October 2018

November 01, 2018 | Revenue & Economic Update

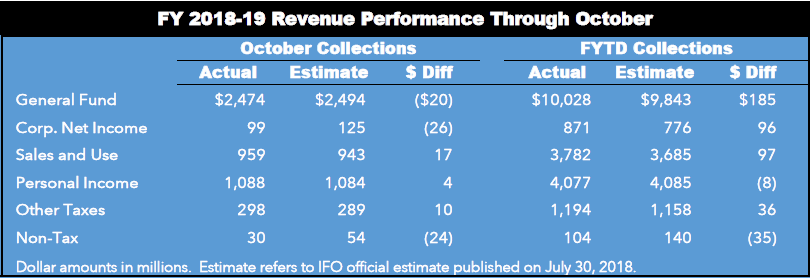

On July 30th, the Independent Fiscal Office (IFO) released monthly revenue projections for fiscal year (FY) 2018-19.1 General Fund collections were $19.5 million (-0.8 percent) below estimate for October and $184.8 million (1.9 percent) above estimate for the fiscal year-to-date (FYTD). October shortfalls in corporate net income tax (CNIT) and non-tax collections were partially offset by overages in gross receipts tax, sales and use tax (SUT) and inheritance tax.

October CNIT collections fell below estimate (-$26.1 million), due entirely to lower than expected final payments (primarily for tax year 2017). Total FYTD CNIT collections are above estimate by $95.6 million, driven by strong estimated payments for tax year 2018 and unusually large settlement payments for old tax years. The next large payment will be received December 15th, when corporations make their fourth estimated payment for tax year 2018.

Total SUT collections for October exceeded estimate ($16.6 million), due largely to higher than expected motor vehicle collections ($15.8 million). FYTD collections exceed estimate by $96.9 million as a result of strength in both non-motor and motor vehicle SUT collections.

Personal income tax (PIT) collections for the month exceeded estimate by $4.2 million and fiscal year collections are essentially meeting estimate. FYTD PIT collections are below estimate by only $8.0 million (-0.2 percent), with shortfalls in withholding and quarterly payments partially offset by higher than expected annual payments.

Non-tax collections were below estimate for October (-$23.9 million), primarily due to lower than anticipated payments for licenses and fees (-$3.9 million) and escheats (-$20.8 million). The IFO’s licenses and fees estimate for October included $34.0 million for fees associated with gaming expansion. The actual amount received was $20.1 million. Escheats collections for the month were impacted by lower than expected escheats payments and higher than anticipated claims by property owners. FYTD non-tax collections are below estimate by $35.5 million as a result of historically low escheat payments, which are partially offset by an overage in Treasury collections.