September 2016

October 03, 2016 | Revenue & Economic Update

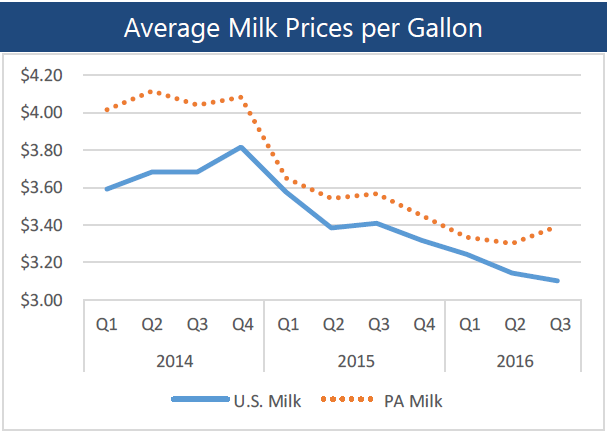

U.S. consumers have recently benefited from very low inflation in 2015 (0.1% annual increase) and 2016 (1.1% through August). Pennsylvania consumers have also benefited, as the Philadelphia metro area Consumer Price Index (CPI-U) shows even weaker regional inflation (-0.1% and 0.4%, respectively). Originally driven by a collapse in energy prices, this trend has now spread to commodities such as groceries. Through August, the CPI-U data show that general grocery prices (called “food at home”) have declined in the U.S. (-0.9%) and Philadelphia (-1.2%) on a year-over-year basis. The latest reading shows that overall food price levels in the U.S. have declined for 9 consecutive months, which represents the longest period of food deflation since the 1960s, excluding the 2009 recession. Milk prices have recorded especially sharp declines, with average U.S. and PA prices falling by nearly 20% during the past two years. Some articles attribute the decline to falling energy prices, which reduce refrigeration and transportation costs. However, other factors are also relevant for the dairy industry.

A major factor in the downturn of dairy prices is falling overseas demand, which has produced a temporary surplus in the U.S. The U.S. dollar has grown stronger relative to the currencies of major dairy importers such as China and Mexico. That trend increases the cost of U.S. imports for consumers in those countries. Over the past two years, the volume of U.S. whole milk powder exports has declined by nearly two-thirds to China and roughly one-third to Mexico.4 Moreover, a Russian ban on agricultural imports from western countries likely had spillover effects, and many EU countries that lost a major export market now offer more competition to U.S. exports, depressing dairy prices further.

As shown by the graph, the average U.S. price for a gallon of reduced fat milk declined from $3.81 in the fourth quarter of 2014, to $3.10 in the third quarter of 2016.1 For Pennsylvania, the average price for a gallon of reduced fat milk declined from $4.09 to $3.30 in the second quarter of 2016. Preliminary data for the third quarter suggest a slight recovery of approximately five to ten cents per gallon.

Looking forward, the Global Dairy Market Outlook projects that dairy prices will be volatile, but prices should generally recover as foreign dairy production slows. Many factors will affect domestic prices including overseas demand, the relative strength of the U.S. dollar and energy prices. However, even if dairy prices fully recover to 2014 levels, the impact on overall food inflation will be modest, since dairy purchases comprise a little more than ten percent of consumer spending on groceries.