IFO Releases

Affordable Connectivity Program Ends

May 01, 2024 | Economics and Other

Due to the depletion of approved funds, the federal Affordable Connectivity Program (ACP) is no longer accepting new enrollments and the last fully-funded program month was April 2024. In 2023, Pennsylvania households received $241 million in ACP funds, an average monthly benefit of $33 per household.

April 2024 Revenue Update

May 01, 2024 | Revenue & Economic Update

The Commonwealth collected $5.69 billion in General Fund revenues for April, an increase of $30 million (+0.5%) compared to April 2023.

The IFO transmitted a brief revenue update to the chairs of the Senate and House Appropriations Committees.

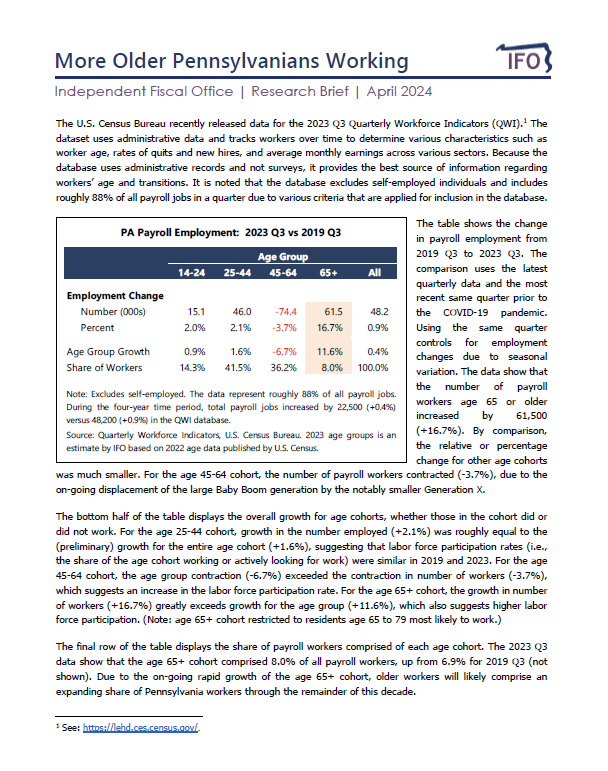

More Older Pennsylvanians Working

April 17, 2024 | Economics and Other

This research brief uses the latest data from the U.S. Census Bureau Quarterly Workforce Indicators to track the age composition of Pennsylvania payroll workers. Compared to data prior to COVID-19, there has been a large absolute (number) and relative (growth) increase in older workers.

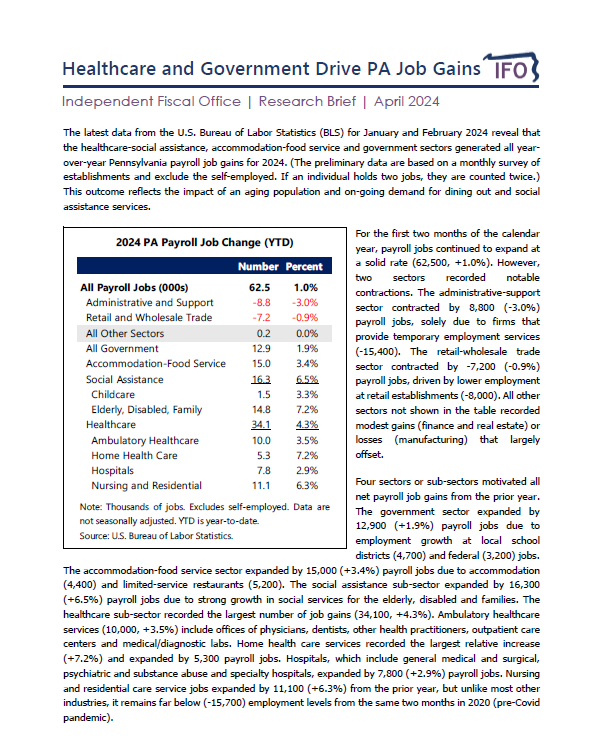

Healthcare and Government Drive PA Job Gains

April 10, 2024 | Economics and Other

The latest jobs data from the U.S. Bureau of Labor Statistics show that all Pennsylvania job gains for 2024 occurred in the government, healthcare or accommodation-food service sectors. The data reflect the aging demographics of the state and on-going demand for dining out and social assistance services.

Economic and Budget Update Presentation

April 05, 2024 | Economics and Other

The IFO presented on the Commonwealth's economic and budget outlook at a session of the Pennsylvania Education Policy and Leadership Center.

Sports, Marketing & Tourism Series: 2023 Ironman PA Happy Valley Triathlon

April 04, 2024 | Economics and Other

The IFO published an economic impact report for the Ironman 70.3 Pennsylvania Happy Valley Triathlon in Centre County (July 2023). The analysis finds that economic activity related to the event generated over $4.7 million in statewide spending, supported 30 full-time equivalent jobs, and $238,000 in select state and local taxes.

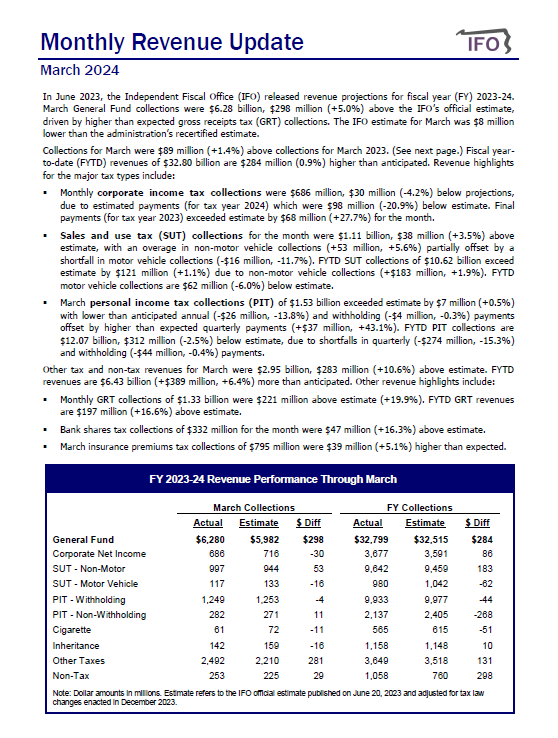

March 2024 Revenue Update

April 01, 2024 | Revenue & Economic Update

The Commonwealth collected $6.28 billion in General Fund revenues for March, an increase $89 million (+1.4%) compared to March 2023.

The IFO transmitted a brief revenue update to the chairs of the Senate and House Appropriations Committees.

Analysis of Revenue Proposals

March 28, 2024 | Revenue Estimates

This report provides estimates for the revenue proposals contained in the 2024-25 Governor's Executive Budget released February 2024. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under Section 604-B (a)(4) of the Administrative Code of 1929. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

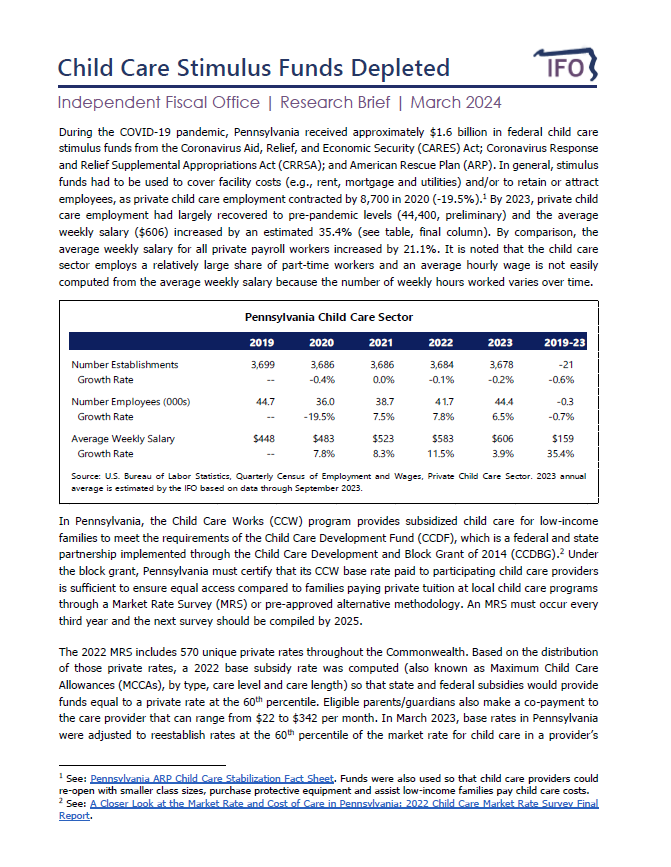

Child Care Stimulus Funds Depleted

March 21, 2024 | Economics and Other

This research brief highlights the depletion of federal child care stimulus funds and the impact on that sector. During the COVID-19 pandemic, Pennsylvania received approximately $1.6 billion in federal child care stimulus funds from the Coronavirus Aid, Relief, and Economic Security (CARES) Act; Coronavirus Response and Relief Supplemental Appropriations Act (CRRSA); and American Rescue Plan (ARP).

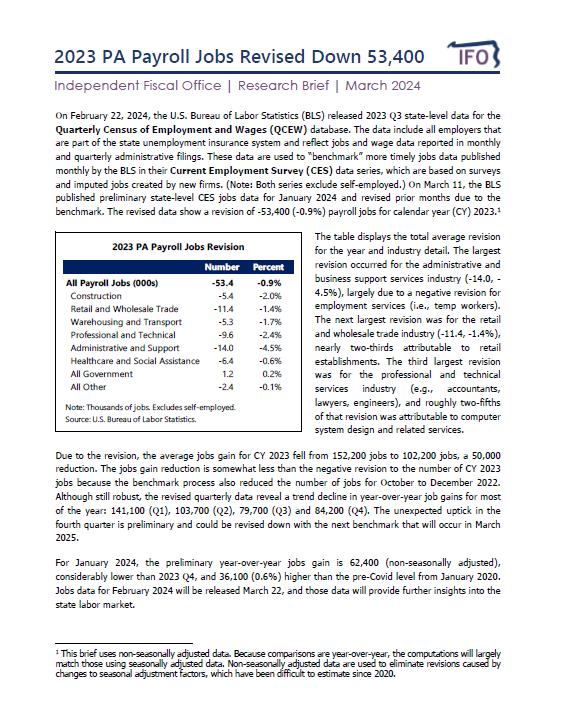

2023 PA Payroll Jobs Revised Down 53,400

March 13, 2024 | Economics and Other

This research brief provides detail on the latest benchmark revision made by the U.S. Bureau of Labor Statistics to Pennsylvania payroll jobs.