February 2018

March 01, 2018 | Revenue & Economic Update

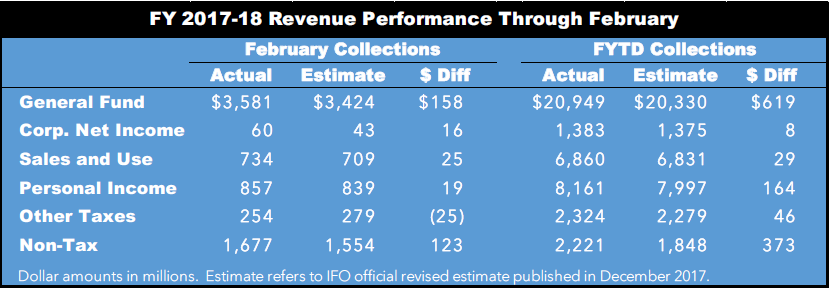

In December, the Independent Fiscal Office (IFO) released an update of the fiscal year (FY) 2017-18 official revenue estimate (originally published in June 2017) and corresponding revised monthly projections.1 Through February, total General Fund revenues are $619 million, or 3.0 percent, above the IFO’s updated official estimate.

February General Fund collections were $158 million (4.6 percent) above estimate. The three largest sources of tax revenue (personal income tax, sales and use tax and corporate net income tax) were all above estimate.

Personal income tax (PIT) withholding payments exceeded estimate by $19 million (2.4 percent) in February. Quarterly payments came in as expected, but year-to-date quarterly payments remain strong and exceed estimate by $128 million (11.0 percent). Annual payments and employer withholding are largely meeting expectations for the year. However, non-withholding payments are expected to be weak in March through June due to the acceleration of payments into December and January in response to federal tax law changes.

Non-motor sales and use tax (SUT) collections were strong in February after a flat January. Non-motor collections were $26 million above estimate (4.2 percent) in February, and fiscal-year-to-date collections are $45 million (0.8 percent) above estimate. Motor vehicle SUT collections came in as expected, but are $17 million (-1.8 percent) below estimate for the fiscal year.

Corporate net income tax (CNIT) payments for the month outpaced the estimate by $16 million (38.0 percent). Final payments were strong, exceeding estimate by $16 million (75.8 percent). Estimated payments came in as expected for February. Year-to-date CNIT payments are $8 million (0.6 percent) above estimate.

Non-tax revenue also exceeded estimate by $123 million due to earlier-than-expected transfers from the state store fund ($85.1 million) and various special funds ($48 million). Additionally, Act 43 of 2017 authorized the securitization of Tobacco Settlement Fund payments to be deposited in the General Fund. In February, these one-time revenues were received as expected ($1.5 billion).