Impact Fee Update - February 2015

February 27, 2015 | Energy

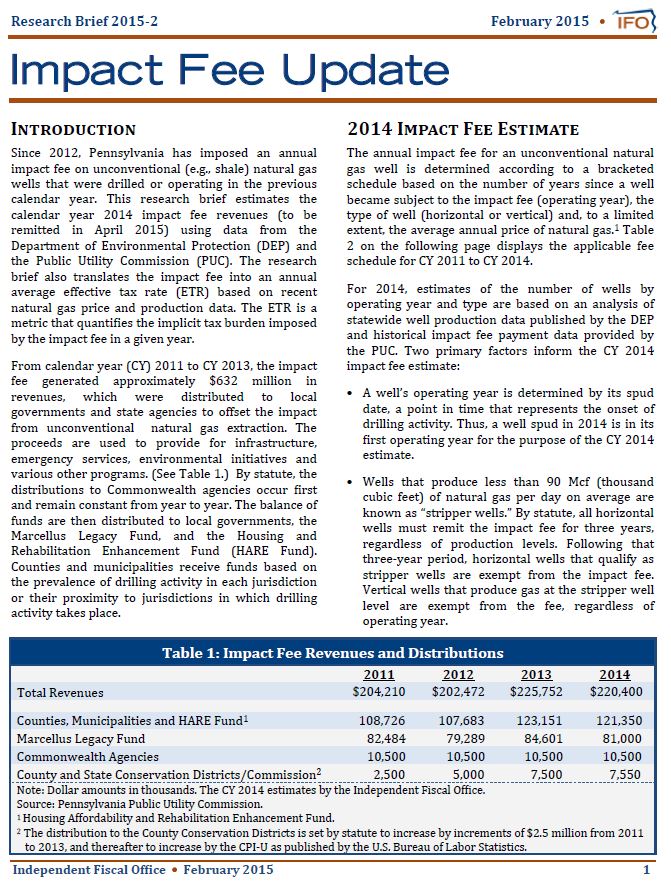

This research brief estimates the calendar year 2014 impact fee revenues (to be remitted in April 2015) using data from the Department of Environmental Protection (DEP) and the Public Utility Commission (PUC). The research brief also translates the impact fee into an annual average effective tax rate (ETR) based on recent natural gas price and production data. The ETR is a metric that quantifies the implicit tax burden imposed by the impact fee in a given year.

The annual impact fee for an unconventional natural gas well is determined according to a bracketed schedule based on the number of years since a well became subject to the impact fee (operating year), the type of well (horizontal or vertical) and, to a limited extent, the average annual price of natural gas.

The CY 2014 impact fee estimate is $220.4 million, which is based on the published fee schedule and the estimated well counts. The CY 2014 impact fee differs from previous years in two respects. First, 2014 was the first year that the number of unconventional wells spud in Pennsylvania exceeded the number spud in the prior year. Due to that outcome, the statute requires the PUC to apply a regional inflation adjustment to the fee schedule. The inflation adjustment will increase collections by an estimated $1.2 million. Second, 2014 was the first year in which horizontal stripper wells were eligible for an exemption after paying the fee for three years (i.e., in their fourth operating year). The horizontal stripper well exemption will decrease collections by an estimated $8.7 million.