August 2015

September 01, 2015 | Revenue & Economic Update

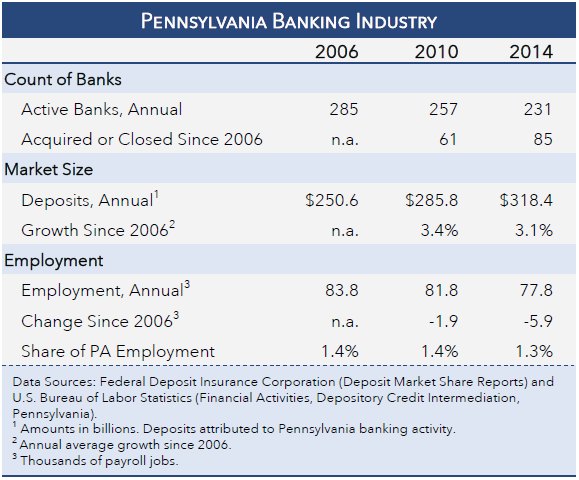

The banking industry is an integral part of the Pennsylvania economy, and supports thousands of jobs by matching borrowers and lenders. The industry has been evolving in recent years due to economic pressures and new financial regulations. Since 2006, an average of ten banks per year have closed or been acquired, according to data from the Federal Deposit Insurance Corporation (FDIC).

Two major economic forces have contributed to consolidation in the banking industry. First, the financial crisis left smaller banks in a weaker financial position, and therefore open to acquisitions by larger banks. Second, in response to the financial crisis, the Federal Reserve required banks to hold greater stores of capital, and smaller banks became less viable as the capital requirements had negative implications for their thinner profit margins.

As a result, large banks now comprise a somewhat greater share of the Pennsylvania market, as measured by their share of total deposits. In 2006, the ten largest banks comprised 59.7 percent of the market, and by 2014 they comprised 61.6 percent. For the twenty largest banks, the respective market shares were 72.6 and 75.8 percent. These trends mirror industry activity at the national level.

The FDIC data also show that total bank deposits have increased at roughly the same pace as the Pennsylvania economy. However, due in part to consolidation, industry employment has contracted by roughly 6,000 payroll jobs from 2006 to 2014. Preliminary data through June 2015 indicate a further contraction of roughly 1,000 payroll jobs. Currently, the banking industry (defined as depository credit intermediation) comprises 1.3 percent of total Pennsylvania payroll employment.

The Federal Reserve’s capital requirements will continue to increase under the international agreement known as Basel III. Under this agreement, the Federal Reserve requires banks to increase their stores of capital to protect against future recessions. These requirements will increase steadily each year through 2019, and may foreshadow further industry consolidation.