November 2018

December 03, 2018 | Revenue & Economic Update

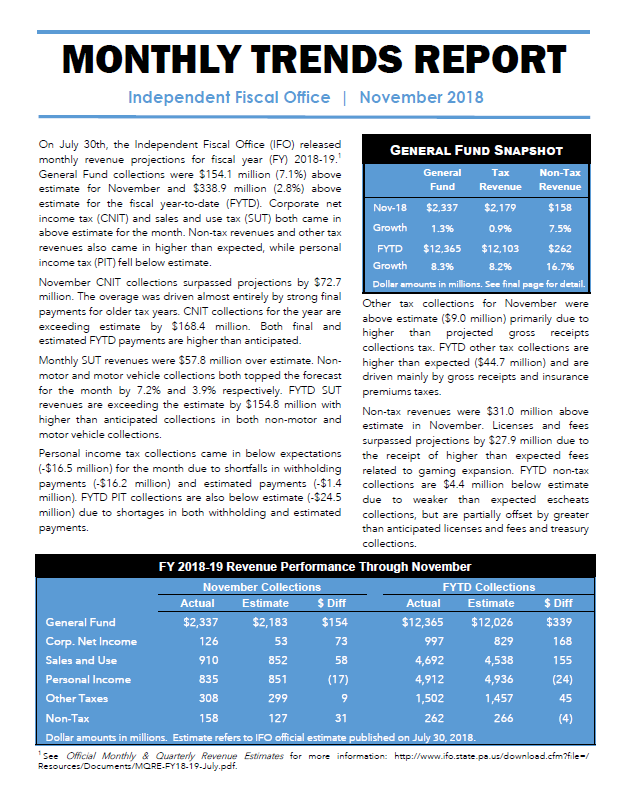

On July 30th, the Independent Fiscal Office (IFO) released monthly revenue projections for fiscal year (FY) 2018-19.1 General Fund collections were $154.1 million (7.1%) above estimate for November and $338.9 million (2.8%) above estimate for the fiscal year-to-date (FYTD). Corporate net income tax (CNIT) and sales and use tax (SUT) both came in above estimate for the month. Non-tax revenues and other tax revenues also came in higher than expected, while personal income tax (PIT) fell below estimate.

November CNIT collections surpassed projections by $72.7 million. The overage was driven almost entirely by strong final payments for older tax years. CNIT collections for the year are exceeding estimate by $168.4 million. Both final and estimated FYTD payments are higher than anticipated.

Monthly SUT revenues were $57.8 million over estimate. Non-motor and motor vehicle collections both topped the forecast for the month by 7.2% and 3.9% respectively. FYTD SUT revenues are exceeding the estimate by $154.8 million with higher than anticipated collections in both non-motor and motor vehicle collections.

Personal income tax collections came in below expectations (-$16.5 million) for the month due to shortfalls in withholding payments (-$16.2 million) and estimated payments (-$1.4 million). FYTD PIT collections are also below estimate (-$24.5 million) due to shortages in both withholding and estimated payments.

Other tax collections for November were above estimate ($9.0 million) primarily due to higher than projected gross receipts collections tax. FYTD other tax collections are higher than expected ($44.7 million) and are driven mainly by gross receipts and insurance premiums taxes.

Non-tax revenues were $31.0 million above estimate in November. Licenses and fees surpassed projections by $27.9 million due to the receipt of higher than expected fees related to gaming expansion. FYTD non-tax collections are $4.4 million below estimate due to weaker than expected escheats collections, but are partially offset by greater than anticipated licenses and fees and treasury collections.