IFO Releases

Act 25 of 2011 Analysis

February 16, 2022 | Property Tax

In response to a legislative request, the IFO transmitted a letter that estimates the potential reduction in property taxes due to Act 25 of 2011.

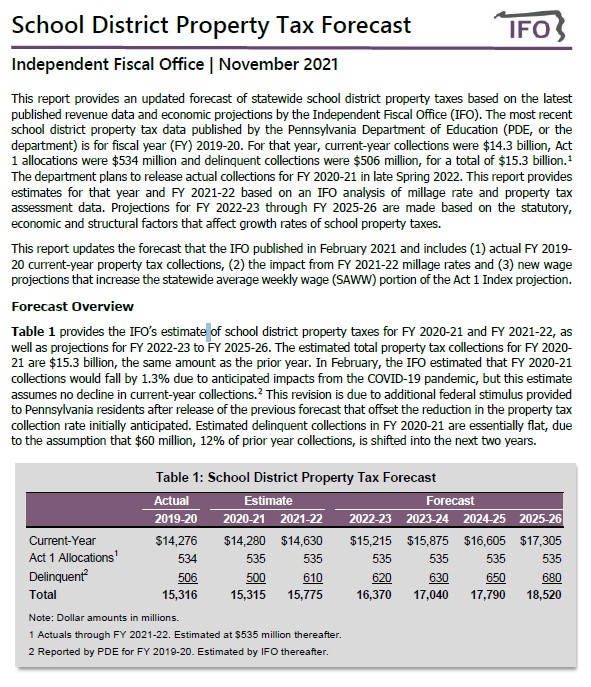

School District Property Tax Forecast

November 08, 2021 | Property Tax

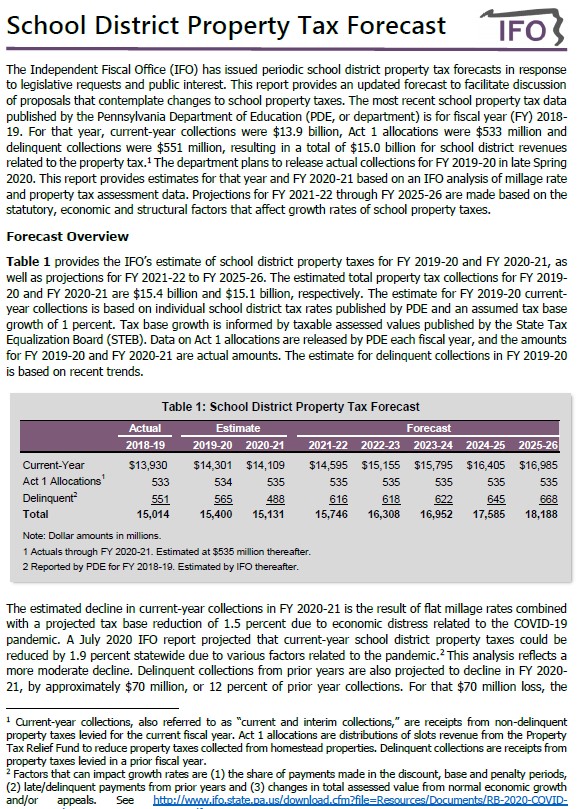

This report contains the IFO's updated forecast of school district property tax collections from FY 2020-21 to FY 2025-26. This report updates the forecast that the IFO published in February 2021 and includes (1) actual FY 2019-20 current-year property tax collections, (2) the impact from FY 2021-22 millage rates and (3) new wage projections that increase the statewide average weekly wage (SAWW) portion of the Act 1 Index projection.

Property Tax Burden by County

August 25, 2021 | Property Tax

This research brief uses (1) income data from the Bureau of Economic Analysis and the Internal Revenue Service and (2) property tax data from the Pennsylvania Department of Education and Department of Community and Economic Development to estimate and rank county-level property tax burdens across the state for 2019.

Note: This research brief was originally posted on 8/17/2021. It has been updated to include a map that displays school district property tax burdens by county.

Projecting the Components of the Act 1 Index

March 17, 2021 | Property Tax

Director Matt Knittel made a presentation to PASBO regarding the IFO’s recent computation of the Act 1 Index.

Tags: presentation, property

School District Property Tax Forecast

February 24, 2021 | Property Tax

This report contains the IFO's forecast of school district property tax collections from FY 2019-20 to FY 2025-26. The report also contains projections of the Act 1 index and estimates of school district property taxes attributable to homestead property. (This report was originally posted on February 2, 2021. Based on new data for the 2020 Q4 ECI, which impacts the FY 2020-21 ECI computation, this report was updated and reposted.)

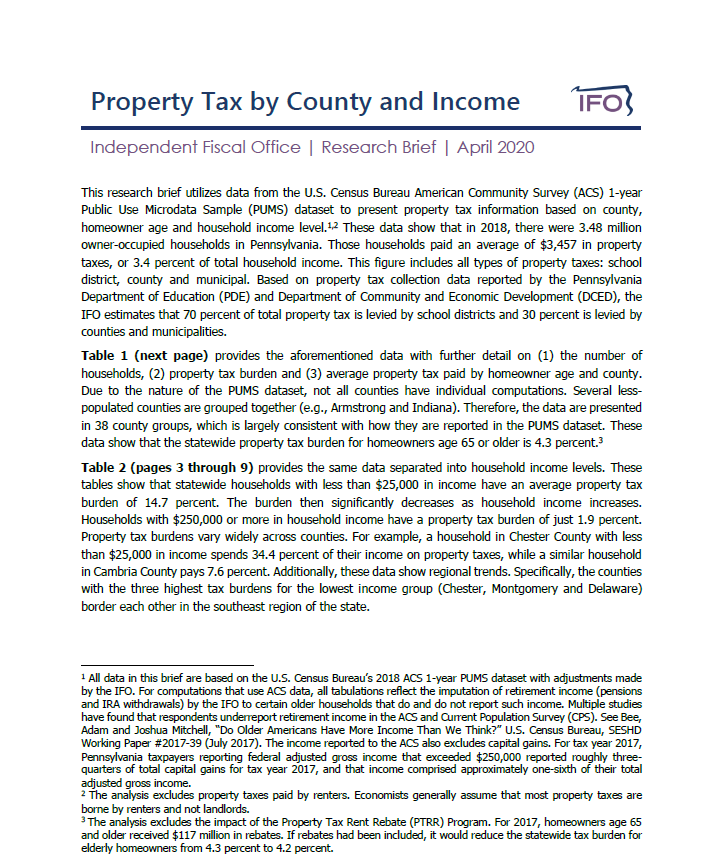

Property Tax by County and Income

April 07, 2020 | Property Tax

This research brief uses data from the U.S. Census Bureau's American Community Survey to provide Pennsylvania property tax data for 2018 by county, household income and homeowner age.

Property Tax Update Presentation

March 13, 2020 | Property Tax

Director Matthew Knittel made a brief presentation to the Pennsylvania School Boards Association on property tax data recently published by the IFO.

Tags: presentation, property

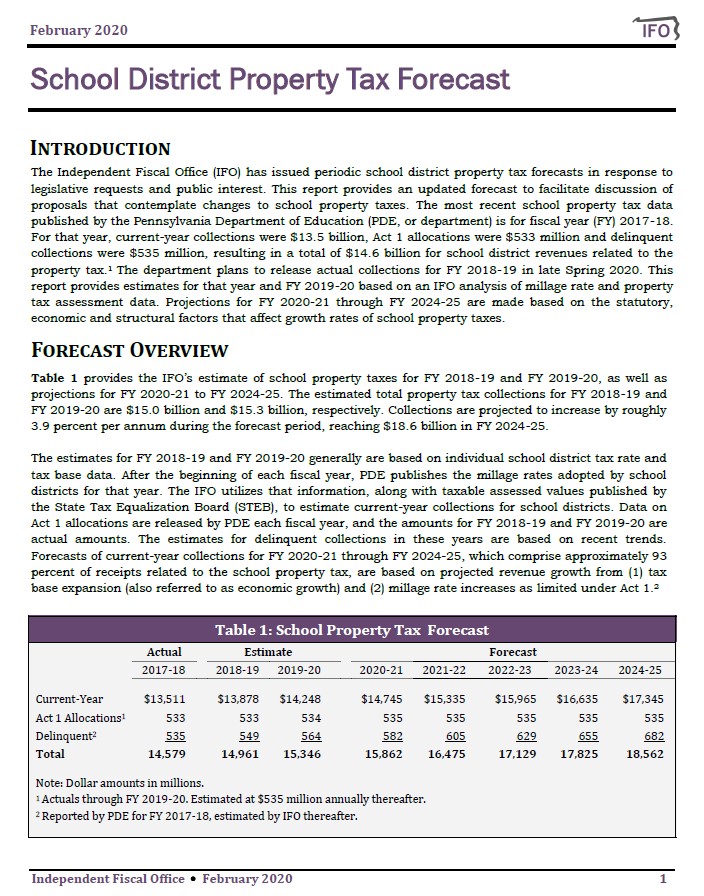

School District Property Tax Forecast

February 06, 2020 | Property Tax

This report contains the IFO's forecasted school district property tax collections from FY 2018-19 through FY 2024-25. The report also contains projections of the Act 1 index and estimates of school district property taxes that can be attributed to homesteads.

Total school property tax collections for FY 2018-19 ($15.0 billion) and FY 2019-20 ($15.3 billion) are estimated using millage rates published by the Pennsylvania Department of Education and property tax assessment data. For FY 2020-21 through FY 2024-25, collections are projected based on the statutory, economic and structural factors that affect growth rates of property taxes. During that period, total school property tax collections are projected to grow at an average annual rate of 3.9 percent, reaching $18.6 billion by FY 2024-25.

Tags: property

School District Property Tax Rebate

November 12, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that analyzes a set of proposed school district property tax rebates for all homestead property owners.

Property Tax Replacement Estimates

October 04, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that provides revenue estimates for various proposed changes to the state tax code affecting personal income and sales and use taxes.