September 2017

October 02, 2017 | Revenue & Economic Update

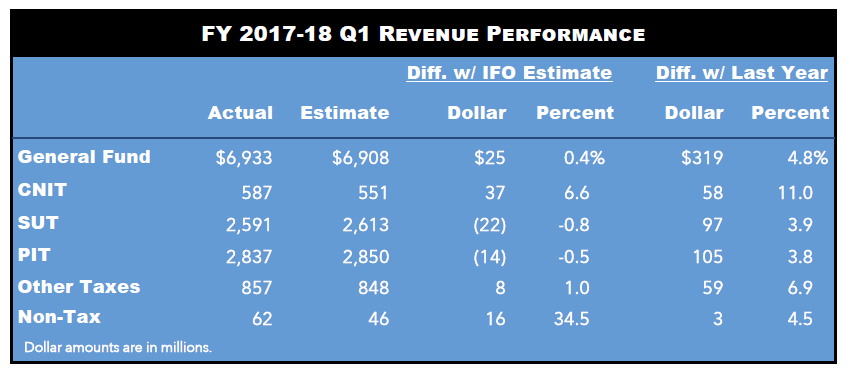

In August, the Independent Fiscal Office (IFO) released monthly projections for the fiscal year (FY) 2017-18 revenue estimate published in June 2017.1 Through the first three months of FY 2017-18, total General Fund revenues were $25.3 million (0.4 percent) above the IFO’s official estimate. Total tax revenues were $9.4 million (0.1 percent) above estimate and non-tax revenues were $15.8 million (34.5 percent) above estimate.

As shown in the table below, two of the three largest sources of General Fund tax revenue, personal income tax (PIT) and sales and use tax (SUT), were below estimate through September. PIT revenues were $13.6 million (-0.5 percent) below estimate, driven by quarterly payments that were $32.4 million (-7.3 percent) below estimate. SUT revenues were $21.8 million (-0.8 percent) below estimate, due to a motor vehicle tax shortfall of $25.0 million (-6.6 percent). Other notable tax revenue sources that were below estimate include realty transfer ($2.5 million, -1.9 percent), cigarette ($6.1 million, -1.9 percent) and gross receipts ($9.2 million, -73.3 percent).

These underperformances were more than offset by strong corporate net income tax (CNIT) revenues and non-tax revenues. CNIT revenues were $36.5 million (6.6 percent) above estimate through the first three months of FY 2017-18. Non-tax revenues were $15.8 million (34.5 percent) above estimate, largely driven by escheat revenues, which were $10.2 million (79.8 percent) above estimate. Other notable tax revenues that exceeded estimates include inheritance ($9.0 million, 4.0 percent), insurance premiums ($7.1 million, 253.0 percent) and bank shares ($9.6 million, 342.7 percent).

For FY 2017-18, the IFO projected a 2.8 percent year-over-year growth rate for the General Fund, after accounting for certain technical factors that reduce revenue.1 Through September, the actual year-over-year growth rate for the General Fund was 4.8 percent, with CNIT revenues showing robust growth.