May 2017

June 01, 2017 | Revenue & Economic Update

Recent data confirm a significant revenue shortfall for the current fiscal year relative to official projections. A primary factor that drives that result is weak sales tax revenues. Through April 2017, total sales tax collections increased by only 0.7 percent from the same period in the prior fiscal year.[1] For the latest three months, collections have increased by only 0.8 percent. Sales tax revenues are critical to the state budget because each percentage point of growth generates roughly $100 million of new revenues.

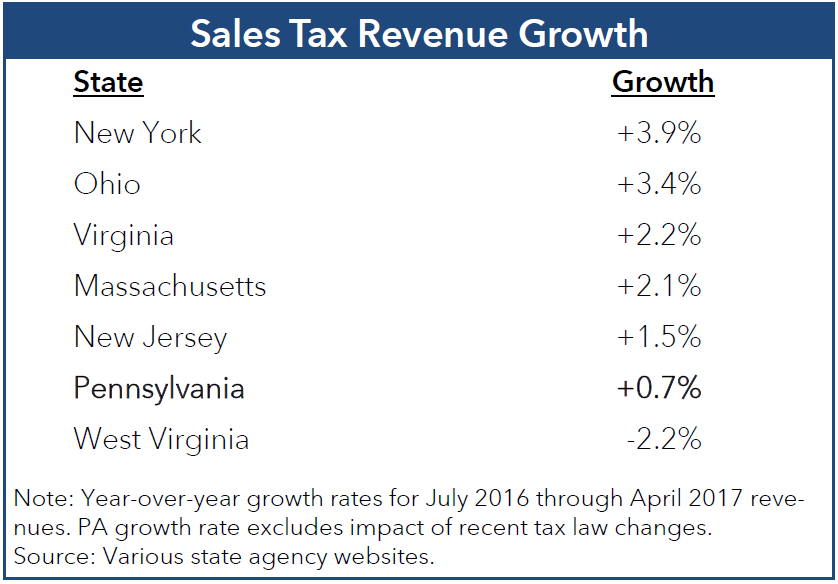

Weak sales tax revenues are not limited to Pennsylvania. As shown by the table, some adjacent states have also experienced modest (or negative) growth of sales tax revenues. Four factors impact spending trends and could motivate that result.

First, PA consumers could be paying down debt. However, recent data from the Federal Reserve Board of New York show that PA per capita consumer debt levels increased (1.3%) during the past nine months. An increase in credit card, auto and student loan debt more than offset a slight decline in mortgage debt.

Second, the PA labor market could be weak, generating few jobs and minor gains in take home pay. However, data for January to April 2017 suggest a strong labor market that created 63,000 net new jobs (annualized rate), compared to 52,200 for CY 2016. Moreover, withholding tax revenues show solid growth in take home pay, growing roughly 3.5% for the first three quarters of FY 2016-17.

Third, consumers could be impacted by “wealth effects” if the stock market is performing poorly or home values are stagnant. However, the S&P 500 Index has increased by 14.8% since July 2016. Data from the U.S. Federal Housing Finance Agency show that median PA home values increased by 4.0% in 2017 Q1 on a year-over-year basis.[2]

A final factor could be weak business spending. Analysts estimate that business purchases may comprise one-third of the PA sales tax base. Unfortunately, state-level business profit or purchases data are not available. Hence, it is not clear why PA sales tax revenues continue to lag other key economic metrics, or U.S. consumer spending generally. Consumer spending will need to accelerate for the PA economy to break from its tepid economic expansion. Sales tax revenues for May were encouraging (3.2% growth), but additional data are needed to establish a new trend.