Impact Fee Update and 2016 Outlook

July 14, 2016 | Energy

For CY 2015, impact fee collections were significantly lower than the prior year. This research brief (1) examines the reasons for that decline, (2) details the number of wells and fee schedule by operating year and (3) discusses three potential scenarios for CY 2016 collections. It also translates the impact fee into an annual average effective tax rate (ETR). This metric quantifies the implicit tax burden imposed by the impact fee in a given year.

Pennsylvania collects an annual impact fee on unconventional (i.e., shale) natural gas wells that were drilled or operating in the previous calendar year. The impact fee for an unconventional natural gas well is determined according to a bracketed schedule based on the number of years since a well became subject to the impact fee (operating year), the type of well (horizontal or vertical) and the annual average price of natural gas.

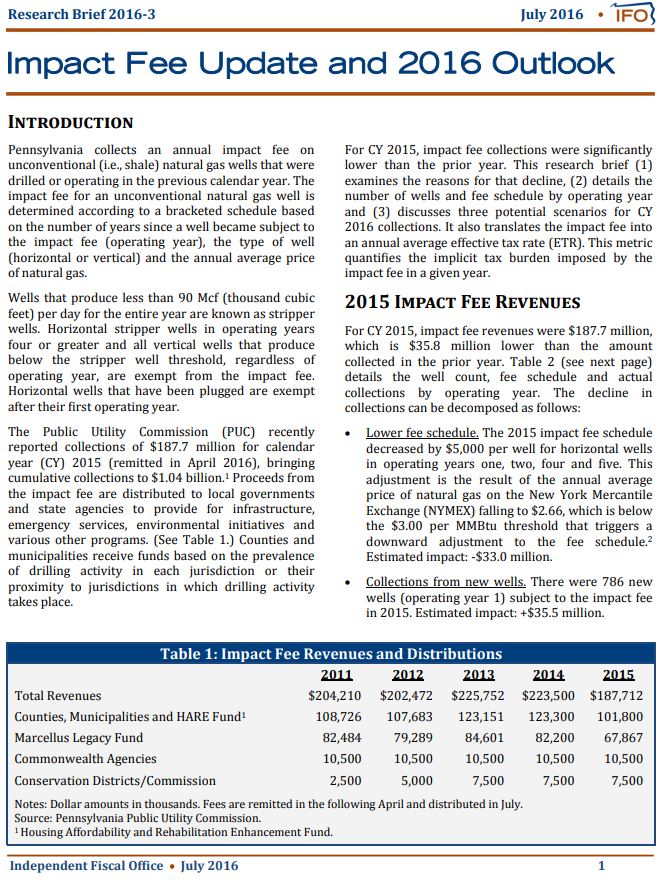

Impact fee revenues were $187.7 million, which is $35.8 million lower than the amount collected in the prior year. The main driver of lower impact fee revenues was the price of natural gas. The dramatic decline in the average price (1) reduced the fee schedule for CY 2015 (the first such occurrence) and (2) motivated firms to reduce the drilling of new wells. The 783 horizontal wells spud in 2015 (operating year 1) were less than the 1,339 horizontal wells spud in 2014 (currently operating year 2). An additional $25.2 million would have been collected for CY 2015 if the number of new wells had remained constant from 2014 to 2015.

For CY 2015, the ETR is 6.9 percent, an increase of 4.5 percentage points from 2014. The annual average ETR for 2011 to 2014 declined in each successive year. The main cause of that trend was the dramatic increase in production over the time period. The 2015 increase is predominantly motivated by the sharp decline of natural gas prices (54.3 percent prior to the deduction of post-production costs).