IFO Releases

General Fund Surplus Likely Depleted Next Year

July 18, 2024 | Economics and Other

This research brief uses the recently passed state budget for FY 24-25 to update deficit estimates for the current and subsequent fiscal year.

Corporate Rate Reduction and Higher NOL Cap

July 17, 2024 | Economics and Other

This research brief examines two recent provisions that reduce corporate net income tax liability: a lower tax rate and a higher net operating loss (NOL) deduction threshold. The provisions significantly reduce corporate tax liability and will be phased-in through tax year 2031.

Stadium Economic Impact Report: Philadelphia Phillies

July 10, 2024 | Economics and Other

The IFO performed an analysis that measured the 2023 economic footprint attributable to the Philadelphia Phillies’ Major League Baseball (MLB) operations at Citizens Bank Park. The analysis finds that economic activity related to team operations and fan spending generated $970 million in statewide spending, supported 5,400 full-time equivalent jobs, and $45 million in state taxes.

Stadium Economic Impact Report: Pittsburgh Pirates

July 10, 2024 | Economics and Other

The IFO performed an analysis that measured the 2023 economic footprint attributable to the Pittsburgh Pirates’ Major League Baseball (MLB) operations at PNC Park. The analysis finds that economic activity related to team operations and fan spending generated $546 million in statewide spending, supported 3,000 full-time equivalent jobs, and $22 million in state taxes.

Revenue Estimate Performance

July 09, 2024 | Revenue Estimates

This report examines the performance of IFO revenue estimates for the past twelve budget cycles. For FY 2023-24, actual collections exceeded IFO projections by 0.6%, or $273 million.

Southern Migration Continued During COVID

July 01, 2024 | Economics and Other

From 2021 to 2022, IRS data indicate that net domestic migration for Pennsylvania was -21,711 (-0.17% of state population) which ranked 35th across all states.

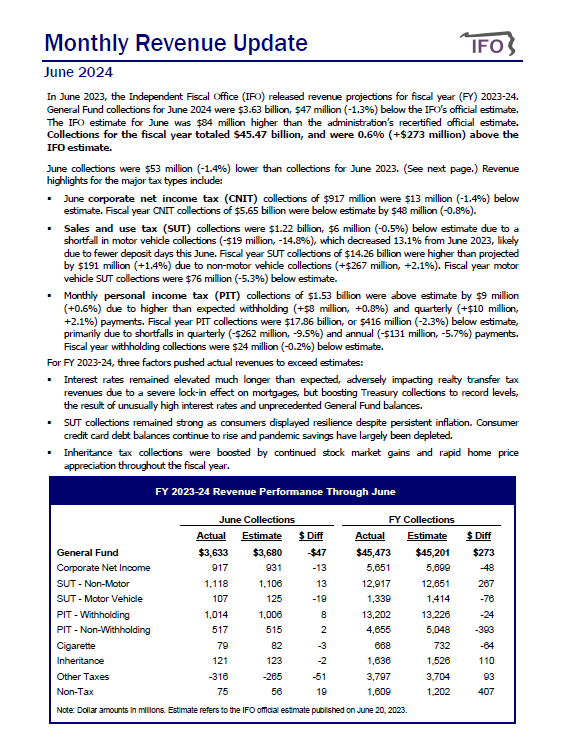

June 2024 Revenue Update

July 01, 2024 | Revenue & Economic Update

The Commonwealth collected $45.47 billion in General Fund revenues for FY 2023-24, which was within 0.6% ($273 million) of the IFO official revenue estimate.

Sources of Pennsylvania Income

June 27, 2024 | Economics and Other

This research brief is the first in a series that describes a new distribution model that will be used to examine the progressivity/regressivity of state-local taxes.

Impact Fee Revenue Update and Outlook 2024

June 26, 2024 | Energy

This update examines 2023 impact fee collections and provides an outlook for 2024. The Commonwealth collected $179.6 million in impact fees for 2023, a $99.2 million decrease from 2022.

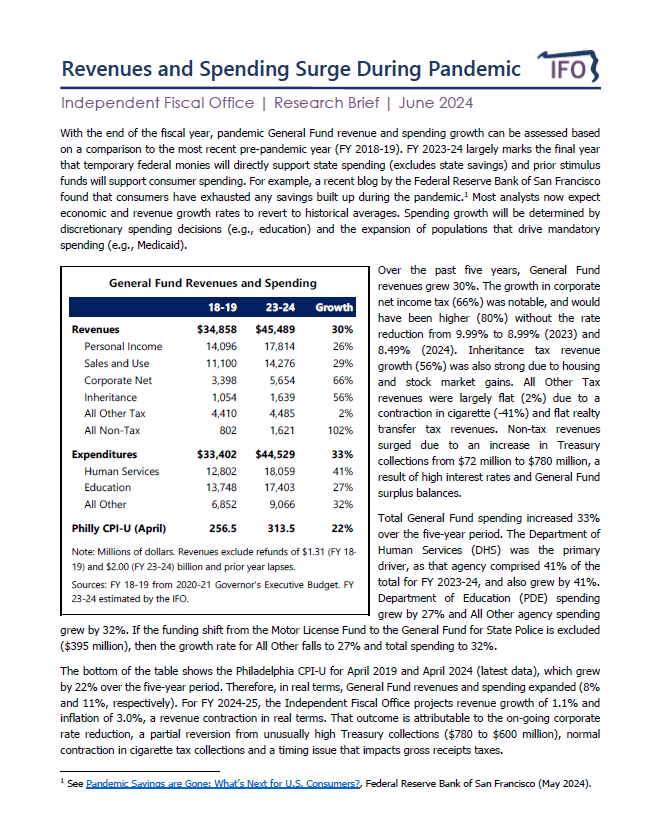

Revenues and Spending Surge During Pandemic

June 25, 2024 | Economics and Other

This research brief looks at the drivers of revenue and spending growth during the pandemic.