February 2016

March 01, 2016 | Revenue & Economic Update

According to the U.S. Department of Commerce, domestic profits of non-financial corporations decreased $56.5 billion (-4.3%) in the third quarter of 2015 on a year-over-year basis. For the fourth quarter, analysts project that earnings will continue to decline by 2% to 10% compared to the prior year. If these projections are correct, it will be the first time that corporate profits declined for two consecutive quarters since the recession.

However, nearly all of the weakness in profits is attributable to two sectors. Mining sector profits have deteriorated rapidly due to the collapse in oil and gas prices. In addition, utility profits have weakened due to falling consumption, strong competition and facility upgrades. The losses in these two sectors are large enough to offset moderate to strong profit gains in most other sectors.

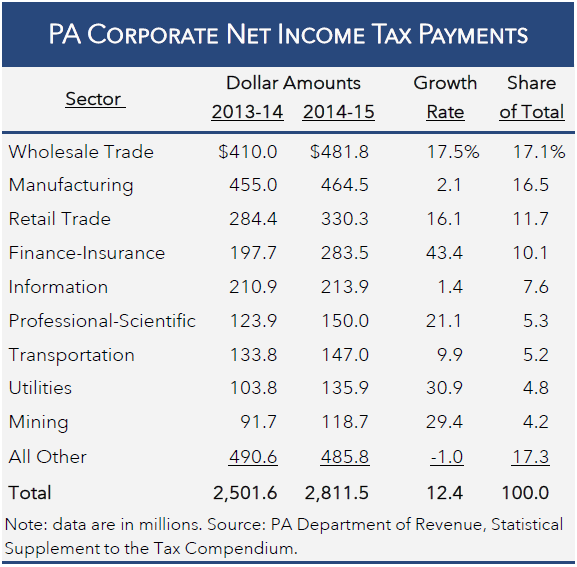

Recent data from the Pennsylvania Department of Revenue show that Pennsylvania’s three largest corporate sectors (in terms of taxable profits) are the manufacturing, wholesale and retail trade sectors. These three sectors comprised 45.4% of total corporate net income tax (CNIT) collections for FY 2014-15. National profit trends for the third quarter of 2015 may suggest strong profit gains for Pennsylvania manufacturers (16.4% growth) and retailers (14.5%), but a reduction for wholesalers (-1.1%).

National profits for two key Pennsylvania industries declined during the third quarter of 2015. The mining and utilities sectors recorded declines of 126.9% (i.e., all sector profits eliminated, resulting in a net loss) and 42.9%, respectively. These two sectors comprised 9.0% of total CNIT payments in FY 2014-15, and the significant decline in their third quarter profits may have a notable impact on tax collections in March and April, when corporations remit their final payments for tax year 2015.