December 2017

January 02, 2018 | Revenue & Economic Update

In December, the Independent Fiscal Office (IFO) released revised monthly projections for the fiscal year (FY) 2017-18 revenue estimate published in June 2017.1 The new release includes the incremental impact on General Fund revenues of (1) Acts 42, 43, 44 and 55 of 2017 and (2) a recent Supreme Court decision on net operating loss deductions.2

December collections were $67 million (2.4%) above estimate primarily due to stronger than anticipated collections in personal income tax (PIT) estimated payments ($80 million above estimate, 49.4%) and sales and use tax (SUT) - non-motor ($33 million, 4.4%). This strength was partially offset by unexpected weakness in corporate net income tax (CNIT) remittances (-$54 million, -10.7%).

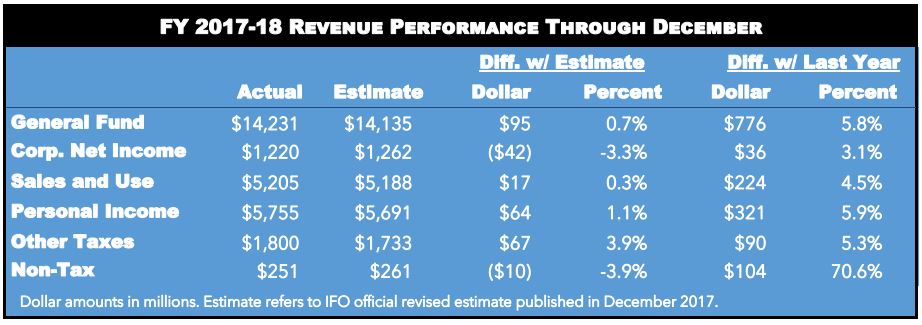

Through the first half of FY 2017-18, total General Fund revenues were $95 million (0.7 percent) above the IFO’s revised official estimate. PIT ($64 million, 1.1%), gross receipts ($12 million, 45.7%), inheritance ($24 million, 5.4%), and insurance premiums ($11 million, 188.2%) revenues were higher than estimate for the first half of FY 2017-18. Gains in those revenue sources were partially offset by weaker than expected CNIT (-$42 million, -3.3%) and escheats (-$29 million, -133.2%) remittances.

Recently enacted federal tax legislation had a material impact on December revenues. For CNIT, it is likely that estimated payments reflect a shifting of income out of tax year 2017 into tax year 2018 due to the significant federal rate reduction. Firms may have also accelerated deductions in the opposite direction to reduce 2017 tax liability. The IFO projects a similar impact on the final payments that will be remitted in April and May.

For PIT, the December estimated payment was very strong as many taxpayers likely remitted payments early to qualify for the uncapped state and local tax deduction. It is also possible that some taxpayers overpaid their tax liability because the overpayments are currently deductible, but the same payments may not be deductible next year. Hence, this large revenue gain will likely be reversed through the remainder of the fiscal year.