July 2016

August 01, 2016 | Revenue & Economic Update

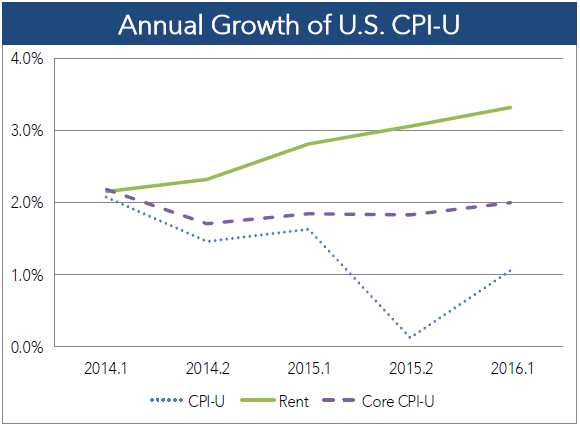

Last month, the U.S. Bureau of Labor Statistics (BLS) released the June 2016 Consumer Price Index (CPI) for the United States. The CPI uses a basket of goods consumers typically buy to determine the inflation rate. The moderate inflation rate for the first half of 2016 (1.1%) can be attributed to low energy prices. The Core CPI-U (excludes energy) is slightly higher (2.0%) for the first half of 2016. (See graph.)

Although general inflation has been modest, U.S. rent prices continue to increase at a solid pace. For the first half of 2014, rent and general inflation increased at the same rate (2.2%). Since then, general inflation has decelerated precipitously, while rent inflation has accelerated. By the first half of 2016, U.S. rent inflation (3.3%) was three times the rate of general inflation (1.1%). Although general inflation is beginning to accelerate, analysts expect the gap between rent and general inflation to persist in the near term.

For Pennsylvania, rent prices are increasing at roughly the same pace as general inflation. In Philadelphia, June year-over-year rent prices grew modestly (0.3%), which was slightly less than general inflation (0.5%). In Pittsburgh, year-over-year rent prices (1.8%) grew slightly faster than general inflation (1.6%).

Data from the U.S. Census Bureau show that homeownership rates declined to 62.9% for the second quarter of 2016, the lowest level since 1965. In particular, 18-35 year-olds saw a 21-year low in homeownership rates (34.1%). The share of households renting has been increasing since 2004, pushing demand and prices for rentals upwards.

The rent affordability metric published by Zillow finds that the average U.S. renter spent 30.1% of their income on rent in the first quarter of 2016. That share is the highest share since the firm tracked that metric (1979). For Philadelphia, the rent share is 29.4%, somewhat less than the all-time high for the city (30.2%). For Pittsburgh, the rent share is only 24.8%, much lower than the all-time high for the city (29.0%). These data, much like the BLS inflation data, suggest more moderate rent inflation in Pennsylvania compared to the U.S.