October 2015

November 01, 2015 | Revenue & Economic Update

The inflation rate, an important economic indicator, has remained relatively low over the past three years, and that outcome has implications for large federal transfers made to Pennsylvania residents. For 2016, the Social Security Administration recently announced that recipients will not receive an annual cost of living adjustment or COLA. Social Security recipients receive COLAs to ensure that their benefits are not eroded by inflation. Annual COLAs are determined by the U.S. Department of Labor based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation’s effect on a typical bundle of goods and services purchased by consumers. Due to low consumer price inflation, Social Security recipients have received an average COLA of 1.9% per annum since 2007.

The impact of Social Security benefits on the Pennsylvania economy is significant. In 2014, approximately 2.8 million Pennsylvania residents received Social Security benefits (includes retirees, disabled workers and survivors) valued at nearly $40.8 billion. If Pennsylvania’s Social Security recipients would have received an average COLA for 2016, an additional $800 million of personal income would have been added to the state economy.

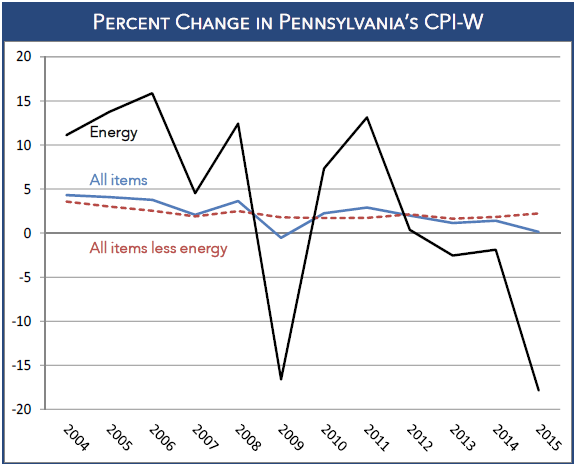

The recent decline in consumer prices is primarily the result of depressed energy costs. Although energy purchases comprise only 11.5% of total consumer purchases used in the CPI computation, its high volatility can have a noticeable impact on the CPI-W. In Pennsylvania, the CPI-W declined 0.2% in the third quarter of 2015 (year-over-year), and is near the national inflation rate, which declined 0.4% over the same period. Gasoline prices fell sharply, declining 27.7%. Natural gas prices also fell, declining 14.0%. Overall, energy costs in Pennsylvania declined 17.2%. Excluding energy costs, the CPI-W increased 1.7% in the third quarter of 2015.

The impact of low gasoline and natural gas prices will also be reflected in COLAs for 2017. The Social Security Administration does not reduce benefit payments when consumer prices fall. However, future COLAs take into account lower consumer prices from the previous year. For example, if consumer prices fall by 0.4% this year, then they must rise by roughly 2.4% next year if Social Security recipients are to receive a 2.0% COLA in 2017.