October 2016

November 01, 2016 | Revenue & Economic Update

Wages and salaries earned by workers are an integral part of the state and national economies. For Pennsylvania, wage income ($308.2 billion) comprised nearly one half (48.4%) of total personal income in 2015.1 Wage earners typically spend most of their earnings, and changes in annual pay can affect consumer confidence. Employers are more likely to increase wages when the labor market is competitive, but less likely to do so if there is slack. Therefore, an acceleration or slowing of total wage growth can serve as both a coincident (i.e., current or real time) and leading indicator of the state economy.

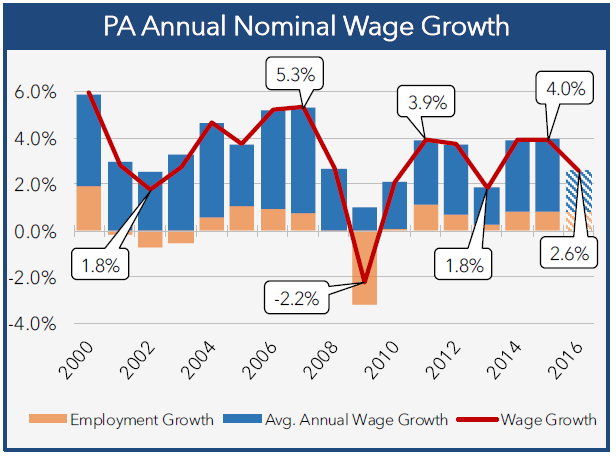

Since 2010, statewide annual wage growth has ranged from 2% to 4% (3.3% average), well below the wage growth from the last expansion period in the mid-2000s (4.7% average). (See red line in graph.) When discussing the growth of total wages paid to all employees in the state, it is useful to decompose it into two parts: (1) the growth in employment, or number of jobs (full and part-time, orange bars) and (2) the growth in the average annual wage (blue bars) paid to workers.

During the prior expansion, employment increased at an average rate of 0.8% per annum, or nearly 50,000 jobs. With the exception of 2013 (0.3% growth due to significant contraction in the government sector), the current recovery has also generated employment growth of roughly 0.8% per annum.

However, the growth in the average wage paid has been notably weaker for the current recovery. For 2003 to 2007, the average wage growth rate was 3.9%. The current expansion period recorded two years of moderate average wage growth (2.7% in 2011; 3.0% for 2012), followed by weak growth in 2013 (1.6%). The weak growth was likely a result of slack in the labor market, as some discouraged workers re-entered the labor force and sought employment. For 2014 and 2015, improving economic conditions and a more competitive labor market encouraged firms to boost wages to attract and retain quality employees, which caused the average wage to increase by 3.1% for both years.

Data for the first three quarters of 2016 reveal a clear deceleration of average wage growth, and imply a growth rate of roughly 1.8% for the year. Recent articles have attributed part of the slowdown to “churn” (baby-boomers retiring and replaced by lower-cost employees) in the labor market.2 While that theory is plausible over the longer term, much of the sudden fall in 2016 is likely due to very low inflation and cautious outlooks for economic growth. Partial data for 2016 Q3 and Q4 suggest a modest acceleration of average wage growth. For 2017, analysts anticipate that an uptick in inflation and a tighter labor market will translate into further acceleration of average wage growth, and possibly higher real and nominal economic growth for Pennsylvania and the U.S.