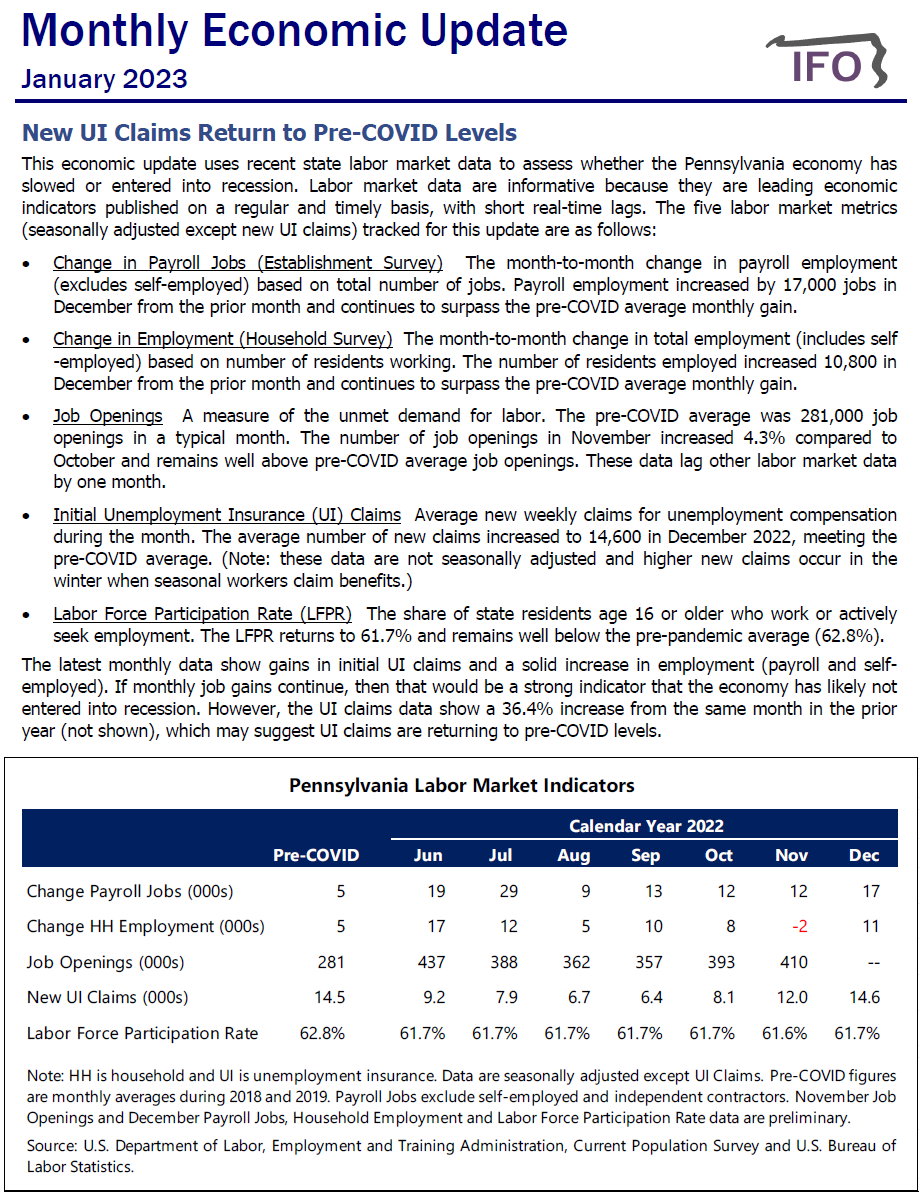

JANUARY 2023 MONTHLY ECONOMIC UPDATE

Revenue & Economic Update

January 25, 2023

The January edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

Economic and Budget Outlook Presentation

Revenue Estimates

January 24, 2023

The IFO presented results from its five-year outlook report published in November 2022.

PBB Overview Presentation for PID and EO

Performance Budgeting

January 11, 2023

IFO presentation of Performance-Based Budget overview and agency highlights for the Pennsylvania Insurance Department and the Executive Offices is posted on the website.

PBB Overview Presentation for DOR

Performance Budgeting

January 10, 2023

IFO presentation of Performance-Based Budget overview and agency highlights for the Department of Revenue is posted on the website.

2023 Tax Credit Reviews

Tax Credit Review

January 10, 2023

IFO presentation of the Manufacturing, Pennsylvania Resource Manufacturing, Rural Jobs and Investment, and Waterfront Development Tax Credit Reviews.

PBB Overview Presentation for DCNR and DDAP

Performance Budgeting

January 09, 2023

IFO presentation of Performance-Based Budget overview and agency highlights for the Department of Conservation and Natural Resources and the Department of Drug and Alcohol Programs is posted on the website.

Resource Manufacturing Tax Credit

Tax Credit Review

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to review all state tax credits over a five-year period. For the fifth year, the IFO reviewed the Manufacturing, Resource Manufacturing, Rural Jobs and Investment, and Waterfront Development Tax Credits.

Click on the link to access the Resource Manufacturing Tax Credit Report.

Manufacturing Tax Credit

Tax Credit Review

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to review all state tax credits over a five-year period. For the fifth year, the IFO reviewed the Manufacturing, Resource Manufacturing, Rural Jobs and Investment, and Waterfront Development Tax Credits.

Click on the link to access the Manufacturing Tax Credit Report.

Executive Offices

Performance Budgeting

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Executive Offices.

Approved by the PBB Board on January 11, 2023.

Pennsylvania Insurance Department

Performance Budgeting

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Pennsylvania Insurance Department.

Approved by the PBB Board on January 11, 2023.

The report was reposted on January 18, 2023 to correct a single year of data on page 14.

Department of Revenue

Performance Budgeting

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Department of Revenue.

Approved by the PBB Board on January 10, 2023.

Department of Drug and Alcohol Programs

Performance Budgeting

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Department of Drug and Alcohol.

Approved by the PBB Board on January 9, 2023.

Department of Conservation and Natural Resources

Performance Budgeting

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Department of Conservation and Natural Resources.

Approved by the PBB Board on January 9, 2023.

Rural Jobs and Investment Tax Credit

Tax Credit Review

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to review all state tax credits over a five-year period. For the fifth year, the IFO reviewed the Manufacturing, Resource Manufacturing, Rural Jobs and Investment, and Waterfront Development Tax Credits.

Click on the link to access the Rural Jobs and Investment Tax Credit Report.

The report was amended on February 17, 2023 to include updates to Table 3.1 on page 14.

Following publication of the RJITC report, the IFO became aware of a data discrepancy contained within a referenced study. As a result, the RJITC report was updated to exclude references to the “Evaluation of Alabama’s Entertainment Industry Incentive Program and New Markets Development Program” on February 23, 2023.

Post-Pandemic Gasoline Consumption

Economics and Other

January 05, 2023

The IFO published a research brief on the decline in Pennsylvania gasoline consumption resulting from recent trends in remote working and higher gasoline prices. Reduced consumption means less funding for road and bridge construction, as gasoline taxes fund 55% of those projects.

Waterfront Development Tax Credit

Tax Credit Review

January 05, 2023

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to review all state tax credits over a five-year period. For the fifth year, the IFO reviewed the Manufacturing, Resource Manufacturing, Rural Jobs and Investment, and Waterfront Development Tax Credits.

Click on the link to access the Waterfront Development Tax Credit Report.

PA Population Contracts Since 2020

Economics and Other

January 04, 2023

The IFO published a research brief that uses the latest Census data to rank states based on net migration between states since 2020. During the past two years, Pennsylvania recorded a net domestic outflow of 16,220. Relative to state population, the net outflow caused state population to contract by 0.1%, which ranked 29th across all states.

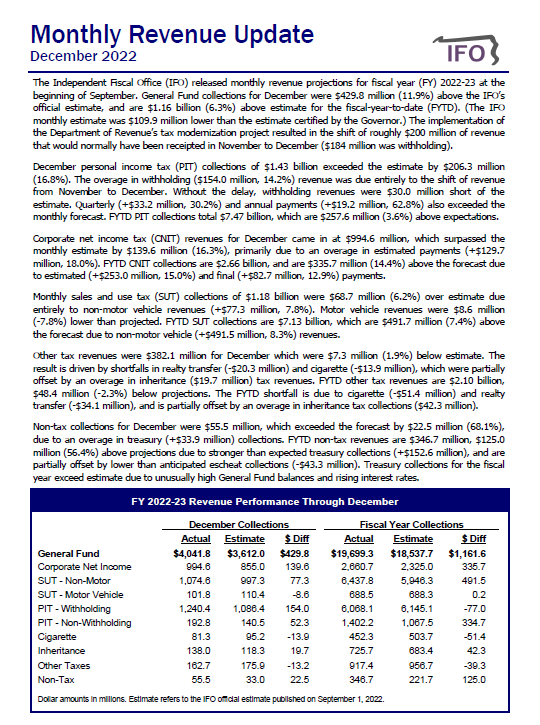

December 2022 Revenue Update

Revenue & Economic Update

January 03, 2023

The Commonwealth collected $4.04 billion in General Fund revenue for December, an increase of $195.9 million (5.1%) compared to December 2021. The implementation of the Department of Revenue’s tax modernization project resulted in the shift of roughly $200 million of revenue that would normally have been receipted in November to December.

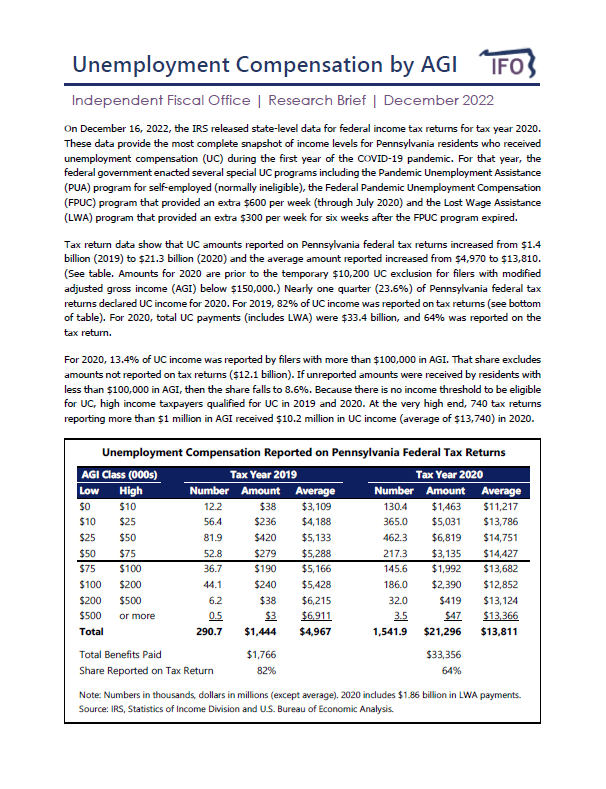

Unemployment Compensation by AGI

Economics and Other

December 21, 2022

The IFO published a research brief that uses the latest federal tax return data to provide a breakdown by income class for unemployment compensation (UC) benefits received by Pennsylvania residents in 2019 and 2020. For 2020, residents received $33.4 billion of UC income and $21.3 billion (64%) was reported on the federal tax return. For amounts reported, $2.9 billion (13.4%) was reported by filers with more than $100,000 of adjusted gross income (AGI). High income taxpayers qualify for UC benefits because the federal program does not apply income thresholds.

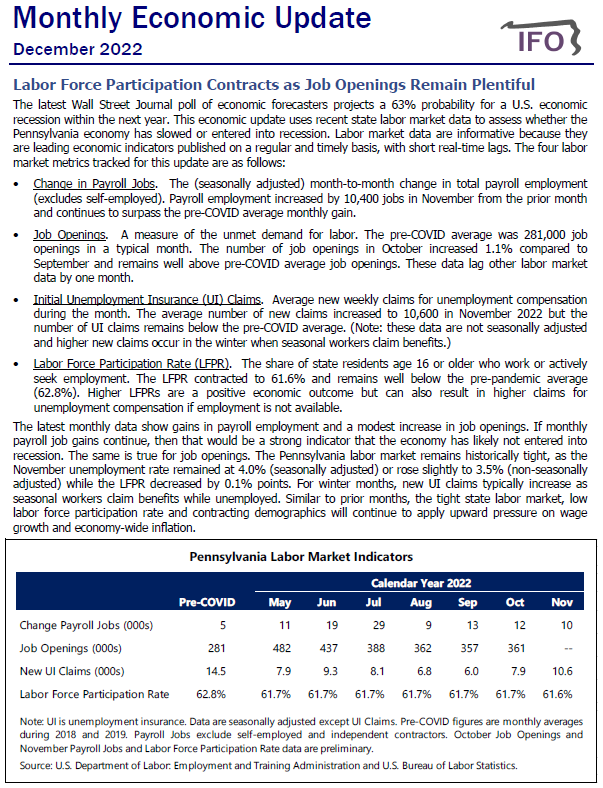

December 2022 Monthly Economic Update

Revenue & Economic Update

December 20, 2022

The December edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

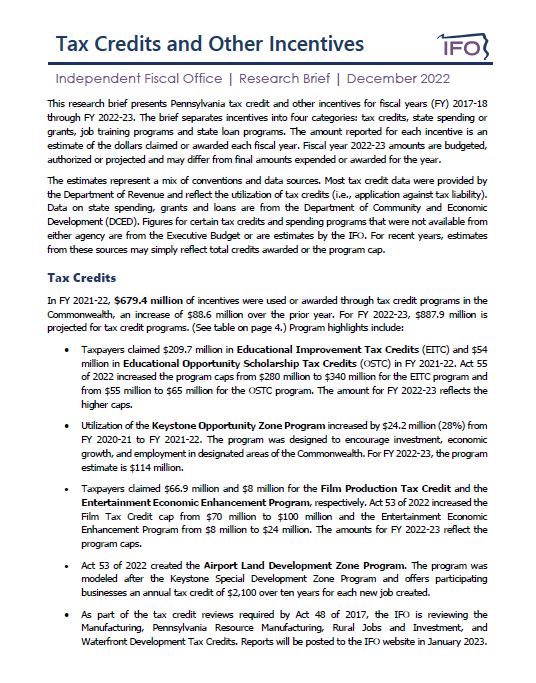

Tax Credits and Economic Development Incentives

Economics and Other

December 15, 2022

This research brief presents data on Pennsylvania tax credits and economic development incentives for fiscal years (FY) 2017-18 through FY 2022-23. The tables provide annual detail on tax credit utilization or awards, state spending or grants, job training programs and state loan programs. Fiscal year 2022-23 amounts are budgeted, authorized or projected and may differ from final amounts expended or awarded for the year. The brief also highlights recent changes to incentive program spending or utilization.

This research brief was reposted on December 21 to correct a text error on page 1.

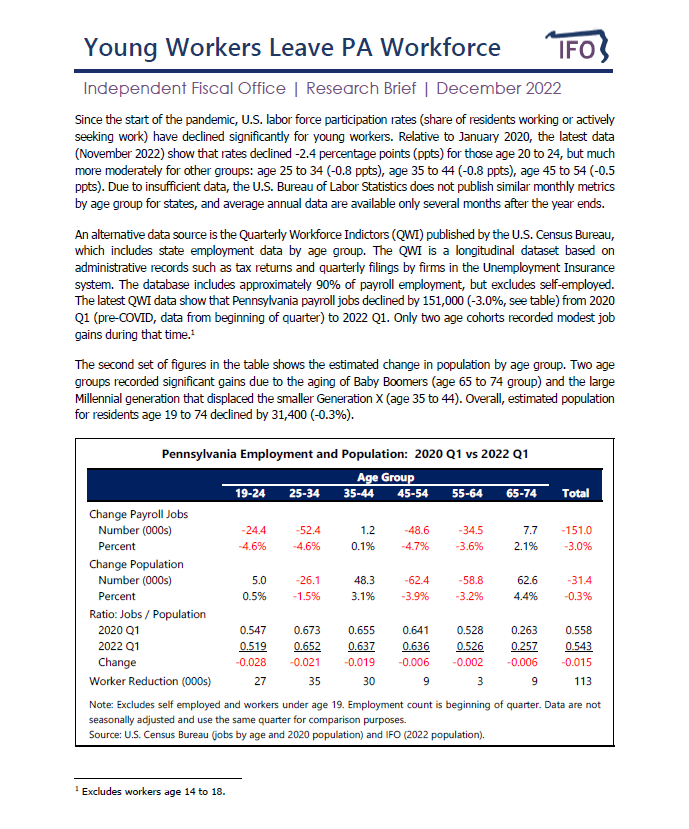

Young Workers Leave PA Workforce

Economics and Other

December 08, 2022

The IFO published a new research brief that examines the age composition of the PA workforce using the latest data from the U.S. Census Bureau. Since the onset of the pandemic, the data show significant reductions in workforce participation rates for workers under age 35. Workforce participation rates declined for older workers too, but contractions were notably more moderate.

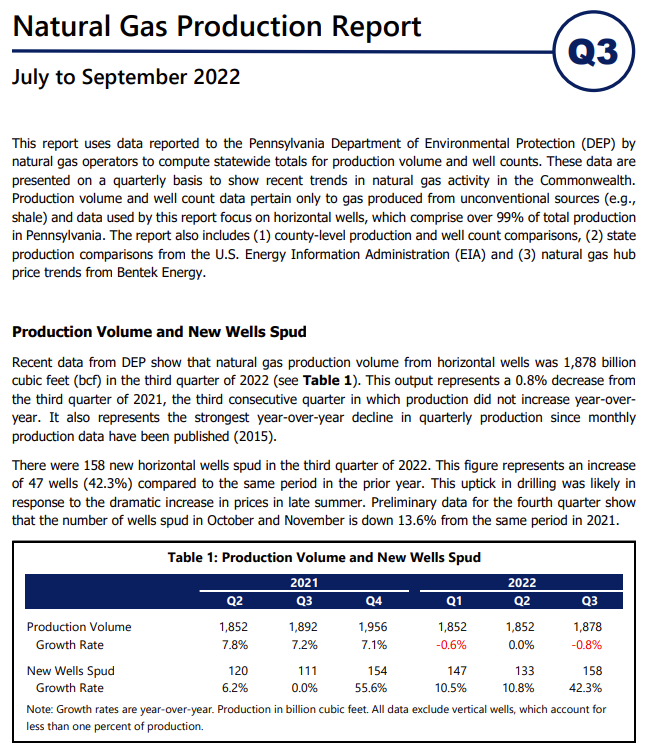

Natural Gas Production Report, 2022Q3

Energy

December 05, 2022

This report for the third quarter of 2022 uses data collected by the PA Department of Environmental Protection to develop statewide and county-level tabulations of production volume and well counts.

Summary and Analysis of Annual SERS Stress Test Report

Pension Analysis

December 01, 2022

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the State Employee Retirement System’s (SERS) recent stress test report. Based on SERS baseline projections, the IFO projects that over the next 20 years, Commonwealth agencies will use $17.8 billion in General Fund revenues (1.5%) for employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance and member salary growth to exceed and fall short of baseline assumptions.

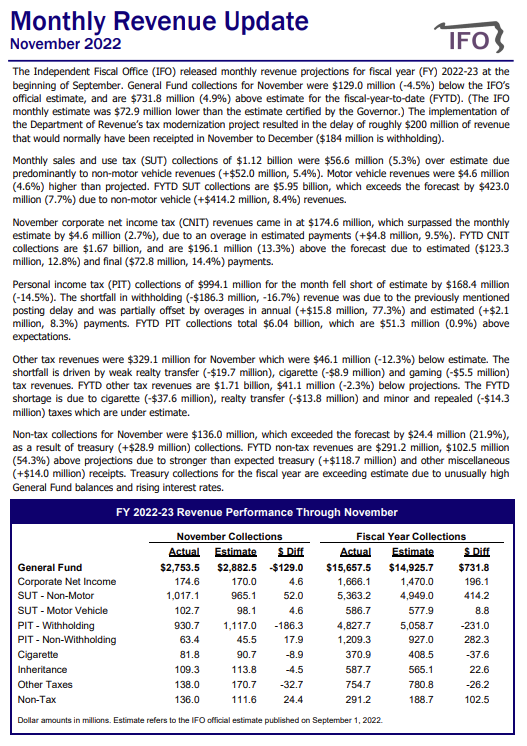

NOVEMBER 2022 REVENUE UPDATE

Revenue & Economic Update

December 01, 2022

The Commonwealth collected $2.75 billion in General Fund revenue for November, a decrease of $3.87 billion (-58.4%) compared to November 2021. The implementation of the Department of Revenue’s tax modernization project resulted in the delay of roughly $200 million of revenue that would normally have been receipted in November to December.

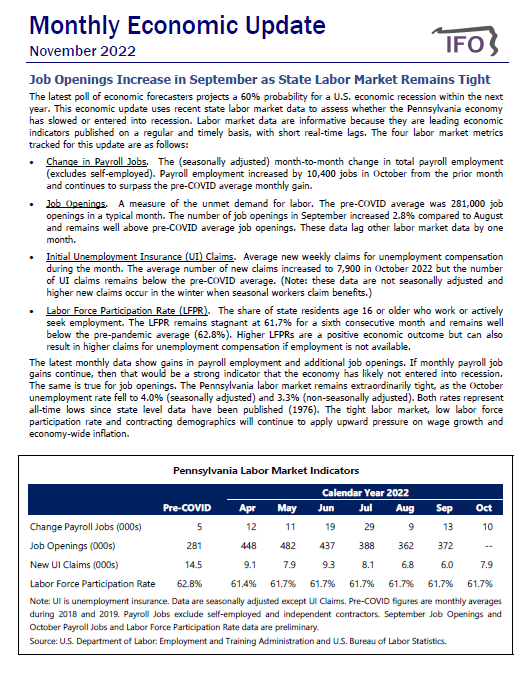

November 2022 Monthly Economic Update

Revenue & Economic Update

November 21, 2022

The November edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic, and fiscal trends.

Five-Year Economic and Budget Outlook

Revenue Estimates

November 15, 2022

The Independent Fiscal Office (IFO) released its five-year Economic and Budget Outlook. Click the hyperlink above to view the report and presentations.

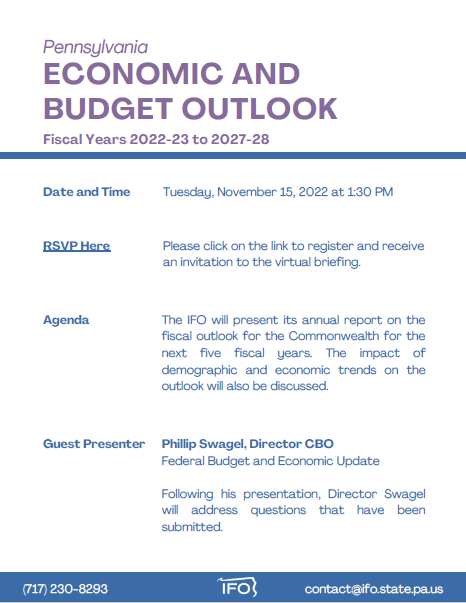

Economic and Budget Outlook

Revenue Estimates

November 02, 2022

The Independent Fiscal Office will release an updated revenue estimate and discuss economic trends for FY 2022-23 to 2027-28. The briefing is open to the public and submitted questions will be addressed at the end of each presentation. The report will also be posted to the IFO website when the presentation concludes. Click on the link for details on how to register.

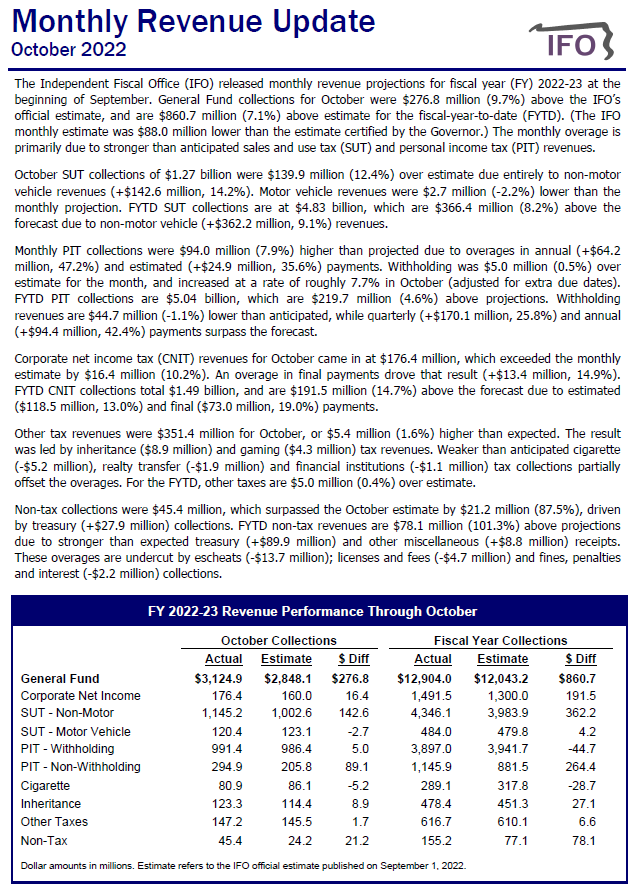

October 2022 Revenue Update

Revenue & Economic Update

November 01, 2022

The Commonwealth collected $3.12 billion in General Fund revenues for October, an increase of $310.8 million (11.0%) compared to October 2021.

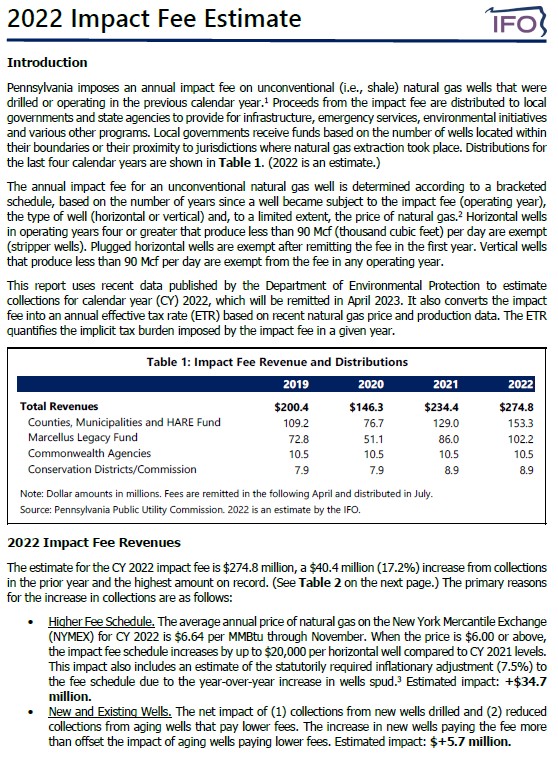

2022 Impact Fee Estimate

Energy

October 31, 2022

This report uses recent data published by the Department of Environmental Protection to project CY 2022 Impact Fee collections (remitted April 2023). Collections are estimated to be $274.8 million, an increase of $40.4 million from the prior year.

Evaluating the Effectiveness of Tax Incentives Without ROI

Economics and Other

October 26, 2022

Michaela Miller gave a brief presentation at the FTA Revenue Estimation and Tax Research Conference on evaluating the effectiveness of tax incentives without ROI. The REAP tax credit was used as a case study.

Where Did the Workers Go?

Economics and Other

October 25, 2022

This research brief updates a prior release in August 2022 to show data for more recent months and new demographic projections from the IFO’s Demographic Outlook report.

The IFO published a research brief that examines the factors that caused the PA labor force to contract by 120,000 workers since the start of the pandemic. The updated research brief focuses on the interaction between recent and projected demographic trends and the contraction of the state labor force.

October 2022 Monthly Economic Update

Revenue & Economic Update

October 24, 2022

The October edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic, and fiscal trends.

REVENUE ESTIMATE PERFORMANCE

Revenue Estimates

October 12, 2022

This report examines the performance of IFO revenue estimates for the past ten budget cycles.

2022 Demographic Outlook

Economics and Other

October 05, 2022

Section 604-B (a)(2) of the Administrative Code of 1929 specifies that the Independent Fiscal Office (IFO) shall “provide an assessment of the state’s current fiscal condition and a projection of what the fiscal condition will be during the next five years. The assessment shall take into account the state of the economy, demographics, revenues and expenditures.” This report fulfills the demographics obligation for the IFO’s release of the Economic and Budget Outlook for Fiscal Years 2022-23 to 2027-28.

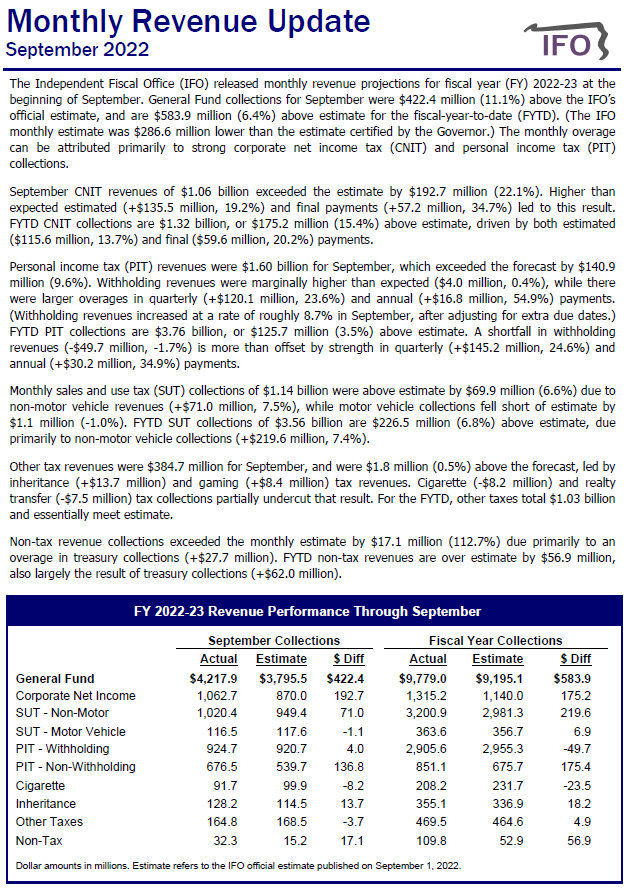

September 2022 Revenue Update

Revenue & Economic Update

October 03, 2022

The Commonwealth collected $4.22 billion in General Fund revenues for September, an increase of $214.8 million (5.4%) compared to September 2021.

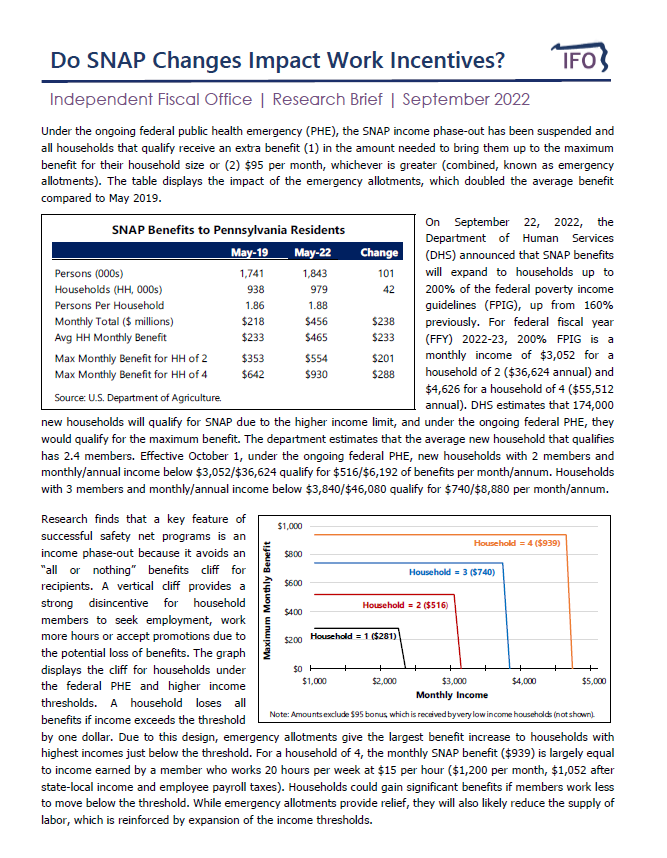

Do SNAP Changes Impact Work Incentives?

Economics and Other

September 29, 2022

A new IFO research brief examines the impact on SNAP benefits from the ongoing public health emergency that eliminates the income phase-out and the recent expansion of income thresholds from 160% to 200% of federal poverty income guidelines (FPIG). Due to the elimination of the income phase-out, recipients face a vertical all-or-nothing benefits cliff. Research finds that vertical cliffs provide strong disincentives.

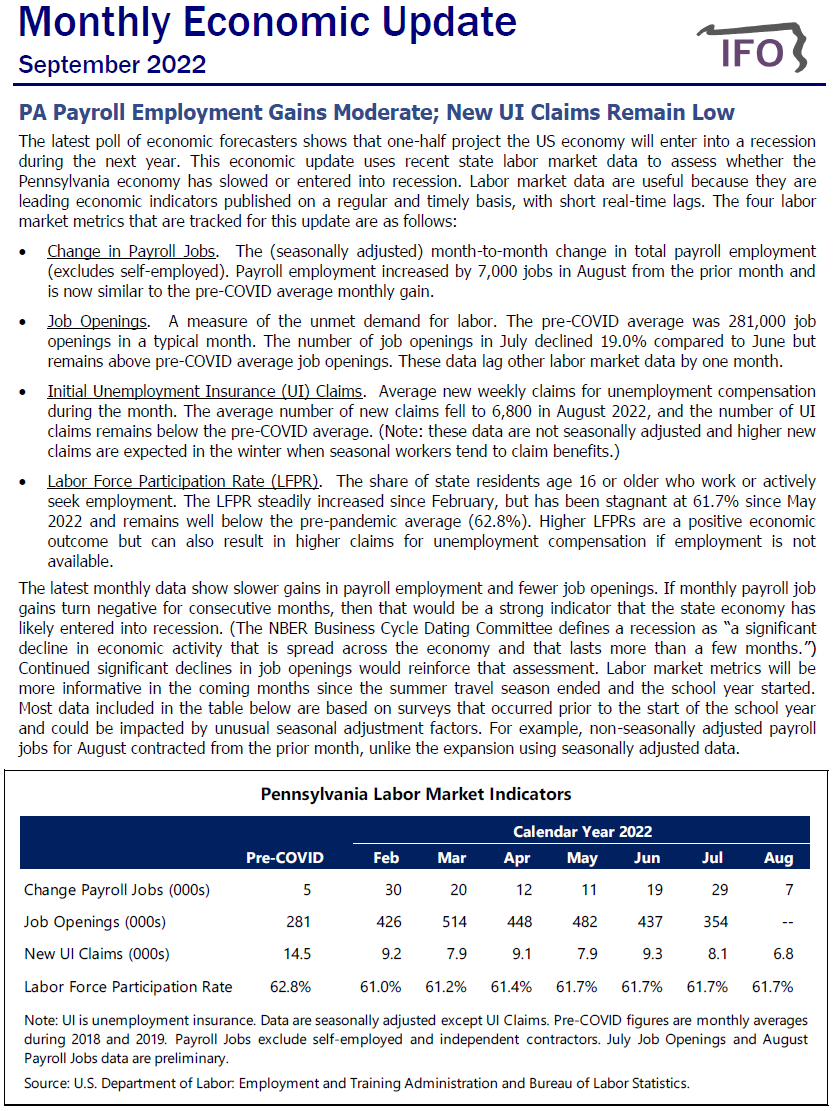

SEPTEMBER 2022 MONTHLY ECONOMIC UPDATE

Revenue & Economic Update

September 19, 2022

The September edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

Property Tax Burden by County

Property Tax

September 06, 2022

This research brief uses (1) income data from the Bureau of Economic Analysis and the Internal Revenue Service and (2) property tax data from the Pennsylvania Department of Education and Department of Community and Economic Development to estimate county-level property tax burdens across the state for 2020.

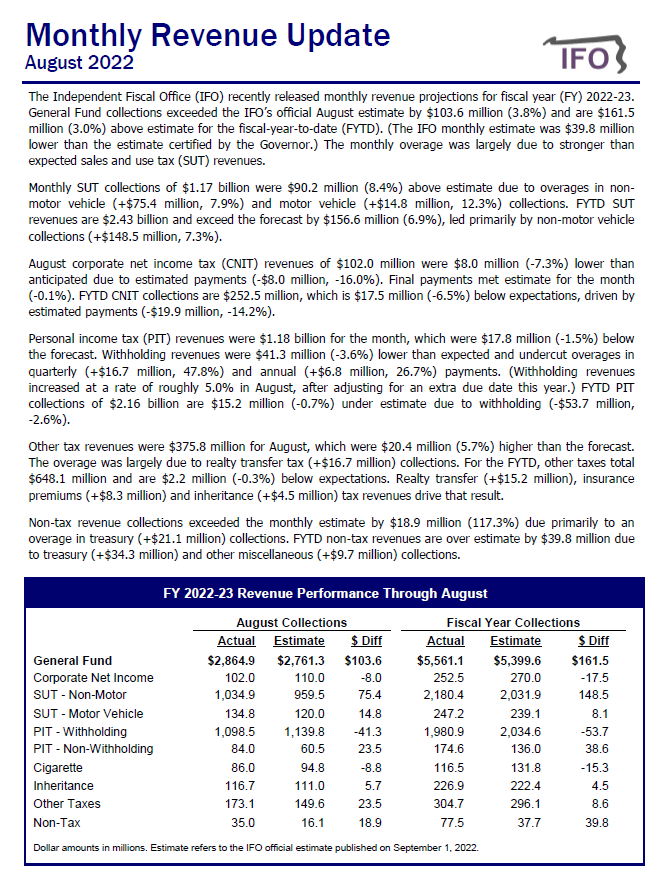

August 2022 Revenue Update

Revenue & Economic Update

September 01, 2022

The Commonwealth collected $2.86 billion in General Fund revenues for August, an increase of $290.7 million (11.3%) compared to August 2021.

Monthly and Quarterly Revenue Estimates

Revenue Estimates

September 01, 2022

This report provides revenue distributions based on the FY 2022-23 projections contained in the Official Revenue Estimate published by the IFO on June 23, 2022 and the statutory changes that were enacted with the FY 2022-23 state budget.

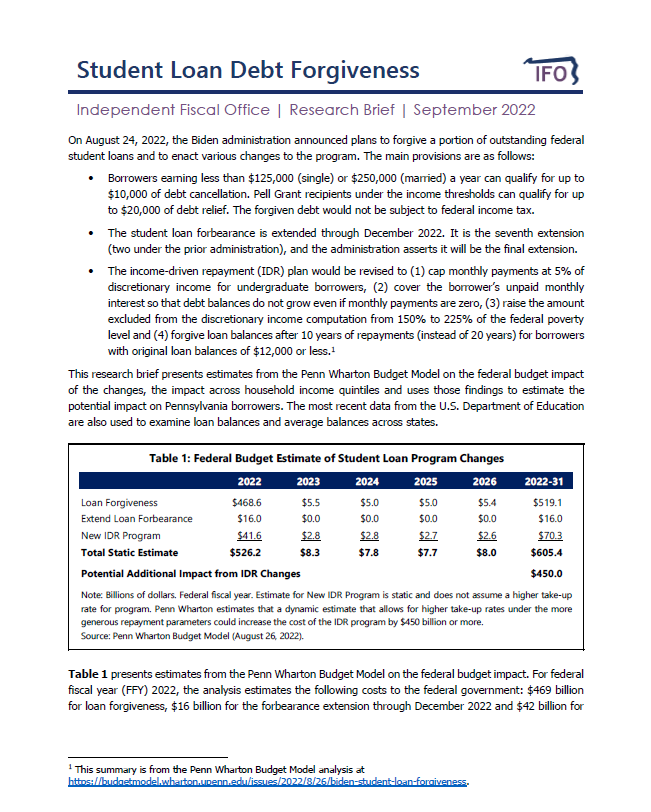

Student Loan Debt Forgiveness

Economics and Other

August 31, 2022

The IFO published a research brief that uses a national analysis from the Penn Wharton Budget Model and data from the U.S. Department of Education to estimate the impact on Pennsylvania borrowers from student loan debt relief and other proposed changes to the federal program.

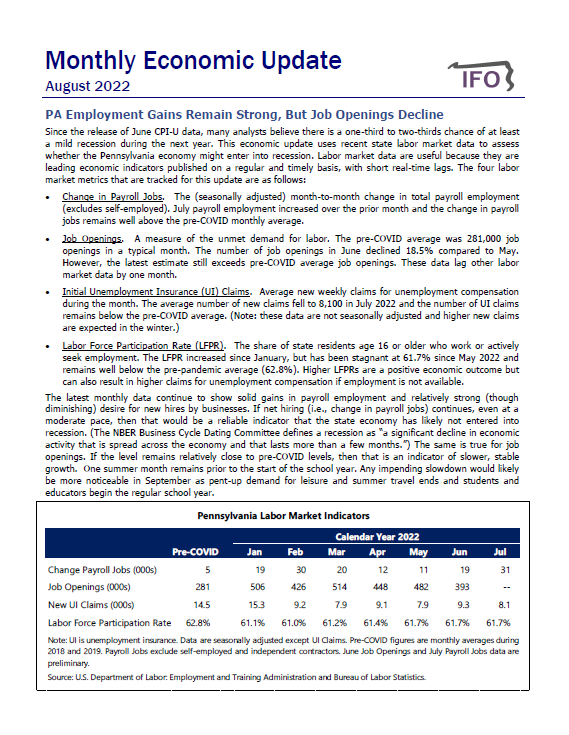

August 2022 Monthly Economic Update

Revenue & Economic Update

August 22, 2022

The August edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

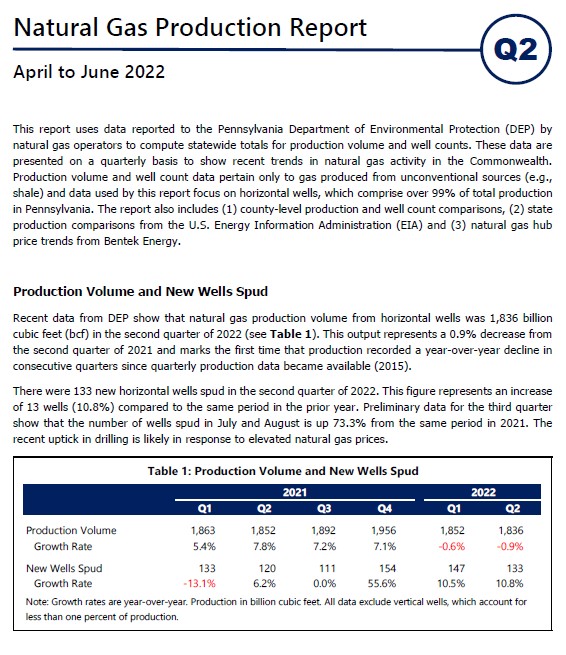

Natural Gas Production Report, 2022Q2

Energy

August 18, 2022

This report for the second quarter of 2022 uses data collected by the PA Department of Environmental Protection to develop statewide and county-level tabulations of production volume and well counts.

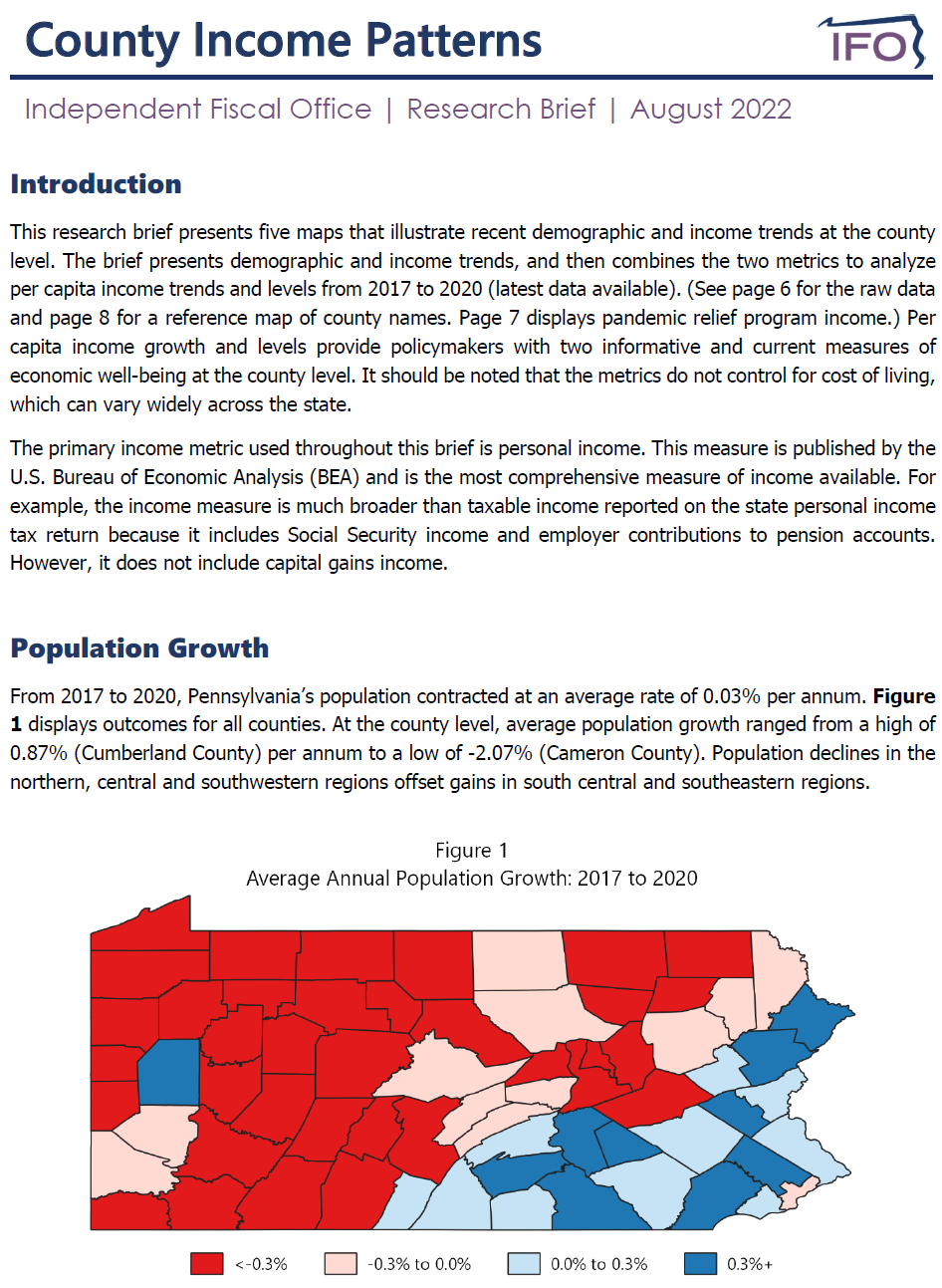

County Income Patterns

Economics and Other

August 16, 2022

This research brief uses the latest published data to generate maps and county rankings of recent demographic and income trends. The release highlights population change, personal income growth and per capita amounts for all counties in the Commonwealth.

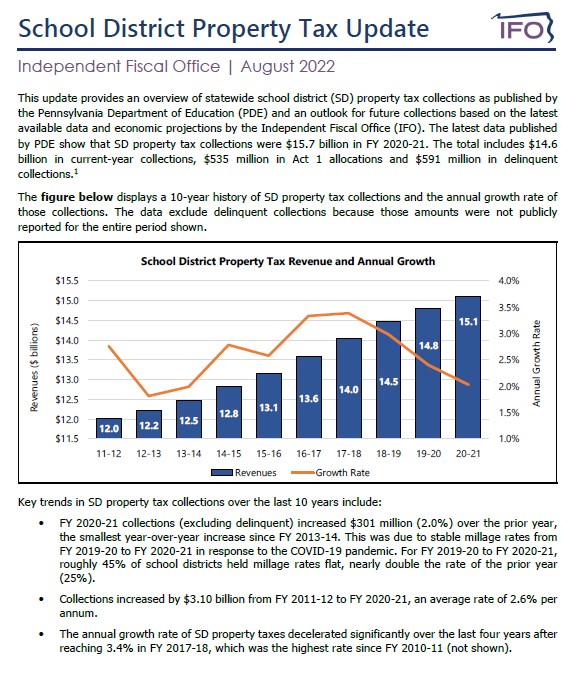

School District Property Tax Update

Property Tax

August 15, 2022

The IFO released an updated school district property tax forecast. The report (1) projects revenues through FY 2026-27, (2) estimates revenues collected from senior homeowners, (3) ranks counties based on per capita revenues and (4) provides detail on the projected Act 1 index.

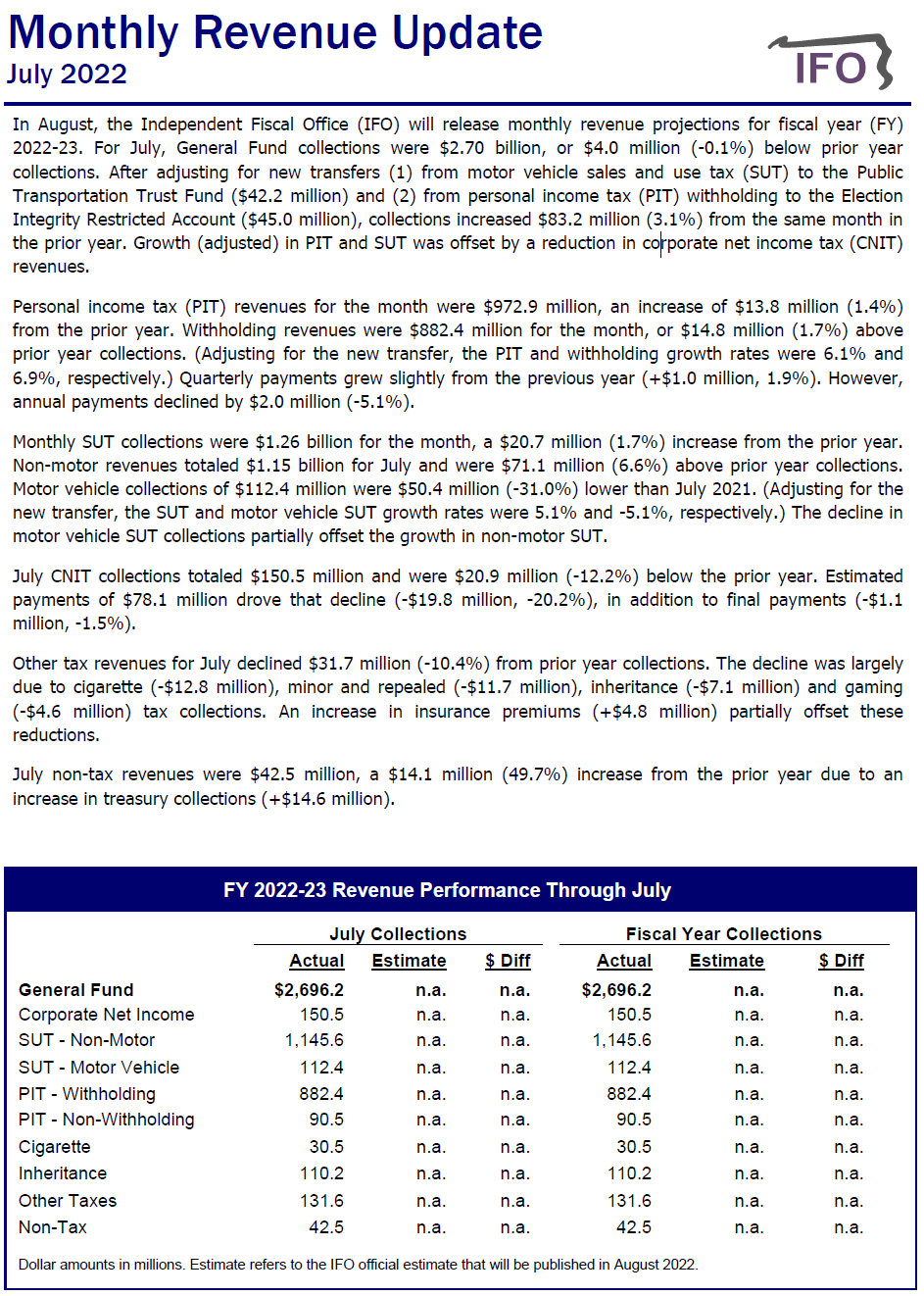

July 2022 Revenue Update

Revenue & Economic Update

August 01, 2022

The Commonwealth collected $2.70 billion in General Fund revenues for July, a decrease of $4.0 million (-0.1%) compared to July 2021.

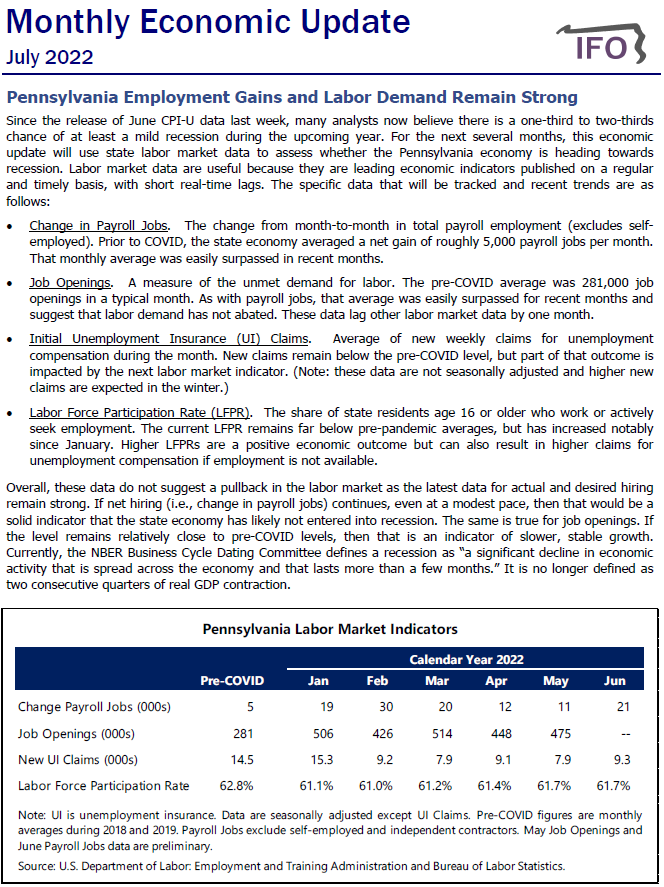

July 2022 Monthly Economic Update

Revenue & Economic Update

July 25, 2022

The July edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

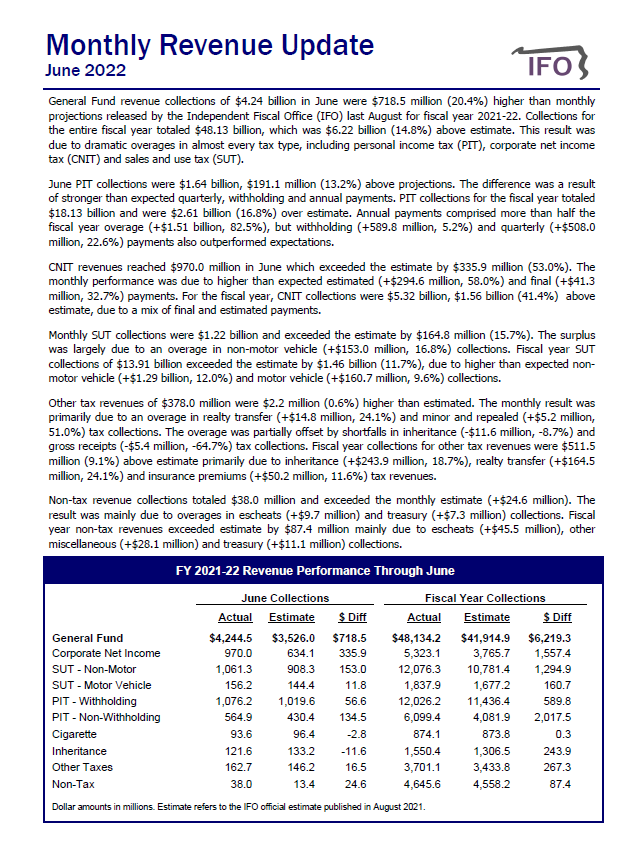

June 2022 Revenue Update

Revenue & Economic Update

July 01, 2022

The Commonwealth collected $48.13 billion in General Fund revenues for fiscal year 2021-22, an increase of $7.74 billion (19.2%) compared to the prior fiscal year.

Official Revenue Estimate FY 2022-23

Revenue Estimates

June 23, 2022

The Independent Fiscal Office (IFO) released its official revenue estimate for FY 2022-23. Updated estimates for FY 2021-22 are included.

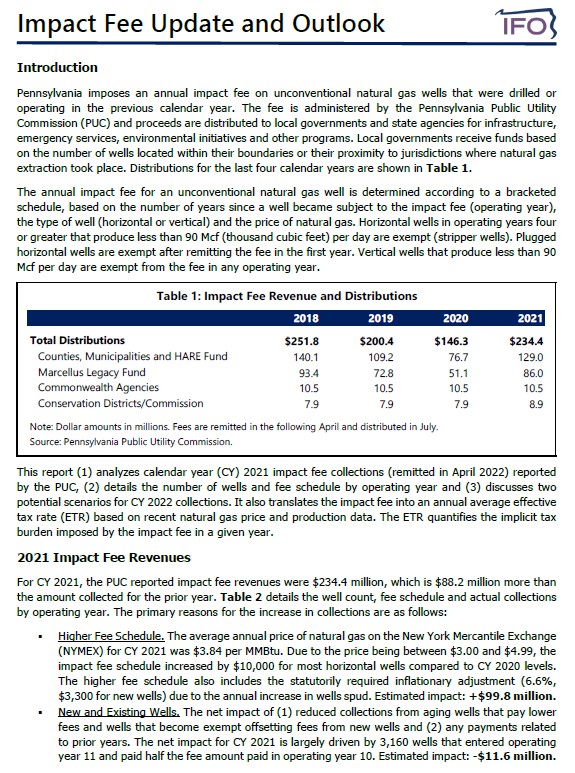

Impact Fee Update and Outlook 2022

Energy

June 21, 2022

This update examines 2021 impact fee collections and provides an outlook for 2022. The Commonwealth collected $234.4 million in impact fees for 2021, an $88.2 million increase from 2020.

JUNE 2022 MONTHLY ECONOMIC UPDATE

Revenue & Economic Update

June 16, 2022

The June edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

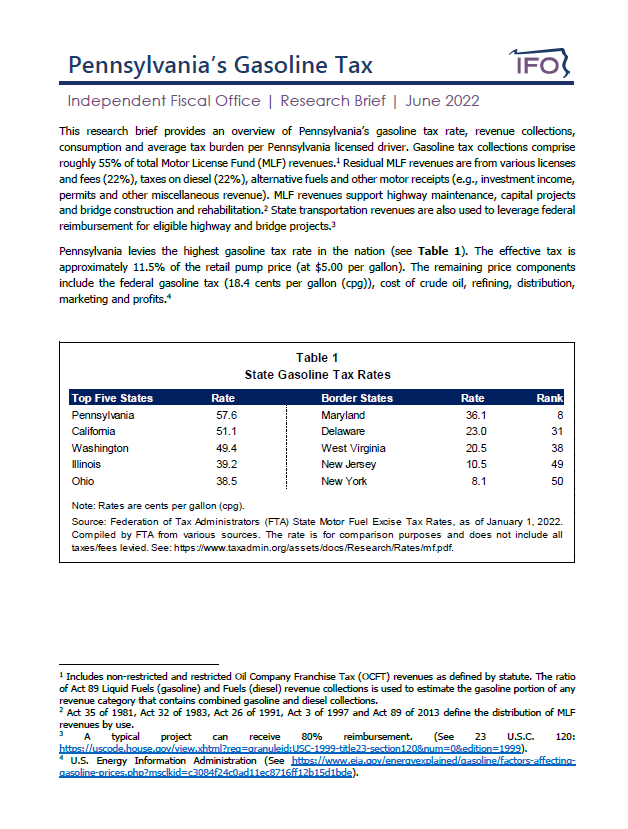

Pennsylvania's Gasoline Tax

Economics and Other

June 13, 2022

The IFO published a research brief that examines the Pennsylvania gasoline tax, which comprises 55% of Motor License Fund revenues. Although Pennsylvania levies the highest gasoline tax rate in the nation, the analysis finds that collections have not kept pace with the rising cost of road construction. This outcome is largely the result of the tax structure, which is tied to the average wholesale price of fuel and has not increased since 2018. For FY 2021-22, the IFO estimates that the annual gasoline tax burden per licensed Pennsylvania driver is $285.

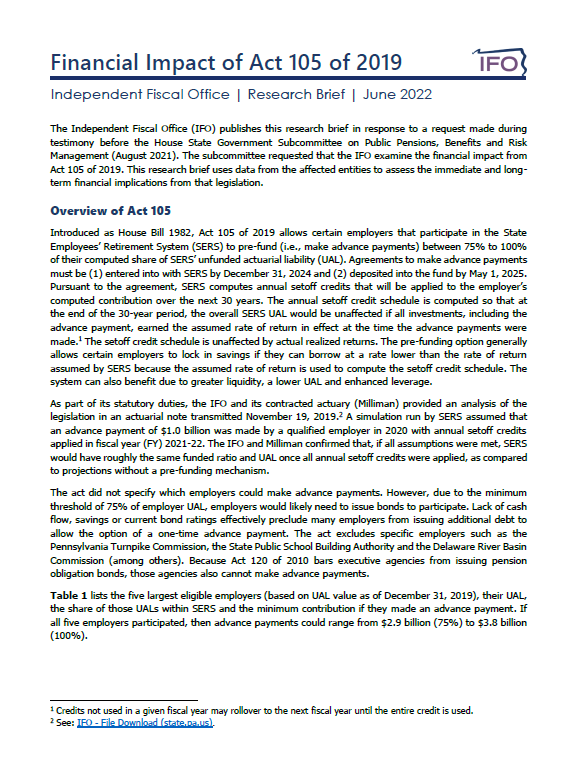

Financial Impact of SERS Pre-Funding Option

Pension Analysis

June 09, 2022

The IFO published a new research brief that examines the impact of Act 105 of 2019, which allows certain SERS employers the option to pre-fund their unfunded liabilities. The analysis finds that the two participating employers effectively locked in roughly $1 billion of nominal savings over thirty years while all SERS employers are projected to save an additional $300 million (nominal). The savings are due to very strong returns realized on advance payments made in 2020 and 2021.

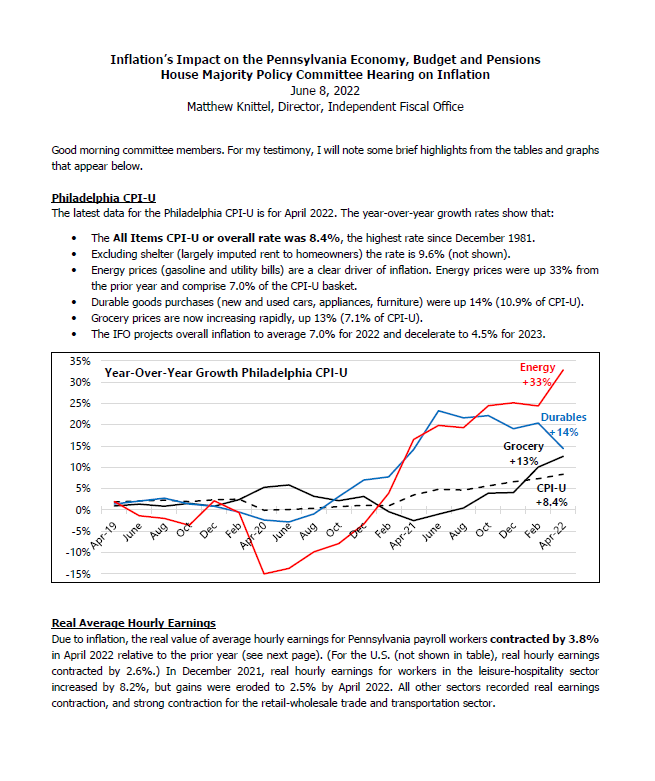

Inflation's Impact on the Pennsylvania Economy

Economics and Other

June 07, 2022

On June 8, Director Matthew Knittel will make a brief presentation to the House Majority Policy Committee on the impact of inflation on the state economy and budget.

PA Residents Migrating to Southern States

Economics and Other

June 02, 2022

The IFO posted a research brief that uses recent IRS tax data to track migration between states for 2019 and 2020. The IRS data show large net inflows from most border states and net outflows to southern states, most notably Florida. Net outflows were much heavier for residents age 55 and older.

May 2022 Revenue Update

Revenue & Economic Update

June 01, 2022

The Commonwealth collected $3.23 billion in General Fund revenues for May, a decrease of $716.2 million (-18.1%) compared to May 2021.

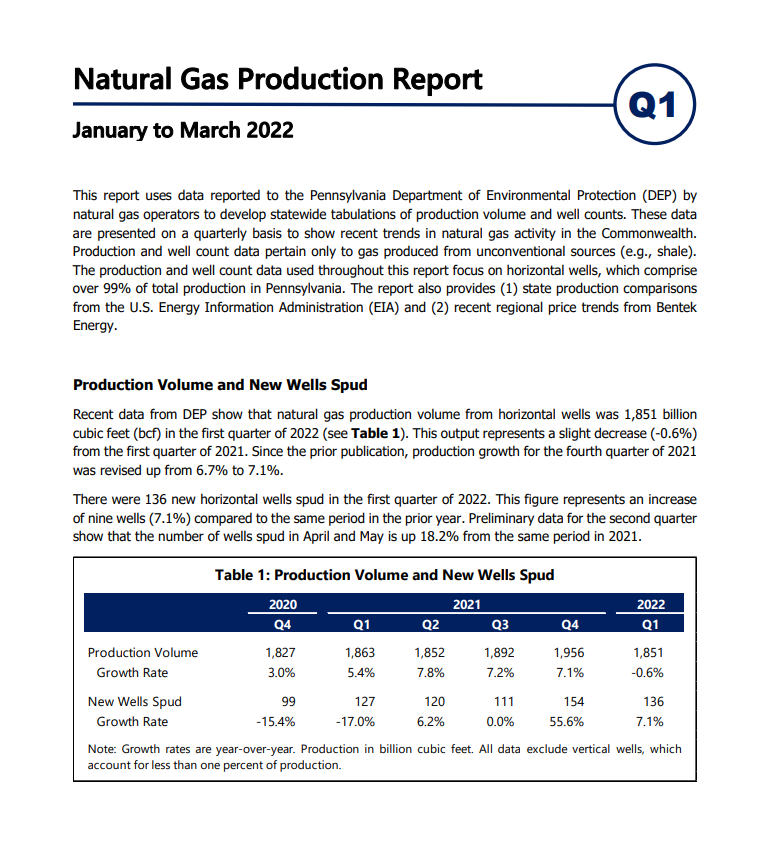

Natural Gas Production Report, 2022Q1

Energy

May 26, 2022

This report for the first quarter of 2022 uses data collected by the PA Department of Environmental Protection to develop statewide and county-level tabulations of production volume and well counts.

Initial Revenue Estimate FY 2022-23

Revenue Estimates

May 23, 2022

The IFO released its initial revenue estimate for FY 2022-23. Click the hyperlink above to view the report and presentation.

May 2022 Monthly Economic Update

Revenue & Economic Update

May 19, 2022

The May edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

Property Tax Replacement Estimates

Property Tax

May 19, 2022

In response to a legislative request, the IFO transmitted a letter that provides additional information to a previous analysis for potential property tax replacement revenues proposed under House Bill 13.

Initial Revenue Estimate Announcement

Revenue Estimates

May 16, 2022

The IFO will release its Initial Revenue Estimate on Monday, May 23rd at 1:30 PM. The report will contain revisions to the FY 2021-22 estimate and an initial estimate for FY 2022-23. See the announcement for a link to register for the presentation.

Department of Human Services - Part 3

Performance Budgeting

May 04, 2022

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fourth year, the IFO reviewed the Departments of Aging, Agriculture, Education, Human Services (Part 3), Labor and Industry and the Pennsylvania Historical and Museum Commission.

Click on the link to access the performance-based budget review for the Department of Human Services (Part 3).

Approved by the PBB Board on January 25, 2022.

The report was updated on May 4, 2022 to include addenda to Activity 1, 7 and 10.

April 2022 Revenue Update

Revenue & Economic Update

May 02, 2022

The Commonwealth collected $6.52 billion in General Fund revenues for April, an increase of $2.56 billion (64.5%) compared to April 2021.

Department of Education

Performance Budgeting

April 27, 2022

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fourth year, the IFO reviewed the Departments of Aging, Agriculture, Education, Human Services (Part 3), Labor and Industry and the Pennsylvania Historical and Museum Commission.

Click on the link to access the performance-based budget review for the Department of Education.

Tabled by the PBB Board on January 26, 2022.

The report was updated on January 31, 2022 for technical changes on pages 10, 15 and 16.

The report was updated on April 26, 2022. The amended report includes additions requested by the PBB Board on March 9, 2022.

The board’s request can be viewed here: http://www.ifo.state.pa.us//Resources/Documents/PBB_Board_Amend_03_09_22.pdf

The underlying data for the dot plots can be viewed here: http://www.ifo.state.pa.us//Resources/Documents/DotPlotData.xlsx

Approved by the PBB Board on May 25, 2022.

Department of Aging

Performance Budgeting

April 26, 2022

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fourth year, the IFO reviewed the Departments of Aging, Agriculture, Education, Human Services (Part 3), Labor and Industry and the Pennsylvania Historical and Museum Commission.

Click on the link to access the performance-based budget review for the Department of Aging.

Approved by the PBB Board on January 25, 2022.

The report was updated on April 26, 2022 to include an addendum to Activity 1.

Property Tax Replacement Estimates

Property Tax

April 15, 2022

In response to a legislative request, the IFO transmitted a letter that provides updated estimates for potential revenue sources that could replace school district property taxes if eliminated.

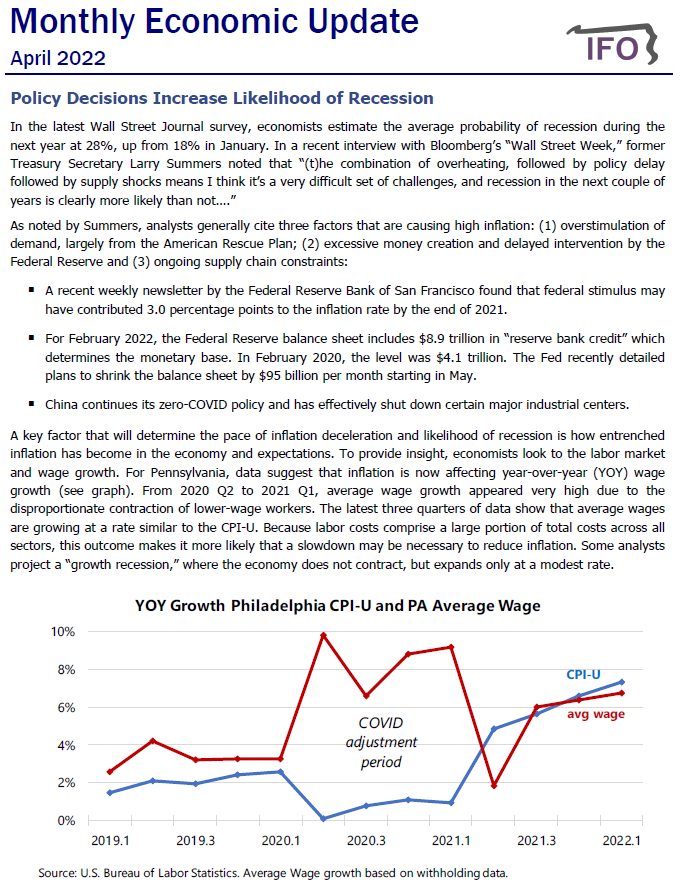

April 2022 Monthly Economic Update

Revenue & Economic Update

April 12, 2022

The April edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

Analysis of Revenue Proposals in the 2022-23 Executive Budget

Revenue Estimates

April 08, 2022

This report provides estimates for the revenue proposals contained in the 2022-23 Executive Budget released February 2022. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under 71 Pa.C.S. § 4104. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

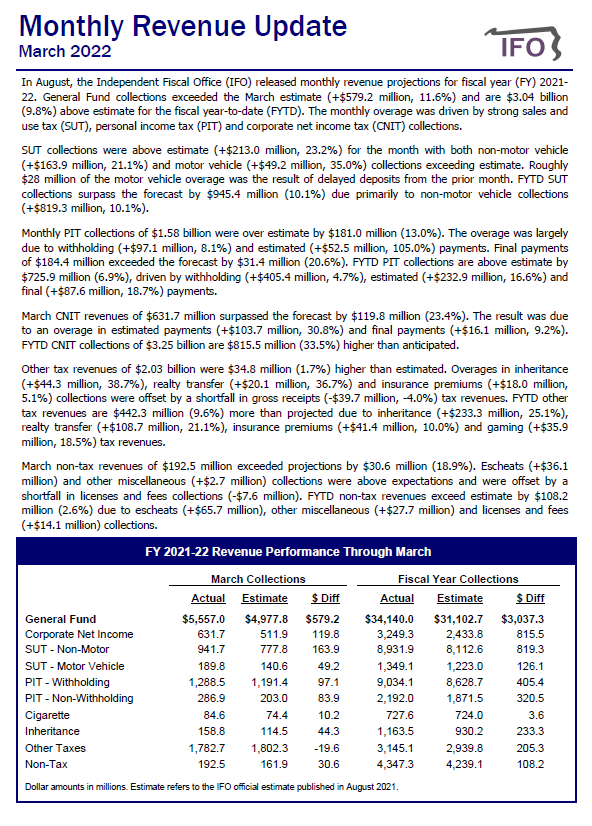

March 2022 Revenue Update

Revenue & Economic Update

April 01, 2022

The Commonwealth collected $5.56 billion in General Fund revenues for March, an increase of $714.3 million (14.8%) compared to March 2021.

BUDGET AND ECONOMIC UPDATE PRESENTATION

Economics and Other

March 31, 2022

Deputy Director Brenda Warburton and Revenue Analyst II Jesse Bushman gave a presentation to the Marcellus Shale Coalition regarding the Commonwealth’s economic and budget outlook and recent natural gas trends.

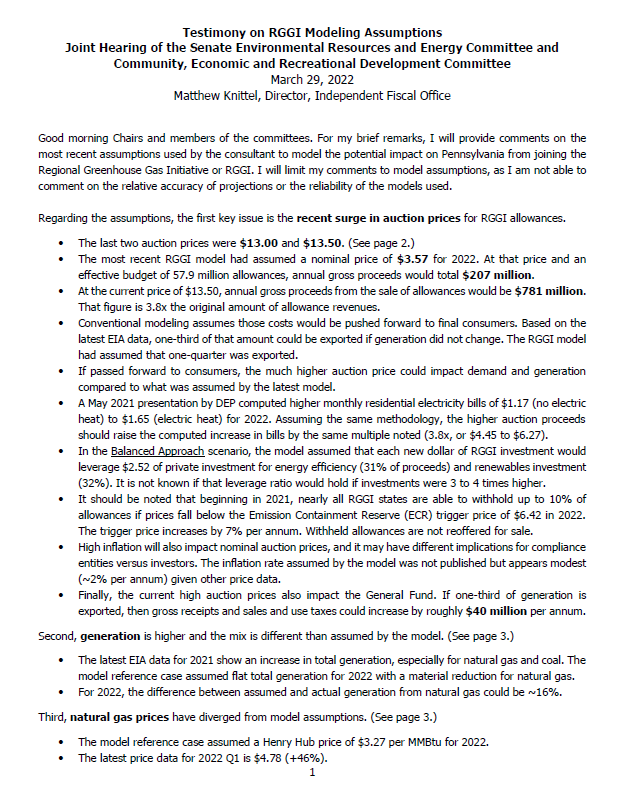

Assumptions Used by RGGI Model

Energy

March 28, 2022

Director Matthew Knittel provided brief testimony on the model assumptions used by a consultant to estimate the impact on Pennsylvania from joining RGGI.

This written testimony was updated on November 4, 2022, to include clarifications for the third and sixth bullets on page 1.

Senate Budget Hearing Request

Economics and Other

March 21, 2022

The Independent Fiscal Office (IFO) responded to two questions raised at the office’s budget hearing before the Senate Appropriations Committee. The questions relate to an update of the IFO’s five-year projections for revenues and expenditures that incorporates the proposed initiatives in the Governor’s Executive Budget and an estimate of school district property taxes paid by seniors.

House Budget Hearing Request

Economics and Other

March 21, 2022

The IFO responded to a question raised at the office’s budget hearing before the House Appropriations Committee. The question relates to the impact of the COVID-19 pandemic on employment by race.

Corporate Net Income Tax Proposals

Economics and Other

March 15, 2022

The IFO responded to a request from Appropriations Committee Chairman Saylor for a dynamic revenue estimate of three corporate net income tax proposals.

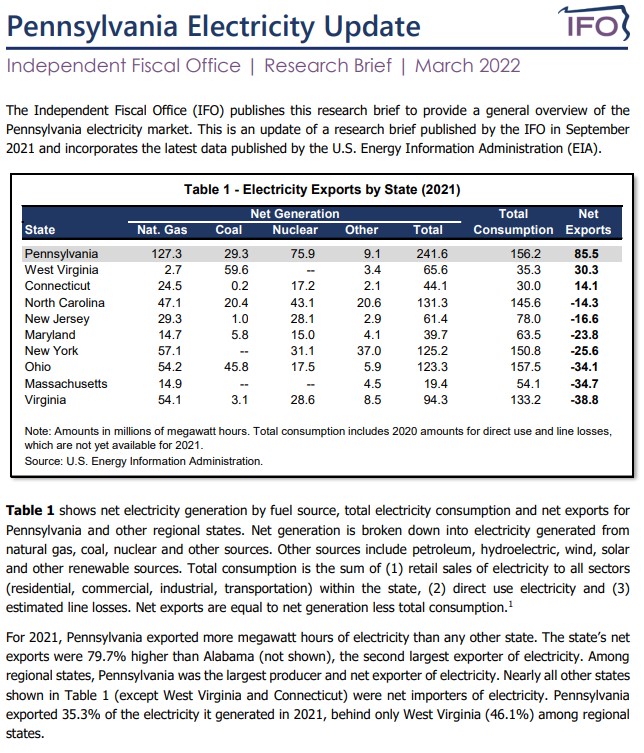

Pennsylvania Electricity Update

Energy

March 14, 2022

This research brief uses data from the U.S. Energy Information Administration to provide a general overview of the Pennsylvania electricity market.

PBB Overview Presentation for PDE

Performance Budgeting

March 09, 2022

IFO presentation of Performance-Based Budget overview and agency highlights for the Pennsylvania Department of Education is posted on the website.

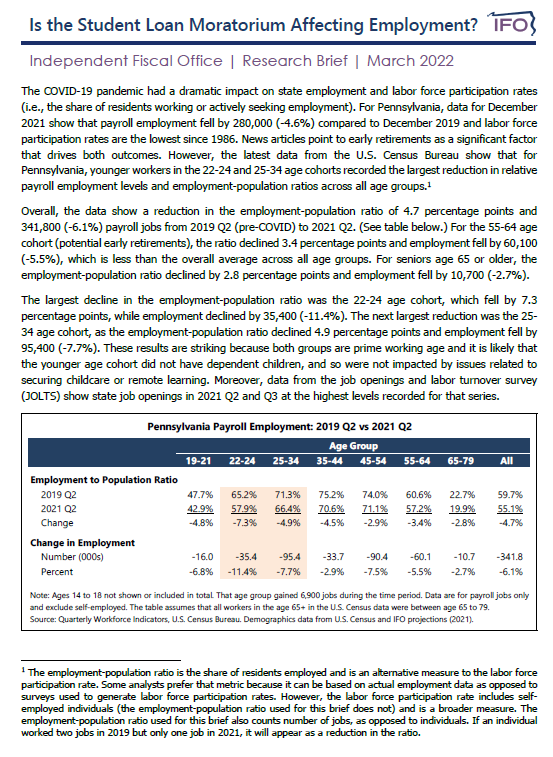

Is the Student Loan Moratorium Impacting Employment?

Economics and Other

March 08, 2022

The federal student loan moratorium enters its third year. The IFO posted a research brief that examines the impact of the COVID-19 pandemic (and related federal policies) on payroll employment and employment-to-population ratios by age group. Despite record-level job openings, the latest data for 2021 Q2 show the largest relative reductions for young workers, many of whom have student loans. By contrast, early retirements appear to have played a smaller role in decades-low labor force participation rates.

Economic and Budget Update Presentation

Economics and Other

March 04, 2022

Deputy Director Brenda Warburton presented on the Commonwealth’s economic and budget outlook at a session of the Pennsylvania Education Policy and Leadership Center.

The presentation was updated on March 18, 2022 for a technical change on slide 30.

February 2022 Revenue Update

Revenue & Economic Update

March 01, 2022

The Commonwealth collected $2.43 billion in General Fund revenues for February, a decrease of $249.5 million (-9.3%) compared to February 2021.

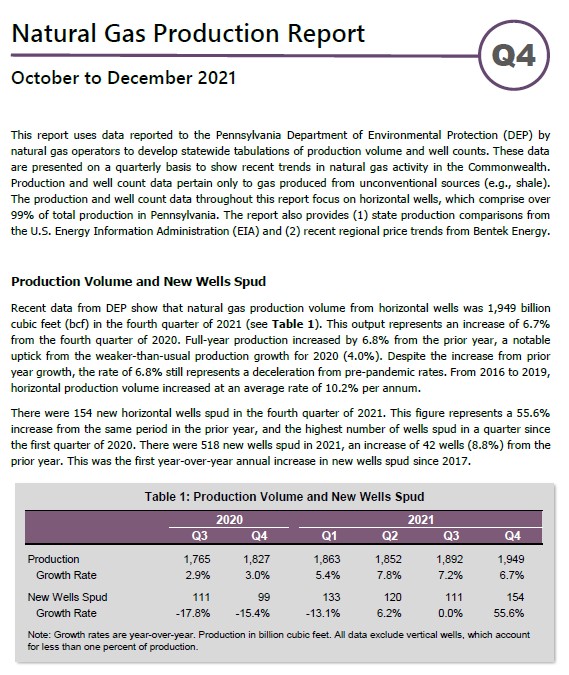

Natural Gas Production Report, 2021Q4

Energy

February 22, 2022

This report for the fourth quarter of 2021 uses data collected by the PA Department of Environmental Protection to develop statewide and county-level tabulations of production volume and well counts.

Budget Hearing Materials 2022

Economics and Other

February 22, 2022

The Independent Fiscal Office submitted materials to the House and Senate Appropriations Committees ahead of its budget hearings. The packet includes data on the state economy, revenues, demographics and other miscellaneous topics.

Act 25 of 2011 Analysis

Property Tax

February 16, 2022

In response to a legislative request, the IFO transmitted a letter that estimates the potential reduction in property taxes due to Act 25 of 2011.

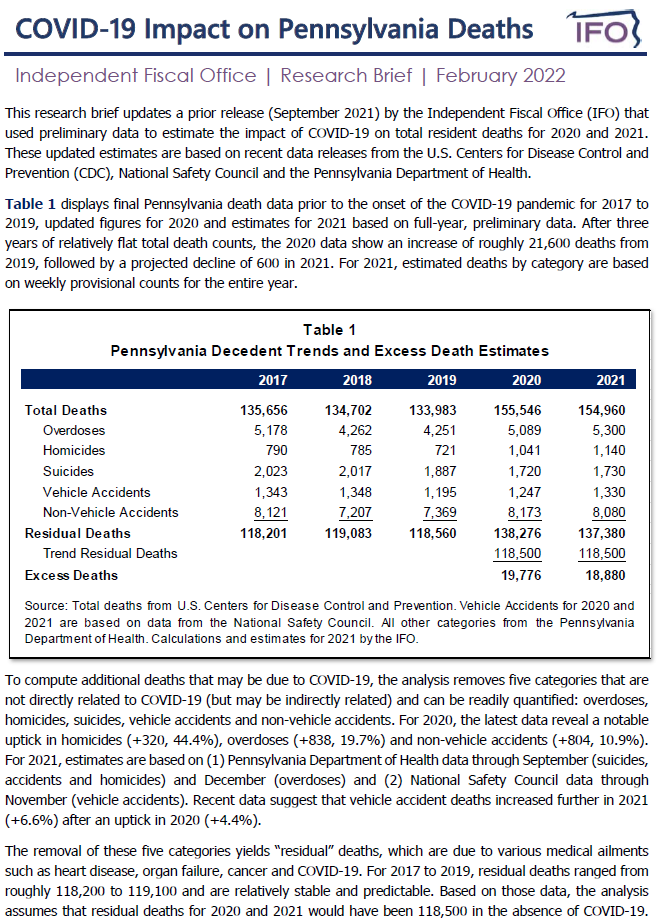

COVID-19 Impact on Pennsylvania Deaths

Economics and Other

February 11, 2022

This research updates a prior release (September 2021) that used preliminary data to estimate the impact of COVID-19 on total resident deaths for 2020 and 2021. The analysis finds 19,800 excess deaths in 2020 and estimates 18,900 excess deaths for 2021.

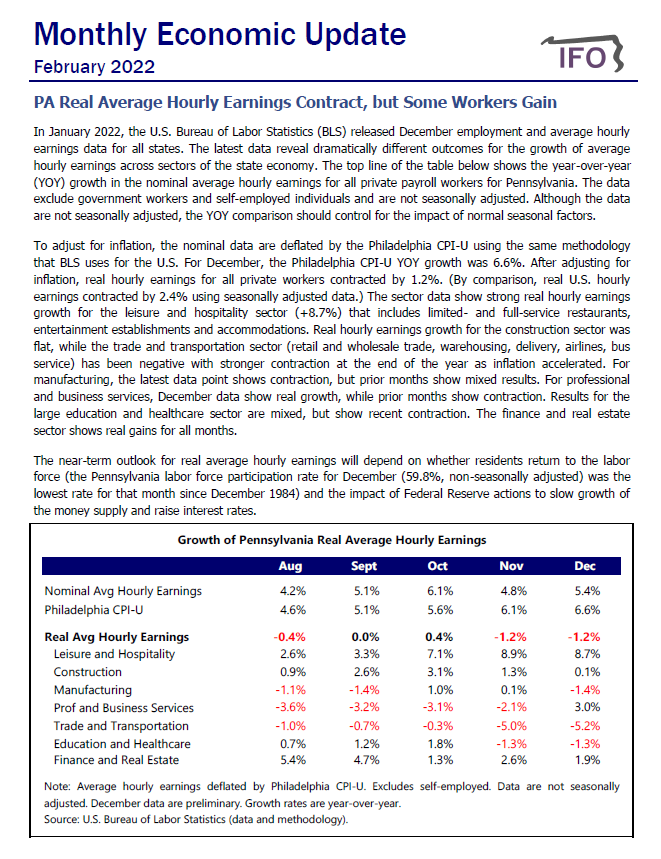

February 2022 Monthly Economic Update

Revenue & Economic Update

February 09, 2022

The February edition of our Monthly Economic Update includes links to recent articles and reports that provide insight into state or national economic, demographic and fiscal trends.

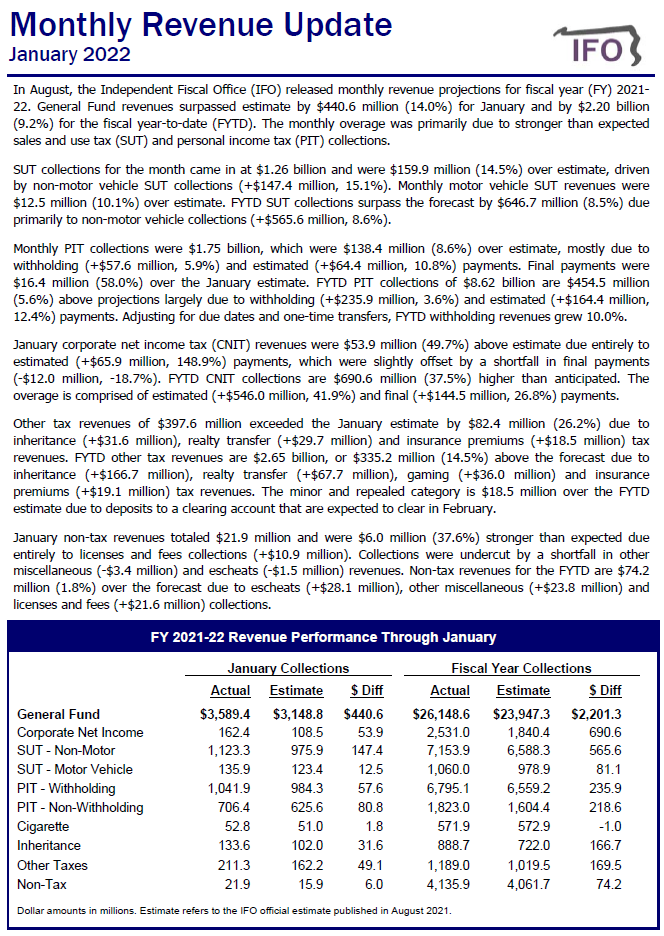

January 2022 Revenue Update

Revenue & Economic Update

February 01, 2022

The Commonwealth collected $3.59 billion in General Fund revenues for January, an increase of $931.08 million (35.0%) compared to January 2021.

Mid-Year Update FY 2021-22

Revenue Estimates

January 31, 2022

The Independent Fiscal Office (IFO) released a mid-year update of its revenue estimate for fiscal year (FY) 2021-22 and provided an advance look at revenue projections for the next fiscal year. The IFO will update the estimate in its next round of revenue projections released in mid May.

PBB Overview Presentation for PDE and Agriculture

Performance Budgeting

January 26, 2022

IFO presentation of Performance-Based Budget overview and agency highlights for the Pennsylvania Department of Education and the Department of Agriculture is posted on the website.

PBB Overview Presentation for Aging and DHS (Part 3)

Performance Budgeting

January 25, 2022

IFO presentation of Performance-Based Budget overview and agency highlights for the Department of Aging and the Department of Human Services (Part 3) is posted on the website.

PBB Overview Presentation for DLI and PHMC

Performance Budgeting

January 24, 2022

IFO presentation of Performance-Based Budget overview and agency highlights for the Department of Labor and Industry and the Pennsylvania Historical and Museum Commission is posted on the website.

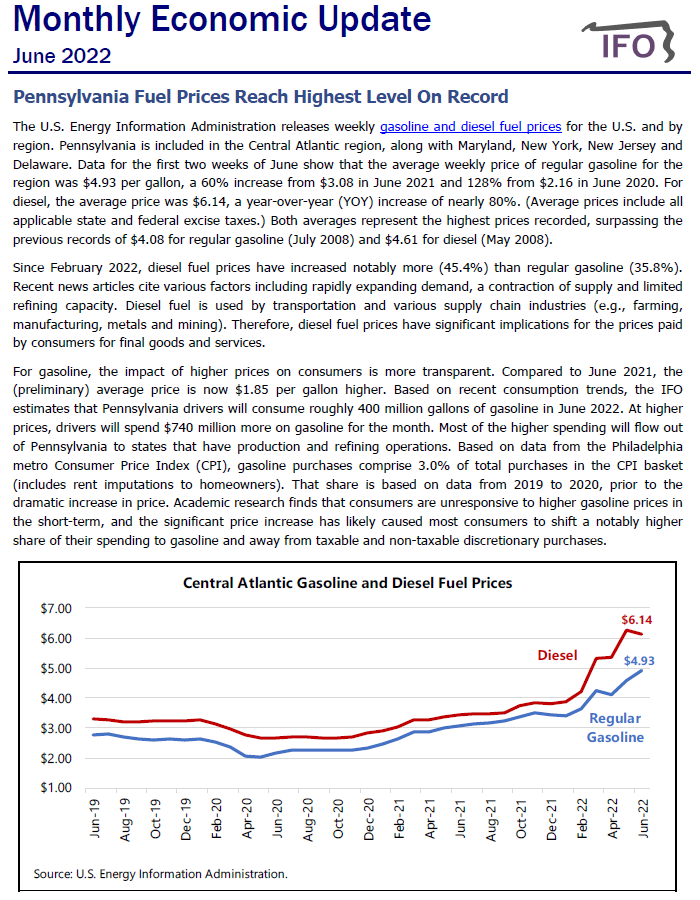

Tax Credit Reviews