IFO Releases

Manufacturing Tax Credit

January 05, 2023 | Tax Credit Review

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to review all state tax credits over a five-year period. For the fifth year, the IFO reviewed the Manufacturing, Resource Manufacturing, Rural Jobs and Investment, and Waterfront Development Tax Credits.

Click on the link to access the Manufacturing Tax Credit Report.

Executive Offices

January 05, 2023 | Performance Budgeting

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Executive Offices.

Approved by the PBB Board on January 11, 2023.

Tags: budgeting, performance

Pennsylvania Insurance Department

January 05, 2023 | Performance Budgeting

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Pennsylvania Insurance Department.

Approved by the PBB Board on January 11, 2023.

The report was reposted on January 18, 2023 to correct a single year of data on page 14.

Tags: budgeting, performance

Department of Revenue

January 05, 2023 | Performance Budgeting

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Department of Revenue.

Approved by the PBB Board on January 10, 2023.

Tags: budgeting, performance

Department of Drug and Alcohol Programs

January 05, 2023 | Performance Budgeting

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Department of Drug and Alcohol.

Approved by the PBB Board on January 9, 2023.

Tags: budgeting, performance

Department of Conservation and Natural Resources

January 05, 2023 | Performance Budgeting

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to develop performance-based budget plans for all agencies under the Governor’s jurisdiction once every five years. For the fifth year, the IFO reviewed the Department of Conservation and Natural Resources, Department of Drug and Alcohol Programs, Department of Revenue, Pennsylvania Insurance Department and the Executive Offices.

Click on the link to access the performance-based budget review for the Department of Conservation and Natural Resources.

Approved by the PBB Board on January 9, 2023.

Tags: budgeting, performance

Rural Jobs and Investment Tax Credit

January 05, 2023 | Tax Credit Review

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to review all state tax credits over a five-year period. For the fifth year, the IFO reviewed the Manufacturing, Resource Manufacturing, Rural Jobs and Investment, and Waterfront Development Tax Credits.

Click on the link to access the Rural Jobs and Investment Tax Credit Report.

The report was amended on February 17, 2023 to include updates to Table 3.1 on page 14.

Following publication of the RJITC report, the IFO became aware of a data discrepancy contained within a referenced study. As a result, the RJITC report was updated to exclude references to the “Evaluation of Alabama’s Entertainment Industry Incentive Program and New Markets Development Program” on February 23, 2023.

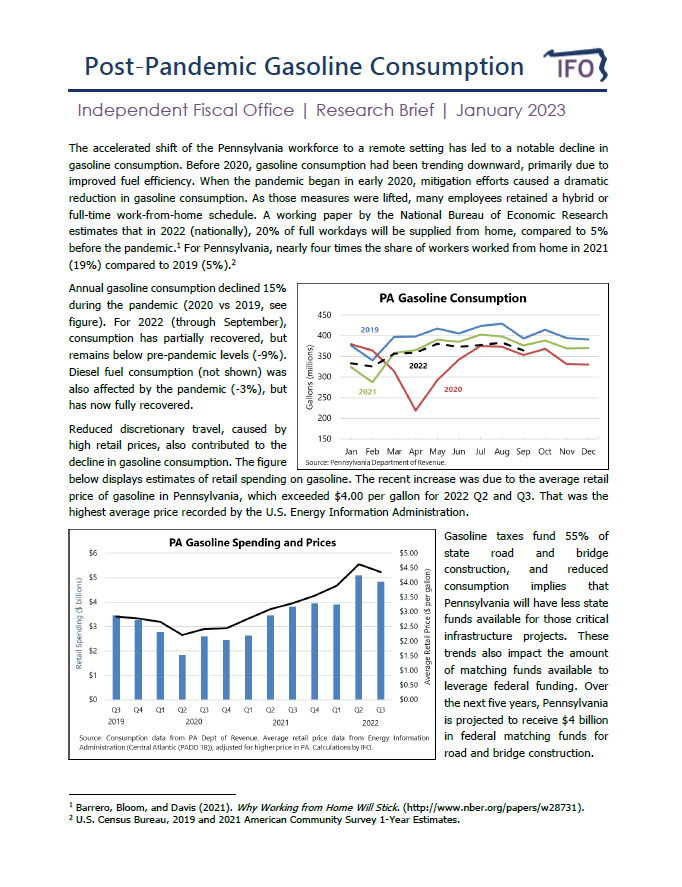

Post-Pandemic Gasoline Consumption

January 05, 2023 | Economics and Other

The IFO published a research brief on the decline in Pennsylvania gasoline consumption resulting from recent trends in remote working and higher gasoline prices. Reduced consumption means less funding for road and bridge construction, as gasoline taxes fund 55% of those projects.

Tags: brief, consumption, gasoline, research

Waterfront Development Tax Credit

January 05, 2023 | Tax Credit Review

Act 48 of 2017 requires the Independent Fiscal Office (IFO) to review all state tax credits over a five-year period. For the fifth year, the IFO reviewed the Manufacturing, Resource Manufacturing, Rural Jobs and Investment, and Waterfront Development Tax Credits.

Click on the link to access the Waterfront Development Tax Credit Report.

PA Population Contracts Since 2020

January 04, 2023 | Economics and Other

The IFO published a research brief that uses the latest Census data to rank states based on net migration between states since 2020. During the past two years, Pennsylvania recorded a net domestic outflow of 16,220. Relative to state population, the net outflow caused state population to contract by 0.1%, which ranked 29th across all states.

Tags: contraction, pennsylvania, population