IFO Releases

An Overview of School District Property Tax Reform

May 04, 2017 | Property Tax

Throughout May, Director Matt Knittel and Deputy Director Mark Ryan will make five presentations on the potential implications of school district property tax reform. The events are sponsored by the Pennsylvania Economy League and will take place at the various locations listed below.

Click the following links for additional details:

READING Thursday May 4th 7:30-9:00am

WILLIAMSPORT Friday May 5th 12:00-1:30pm

YORK Thursday May 11th 12:00-1:30pm

WILKES-BARRE Friday May 12th 12:00-1:30pm

LEHIGH VALLEY Friday May 19th 12:00-1:30pm

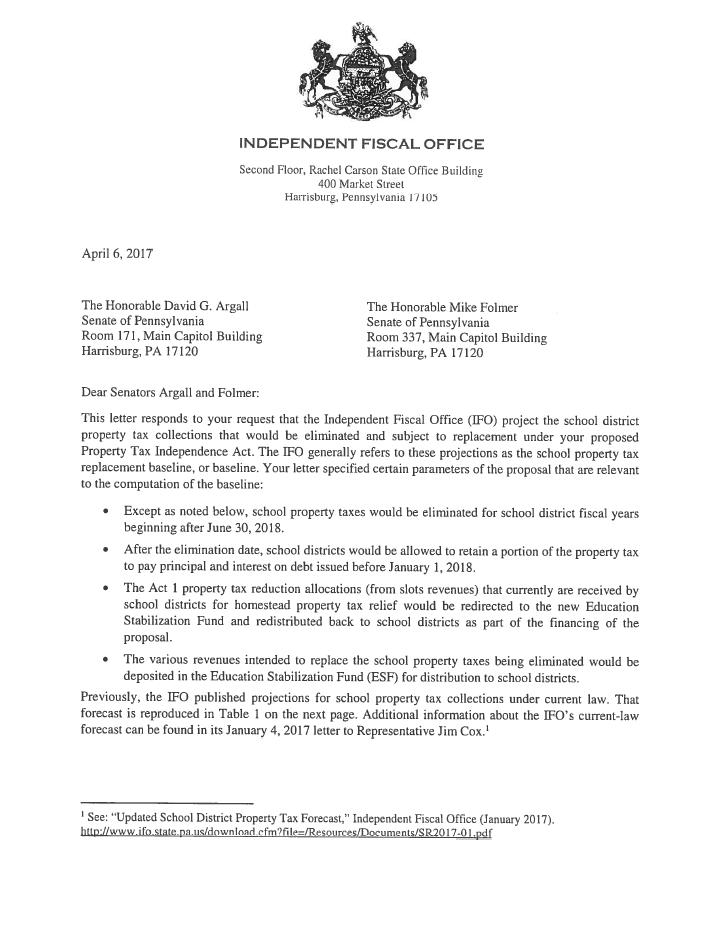

Property Tax Elimination Projection

April 11, 2017 | Property Tax

The IFO has released new projections regarding school property tax elimination. The document projects the school property tax revenues that would be eliminated, and thus subject to replacement, under legislation that may be introduced in the near future (the relevant parameters are summarized in the document). The projection builds upon a school property tax forecast the IFO released in January of this year.

School District Property Tax Elimination

January 19, 2017 | Property Tax

Director Matt Knittel and Deputy Director Mark Ryan made a presentation to the Pennsylvania School Boards Association (PSBA) regarding the current proposal and forecasts for school district property taxes in Pennsylvania.

*Updated February 13, 2017

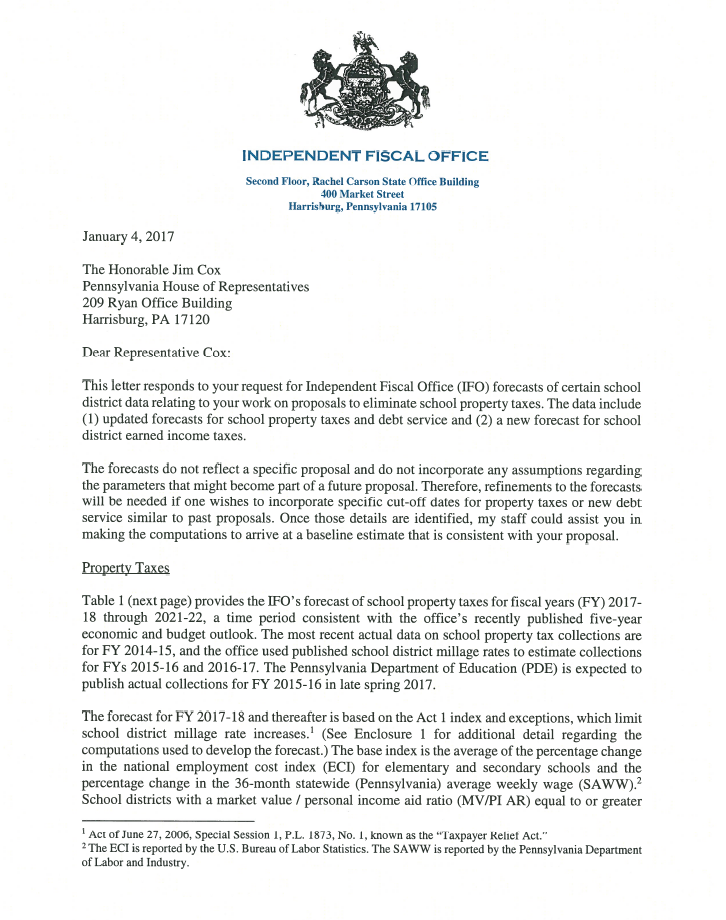

Updated School District Property Tax Forecast

January 09, 2017 | Property Tax

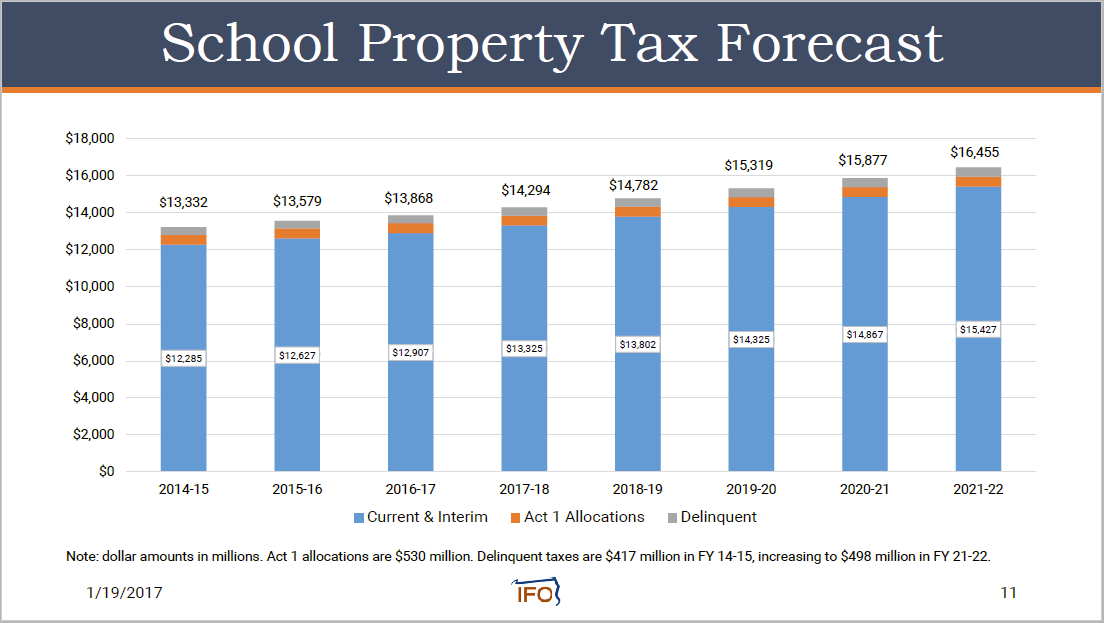

Letter updating the IFO's forecast of school district property tax collections for FY 2015-16 through FY 2021-22. The letter also includes projections of school district debt service payments and earned income tax collections for FY 2015-16 through FY 2021-22.

Total school property tax collections for FY 2015-16 ($13.6 billion) and FY 2016-17 ($13.9 billion) are estimated using millage rates published by the Pennsylvania Department of Education. For FY 2017-18 through FY 2021-22, collections are projected based on a forecast of the Act 1 index and exceptions. During that period, total school property tax collections are projected to grow by an average annual rate of 3.5 percent, reaching $16.5 billion by FY 2021-22.

Prior reports / references: (1) 2013 IFO analysis of HB / SB 76 and (2) 2014 update of the school property tax forecast.

The Effect of Act 1 of 2015

April 17, 2015 | Property Tax

Letter discussing the effect of Act 1, which uses an index to limit the ability of school districts to increase real property millage rates (April 2015).

Property Tax Rebate Estimate

March 11, 2015 | Property Tax

Letter providing estimates for a potential proposal to give homestead owners school property tax rebates equal to the statewide average school property tax paid (March 2015).

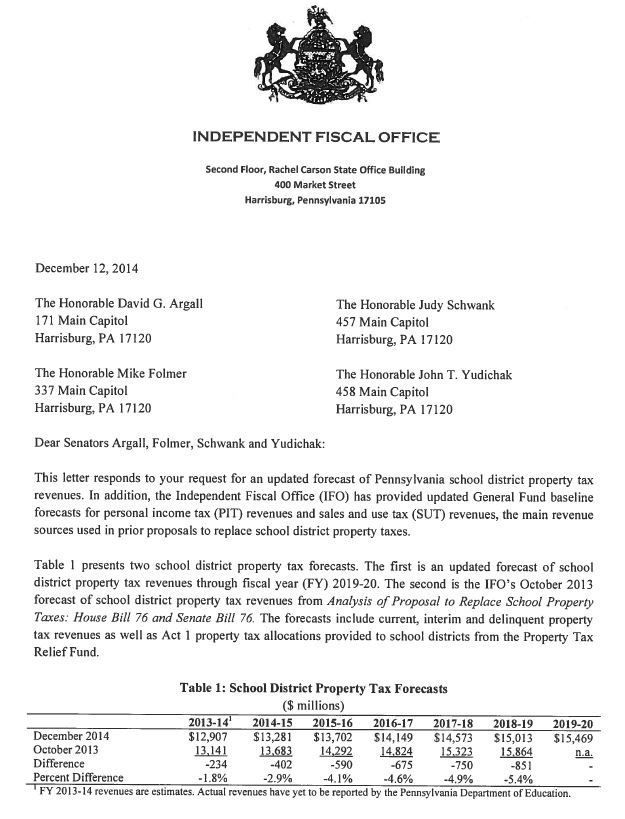

Updated School District Property Tax Forecast

December 12, 2014 | Property Tax

Letter updating the IFO's forecast of school property tax collections for FY 2013-14 through FY 2019-20 (December 2014).

Fiscal Implications of a York County School District Consolidation

December 12, 2014 | Property Tax

The report provides potential consolidation savings and costs for 15 York County school districts and computes the real estate tax millage using various earned income tax rates and administrative savings scenarios.

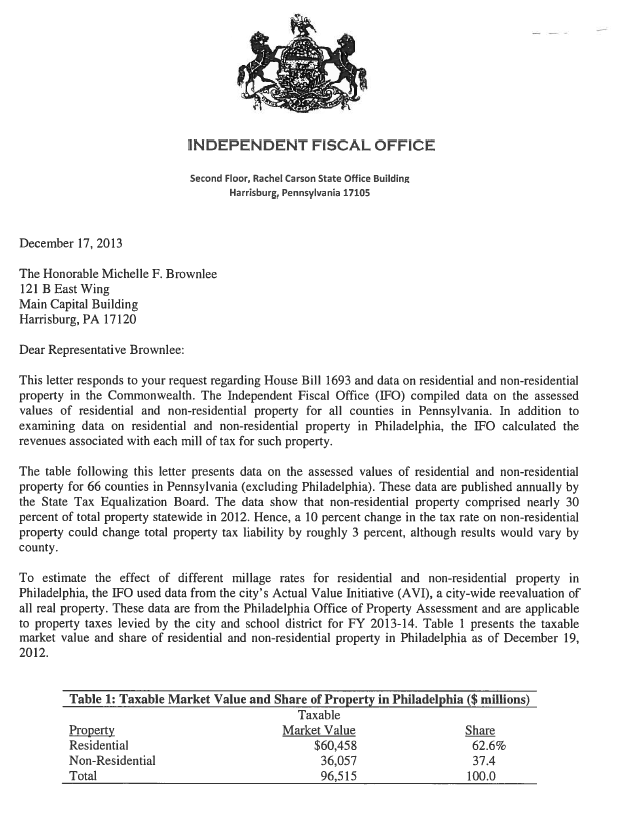

Analysis of House Bill 1693 (2013)

December 17, 2013 | Property Tax

Letter providing data on the share of residential and nonresidential property assessments by county (December 2013).

The letter was in response to a request regarding HB 1693, which was a proposed constitutional amendment permitting different millage rates for residential and nonresidential property.

Analysis of school property taxes paid by homeowners age 70 and older

October 29, 2013 | Property Tax

Letter providing an analysis of school property taxes paid by homeowners age 70 and older (October 2013).

The analysis presents a preliminary assessment of data on the cost of a school property tax freeze for those homeowners and a brief discussion of factors that affect the cost of a freeze over the long-term.