IFO Releases

Pennsylvania Medicaid Update

June 12, 2025 | Economics and Other

This budget brief highlights Pennsylvania Medicaid (MA) enrollment and funding trends from FY 18-19 through the administration’s proposal for FY 25-26. It also provides projections of the impact for certain MA provisions included in the federal reconciliation bill passed by the U.S. House of Representatives.

Proposed SNAP Changes: Budget Impact

June 03, 2025 | Economics and Other

As part of the draft reconciliation bill, the US House proposed to increase the state share of costs for the Supplemental Nutrition Assistance Program (SNAP). This research brief describes the proposed changes and the potential impact on the state budget.

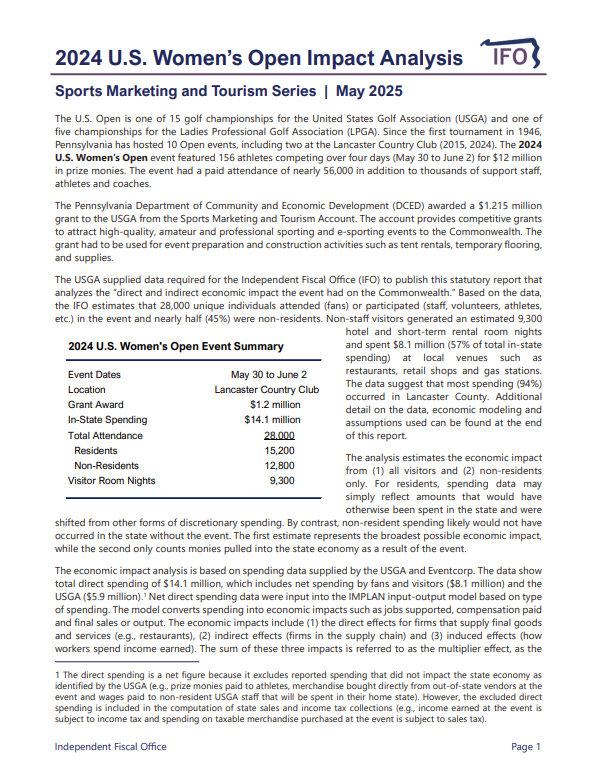

Sports, Marketing & Tourism Series: 2024 U.S. Women’s Open

May 12, 2025 | Economics and Other

The IFO published an economic impact report for the 2024 U.S. Women’s Open which took place May 30 to June 2, 2024 at the Lancaster Country Club. The analysis finds that economic activity related to the event supported 147 full-time equivalent jobs and generated $14.1 million in in-state spending, nearly $570,000 in state sales and use tax and $560,000 in personal income tax revenue.

Pennsylvania Unemployment Claims Tracker

April 29, 2025 | Economics and Other

This economic brief tracks the latest claims for unemployment compensation (UC) for all covered workers and federal workers only. The IFO is tracking these claims in preparation for its May 20 initial revenue estimate.

Retail Delivery Fee Revenue Estimates

April 23, 2025 | Economics and Other

In response to a legislative request, the IFO transmitted a brief that provides revenue estimates for a statewide retail delivery fee.

Unemployment Claims Tracker

April 10, 2025 | Economics and Other

This economic brief tracks the latest claims for unemployment compensation (UC) for all covered workers and federal workers only. The IFO is tracking these claims in preparation for its May 20 initial revenue estimate.

FY 2024-25 Interim Revenue Update

April 03, 2025 | Economics and Other

This budget update supplements the regular monthly revenue update published by the IFO and provides additional detail for March General Fund revenues. March revenues include large payments for gross receipts, insurance premiums, bank shares and corporate net income taxes.

Aging Population Drives Job Gains

March 20, 2025 | Economics and Other

This research brief uses new benchmarked jobs data from the U.S. Bureau of Labor Statistics to track the sectors and industries that gained or lost jobs since 2019 (i.e., pre-Covid).

Charging Pennsylvania’s Electric Vehicles

February 24, 2025 | Economics and Other

A new research brief examines Act 85 of 2024, which replaces the alternative fuel tax on electric vehicles with an annual electric vehicle road user charge for battery electric and plug-in hybrid vehicles. It also details the impact of federal funds from the Infrastructure Investment and Jobs Act on Pennsylvania’s EV charging infrastructure.

State and Local Tax Incidence in Pennsylvania

February 19, 2025 | Economics and Other

Director Knittel submitted an article for publication in the February 3, 2025 edition of Tax Notes State. It reviews recent results from the Pennsylvania tax incidence model and discusses factors that make state and local tax systems appear more regressive than they are in practice.