January 2018

February 01, 2018 | Revenue & Economic Update

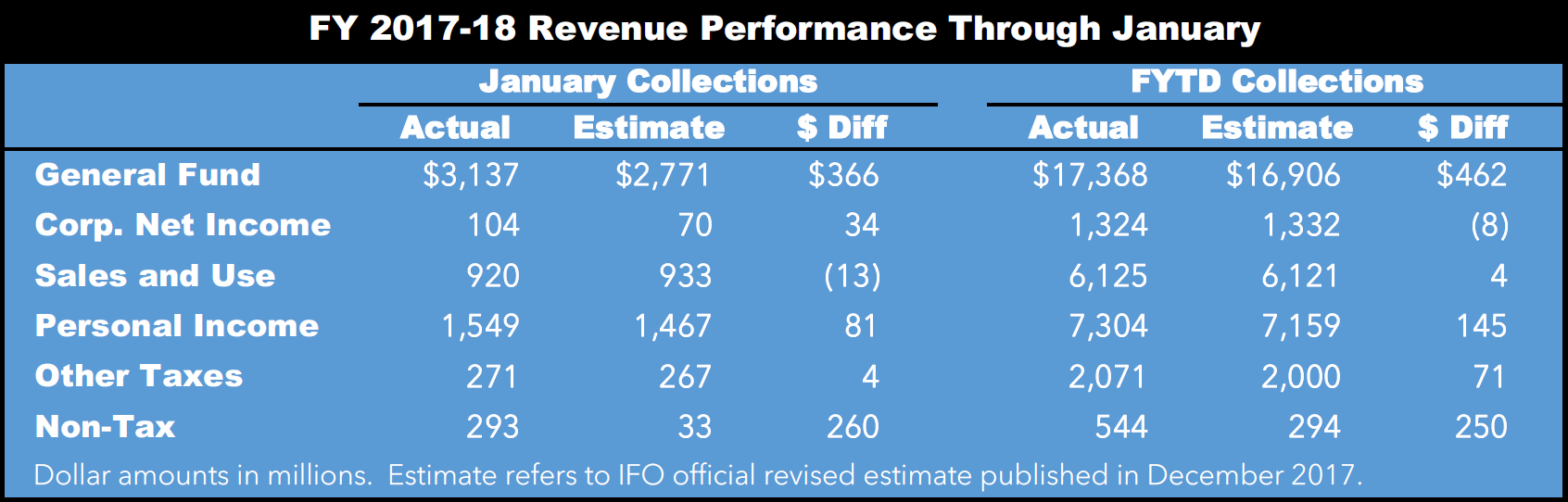

In December, the Independent Fiscal Office (IFO) released an update of the fiscal year (FY) 2017-18 official revenue estimate (originally published in June 2017) and corresponding revised monthly projections.1 Through January, total General Fund revenues are $462 million, or 3 percent, above the IFO’s updated official estimate. Most of the year-to-date overage occurred in the current month.

January 2018 total General Fund collections exceeded estimate by $366 million, due largely to the receipt of $200 million from the lease of the Pennsylvania Farm Show Complex. This transfer was included in the IFO’s official estimate, but was not anticipated until April/May. Additionally, the Commonwealth collected $90 million ($75 million more than projected) from the auction of newly authorized mini-casino licenses. As a result, total non-tax revenues exceeded estimate by $260 million in January.

Corporate net income tax (CNIT) payments for the month outpaced the estimate by $34 million. The strength in collections was entirely attributable to final payments (for tax year 2017), which were more than 2.5 times the monthly estimate of $25 million. Conversely, estimated payments were weak, falling short of the monthly estimate by 22 percent. The January trend in CNIT payments likely reflects income and deduction shifting by taxpayers in response to federal tax law changes.

Personal income tax (PIT) quarterly payments were again exceptionally strong in January, exceeding estimate by $81 million. It is expected that tax filers are taking advantage of the final year of the uncapped federal deduction for state and local taxes (SALT), by overpaying for tax year 2017. This behavioral response to federal tax law changes is likely to result in weaker non-withholding payments in March through June. Year-to-date PIT quarterly payments exceed estimate by $128 million, while annual payments and employer withholding are largely meeting expectations for the year.

Non-motor sales and use tax (SUT) collections were unexpectedly flat in January, in spite of retailer reports of strong holiday sales. Motor vehicle SUT collections came in as expected, but are $16 million short of estimate for the fiscal year.