March 2019

April 01, 2019 | Revenue & Economic Update

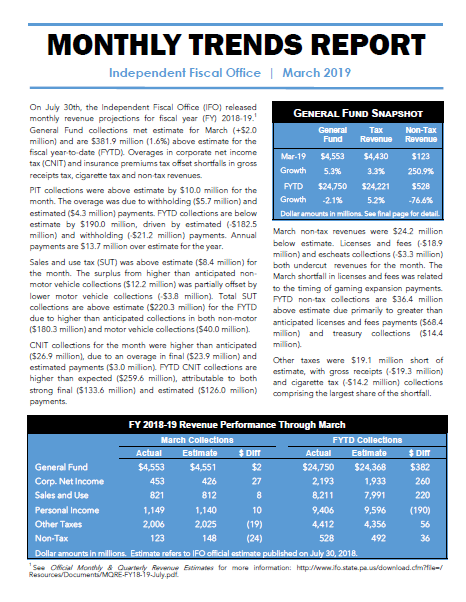

On July 30th, the Independent Fiscal Office (IFO) released monthly revenue projections for fiscal year (FY) 2018-19.1 General Fund collections met estimate for March (+$2.0 million) and are $381.9 million (1.6%) above estimate for the fiscal year-to-date (FYTD). Overages in corporate net income tax (CNIT) and insurance premiums tax offset shortfalls in gross receipts tax, cigarette tax and non-tax revenues.

PIT collections were above estimate by $10.0 million for the month. The overage was due to withholding ($5.7 million) and estimated ($4.3 million) payments. FYTD collections are below estimate by $190.0 million, driven by estimated (-$182.5 million) and withholding (-$21.2 million) payments. Annual payments are $13.7 million over estimate for the year.

Sales and use tax (SUT) was above estimate ($8.4 million) for the month. The surplus from higher than anticipated non-motor vehicle collections ($12.2 million) was partially offset by lower motor vehicle collections (-$3.8 million). Total SUT collections are above estimate ($220.3 million) for the FYTD due to higher than anticipated collections in both non-motor ($180.3 million) and motor vehicle collections ($40.0 million).

CNIT collections for the month were higher than anticipated ($26.9 million), due to an overage in final ($23.9 million) and estimated payments ($3.0 million). FYTD CNIT collections are higher than expected ($259.6 million), attributable to both strong final ($133.6 million) and estimated ($126.0 million) payments.

March non-tax revenues were $24.2 million below estimate. Licenses and fees (-$18.9 million) and escheats collections (-$3.3 million) both undercut revenues for the month. The March shortfall in licenses and fees was related to the timing of gaming expansion payments. FYTD non-tax collections are $36.4 million above estimate due primarily to greater than anticipated licenses and fees payments ($68.4 million) and treasury collections ($14.4 million).

Other taxes were $19.1 million short of estimate, with gross receipts (-$19.3 million) and cigarette tax (-$14.2 million) collections comprising the largest share of the shortfall.