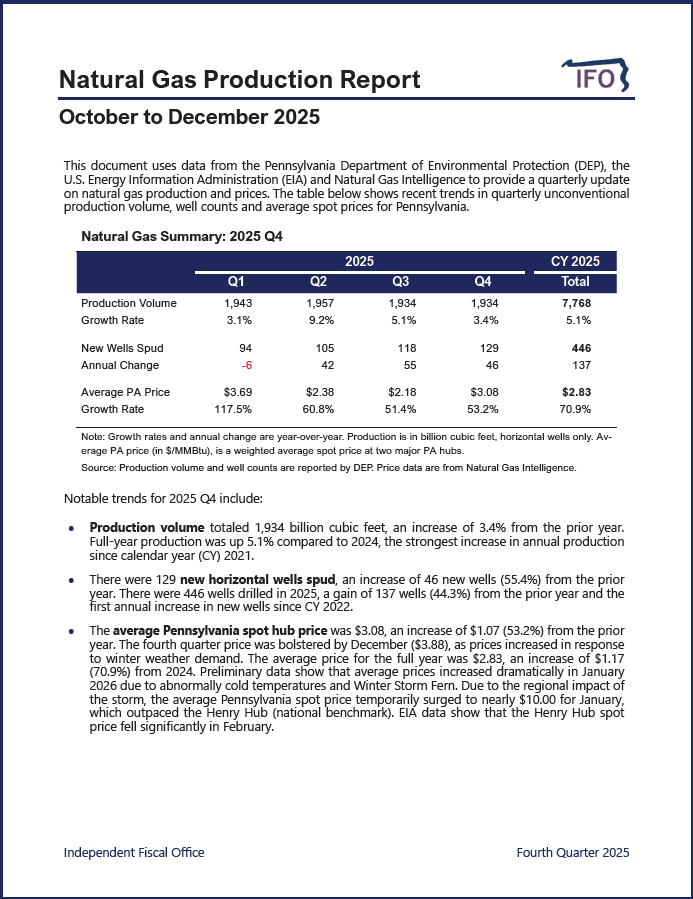

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

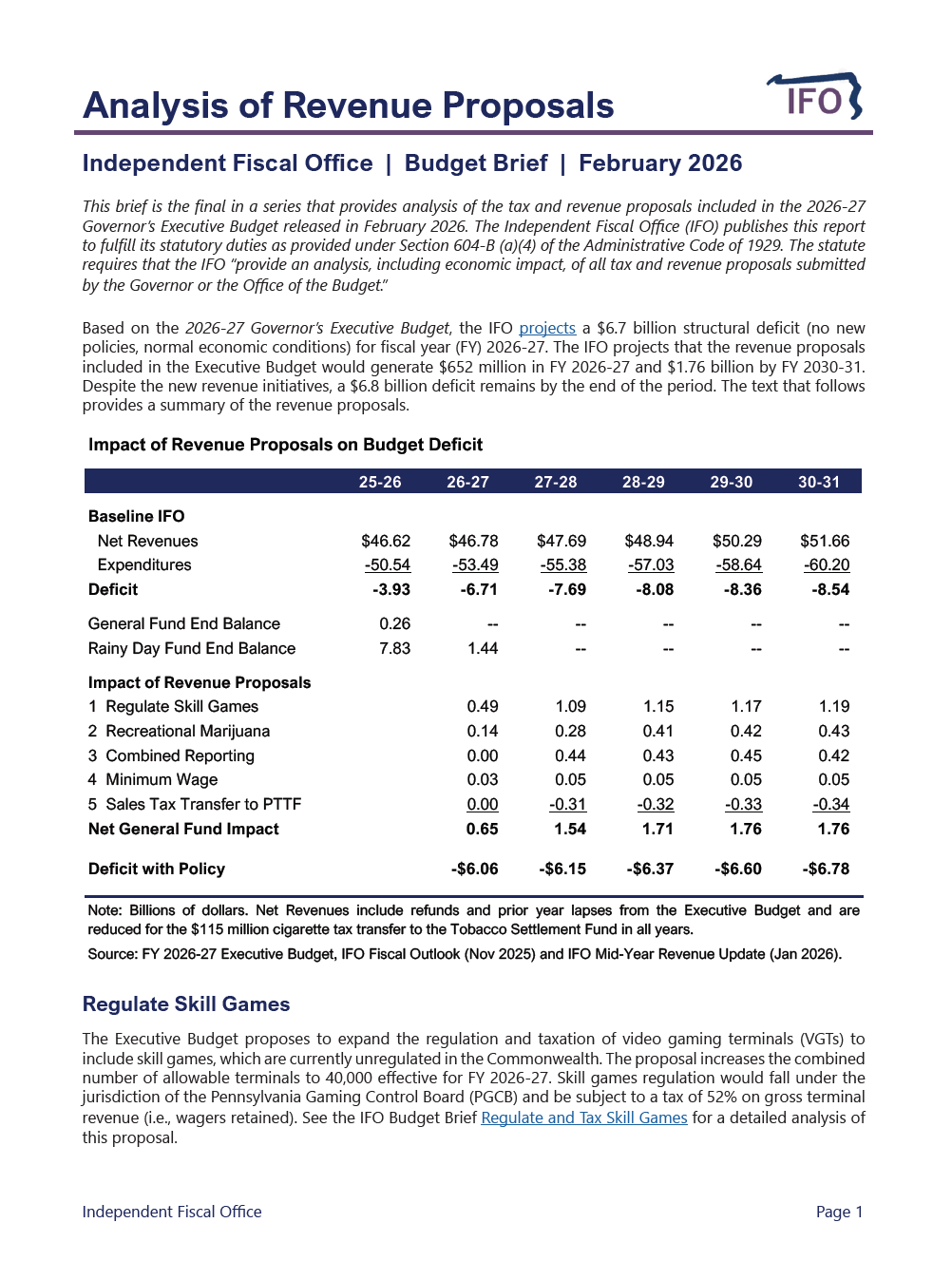

This budget brief is the final in a series that provides analysis of the revenue proposals included in the 2026-27 Governor’s Executive Budget. The IFO projects that the proposals would generate $652 million in FY 2026-27 and $1.76 billion by FY 2030-31. Despite the new revenue initiatives, a $6.8 billion deficit remains by the end of the period.

In response to a legislative request, the IFO used the dynamic REMI model to analyze a proposal that replaces school district property taxes with higher income and sales tax.

Director Knittel provided a budget and economic update to the PA Chamber of Business and Industry.

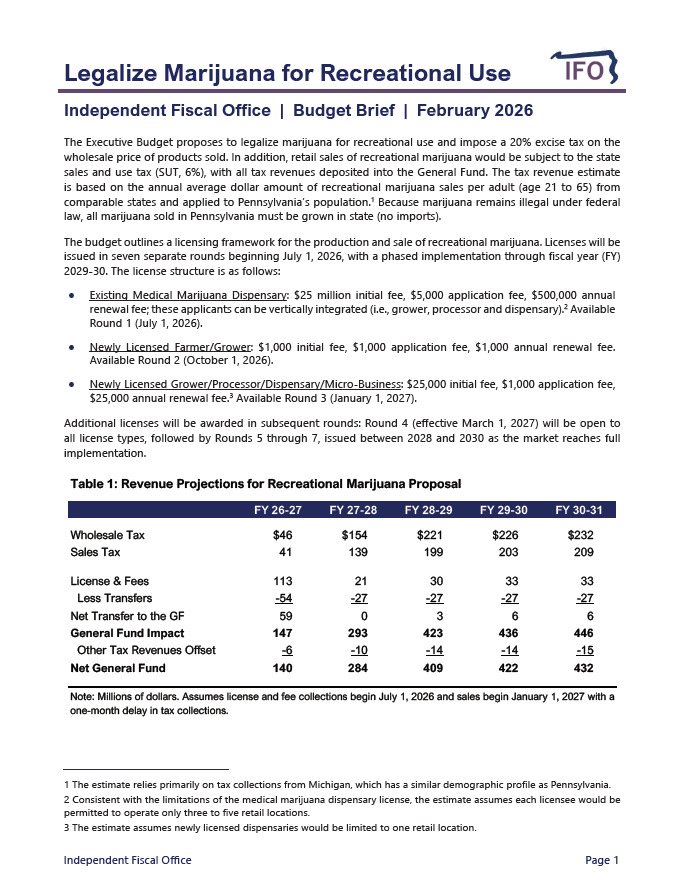

This report provides a revenue estimate for the proposal to legalize recreational marijuana contained in the FY 2026-27 Governor's Executive Budget. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under Section 604-B (a)(4) of the Administrative Code of 1929. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

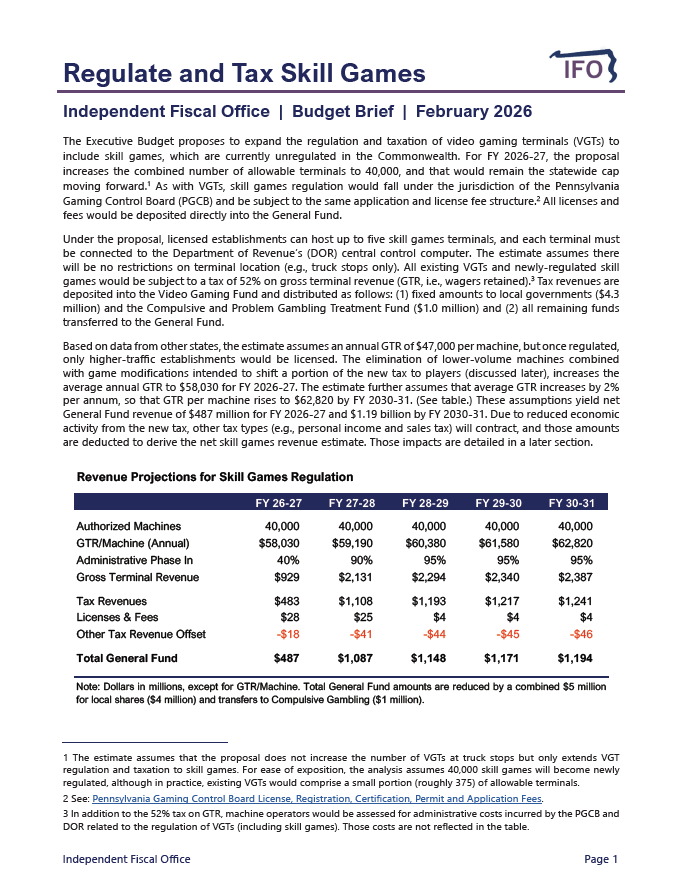

This report provides a revenue estimate for the proposal to tax and regulate skill games contained in the FY 2026-27 Governor's Executive Budget. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under Section 604-B (a)(4) of the Administrative Code of 1929. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

This report uses data from the U.S. Census Bureau, the Internal Revenue Service (IRS), the U.S. Bureau of Economic Analysis (BEA) and other sources to facilitate a comparison of state and local tax systems across the 50 states. The report examines (1) state and local effective tax rates across states, (2) the distribution of state and local taxes across revenue sources (e.g., income, sales and property) and (3) state debt levels.

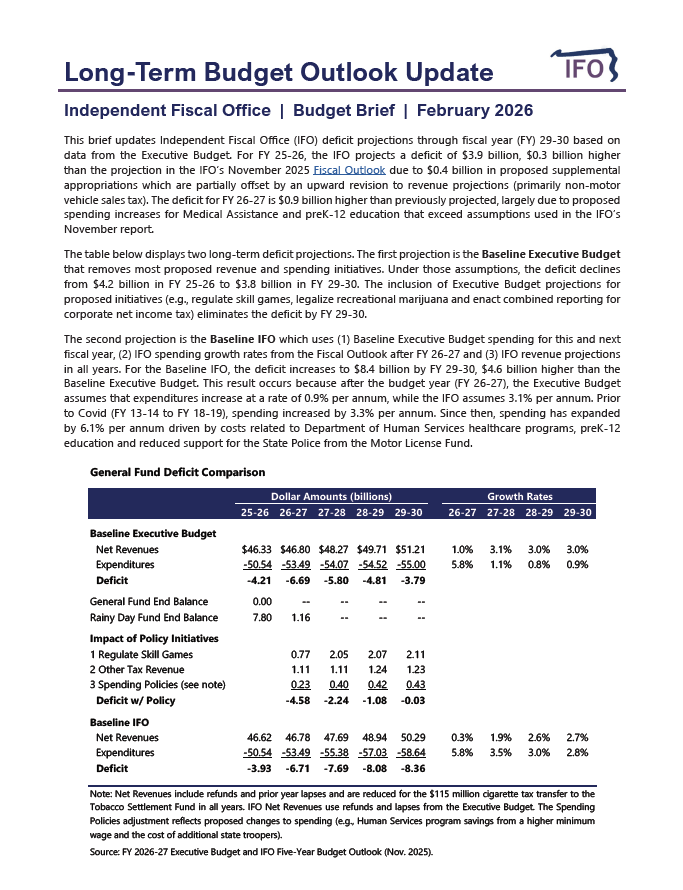

This budget brief provides updated IFO deficit projections through FY 2029-30. Excluding new revenues proposed in the Executive Budget, the FY 2025-26 underlying structural deficit of $3.9 billion is projected to expand to $8.4 billion by FY 2029-30.

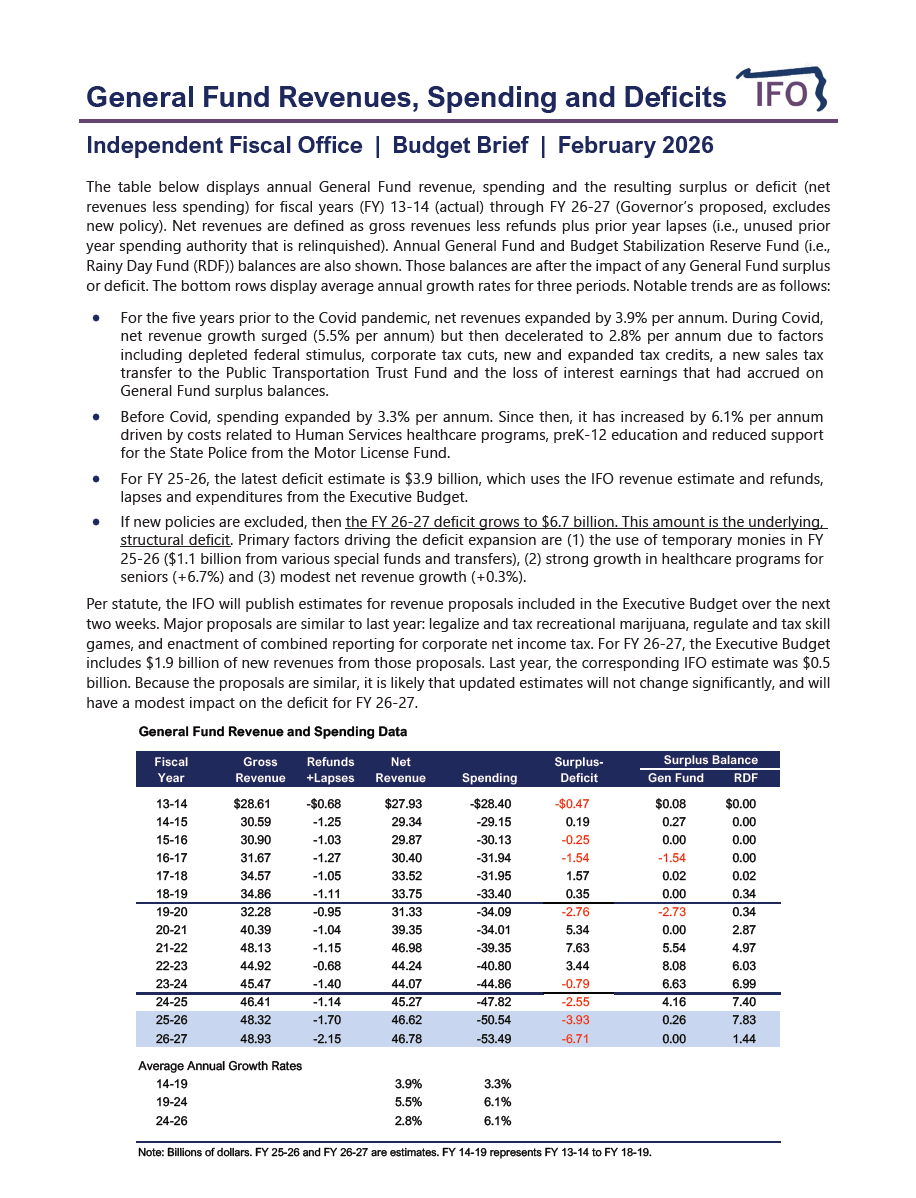

This budget brief tracks General Fund surpluses and deficits since FY 2013-14. Excluding new revenue and spending policies proposed in the Executive Budget, the underlying structural deficit is projected to expand to $6.7 billion in FY 2026-27.

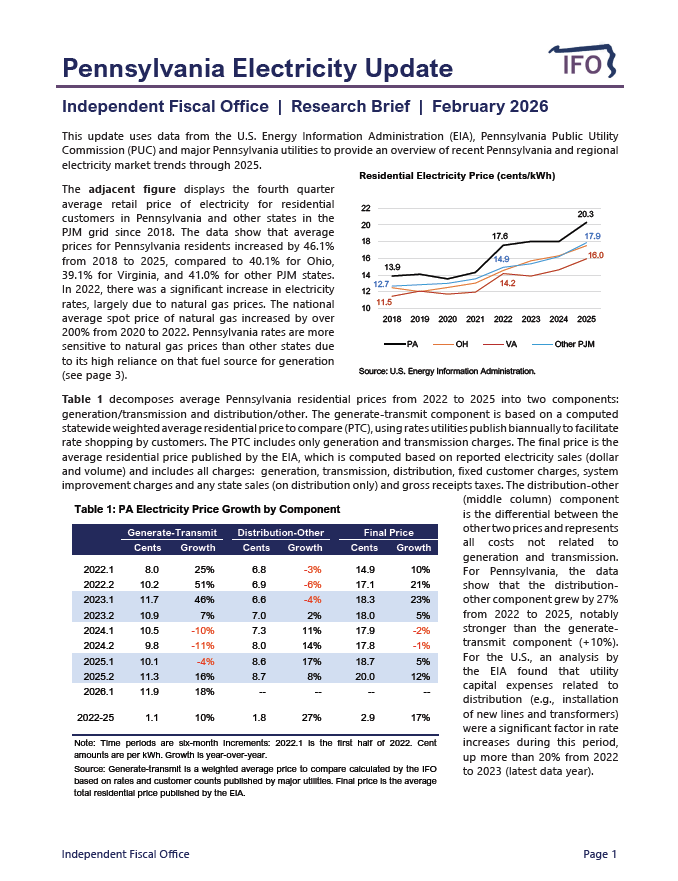

This report utilizes data from the U.S. Energy Information Administration to display recent trends for the Pennsylvania and regional electricity markets. The report examines recent trends in prices, net generation and net exports.