March 2017

April 03, 2017 | Revenue & Economic Update

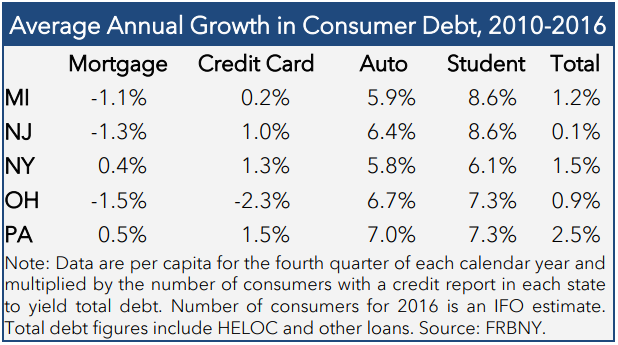

The Federal Reserve Bank of New York (FRBNY) publishes quarterly state data on consumer debt. The data span major loan types, such as mortgage, auto, credit card and student loan, and provide insight as to whether consumers are accumulating or paying down debt. For Pennsylvania and most nearby states, total consumer debt peaked in 2008 prior to the Great Recession. Pennsylvania’s total consumer debt surpassed its 2008 level ($395 billion) in 2011 ($399 billion) and has grown by 2.5% per annum post-recession. This represents a more rapid rebound compared to several nearby states that have only reached their pre-recession levels in the past two years. Some states (Michigan, New Jersey and Ohio) have yet to reach their pre-recession levels.

Mortgage debt is the largest category, comprising more than 60% of the total. Compared to nearby states, Pennsylvania has experienced the highest, albeit relatively flat, average annual growth in mortgage debt since the recession at 0.5% per annum (2010 to 2016), and it was the only state in this comparison to surpass its 2008 peak during this period. Michigan, Ohio and New Jersey fell by more than 1% per annum, but recent data show modest gains.

Similar to mortgage debt, credit card debt peaked in 2008 for the states below. However, credit card debt grew more quickly than mortgage debt from 2010 to 2016. Pennsylvania outpaced nearby states, with a growth rate of 1.5% per annum. Despite recent acceleration in U.S. credit card debt (roughly 6% growth in 2016), January 2017 data suggest that consumers either paused on making new purchases or paid down existing debt.[1]

Auto and student loans have been the fastest growing loan types over the past six years for Pennsylvania and nearby states. The rise in auto loans directly correlates with the increase in national consumer spending on auto vehicles and parts (7.7% per annum from 2010 to 2016), according to retail sales data from the U.S. Census Bureau.

Although Pennsylvania’s student loan debt growth is not the highest among the nearby states, the Commonwealth continually ranks second nationwide in the average debt per graduate with debt ($34,798) and third in the share of graduates with debt (71%).[2]

The strong growth in auto and student loans, coupled with the weak growth in mortgage loans, have changed the composition of consumer debt. For Pennsylvania, the weak growth in mortgage debt drove down that share of total debt from 68% in 2010 to 61% in 2016. The share of auto loans grew from 7% to 9%, while the share of student loans increased from 11% to 14% over that same period. Credit card debt was unchanged at 7%. Research by the FRBNY suggests that the changing composition of debt is influenced by (1) the aging population and associated change in consumer habits and (2) tighter underwriting standards that hindered loans to potential new homeowners.[3]